Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Supply Chains on the Mend, but Challenges Remain

So far, 2023 looks to be the year that supply chains recover some semblance of normalcy from the twin shocks of the COVID-19 pandemic and geopolitics. But global supply chains are too vast and various not to have areas of concern. Chris Rogers, head of supply chain research for S&P Global Market Intelligence, recently published the article “Supply Chain: 2023 So Far in 10 Data Points,” which summarizes a larger report that is available for download. Rogers identified the following 10 data points that demonstrate the ways supply chains are returning to normal.

In the first half, weak demand for consumer discretionary goods in the US led to a 16% fall in US seaborne imports compared with the same period last year.

Delivery times for global manufactured goods in May were the fastest since April 2009. The reduced demand and reduced orders for manufactured goods gave supply chains a much-needed opportunity to debottleneck.

Containerized freight costs are returning from the stratospheric levels of the pandemic. According to S&P Global Commodity Insights, shipping costs from North Asia to both Northern Europe and the US West Coast fell to $1,050 per forty-foot equivalent unit on June 30, a 28% slide in price from the beginning of the year for Europe and a 22% slide for the US West Coast.

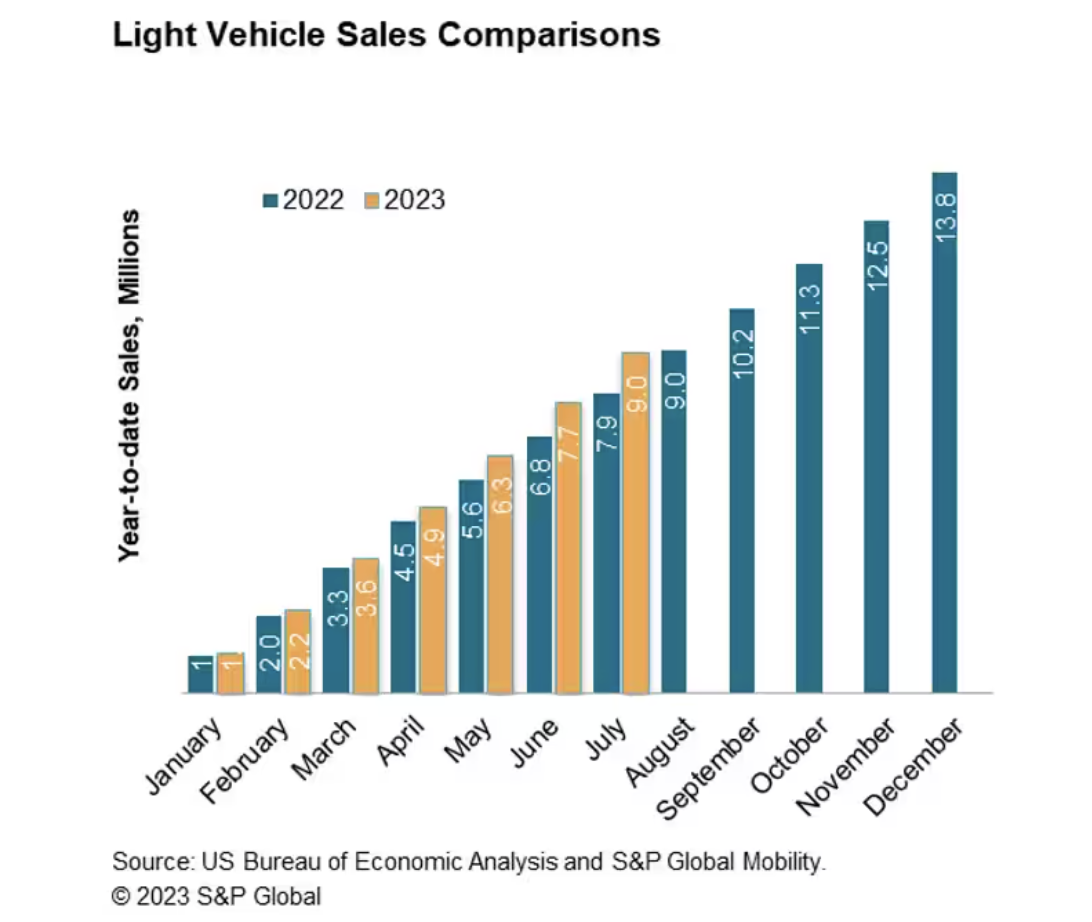

The shortage of semiconductors that bedeviled the automotive market has eased. According to data from S&P Global Mobility, light vehicle sales hit 28.8 million globally in the first five months of 2023. This is a 9% improvement over the same period last year.

According to S&P Global Market Intelligence data, the price per pound of lithium carbonate — used in lithium-ion batteries for electric vehicles — fell to $20.4 in March, from the recent high of $35.8 in December 2022.

