Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Sub-Saharan Africa's Struggle For Growth

The inflationary implications of the war in Ukraine are hurting Sub-Saharan African economies, which are struggling to return to pre-pandemic economic output.

The region hasn’t kept pace with the recoveries that others have enjoyed following the depths of the pandemic-prompted downturn, as growth in many key Sub-Saharan African countries has remained below pre-COVID trends and current conditions are likely to keep projected GDP growth rates insufficient to bring them back to their former trajectories, according to S&P Global Ratings. The indirect effects of rising food and commodity prices due to the Russia-Ukraine war are putting additional pressures on Sub-Saharan Africa’s economic outlook, according to S&P Global Market Intelligence.

Overall, the Sub-Saharan Africa region is likely to be deeply affected by surging food and fuel prices, with a high risk of social unrest. The global geopolitical shocks and their corresponding inflationary pressures are expected to weigh on regional growth moving forward.

“While there are concerns around the impact of rising prices for both fuel and food, higher fuel costs have emerged as the key driver of rising purchase prices for companies in Sub-Saharan Africa, according to respondents to the PMI surveys,” S&P Global Market Intelligence said in its recent purchasing managers’ index research. “With prices of key items such as food and fuel set to remain high for some time to come, there will be worries that growth across Sub-Saharan Africa will continue to wane as the year progresses.”

Higher prices began limiting economic growth in the region at the onset of the war in Ukraine in February, and the situation has intensified. The three months from March to May has seen the strongest period of price rises across Sub-Saharan Africa since at least 2014—with energy prices running at between six and eight times the pre-pandemic average level, and wholesale and retail charges increasing at the fastest pace on record in May, according to purchasing managers’ index data from S&P Global Market Intelligence.

S&P Global Ratings anticipates real GDP growth in seven key Sub-Saharan African economies—Angola, the Democratic Republic of the Congo, Ethiopia, Ghana, Kenya, Nigeria, and South Africa—to soften to 3.2% on aggregate for 2022-2024, with output significantly 7.8% smaller than the pre-pandemic long-run trend.

“Sub-Saharan Africa is struggling to return to pre-pandemic economic growth. Commodity-fueled exports and investments should help reduce external imbalances and boost activity in commodity rich countries,” S&P Global Ratings said in recent emerging markets research. “However, the rising cost of goods and services will hurt households across the region, especially in fuel and food-importing countries. The authorities and regulators will likely look to balance providing subsidies and other support measures against permitting price rises, while dealing with large fiscal deficits and sizable public-sector debt.”

