Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Jul, 2020

By S&P Global

As equities markets continue to ride a rollercoaster of volatility, investors’ weakened confidence in a smooth and strong near-term economic recovery has been buoyed by new optimism about a potential vaccine to treat the coronavirus.

In the week ended July 10, the S&P 500 closed up 1.76% after experiencing turbulence spurred by rapidly swelling outbreaks across the U.S. tipping the country past 3 million confirmed cases. Gilead Sciences, the pharmaceutical company, said on Friday that its antiviral drug remdesivir “was associated with an improvement in clinical recovery and a 62% reduction in the risk of mortality compared with standard of care,” rallying equity markets.

“If we just let drugs and vaccines go to the highest bidder, instead of to the people and the places where they are most needed, we’ll have a longer, more unjust deadlier pandemic,” Bill Gates, the philanthropist and technologist, said during a July 11 virtual International AIDS Society conference. “We need leaders to make these hard decisions about distributing based on equity, not just on market-driven factors.”

The SNL U.S. Insurance Index declined 0.45% to 993.42 for the week ended July 10, while Twitter stock closed up 15.71% and Microsoft closed up 3.91% for the week at the end of the July 9 trading session, according to S&P Global Market Intelligence.

Despite Florida reporting more than 15,000 new cases of coronavirus on July 12—the greatest-ever number of new coronavirus cases confirmed in a single day of any U.S. state during the entirety of the pandemic—equities futures rallied in overnight trading on Sunday. Across the world, international investors also appeared to shrug off the U.S.’s dramatically worsening situation, as evidenced by Asian stocks trading higher this morning.

Today is Monday, July 13, 2020, and here is today’s essential intelligence.

Credit Trends: Potential Downgrades Reach Another Record High Amid COVID-19 Stress