Exports of computer chips are down significantly this year. In May, exports of chips from mainland China, Japan, South Korea and Taiwan were down 22% year over year. While some are blaming geopolitical tensions, the more likely culprit is weaker demand from the computing and telecom sectors. Exports from South Korea, which is unsanctioned, are down 36%.

The Netherlands is a leader in semiconductor manufacturing equipment for the global chip industry. Exports of this manufacturing equipment to China increased 47% in the three months to April compared with the period from November 2022 to January 2023. The Dutch government has since imposed restrictions on these exports.

According to Panjiva data, exports of mobile phones from India reached $5.1 billion in the first four months of the year, an 85% increase from the same period in 2022.

Data from S&P Global Market Intelligence indicates that worker shortages and increased consumer spending led to a 5.1% year-over-year increase in hourly wages for US workers in the first quarter.

Disruptions in Black Sea supply chains for Ukrainian oilseeds and grains have led to a shift to land-based transport through Europe. According to S&P Global Market Intelligence data, 9.9 million metric tons of Ukrainian cereals and oilseeds were exported overland to Europe from January to April compared with the year-ago period, a 117% year-over-year increase.

Today is Wednesday, July 26, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

US Weekly Economic Commentary: Consumer Resilience Keeps Economy Growing

On balance, the takeaway from a relatively full calendar of data this past week is that the US economy continued to hum along in the second quarter and near the US' "potential" growth rate — the pace that can be sustained from the supply side of the economy. The resilience of the economy and what that means for employment, wages and inflation going forward suggests to us that two more Fed rate hikes will be needed to wrestle inflation back to the Fed's 2% target quickly enough to satisfy Fed policy makers. S&P Global Market Intelligence expects the first of those hikes at next week's meeting of the Federal Open Market Committee.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

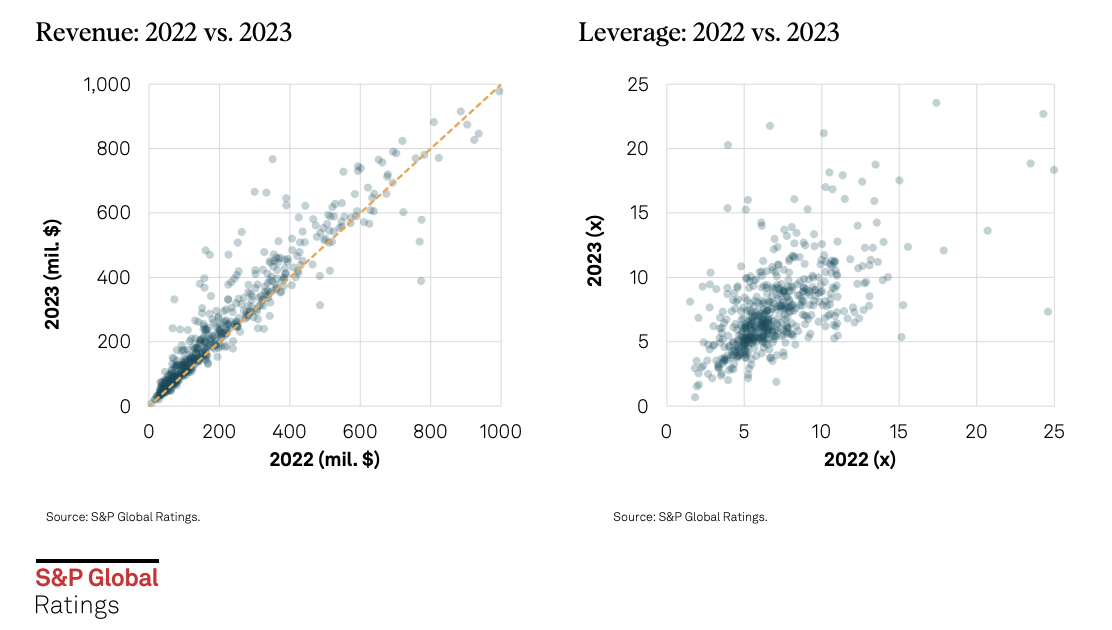

Middle-Market CLO And Private Credit Quarterly: Navigating The Post-Pandemic Economy

For the third consecutive quarter, US credit estimate downgrades outpaced upgrades as the effect of high-interest burden from the increase in benchmark rates and inflationary pressures challenged companies’ financial and operational performances. During the second quarter, a total of 50 entities were downgraded, bringing the aggregate downgrade for the first half of 2023 to 84. This compares to 22 upgrades in the second quarter and 42 upgrades for the first half of the year, for an overall upgrade-to-downgrade ratio of 1:2.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