Today is Monday, June 13, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

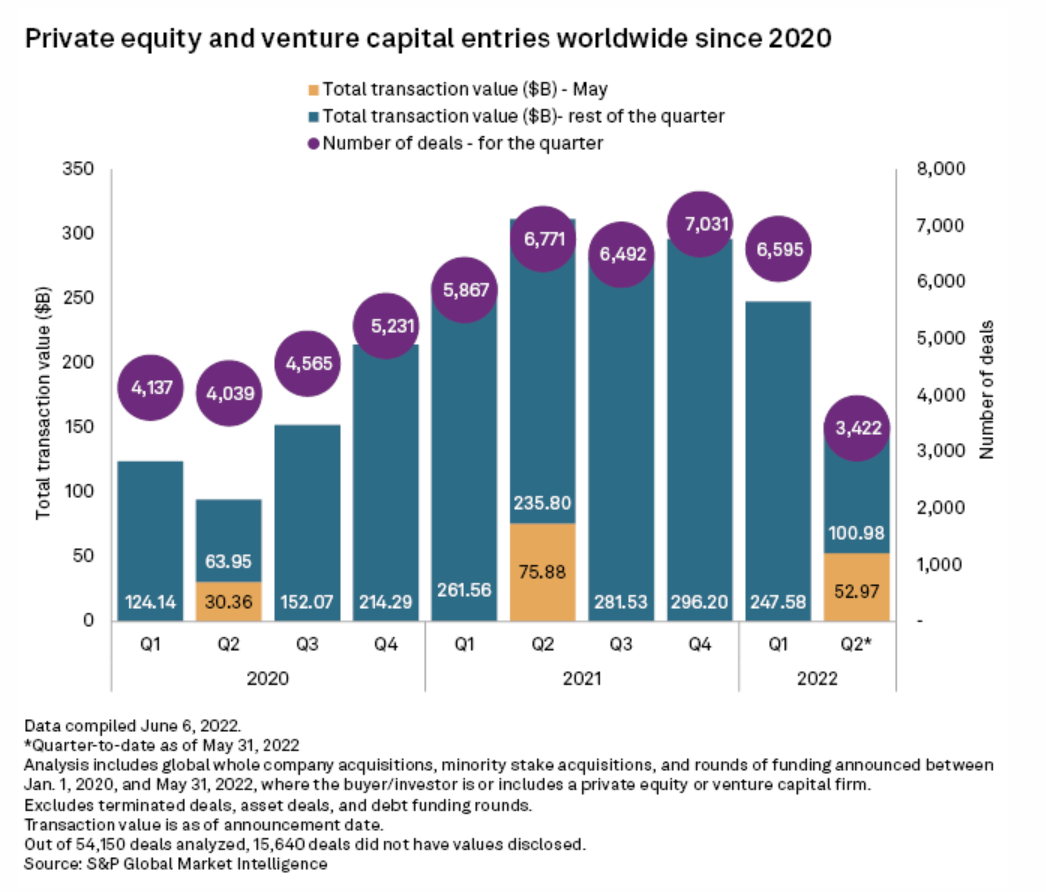

Inflation Dampens Dealmaking Outlook; May Entries Dip To 12-Month Low

Rising inflation and interest rates are sapping the momentum of private equity dealmaking. Dealmaking surged in late 2020 after private equity shook off a temporary COVID-19-related slowdown, setting the industry up for what turned out to be a record-setting year in 2021. Expectations that private equity could maintain that pace through 2022 met hard reality in the first five months of the year, with a tight labor market, Russia's war in Ukraine, ongoing supply chain snags, and rising inflation.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

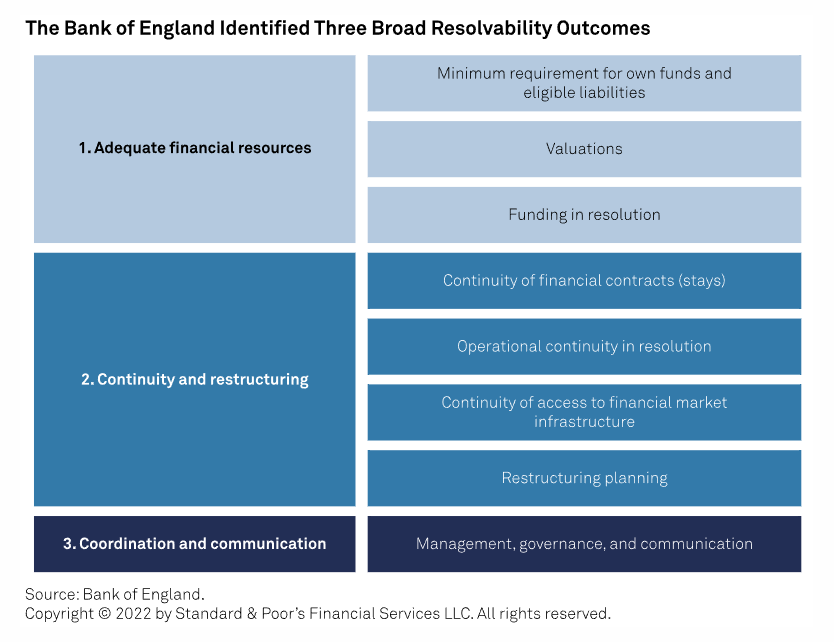

Bank of England Sees Systemic U.K. Banks As Substantially Resolvable, With Certain Gaps Still To Close

