Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Jul, 2020

By S&P Global

“Get out now, or risk the consequences,” U.S. Secretary of State Mike Pompeo said July 15 at a press conference.

The U.S. government offered a stark warning to investors involved in Russia’s Nord Stream 2 gas pipeline. Updating its guidance for companies under the 2017 Countering America’s Adversaries Through Sanctions Act—which in part strives to constrict business with Russia—the State Department moved to now allow the implementation of sanctions on companies who participate in the energy project. Individuals who perform services that “directly and significantly” contribute to the project, or invest between $1 million and $5 million over one year, could be subject to removal from banking and financial services systems, property seizures, and visa restrictions.

“It’s a clear warning to companies aiding and abetting Russia’s malign influence projects it will not be tolerated,” Mr. Pompeo said. “Our expectation is that those who take part in the continued project will be subject to review for potential consequences related to that activity.”

The sanctions are Washington’s latest move in a series of many to shut down the construction of Nord Stream 2, a 764-mile (1,230-kilometer) pipeline that will carry gas to Germany and central Europe. The pipeline is half funded by the European energy conglomerates Engie, OMV, Shell, Uniper, and Wintershall and is being built by the Kremlin-controlled gas company Gazprom. The U.S. has criticized the Nord Stream 2 as a venture for Russia to exert control in Europe. German and Russian officials assert that the project is commercial and that the interference is undermining their respective countries’ energy supplies.

“Let me be clear, these aren’t commercial projects,” Mr. Pompeo said. “They are Kremlin’s key tools to exploit and expand European dependence on Russian energy supplies, tools that undermine Ukraine by cutting off gas transiting that critical democracy, a tool that ultimately undermines transatlantic security.”

If completed, the Nord Stream 2 would transport at least 55 billion cubic meters of natural gas from Russia to Europe through the Baltic Sea each year. This would supply energy to 26 million households annually for at least 50 years, and ultimately double Germany’s gas imports from Russia.

In Germany, "we believe that the type of extraterritorial sanctions imposed by the U.S. is not in line with our understanding of the law," German Chancellor Angela Merkel said in the country’s parliament on July 1 after the U.S. first proposed the sanctions. “We have to concede, however, that this will make the construction process more difficult… Nevertheless, we believe that it is right to complete this project, and we are acting in this spirit."

The pipeline is currently 99 miles (160 kilometers) from completion, after U.S. sanctions imposed in December of last year halted construction. The sanctions targeted companies who participated in the technical construction of Nord Stream 2 and prompted the Swiss pipe-laying company Allseas to abandon the project. On July 6, Denmark approved a request by the Gazprom-owned Nord Stream 2 operating company to use Russia-owned vessels with anchors to finish laying the pipeline. As of July 10, the Danish Energy Agency said it had not received an updated schedule with timelines for the project.

“If the [new U.S.] sanctions are actually enforced, the completion or commissioning of the pipeline is currently not possible," Timm Kehler, chairman of the German gas advocacy group Zukunft Erdgas, told S&P Global Platts on July 1.

Gazprom's head of investor relations, Anton Demchenko, told investors that the company “continue[s] to work on this project and expect that its construction will be completed at the end of 2020 or the beginning of 2021," as he was quoted as saying by the RIA Novosti news agency on June 22, according to S&P Global Platts.

Russia and Germany have solidified a strategic energy partnership with the NordStream 2 pipeline. Businesses from both countries proposed the construction of a hydrogen production plant on July 7.

Today is Thursday, July 16, 2020, and here is today’s essential intelligence.

