Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Emerging Markets Are All Over the Place (Literally)

S&P Global Ratings held its annual Global Emerging Markets Conference in London on July 11. As experts from around the world discussed the economic outlook for different countries and regions, the exception became the rule — there was simply too much variability to talk about emerging markets as one cohesive category. Economic growth in Malaysia confronted contraction in Peru. Increasing inflation in Africa contrasted with moderating inflation in Asia. Emerging markets lack a tidy definition, although they are generally considered middle-income countries with increasing exports to global markets of raw materials or manufactured goods. Because emerging markets are geographically scattered and have different leading exports and trading partners, they tend to have divergent performance. However, viewed cumulatively, emerging markets often appear to experience slow, steady growth. Economic strength or weakness in their large export markets, especially the US and EU, will trigger common reactions in emerging markets. But during periods of relative stability, it’s hard to generalize developing economies.

When the economic indicators for emerging markets are averaged, it seems they are having a pretty good year. The economic growth of emerging markets appears strong compared with developed markets: Headline inflation continues to ease, manufacturing is performing well and tourism is creeping back to pre-pandemic levels. However, the devil remains in the details. The difference between a manufacturing- and tourism-led economy in Southeast Asia and a commodities-led economy in Africa or South America is massive.

“We project that the combined economy of India and Southeast Asia will expand at [an] annual clip of 5.4% over 2023–2026, compared with 3.2% for the world,” Christopher Lee, Asia-Pacific chief analytical officer for S&P Global Ratings, said during a panel discussion. “Together these countries had US$6.4 trillion in nominal GDP at the end of 2022 — that is 50% larger than Japan’s and, if this were one country, it would be the world’s third-largest economy.”

While it feels increasingly inaccurate to describe India, China or many Southeast Asian countries as “emerging,” big challenges remain in other regions. Eight emerging market economies have a CCC sovereign credit rating, and three — Argentina, Mozambique and El Salvador — have already defaulted on their sovereign debt this year. Some emerging economies that rely on oil exports have been squeezed by OPEC production quotas. Other countries such as South Africa have been affected by unreliable electricity for factories and homes.

Any discussion about emerging markets inevitably begins and ends with China. While describing the world’s second-largest economy as “emerging” rather than “emerged” may seem a bit strange, China has historically served as a backstop for emerging markets, purchasing goods and lending money at favorable terms. The country continues to loan money and purchase goods within Asia. All eyes will be on the annual BRICS (Brazil, Russia, India, China and South Africa) Heads of State Summit in Johannesburg in August. A range of countries are seeking BRICS membership, and member countries appear eager to establish a consensus against Western-imposed multilateral sanctions related to the war in Ukraine.

“We are not in the ‘peak China’ camp,” Louis Kuijs, chief economist for Asia-Pacific at S&P Global Ratings, said during a panel discussion. “Given the combination of its large size and solid growth, China’s economy will continue to be a major driver of global growth.”

Today is Monday, July 24, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Singapore Economic Growth Weakens In First Half Of 2023

Singapore's advance estimate for second quarter GDP for 2023 showed weak expansion at a pace of 0.7% year-on-year (y/y), albeit slightly higher than the 0.4% y/y GDP growth rate in the first quarter of 2023. Economic growth momentum has slowed significantly compared with annual GDP growth of 3.6% in 2022. A key factor driving the slowdown of economic growth in the first half of 2023 has been declining manufacturing output, which fell by 7.5% y/y in Q2 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Default, Transition, And Recovery: 2022 Annual European Structured Finance Default And Rating Transition Study