The Bank of England confirmed today that the eight largest U.K. banks are well-advanced in becoming resolvable. Bail-in resolution is a complex, largely untested concept and a successful outcome would rely in large part on market confidence in the process. By improving transparency, S&P Global Ratings believes that today's disclosures enhance the likelihood of a well-executed resolution, assuming the banks go on to address the residual gaps identified in the assessments. We see these gaps as areas requiring further work to maximize preparedness, not material obstacles to an effective resolution.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

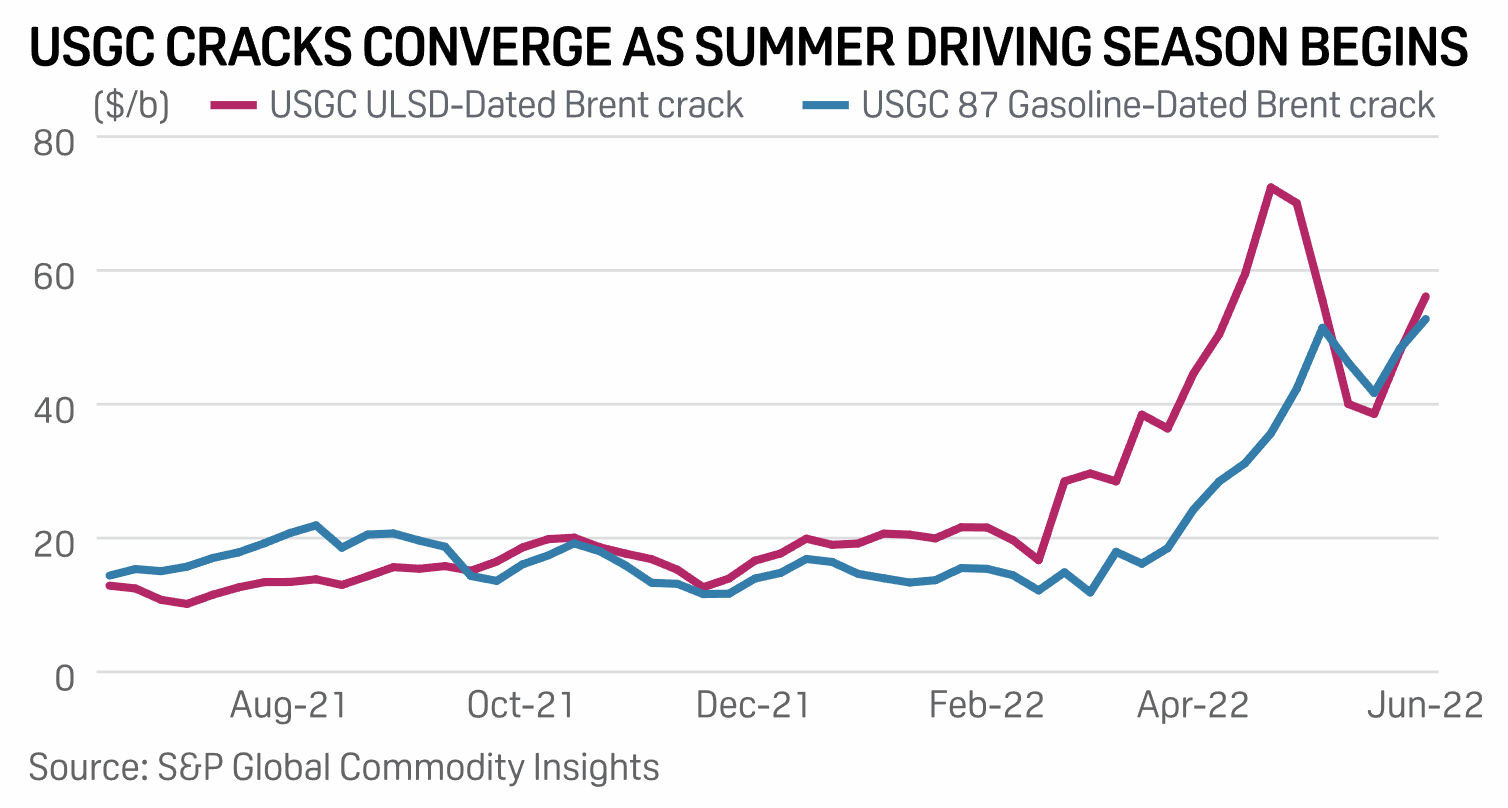

Feature: U.S. Drivers In For Expensive Summer As Refiners Grapple With High Demand

With average U.S. gasoline prices breaking the $5/gal level in early June, refiners are working hard to meet rising post-coronavirus demand from drivers seemingly undeterred by high pump prices. "Pent-up travel demand in North America will support oil consumption despite mounting pressure from high retail prices and eroded consumer purchasing power from high inflation," according to Platts Analytics.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