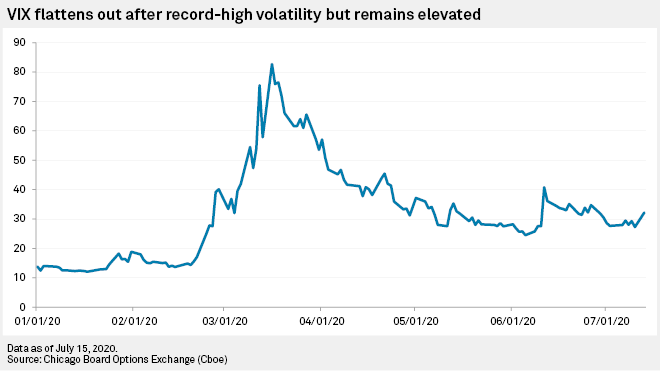

VIX sees sharpest spike in a month as equity volatility persists – risk monitor

Whereas most measures of stress in financial markets have flattened, albeit at elevated levels compared to pre-coronavirus, the heightened volatility in U.S. equities is the clearest signal of insecurity among investors. The CBOE Volatility Index, or VIX, rose 4.9 points on July 13 to 32.2, the largest single-day rise in the so-called fear gauge since June 11, amid increasing COVID-19 cases in southern and western U.S. states and worsening Sino-American relations. The VIX — a measure of expected volatility on the S&P 500 — fell back to 29.5 on July 14 but remained higher than the 90th percentile level of 28.7 and more than double the 13.9 it averaged in January.

—Read the full article from S&P Global Market Intelligence

Credit Trends: U.S. Corporate Downgrades Rise To A New High In Second-Quarter 2020

U.S. corporate downgrades reached a high of 414 in second-quarter 2020 as the sudden-stop U.S. recession deepened. This sudden contraction in economic growth hit lower-rated companies hardest: 92% of downgrades were speculative-grade (rated 'BB+' and lower), and the negative bias (the percentage of issuer credit ratings with negative outlooks or on CreditWatch with negative implications) for speculative-grade companies reached a record high (at 52%). The pace of downgrades slowed, and the share of issuer credit ratings on CreditWatch with negative implications declined after April as cities and states eased lockdown measures. Even as S&P Global Ratings expects the economic recovery to begin in the second half of this year, corporate credit measures are anticipated to take longer to recover, and all sectors currently show a negative bias that is above their long-term average.