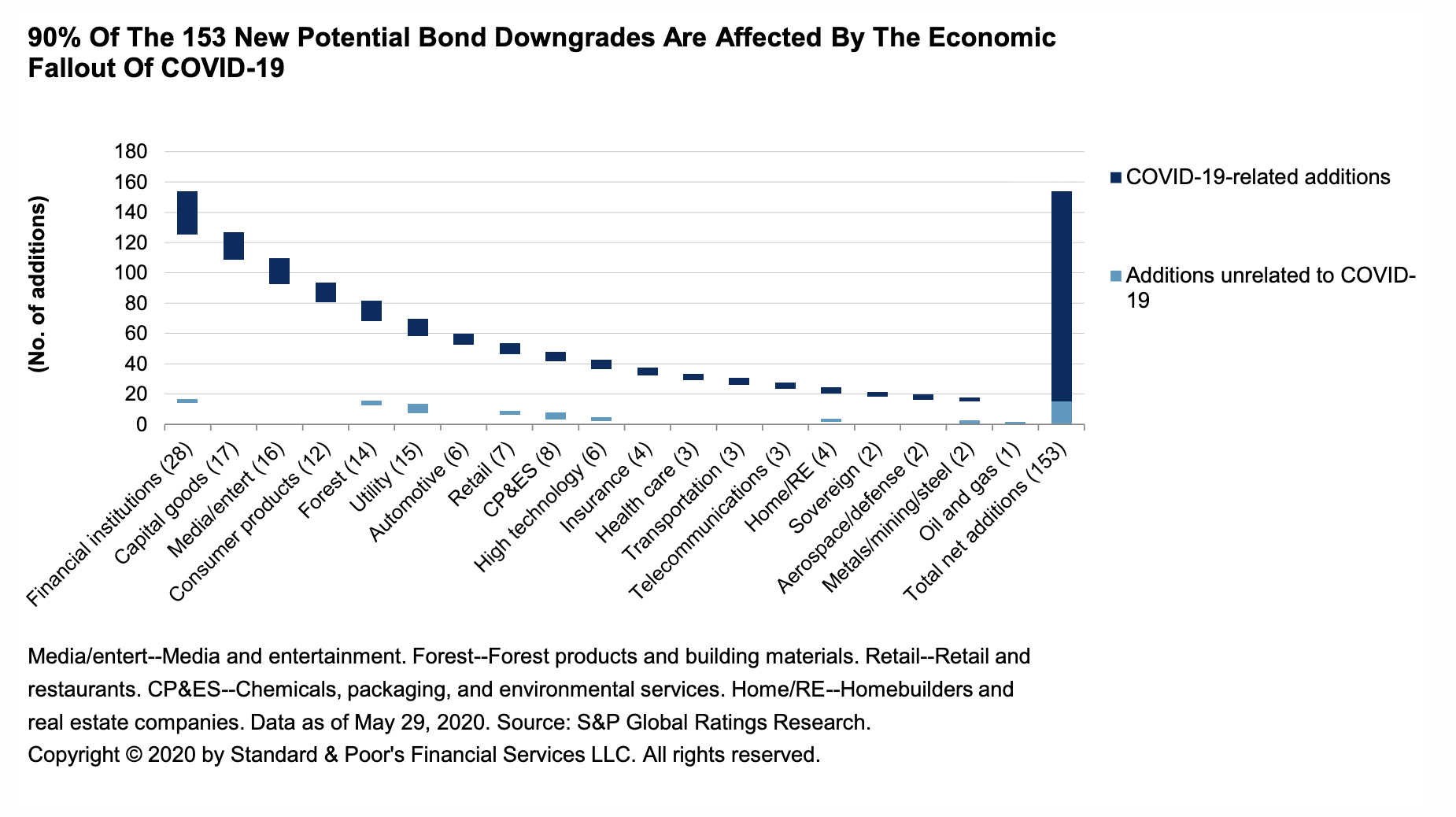

The tally of potential bond downgrades climbed to a record high of 1,350 as of May 29, from 1,287 a month earlier. This tally is well above the crisis-era record of 1,028 from 2009 and over double the tally in February. Of the total, 1,082 are assigned negative outlooks and 268 are on CreditWatch negative (a ratio of 4 to 1, compared with 3 to 1 in April), which is significant because negative outlooks typically show a 1-in-3 chance of downgrade in the next two years (sooner for issuers rated 'BB+' and below), whereas negative CreditWatch placements typically show a 50% likelihood of downgrade in the next 90 days. Of the 153 new additions to S&P Global Ratings’ list, 137 were affected by the economic slowdown and decreased business activity, particularly in the media and entertainment (including leisure and lodging), automotive, and transportation sectors.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: The Oil And Gas Sector Leads 2020 Corporate Defaults

The 2020 global corporate default tally has reached 132, after six issuers defaulted since S&P Global Ratings’ last report. The 2020 year-to-date tally—at 132—has surpassed the full-year 2008 total of 127 defaults but remains below the 2009 year-to-date tally of 175. With two of the six defaults last week, the oil and gas sector default tally is 23 so far in 2020—the most of any sector. The sector's global negative bias reached an all-time high in April at 69.0%, while in the U.S., the sector's negative bias peaked in May, at 81.4%. Following the collapse of oil and gas prices, S&P Global Ratings has taken a significant amount of rating actions on upstream oil and gas companies, particularly in the U.S. As oil prices remain unsustainably low, S&P Global Ratings estimates that the recovery of oil and gas North American companies will not be until mid-2022.

—Read the full report from S&P Global Ratings

LCD Survey: US leveraged loan default rate expected to rise to 5.3% by year-end

An unprecedented policy response appears to have curtailed the worst of the assault on risk assets amid COVID-19 disruption, though the improved sentiment has not shifted equally across the credit spectrum, LCD's survey of loan portfolio managers confirms. With the dust settling on the extreme volatility — at least for now — LCD asked loan managers their forecast on future default and return expectations. Polling for year-end 2020, participating portfolio managers, on average, expect the default rate to climb to 5.32%, from the June default rate of 3.23%. It has since risen to 3.48%.