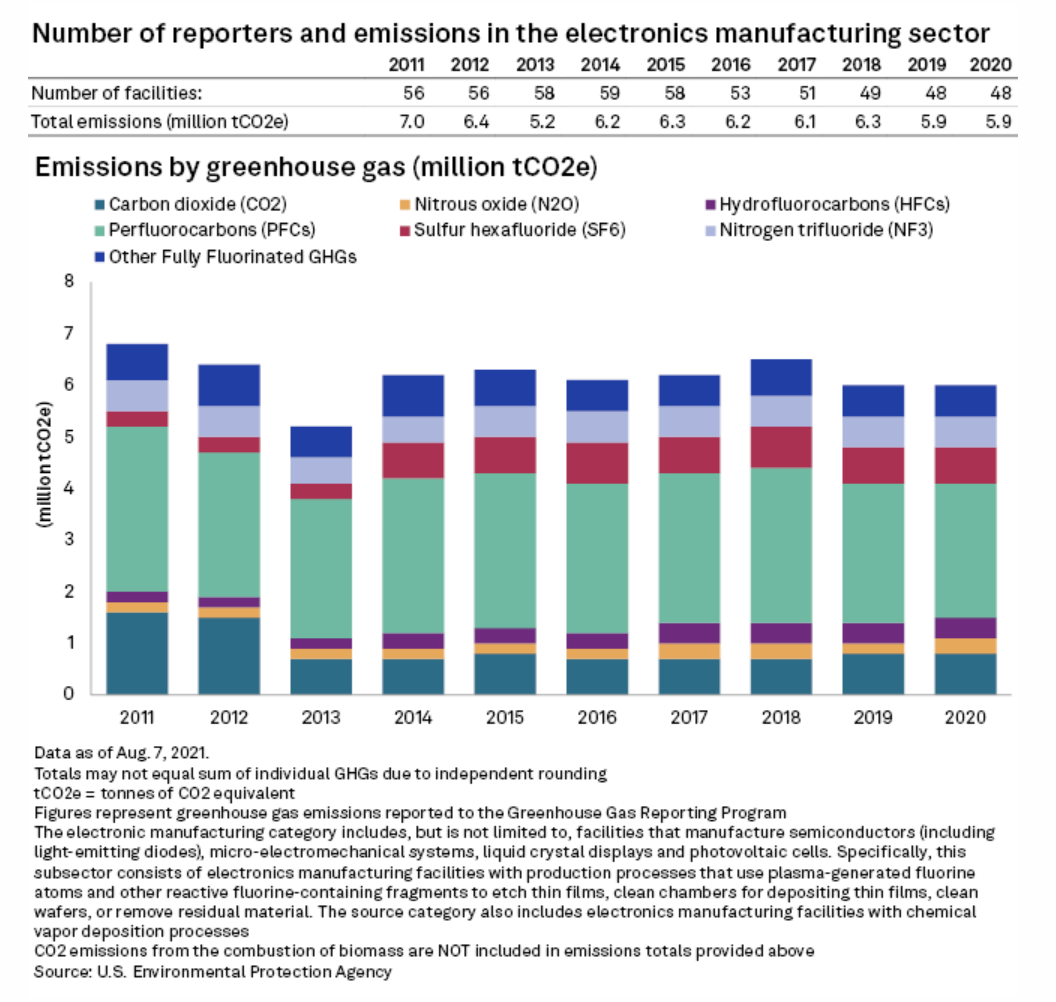

Path To Net-Zero: U.S. Chipmakers Balance Growth Vs. Going Green

A $52 billion plan to boost U.S. chipmaking also presents a chance to make the industry more environmentally sustainable. The CHIPS for America Act will pump federal money into raising the number of U.S. foundries, easing a global supply crunch and the nation's reliance on imported semiconductors. The legislation became law in 2021 but still needs funding. It provides financial assistance for the construction, expansion, or modernization of semiconductor fabrication plants, or "fabs," in the U.S. As new foundries are built domestically, firms can invest in zero- or low-emission technologies.