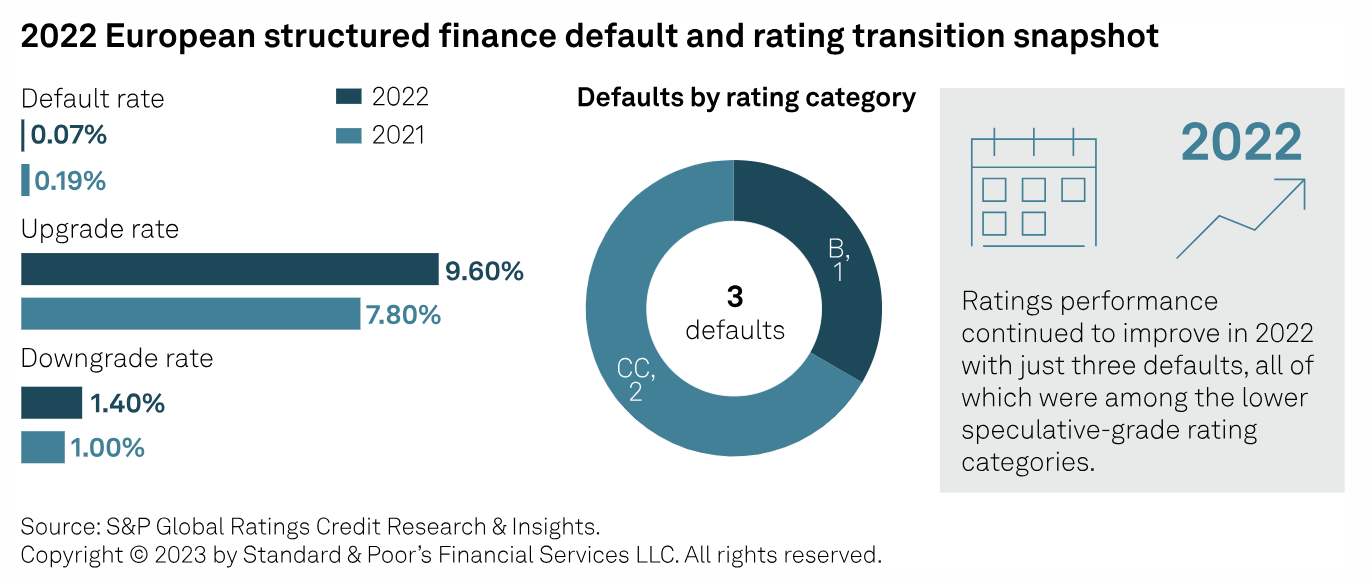

The European structured finance default rate fell to 0.07% in 2022 from 0.19% in 2021. Defaults in 2022 were from the structured credit (two defaults) and RMBS (one default) sectors, yielding default rates of 0.09% and 0.06%, respectively. The default rates in every sector remained below their respective one-year averages and the CMBS sector had zero defaults in 2022 for the first time since 2006. The downgrade rate rose marginally in 2022 to 1.4% up from 1.0% in 2021. Meanwhile, the upgrade rate rose considerably to 9.6% from 7.8% in 2021.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Fujairah Hub Sees Stiffening Competition As Middle East Bunker Market Evolves

