Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Jul, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The social unrest that has swept South Africa into violence—the worst the nation has seen since the end of apartheid in 1994—has left at least 212 people dead, deepened the wounds of socioeconomic inequality, and triggered disruption across supply chains.

Beginning July 8, when former President Jacob Zuma started serving a 15-month prison sentence for contempt of court after failing to participate in an inquiry into corruption during his administration, rioting and looting continued through July 19 in what government officials characterized as an “insurrection” across the Gauteng and KwaZulu-Natal provinces. Major highways were blocked. Fields of crops and trucks were set ablaze. Warehouses, shopping centers, liquor stores, schools, and medical offices were ransacked. The damage to destroyed property and trucks and lost and stolen goods totaled 10 billion rand ($680 million), according to the Economist Intelligence Unit. Despite the South African government’s deployment of tens of thousands of military troops, chaotic stampedes and violent clashes unfolded into bloodshed.

Prior to the unrest, South Africa’s economy already hung in the balance between recession and recovery. While S&P Global Ratings’ raised its full-year growth expectation for the country to 4.2% in its third-quarter outlook from 3.6% in March, the third wave of coronavirus and the more infectious delta variant spreading across the nation poses a primary risk to its recovery. Current conditions mark growth more than 3% below pre-pandemic output levels.

The social unrest further threatens South Africa’s recovery. The area in which the turmoil occurred is home to the major cities of Johannesburg, Durban, and Pretoria, and accounts for approximately half the country’s gross domestic product. Those most affected by the social unrest have been populations of the lowest socioeconomic status, who have long been burdened by South Africa’s widening economic inequality and doubly so during the COVID-19 crisis. South Africa has one of the highest and most persistent rates of inequality worldwide, which has worsened in the past decade, according to the World Bank. Government statistics spotlight the issues: while overall unemployment totals 32%, it’s 64% for South Africans under 35 years old, and more than one-fifth of the country faces food insecurity. Market participants told S&P Global Platts that the situation is likely to put the movement of food and agriculture commodities at a standstill inside and outside of the country in the immediate-term.

"The looting of shops, burning of trucks and crops, as well as the theft of livestock, are posing a serious threat to food security in the country," South Africa's federation of agricultural organizations, Agri SA, said in a recent report, according to S&P Global Platts. "South Africa runs the risk of people not being able to buy or access food.”

At the epicenter of the violence, South Africa’s KwaZulu-Natal province serves as the major entry and exit point for the production and exports of crops, grains, milk, poultry, and sugar alongside imports of food products including wheat, rice, and palm oils—activity which has been severely disrupted and even destroyed due to the damage.

"The biggest risk in the short term is the free movement of goods, including food and agricultural produce on the roads, specifically to and from the Durban port," Wandile Sihlobo, chief economist of the Agricultural Business Chamber of South Africa, told S&P Global Platts. Highlighting his major concerns over the availability of food transportation, he said he fears that the declaration of force majeure related to oil refineries in the region could prompt a fuel shortage. "I highlight this because a large share of South Africa's food is transported by road," he said.

Sapref, the country’s largest refinery, announced it would temporarily shut down and suspend its supply of all oil products due to the social unrest.

The situation additionally stimulated South Africa’s mining industry to declare force majeure, disrupting supply chains and potentially damaging future financing conditions. South Africa's exports are dominated by commodities, with precious metals and mineral ores having respectively accounted for 22.6% and 15% of exports last year, according to Panjiva, part of S&P Global Market Intelligence.

Among the many companies to halt operations, Afro Minerals Trading confirmed to S&P Global Platts on July 16 that factors beyond the company's control prevented it from fulfilling its delivery obligations and led to its shutdown. Andre Joubert, executive director of the ferrous metals miner and processor Assmang, told S&P Global Platts on July 14 that "we are not moving anything in and out of the plant in terms of product and raw materials” due to disruptions to road transportation to and from its facilities.

South African mining companies will be impacted by disruptions to transport infrastructure in the short-term, but over the long-term will suffer both from the economic losses spurred by the damages to private property and investors' perceptions of the country likely deteriorating, Aleix Montana, an Africa analyst at the risk intelligence company Verisk Maplecroft, told S&P Global Platts.