—Read the article from S&P Global Market Intelligence

Freeport Outage Brings More Gas To East Texas Market, South Central Storage

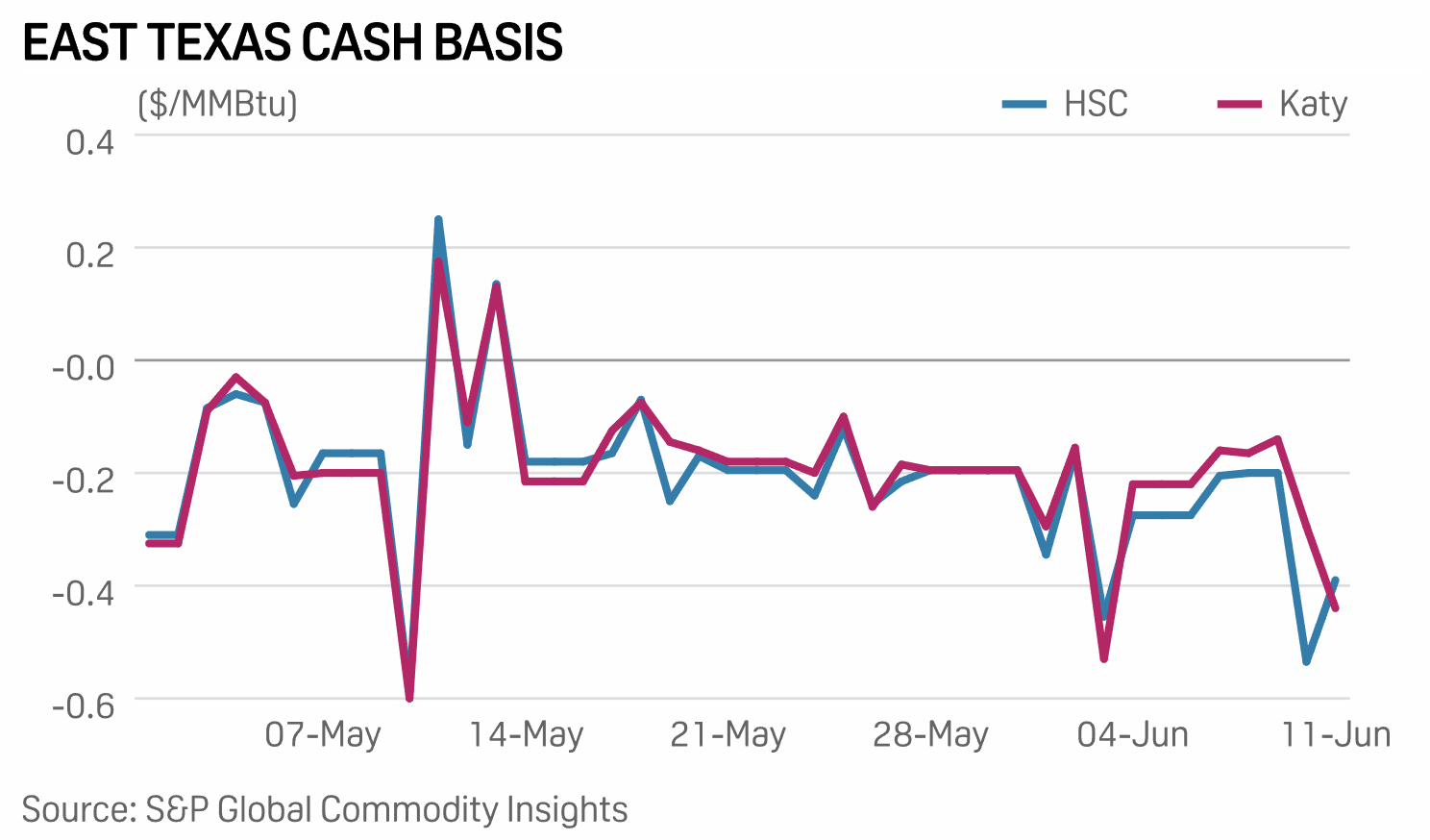

Basis prices in the East Texas gas market are down sharply following the recent suspension of feedgas deliveries to Freeport LNG. With the facility expected to remain offline through June, the added supply could boost regional storage levels in a potentially longer-term impact to the East Texas market. In June 10 trading, cash prices at East Texas hubs were up on the day as hotter weather fueled a spike in cooling demand across the Lone Star State. Despite the cash market gains, basis prices at Houston metro-area hubs have tumbled over the last several days as the region's supply balance lengthens.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