—Read the full report from S&P Global Ratings

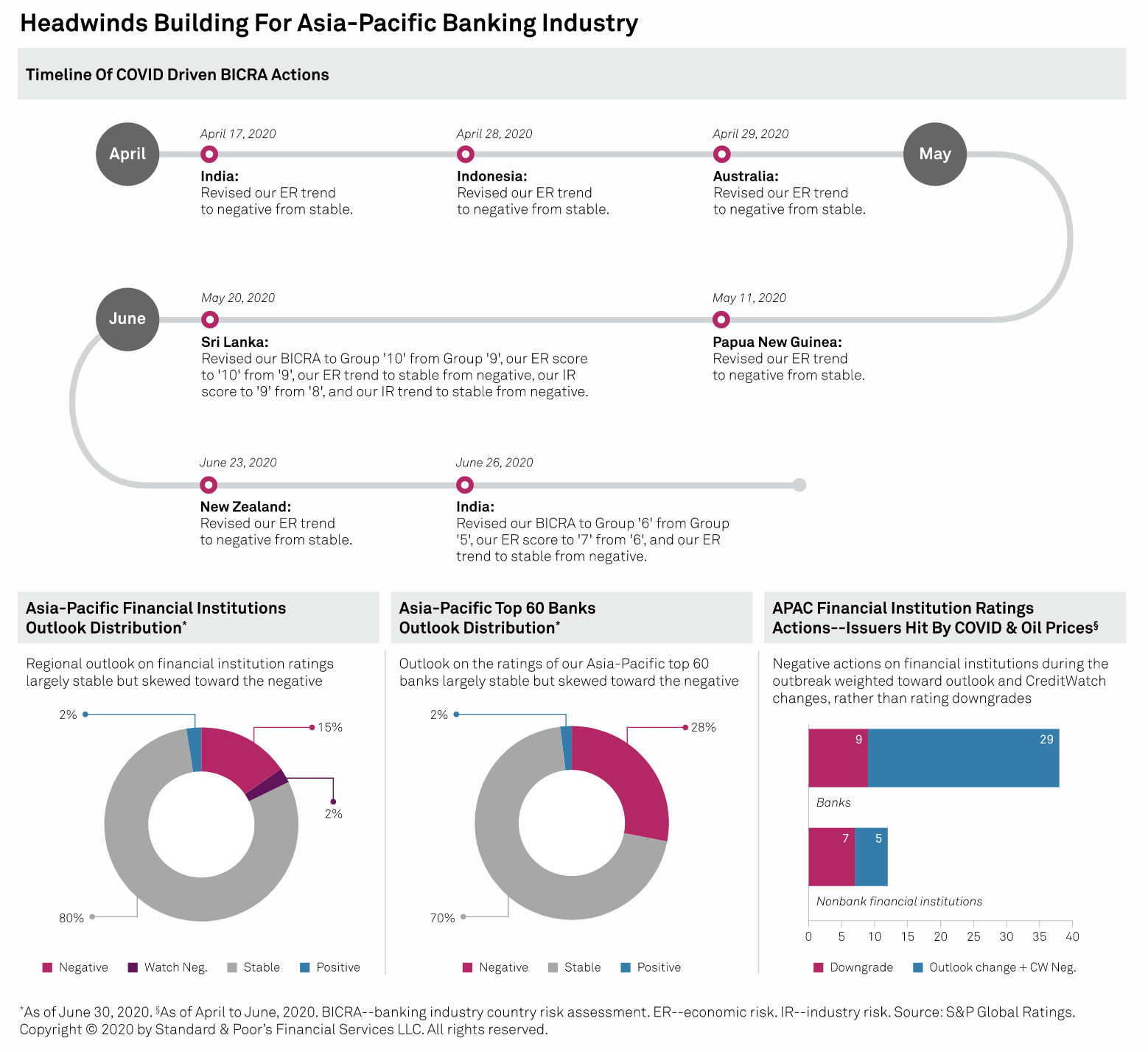

Industry Report Card: Top 60 Asia-Pacific Banks: COVID-19 Drives Downside Risks As Credit Losses Jump And Earnings Fall

S&P Global Ratings expects that US$2.7 trillion of economic output will be lost in Asia-Pacific over 2020 and 2021, hitting the performance of banks in the region. S&P Global Ratings believes that the risks for Asia-Pacific banks are firmly on the downside— S&P Global Ratings took 50 negative rating actions on lenders in the second quarter of 2020, and S&P Global Ratings may yet downgrade more institutions. S&P Global Ratings’ ratings on lenders are clearly linked to the region's economic health, and S&P Global Ratings only sees Asia-Pacific GDP trends normalizing by 2023, at the earliest.

—Read the full report from S&P Global Ratings

Japanese banks' efficiency behind most Asia-Pacific lenders; Chinese lead

Japanese banks were still less efficient than most other major Asia-Pacific lenders in the first quarter of 2020 amid slow income growth and elevated operating costs, according to data compiled by S&P Global Market Intelligence. Meanwhile, Chinese lenders scored some of the lowest cost-to-income ratios in the region in the January-March quarter, in part because of their economies of scale and relatively early adoption of financial technology, which helped mitigate some impact from the pandemic disruptions, analysts say.

—Read the full article from S&P Global Market Intelligence

Banks accelerate new branch strategies in increasingly digital post-COVID world

After the novel coronavirus forced banks to close their branch lobbies, Pittsburgh-based F.N.B. Corp. added an online tool allowing customers to make in-branch appointments with a banker for the first time. The customer response was swift and unexpected: The bank went from 21 appointments in January to more than 2,700 during April, according to CEO Vincent Delie. F.N.B.'s experience is emblematic of how the pandemic is forcing consumers to rethink many behaviors — including the way they use physical bank branches. In the age of social distancing, even customers who long relied on their local branch are turning to digital options. And that is opening the door for banks to rethink their branch footprints.