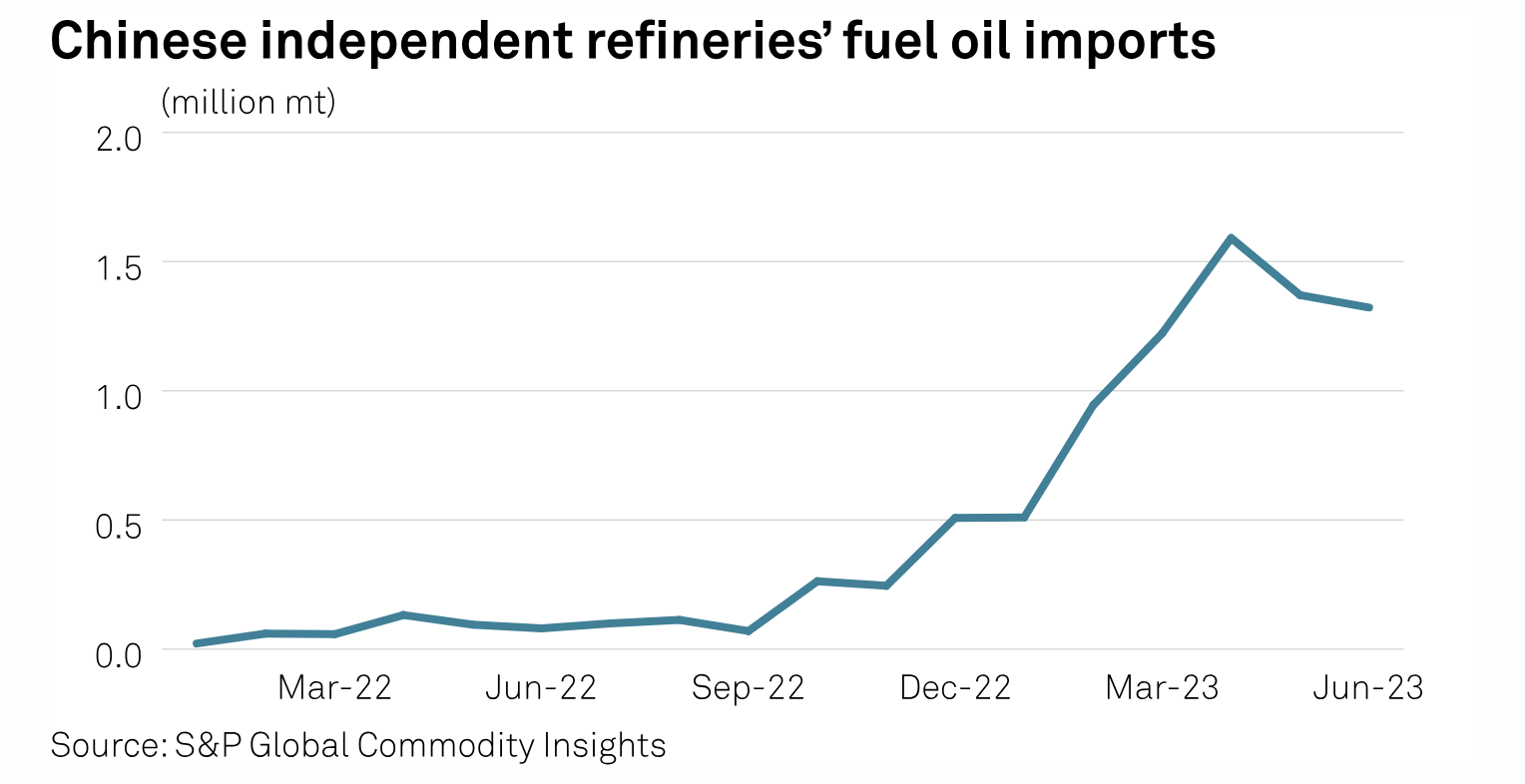

China's Fuel Oil Imports To Continue Uptrend In 2023 Amid Strong Demand, Tight Crude Quotas

Chinese independent refineries are likely to keep importing large volumes of fuel oil as feedstock for the rest of the year to compensate for tight crude quota availability, refinery and trade sources told S&P Global Commodity Insights July 25. These independent refineries, mostly based in Shandong, ramped up fuel oil imports in June to at least 1.32 million mt from 80,000 mt in the same month last year, only marginally retreating from the recent high of 1.59 million mt seen in April, data from S&P Global showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Investor Engagement Initiatives On Climate, Nature Are Evolving

On the ESG Insider podcast, we often hear from financial institutions about how they're engaging on sustainability issues — including by participating in investor engagement initiatives or networks. In this episode, hosts Lindsey Hall and Esther Whieldon explore the evolution of two such investor-led engagement initiatives: Climate Action 100+ and Nature Action 100.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

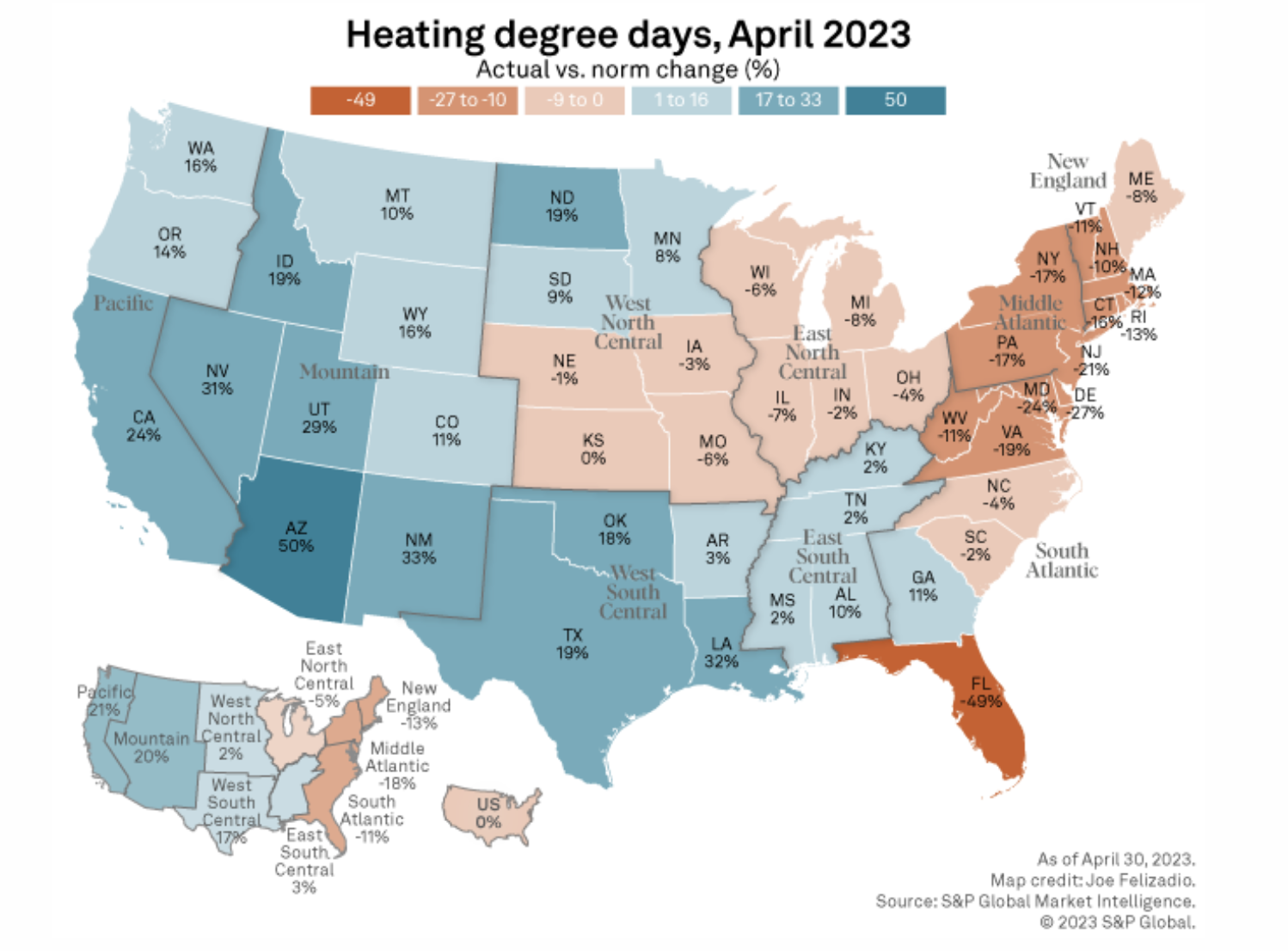

Mild Weather To Cast Cloud Over Q2 2023 Gas Utility Earnings

Wall Street is expecting an underwhelming earnings reporting period from gas utility operators as mild second-quarter weather continued to create headwinds for the sector. The outlook was brighter for utilities with a sharper focus on distributing natural gas. Analysts expect seven out of eight gas utilities selected by S&P Global Commodity Insights to match or exceed year-ago earnings per share.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

US Auto Sales Progress Again In July

S&P Global Mobility projects new US light vehicle sales volume in July 2023 to reach 1.33 million units, up 18% year over year. Expected July results represent a full calendar year worth of consecutive monthly sales growth (as measured in year-over-year unadjusted monthly volume comparisons), reflecting the recovery from the depths of the supply chain constraints realized through much of 2022. This volume would translate to an estimated sales pace of 16.1 million units (seasonally adjusted annual rate: SAAR).

—Read the article from S&P Global Mobility

Content Type

Location

Segment

Language