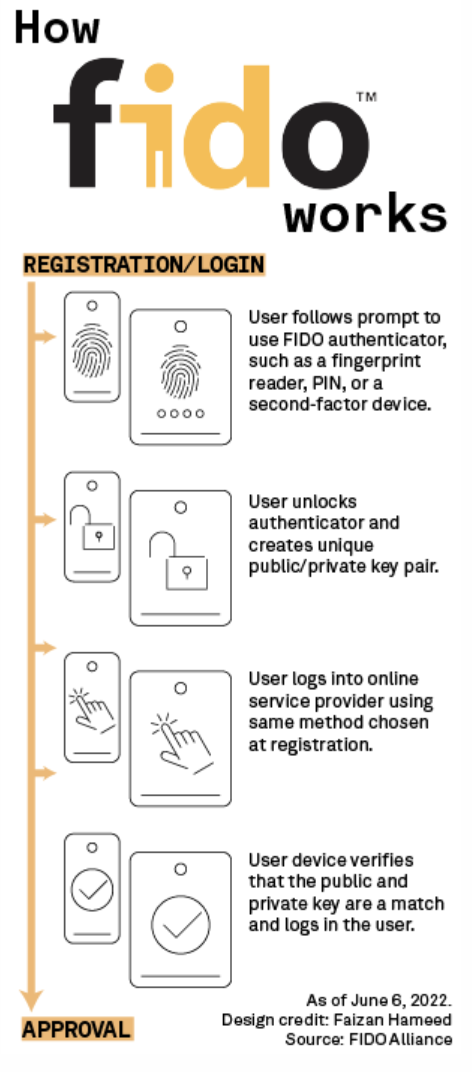

Big Tech Pushes Forward With Password-Less Authentication

A tech industry coalition including Apple Inc., Alphabet Inc., and Microsoft Corp. is working to expand adoption of a secure alternative to the common password. Under agreements struck this year, a new standard known as FIDO, short for Fast IDentity Online, will be built into major operating systems like macOS, iOs, Windows 11, Chrome OS, and Android in the coming months. Users will have the choice to opt in to the new protocols, which will allow them to log in securely without a password.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >