Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Jul, 2020

By S&P Global

American investment manager Jim Chanos chose to name his fund Kynikos Associates after the ancient Greek word for “cynic.” While Mr. Chanos’s cynicism has at times been rewarding for his investors – most notably his short positions on Enron and Wirecard – his high-profile bet against electric-car manufacturer Tesla seems to be running counter to market sentiment.

On July 22, Tesla reported its fourth consecutive profitable quarter, with its shares soaring more than 500% in the past year and making it the most valuable car manufacturer in the world, having overtaken Toyota. Tesla followed up the news by announcing it would be building its next Gigafactory near Austin, Texas.

In January, S&P Global Market Intelligence reported that many short sellers had backed off their positions against Tesla, saying, “Short sellers were down $2.89 billion in mark-to-market losses in 2019, according to S3.” With an additional two quarters of reported profitability, estimated losses for short sellers of Tesla have reached $18 billion through July.

Tesla’s resilience during the coronavirus crisis is remarkable given that ratings agencies and consultancies have predicted global auto sales to drop 20-25% this year. In early July, S&P Global Market Intelligence suggested that, “Tesla's resilience may be in part due to a business model that emphasizes online sales, something that anomalously made it the top-selling brand in the U.K. in April and May as rivals' dealerships were shut.”

Mr. Chanos remains unpersuaded for now, attributing Tesla’s reported profitability to “aggressive accounting” in a recent interview with the Financial Times.

Allegations of unusual accounting practices have dogged Tesla for years. In April, another short-seller, David Einhorn of Greenlight Capital, questioned why an unidentified entity made up more than 10% of Tesla’s accounts receivable balance in regulatory filings. In September of 2019, the Securities and Exchange Committee questioned Tesla’s accounting of warranties for leased vehicles and solar-powered systems under leased contracts.

The financial and accounting functions at Tesla have seen high levels of turnover. In September of 2018, Tesla’s Chief Accounting Officer Dave Morton abruptly left the company over reported differences with CEO Elon Musk. Then in late 2019, Chief Financial Officer Deepak Ahuja announced he was leaving. Mr. Ahuja had rejoined the company after previous CFO Jason Wheeler had abruptly departed in 2017.

Mr. Musk has long taken a dim view of short sellers, suggesting on Twitter that, “What they do should be illegal.” In early July, Tesla began selling red satin short shorts on the company website in a move seen as taunting short sellers for their positions against the company.

Governments around the world have identified electric vehicles as an essential aspect of their approaches to energy transition related to climate change. According to S&P Global Platts, “An accelerated shift to cleaner energy and electric vehicles, along with vehicle efficiency improvements, had already started to gnaw away at oil demand well before the coronavirus hit.”

Mr. Chanos remains cynical about Tesla’s valuation. During the Bloomberg Invest Global digital summit in late June, he said, “This is a company that trades at 8x revenues, compared to other automotive companies, which trade at 0.25 or 0.5x revenues. People see Tesla how they want to see it.”

Today is Monday, July 27, 2020, and here is today’s essential intelligence.

From 'cautiously optimistic' to 'roller coaster,' CEO recovery outlooks diverge

U.S. management teams face a daunting challenge this earnings season: Message your results to a nation facing a surge of new coronavirus infections and, for many states, a backslide into lockdown, only weeks after initial glimmers of a recovery emerged. For added difficulty, do it just as federal government stimulus expires.

— Read the full article from S&P Global Market Intelligence

COVID-19 dampens US private equity dealmaking, fundraising activity in Q2

U.S. private equity deal and fundraising activity slowed during the second quarter, as the coronavirus pandemic and consequential lockdown took its toll. Entry deal volume plunged 42.3% year over year to 932 announced transactions in the second quarter. This was also down 33.8% from 1,407 deals in the three months to March 31, according to S&P Global Market Intelligence data.

— Read the full article from S&P Global Market Intelligence

Default, Transition, and Recovery: 2020’s U.S. Oil And Gas Defaults Have Already Surpassed 2019’s Full-Year Tally

So far in 2020, the oil and gas sector leads the default tally with 27 defaults globally. The sector has also surpassed both its year-end 2019 U.S. and global tallies of 18 and 20, respectively. The largest portion of the global total comes from the U.S and Canada at 82%. In North America, we expect a high number of defaults to continue as access to capital markets for lower-rated speculative-grade issuers remains limited and liquidity shrinks due to cuts to the borrowing bases of revolving credit facilities (see "North American Corporate Credit Mid-Year Outlook 2020," July 16, 2020).