“These actions are intended to cripple the economy, cause social instability and severely weaken—or even dislodge—the democratic state,” South African President Cyril Ramaphosa said about the violence during a July 16 news conference. “We will identify and act against those who lit the flame, and those who spread it. We know who they are.”

Today is Tuesday, July 20, 2021, and here is today’s essential intelligence.

After Risk-On Run, U.S. Leveraged Finance Market Tops $3 Trillion In Size

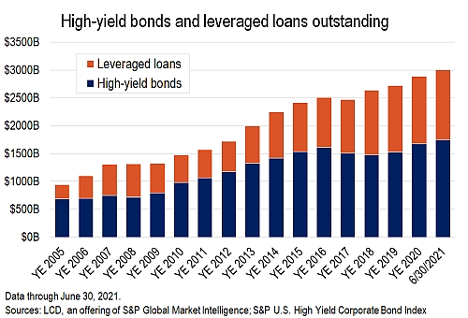

For the first time ever, the U.S. leveraged finance market has topped $3 trillion in size, according to S&P Global and LCD indexes tracking the high-yield bond and leveraged loan segments. These combined asset classes more than doubled in volume amid a rapid growth in sub-investment-grade borrowing between the crunch points of the 2008 Global Financial Crisis and the pandemic-driven crash of 2020.

—Read the full article from S&P Global Market Intelligence

Economic Research: U.S. Biweekly Economic Roundup: Auto Sector Problems Leave Imprints Throughout Major Economic Data

Retail sales were much stronger than expected in June but were close to what most expected once adjusted for the downward revision for May. Sales rebounded 0.6% in June and were up 1.3% excluding autos. Core sales—headline sales excluding autos, gas, and building material, which are directly accounted for in GDP calculations—were up 1.3% in June after falling 0.6% the month earlier. Eating/drinking establishment sales rose a solid 2.3% following the prior month's increase of 3.7%, now back above the pre-pandemic high.

—Read the full report from S&P Global Ratings

Non-U.S. Local Governments: To What Extent Did Sovereign Support Offset the Pandemic Downdraft?

Central governments opted for various approaches in helping local and regional governments (LRGs) weather the pandemic's harsh fiscal and economic impact. Some provided direct financial support in the form of loans, debt relief, or cash transfers, while others focused on economic stimulus measures.

—Read the full report from S&P Global Ratings

After A Massive SOE Default, China Rethinks Resolutions

The Peking University Founder Group (PUFG) has sped through a restructuring, underscoring the Chinese government's desire for efficient, market-based default resolutions. S&P Global Ratings believes the deal's speediness and the high recovery rate will increase market acceptance of court-led workouts, but that the process may put offshore bondholders at a disadvantage compared with onshore creditors.

—Read the full report from S&P Global Ratings

Delta Variant Fears Infect Markets but Symptoms May be Short-Lived

Overlooked for weeks by investors, the risk that the coronavirus delta variant could disrupt the post-pandemic economic recovery has contributed to a sharp decline in stocks, a surge in demand for government bonds and a U.S. dollar rally. The impact of the variant on markets, however, may be short-lived, analysts said.

—Read the full article from S&P Global Market Intelligence

Using Market Fluctuations to Unlock Opportunity

Volatility often represents uncertainty, but it could also signal opportunity. Take a closer look at how the systematic design of the S&P 500 Dynamic Participation Index may help market participants identify and reflect potential opportunities inside the daily price fluctuations of the S&P 500.

—Read the full article from S&P Dow Jones Indices

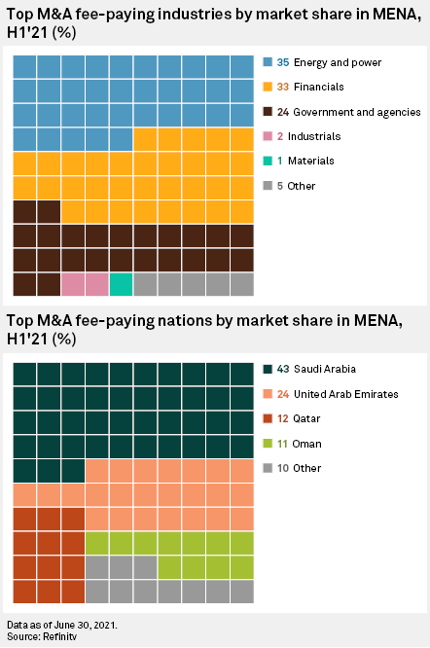

European, US I-Banks Aim to Cash In on GCC's 'Excellent Growth Outlook

State and private sector restructuring in the Gulf Cooperation Council will boost international banks' deal-making fees, although foreign lenders are set to face stiffer competition from larger local lenders, according to market insiders and experts.

—Read the full article from S&P Global Market Intelligence

EMEA Financial Institutions Monitor 3Q2021: Resilience Amid the Search for Stronger Profitability

S&P Global Rating believes that banks in EMEA will remain resilient in the months ahead. Indeed, S&P Global Ratings now project that asset quality will weaken less than S&P Global Ratings previously expected and certainly far less than during the global financial crisis in 2009.

—Read the full report from S&P Global Ratings

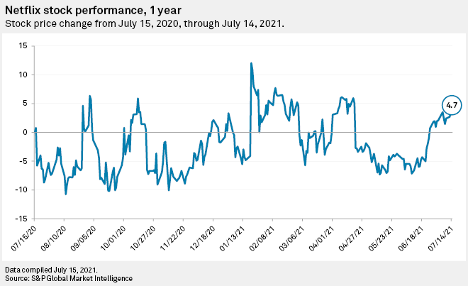

Netflix's Q2 Results to Clarify Post-Pandemic Growth Prospects

The first half of 2021 was not particularly kind to the streaming giant, despite significant gains made during the pandemic in 2020. Executives' prediction of a pull-forward in membership growth proved to be accurate. After a notable miss in paid new member additions during the first quarter, the company kept guidance at a modest 1 million paid net additions for the second quarter. Analysts are affirming that slow growth figure and setting their sights ahead to determine whether Netflix can continue to warrant its high price.

—Read the full article from S&P Global Market Intelligence

Targeting Amazon Brands, House Bill Could Spur Competition — Or Raise Prices

Small online merchants could soon get a boost if Congress succeeds in passing a bipartisan bill that aims to prohibit Amazon.com Inc. and other online platforms from promoting their own products over those of competitors.

—Read the full article from S&P Global Market Intelligence

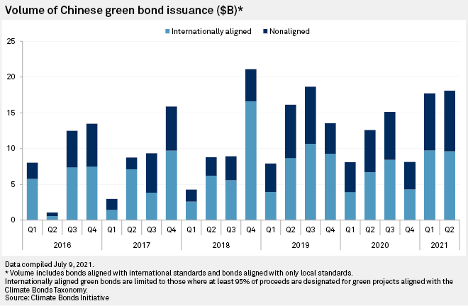

China's Push for Emissions Reduction to Boost Green Bond Sales

China's green bond issuance in the April-to-June period rose to its highest point in almost two years as the world's biggest polluter pushes ahead with plans to cut emissions, with the goal to become carbon neutral by 2060.

—Read the full article from S&P Global Market Intelligence

Foreign Investors Flock To Spain's Booming Renewables Market

Spain has become the hottest ticket in town for international investors in renewable energy, with the government's green policies and a favorable power market helping to spark overseas interest.

—Read the full article from S&P Global Market Intelligence

Tilting Toward Sustainability with the S&P/NZX 50 Portfolio ESG Tilted Index

As they begin their journey in environmental, social, and governance (ESG) investing, many market participants are realizing that there are multiple ways in which an index methodology can incorporate ESG characteristics. Some strategies will look to screen out particular industry groups or companies participating in various business activities, while other strategies will make relative adjustments based on ESG scores. With the exception of a few eligibility criteria that are rather standard with ESG indices, the new S&P/NZX 50 Portfolio ESG Tilted Index takes the latter approach and tilts the weight of companies by their S&P DJI ESG Scores.

—Read the full article from S&P Dow Jones Indices

Automakers Give Lithium from U.S. Geothermal Brines A Shot

Amid the global push to decarbonize, automakers have rushed to secure the lithium needed to make electric vehicle batteries. The potential to sustainably recover the white metal using geothermal resources in the U.S. has caught the interest of a pair of car companies in recent months.

—Read the full article from S&P Global Market Intelligence

Air Travel, Demand And Decarbonization: Will Passengers Accept Potential Doubling In EU Ticket Prices?

A proposed new tax on traditional aviation fuel put forward by the European Commission could add around Eur35 to the cost of a return Paris to Rome flight, doubling the cost of low-cost ticket prices, S&P Global Platts calculations show.

—Read the full article from S&P Global Platts

IEF Points to 'Emerging Consensus' on Methane Emissions Methodology

The International Energy Forum, or IEF, said July 19 there was an "emerging consensus" for a common measurement methodology for methane emissions from the energy industry.

—Read the full article from S&P Global Platts

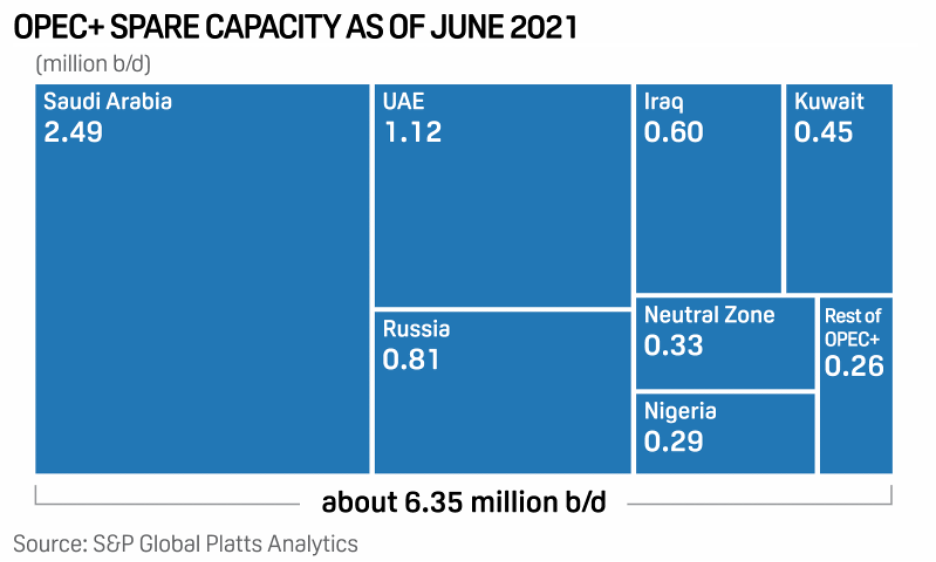

OPEC+ Gives the Market More Crude, but Could Leave Some Members Behind

OPEC and its allies have set aside their differences for now, with their deal to hike crude production, but the coalition's internal battles for market share are just getting started.

—Read the full article from S&P Global Platts

OPEC+ Green Lights Deal to Hike Oil Output In Saudi-UAE Compromise

OPEC and its allies clinched an agreement July 18 to raise crude oil production in the coming months, while also allocating five members more generous output quotas starting May 2022, resolving a dispute with the UAE that had threatened to destabilize the oil market and the organization itself.

—Read the full article from S&P Global Platts

COVID-19 Resurgence May Put Brakes on South Korea's Crude Import Uptrend

South Korea's crude imports rose 6.3% year on year in June on the back of robust economic recovery, but a new wave of COVID-19 cases could put the brakes on the upward momentum in the second half 2021 as refiners expect strict mobility restriction measures to dampen domestic fuel sales, market sources and analysts in Seoul said.

—Read the full article from S&P Global Platts

As Disasters Multiply, Container Ship Insurers Face Troubled Seas

A series of major loss events involving container ships in recent months — including a sudden surge in containers lost overboard in the North Pacific region in late 2020 and early 2021, the grounding of the Ever Given in the Suez Canal in March and a fire that destroyed the X-Press Pearl off the coast of Sri Lanka in June — has highlighted the risks to companies that insure ever-larger vessels.

—Read the full article from S&P Global Market Intelligence

German Floods Add to Problems for Commodities In Region

Catastrophic flooding in Germany, Belgium and the Netherlands over the last week has caused transport and production disruption in the Rhine valley, a major shipping route for commodities in Northern Europe. The Rhine and Meuse rivers are key waterways used for the transport of fuel, oil, metals and agricultural commodities across the EU's most industrialized regions.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language