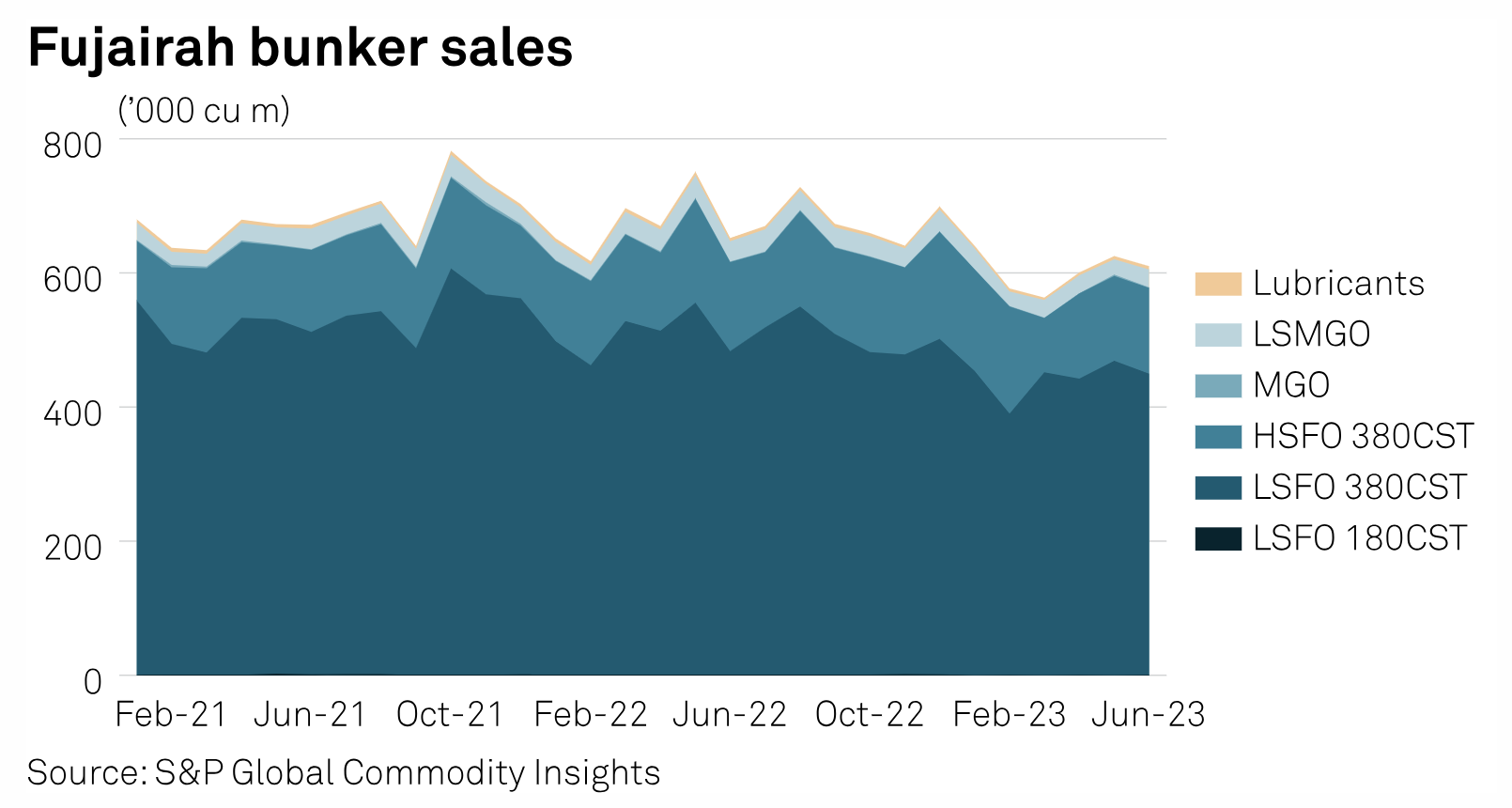

A gradually evolving downstream market around the Middle East with more refueling options might pose challenges in the longer term at the UAE's bunker hub Fujairah, market participants said, adding that the rising competition among domestic players is chipping away Fujairah's status as bunker hub. The emergence of alternative refueling options at strategic locations around the Middle East and a recent growth in bunkering activity outside port limits off the coast of Fujairah could pose further downward pressure on Fujairah's market, traders said, while macroeconomic headwinds also dented bunker demand.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Europe Will Struggle To Reach Its Solar PV Manufacturing Target Without Subsidies

China has dominated the module supply chain for the last 15 years. This status quo is shifting as multiple emerging factors pose a threat to mainland China's dominant position in the solar supply chain, including increasing scrutiny of solar supply chain sustainability and traceability, along with a growing global subsidy race, with the United States, India and the EU announcing plans to provide funding support to domestic manufacturers. A suite of policy levers has been recently used by global markets to directly or indirectly support growth of domestic PV manufacturing such as the IRA in the US or the BCD and the PLI scheme in India.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