—Read the full article from S&P Global Market Intelligence

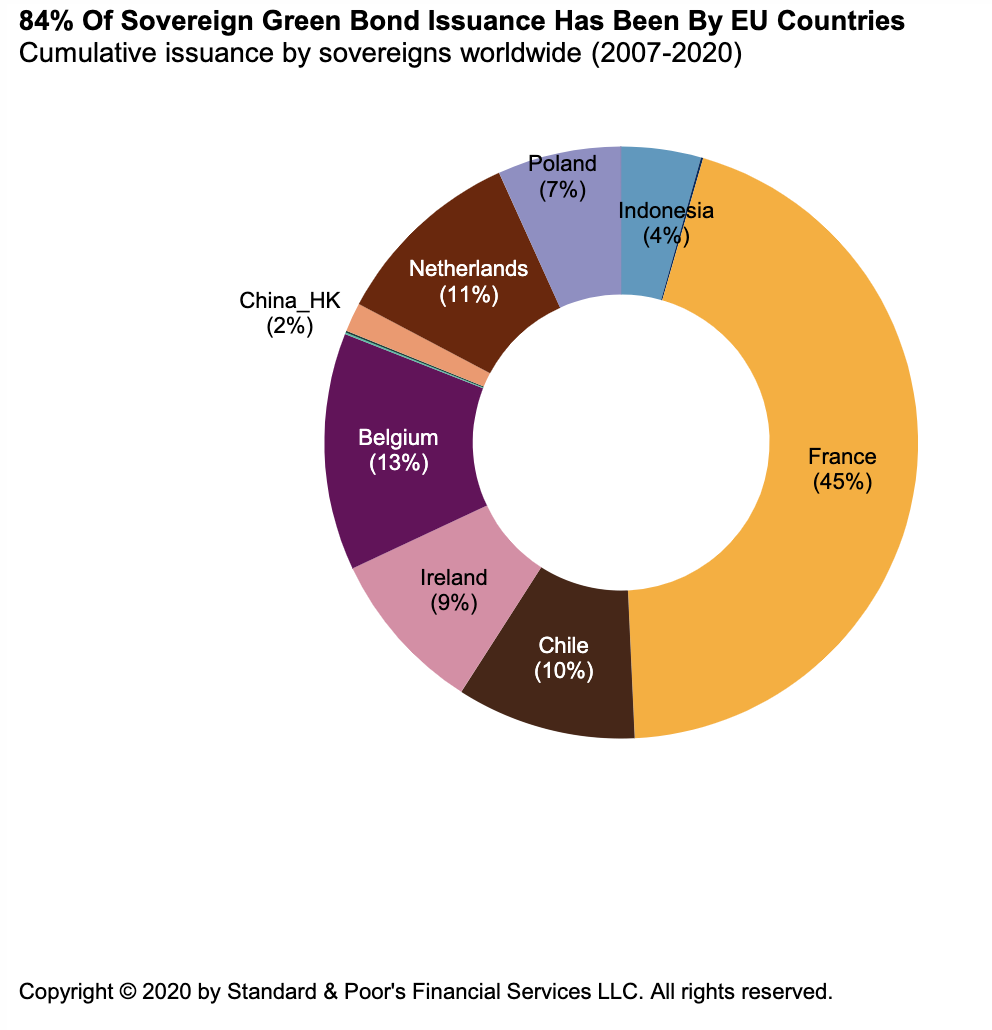

The EU Recovery Plan Could Create Its Own Green Safe Asset

The EU could become the main liquidity provider for a green safe asset with long duration by financing 30% (€225 billion) of its proposed €750 billion recovery fund through green bond issuance. EU green bond issuance on such a large scale would help respond to a fast-growing ESG investor base and increase the size of the global green bond market by around 89% compared with total issuance in 2019. A larger pool of green assets would also help policymakers and central banks toward their aim to "green" the financial system. Currently, the green bond market represents only 3.7% of total global bond issuance, making it difficult to ask market participants to build green portfolios.

—Read the full report from S&P Global Ratings

UK businesses urge govt to target 100% electric car, van sales by 2030

UK businesses belonging to the UK Electric Fleets Coalition, have called on the government to target 100% electric car and van sales by 2030 as the next step in the UK's green recovery. The coalition said July 15 it was recommending a comprehensive package of measures to boost the electric vehicle business case, stimulate EV manufacturing and strengthen the charging network. The recommendations come as the government is outlining plans to "build back better" from the coronavirus pandemic and consulting with stakeholders about bringing forward the UK's EV switchover to 2035 or possibly earlier.

—Read the full article from S&P Global Platts

Insight Conversation: Edgare Kerkwijk, Asia-Pacific Hydrogen Association

Edgare Kerkwijk spoke to S&P Global Platts Senior Editor Sambit Mohanty on how hydrogen is garnering attention among policy makers and industry leaders in Asia as the region prepares for energy transition. Kerkwijk is a member of the board of the Asia-Pacific Hydrogen Association, a regional industry platform that aims to promote the interests of the hydrogen sector. Its members include utilities, power project developers, equipment manufacturers, technical consultants and financial institutions.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language