— Read the full article from S&P Global Ratings

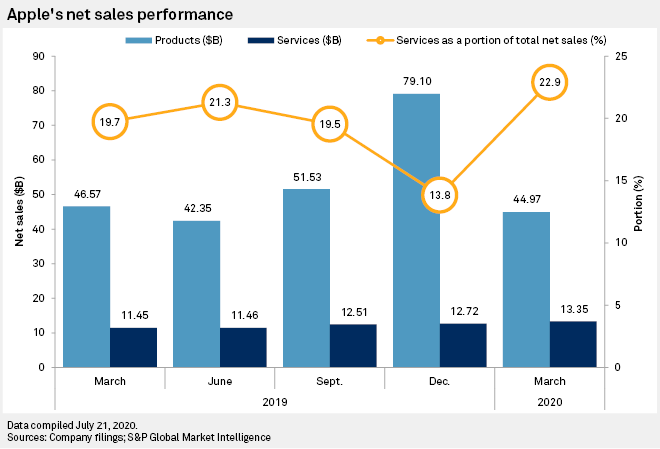

Analysts urge long-term view of Apple ahead of fiscal Q3 earnings

Despite muted expectations for Apple Inc.'s just-ended fiscal third quarter, analysts remain optimistic that strong demand for its devices and surfaces will overcome broad-market uncertainties by 2021. Apple faced significant production delays and retail closings as a result of the coronavirus pandemic this year, sparking some investor concerns about the company's upcoming July 30 earnings announcement. But analysts say anticipation for the launch of a 5G iPhone this fall and strength in Apple's service business should carry the tech company to new highs later this year and into the next.

— Read the full article from S&P Global Market Intelligence

Facebook lobbying spending on pace for record year as government scrutiny grows

Facebook Inc. is on pace to spend record amounts of money on lobbying in 2020, public data shows, at a time when lawmakers and antitrust enforcers continue to ramp up scrutiny of the company. A July 20 public filing from the company shows that it spent $4.8 million for the second quarter of 2020, a 17.5% increase from what the company spent in the second quarter of 2019, according to data from the Center for Responsive Politics' OpenSecrets.org website. Data from the center also shows that the company spent $5.3 million in the first quarter, which brings its 2020 lobbying total to $10.1 million.

— Read the full article from S&P Global Market Intelligence

Recyclers greet EU plastic tax proposals with skepticism, confusion

The EU's proposed plastic tax has been met with skepticism and confusion by some participants in the recycling sector, who said investment decisions that need to be made straight away cannot be taken until there is more clarity on how the tax will operate.The proposed plastic tax, announced July 21 as part of the EU's larger Eur750 billion ($870 billion) recovery fund, would look to levy Eur800/mt on non-recycled plastic packaging waste.

— Read the full article from S&P Global Platts

Norway's Equinor favors blue hydrogen developments over green: CFO

Norway's Equinor sees the development of blue hydrogen -- fuel produced from natural gas in combination with carbon capture and storage -- as currently more worthy of pursuing than green hydrogen, CFO Lars Christian Bacher said July 24. Earlier this month, Equinor said it was leading a project in the UK to develop one of the world's first "at-scale" facilities to produce blue hydrogen at Saltend Chemicals Park near the city of Hull in northeast England.

— Read the full article from S&P Global Platts

Essential Energy Insights July 2020

Carbon dioxide emissions from the largest 100 power producers in the U.S. decreased 8% over the course of 2018 largely due to the displacement of coal-fired generation with that fired by natural gas and wind and solar projects.

— Read the full report from S&P Global Market Intelligence

Pakistan's oil demand feels COVID-19 pain, set to bounce back

Pakistan's oil consumption declined by as much as 11% in the fiscal year 2019-20 (July-June) as COVID-19 kept people indoors while industrial activity slowed to a trickle for a substantial part of the year, but analysts are hopeful that demand will bounce back in fiscal 2020-21. But despite the sharp fall in domestic oil consumption in a year that witnessed negative economic growth for the first time in 68 years, the country's oil product imports posted positive growth, while imports of crude oil slowed sharply in the same period.

— Read the full article from S&P Global Platts

China's CRC steel demand to remain subdued in H2 on weak car sales forecast: traders

China's passenger vehicle market will remain challenging in the second half of 2020, despite showing some signs of improvement from H1, a key industry association forecast this week, which steel market sources said meant demand for cold rolled coil was unlikely to see any substantial increase before year end. Passenger car retail sales are forecast to fall 11% year on year in 2020, despite sales in H2 improving after a 22.5% year-on-year decline in H1, the China Passenger Car Association forecast on July 21. This decline would follow a 7.4% year-on-year fall in domestic car sales in 2019, CPCA data showed.

— Read the full article from S&P Global Platts

Crude rises on bargain-hunting, but coronavirus worries linger

Oil futures rose in mid-morning trade in Asia July 24, as investors looked for bargains following the overnight crude losses after a weak US jobs report fueled growing economic uncertainty. At 11:50 am Singapore time (0350 GMT), ICE Brent September crude futures were up 16 cents/b (0.37%) from the July 23 settle to $43.47/b, while the NYMEX September light sweet crude contract was up 9 cents/b (0.22%) at $41.16/b.

— Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language