Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Impact of Turkey’s Election on Energy Markets

Energy security — the topic of many politicians' campaign rhetoric as they bid for their country's highest offices — is a national issue that often has global implications. Such was displayed in Turkey over the past several months as incumbent President Recep Tayyip Erdoğan ran for and secured reelection against opposing candidate Kemal Kılıçdaroğlu.

Soaring energy prices and the country's dependence on energy imports was an important campaign issue that Erdoğan leaned into in his bid to connect with Turkish voters, who have been facing the hardships of an economy gripped by heightened inflation. As with many countries, the twin challenges of inflation and high energy prices have enticed Turkey to purchase discounted Russian energy, increasing the country’s dependence on Russia.

Turkey's energy minister, Fatih Dönmez, confirmed that Russia allowed Turkey to postpone payments for some gas imports. Such support from the Kremlin may well have aided Erdoğan's reelection by enabling him to continue subsidizing retail gas sales by up to 80% and power by up to 50% ahead of the election, according to S&P Global Commodity Insights. Iraq is Turkey's main oil supplier, but Russia has increased its share of Turkey's imports in recent years, often trading at steep discounts. Turkey's monthly imports of Russian crude more than doubled since April 2022 and product imports are surging.

But Turkey's energy security is far more than a national topic of political rhetoric and consumer angst. Turkey is imbued with global energy market significance as an energy crossroads, straddling the Turkish Straits that connect the Black Sea with the Mediterranean. Several important pipelines transit Turkey too, increasing its importance in global energy markets as European countries work to replace Russian oil and gas. Despite not being a major producer, Turkey’s geostrategic position and role as a transport hub mean that its energy policies ricochet through global markets.

Policymakers in Ankara, recognizing the tenebrous state of the nation's energy security, are working to ramp up domestic energy production and realize the goal of establishing a gas trading hub near interconnectors with Bulgaria and Greece. For example, the recently commissioned Sakarya gas field is slated to produce 14-15 billion cubic meters per year by 2025, and Bulgargaz — Bulgaria's national gas company — already uses Turkey's northern liquefied natural gas terminals for imports to replace lost Russian volumes.

Turkey may drift closer to Russia with Erdoğan having won reelection, but the country would likely remain in its energy dilemma even if the election had catapulted a new president into office. For global energy markets, it's a bit of a mixed bag. A closer Turkey-Russia relationship vis-à-vis energy may mean Turkey continues increasing its imports of Russian fossil fuels. But Turkey realizing its ambitious goal of becoming a gas hub could bolster energy security for southeastern Europe and eventually provide broader Europe with access to alternative gas suppliers.

Today is Friday, June 16, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

The next edition of the Daily Update will be published Tuesday, June 20.

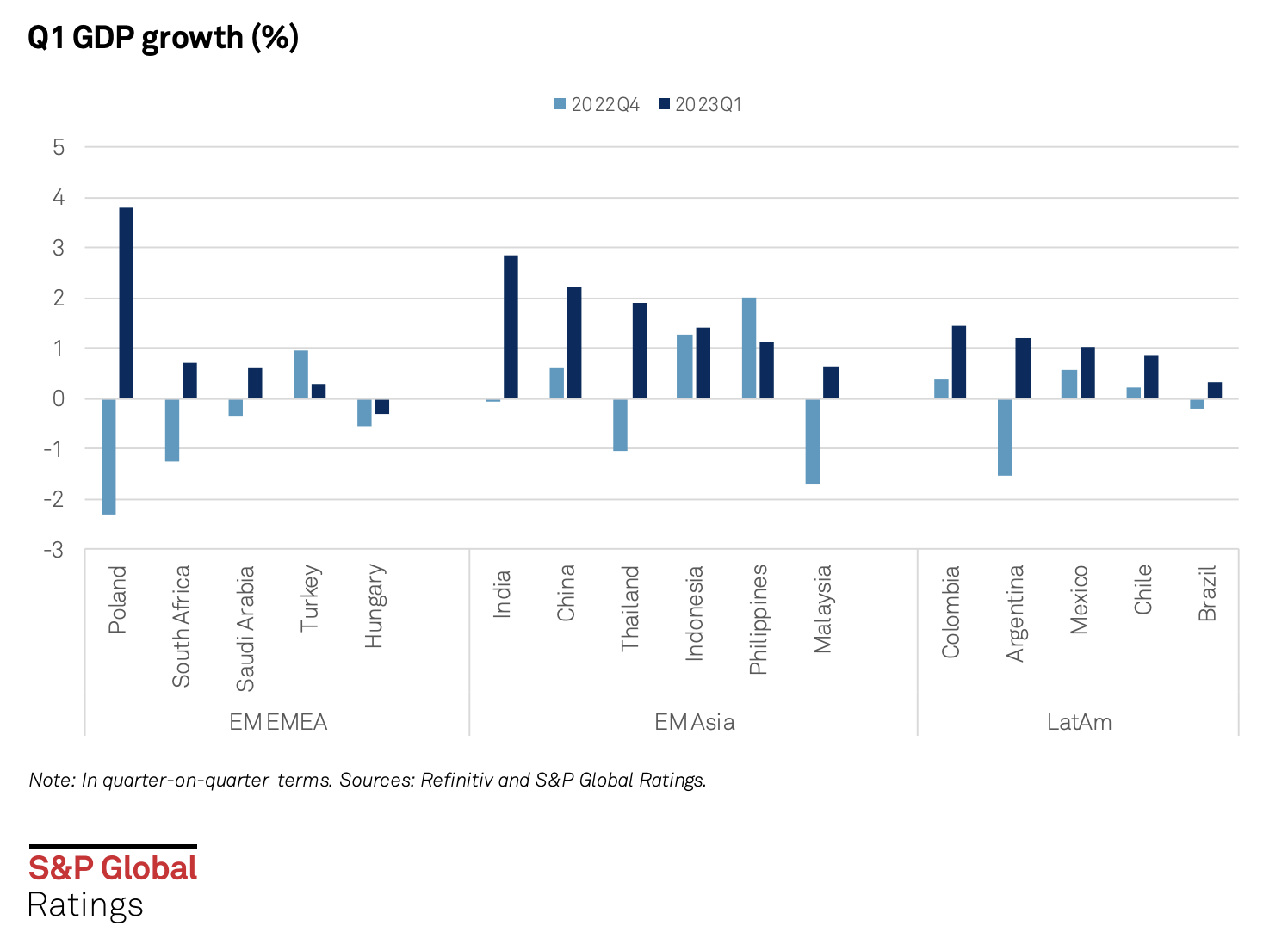

Emerging Markets Monthly Highlights: Resilience To Diverging External Trends

In most cases, Q1 GDP growth across Emerging Markets (EM) was better than expected. Domestic demand was resilient across most of less dynamic in EM EMEA and LatAm, as high real interest rates and inflation take a toll on fixed investment and consumption. Soft indicators are pointing to some improvement in external demand, which could support continued resiliency in GDP growth in the coming quarters.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

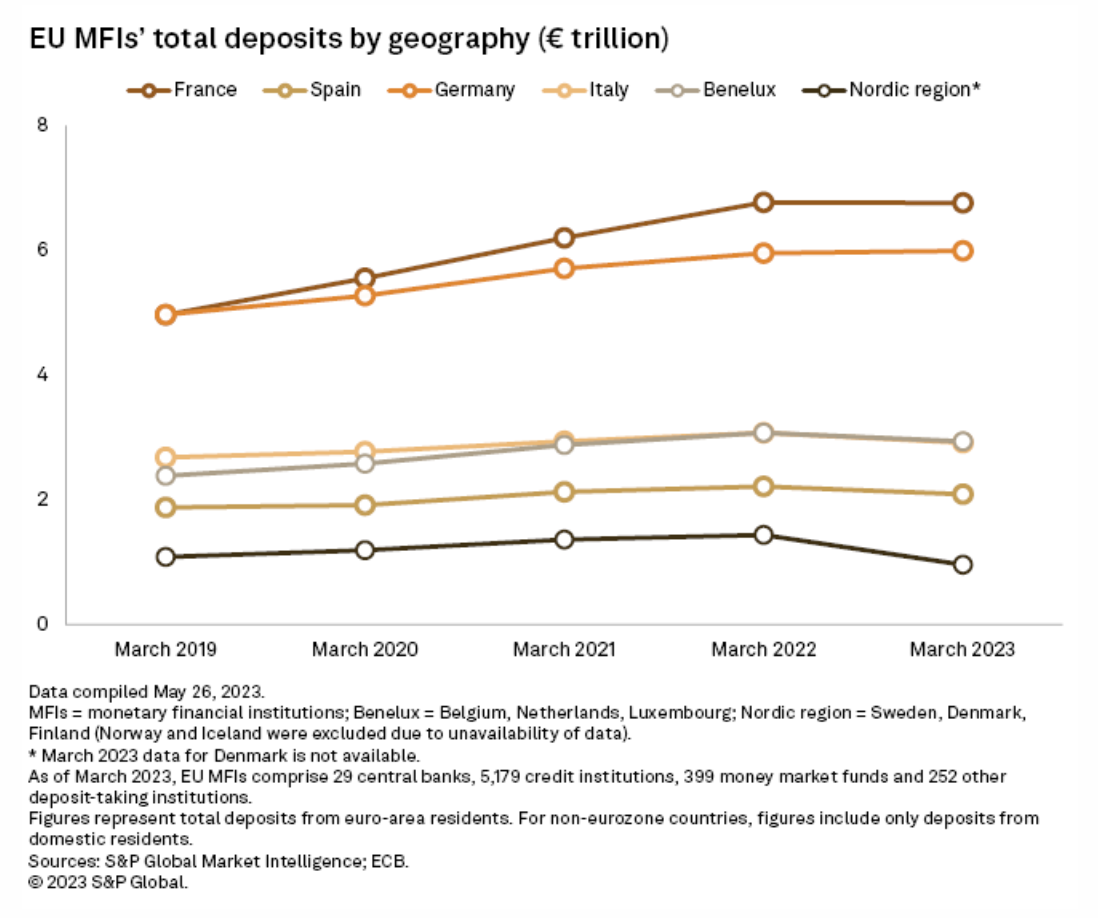

Deposit Outflows Emerge At European Banks

Total deposits fell in several major European markets in the early part of 2023, marking an end to a sustained period of growth in customer funding. Deposits at monetary financial institutions in France, Italy, Spain and the Benelux region were all lower as of March 2023 compared to 12 months prior, data from S&P Global Market Intelligence and the European Central Bank shows. Deposits also fell in the Nordic region, although the latest figures do not account for Denmark.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Exploring Europe's Shifting Trade Patterns Amid The Russia-Ukraine War

The war in Ukraine has created a new set of trade flows, as many buyers look to avoid Russian commodities. What are European buyers doing to replace Russian crude oil, and how have these changed flows upturned the markets? In the latest Oil Markets podcast, London-based crude oil price reporters Luke Stuart, George Delaney and Sam Angell discuss with Joel Hanley how oil from Brazil, Iraq and the US is helping fill the gap.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

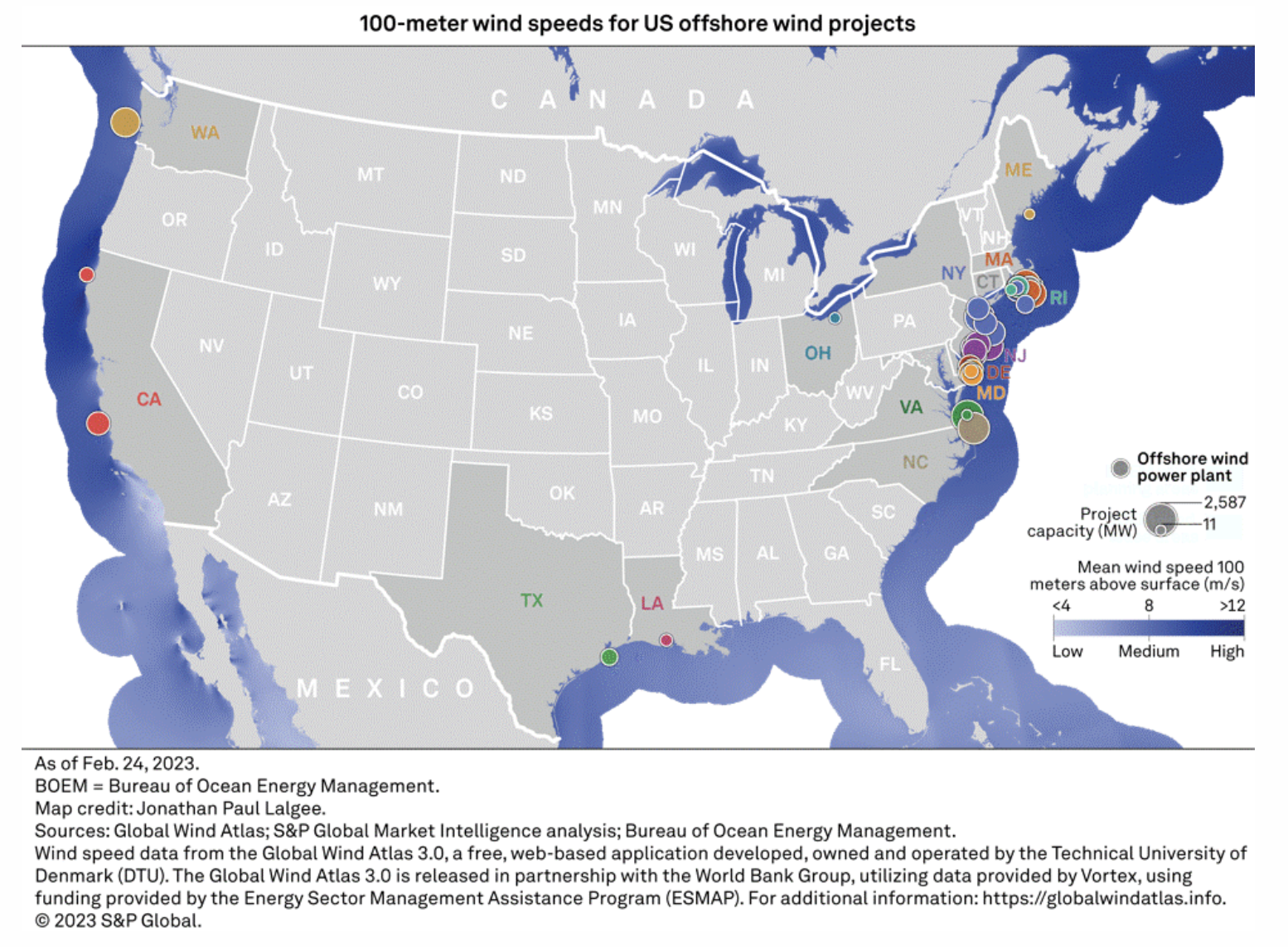

Strong Coastal Winds Fueling US Offshore Industry Looking To Break Through

In the US, state-level offshore wind procurement targets currently total 80.7 GW, and the Biden administration implemented a countrywide goal of 30 GW by 2030. Additionally, coastal states — particularly along the mid- and northern Atlantic Ocean — boast strong offshore wind resources, with nine states averaging 100-meter wind speeds above 8 meters per second. Despite these formidable legislative and geographic drivers, the US offshore wind industry continues to move at a snail's pace, with only 42 MW in operation and just 3% of the 39 GW of capacity in the pipeline having begun construction.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

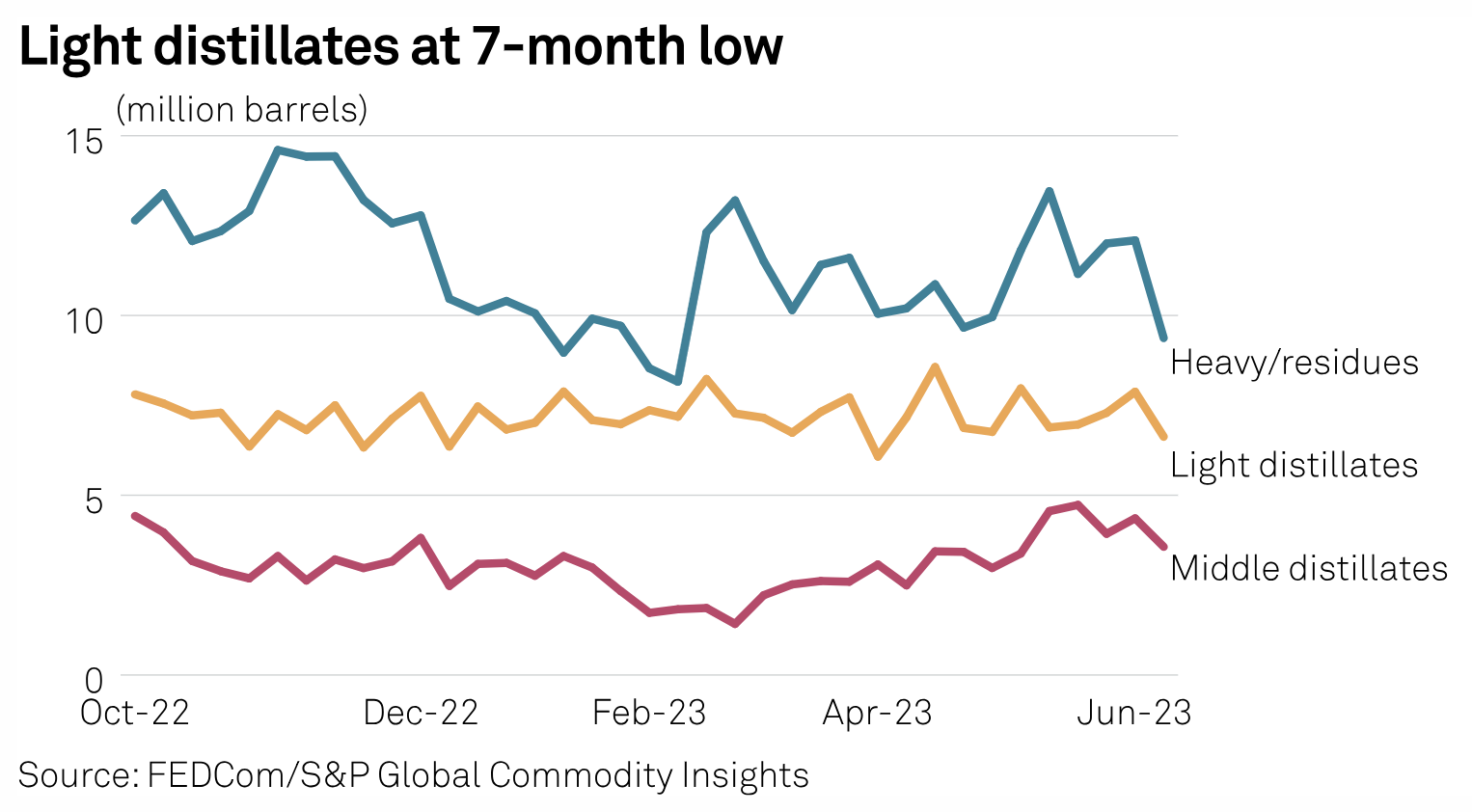

Oil Product Stockpiles Drop To Two-Month Low

Stockpiles of oil products at the UAE's Port of Fujairah fell to a two-month low as of June 12, with all categories showing double-digit declines from a week earlier, as exports for most products picked up, according to June 14 figures from the Fujairah Oil Industry Zone and latest shipping data. Total inventories dropped 20% on the week to 19.566 million barrels as of June 12, the lowest since April 3, the FOIZ data provided exclusively to S&P Global Commodity Insights showed. Total inventories were down 5.3% since the end of 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

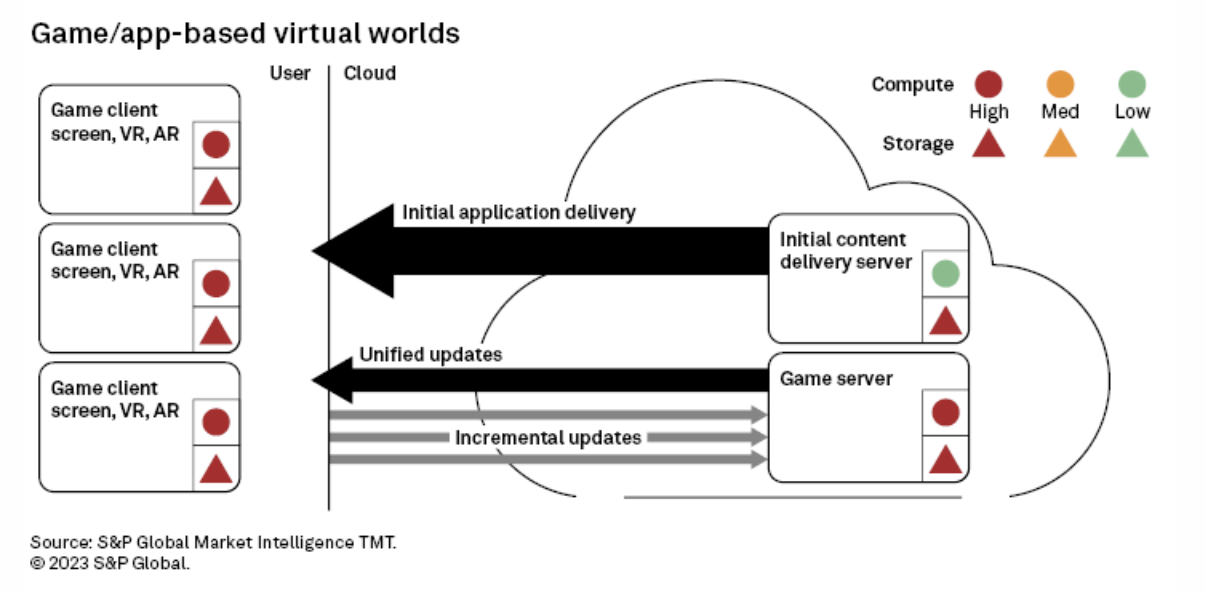

Diverse Network And Infrastructure Challenges For Metaverse Development

The evolution of the metaverse is likely to build on existing infrastructure and application patterns. The experiences that have the metaverse attributes of shared, immersive, persistent 3D virtual spaces, where humans and machines interact with one another and with data, may look similar on the surface to a user. But for infrastructure providers, the architectures are quite varied. This report looks at four major architecture patterns and the significant differences between them.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Segment

Language