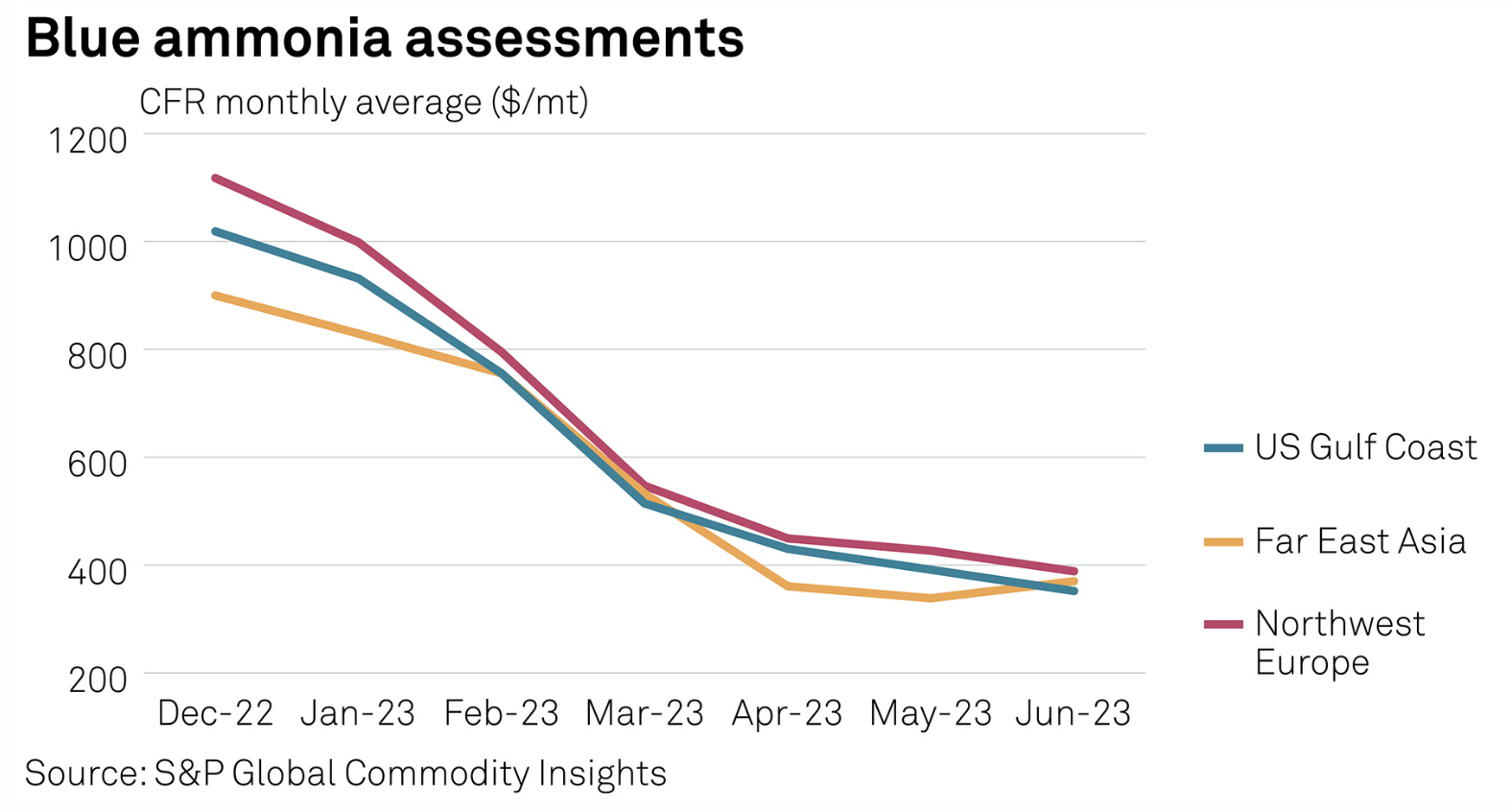

US, Europe Ammonia Prices Extend Losses In June On Weak Demand, Lower Natural Gas

Ammonia prices in the Atlantic Basin extended steep losses in June, with feedstock gas prices continuing to come off and demand remaining muted as buyers held off purchases waiting for further falls. However, prices in Far East Asia rebounded, supported by an extended maintenance turnaround at a major production plant in Indonesia, while prices in the Middle East were stable. The Platts Ammonia Price Chart illustrates monthly averages of daily assessments for gray, blue and green ammonia across a range of geographies and delivery options. Platts is part of S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

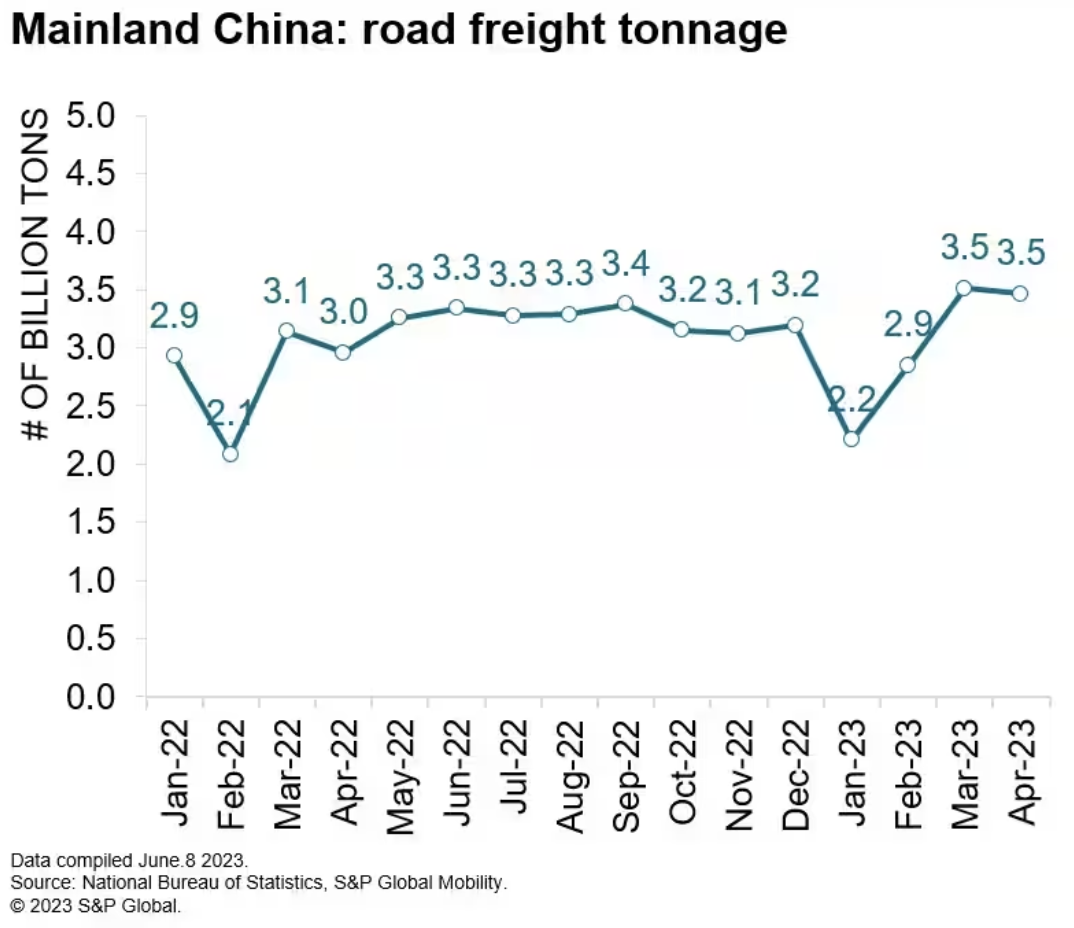

Mainland China Commercial Truck Production Starts 2023 With A Powerful Rebound

Mainland China's medium- and heavy-duty truck production has surged strongly in early 2023, with double-digit year-over-year growth seen in the February through April period. As a result, S&P Global Mobility has increased its outlook for mainland China's medium- and heavy-duty truck production for 2023 by an additional 4 percentage points to 914,000 units, bringing the forecast year-over-year gain from 2022 to 26%.

—Read the article from S&P Global Mobility

Content Type

Location

Segment

Language