—Read the full article from S&P Global Market Intelligence

Domestic Credit Losses For French Banks Could More Than Double Amid COVID-19 Pandemic

S&P Global Ratings' believes domestic credit losses for French banks will more than double in 2020 and remain elevated in 2021, as economic fallout from the COVID-19 pandemic damages asset quality. In particular, unemployment rising to about 10% (despite partial or temporal unemployment schemes) and corporate bankruptcies (despite government guarantees and other measures) will lessen the ability of borrowers to pay back their loans. S&P Global Ratings estimates domestic credit losses for French banks will increase to about 50 basis points of domestic lending in 2020, more than 2.5x the 2019 figure, and stay at this elevated level in 2021.

—Read the full report from S&P Global Ratings

Listen: The Power Of Stakeholder Pressure: How Companies Are Responding To Systemic Racism

In the inaugural episode of Beyond the Buzz, co-hosts Corinne Bendersky and Mike Ferguson discuss the Black Lives Matter movement and how it’s translating into calls for greater racial equity in the workplace. S&P Global CEO Doug Peterson and Funmi Afonja share their unique perspectives on the BLM movement and how employees, companies, and society at large are confronting the reality of racism. Corinne also digs in further with sustainable finance analyst Neesha-ann Longdon, focusing on what “diversity and inclusion” means in practice and how stakeholders are pressuring companies to not only respond to the current movement, but enact meaningful long-term changes to root out racism from corporate cultures.

—Listen and subscribe to Beyond the Buzz, a podcast from S&P Global Ratings

INTERVIEW: Big Oil faces tough, but necessary choices to navigate the energy transition: BP's former CFO

The world's transition to cleaner, low-carbon energy presents a unique set of challenges and opportunities for integrated oil companies as they struggle to meet both the needs of investors and climate change goals, according to Brian Gilvary the former chief financial officer of BP. Speaking a week after retiring from a career spanning more than three decades at the oil major, Gilvary said oil majors are facing tough decisions on where to invest in emerging portfolios of renewable energy, power markets, low-carbon mobility and battery technology.

—Read the full article from S&P Global Platts

Dominion points to ESG as key factor in decision to off-load gas assets

Dominion Energy Inc. pointed to the growing importance of environmental, social and governance practices as one of the "key considerations" in weighing the sale of its midstream gas assets and narrowing its focus on cleaner energy resources. Dominion announced the sale of its natural gas transmission and storage business to Berkshire Hathaway Energy on July 5 in a deal with an enterprise value of about $9.7 billion, including the assumption of $5.7 billion of debt. "In reviewing this transaction, in the context of our long-term strategic direction, we weighed several key considerations, including the value to our industry-leading ESG-focused strategy," Dominion Chairman, President and CEO Thomas Farrell II said on a July 6 call with investors.

—Read the full article from S&P Global Market Intelligence

Human rights group calls for major gold refiner to lose 'good delivery' status

A U.K.-based human rights watchdog is calling on The London Bullion Market Association to suspend the certification of a gold refiner used by some of the largest companies in the world, saying the refiner failed to adequately investigate allegations of human rights abuses at one of its source mines. The London Bullion Market Association, or LBMA, is the world's largest gold exchange, and its "good delivery" standard is used globally as a de facto criteria for acceptable gold and silver bars. Adherence to the Responsible Sourcing program is required in order to maintain the accreditation, according to the association's website and guidance documents.

—Read the full article from S&P Global Market Intelligence

Insight from Brussels: EU makes multi-billion euro bet on energy transition tech

Clean hydrogen, renewables, batteries, and carbon capture and storage are among the energy transition technologies set to benefit from billions of euros of public funding as the EU seeks to become climate neutral by 2050. Much of this is to come from the European Commission’s proposed Eur750 billion ($852 billion) “green” recovery plan, which needs unanimous approval from the EU’s 27 national governments to go ahead. The proposal includes EU budget guarantees of Eur20 billion for sustainable infrastructure, Eur10 billion for research, innovation and digitization, and Eur31 billion for strategic European investment under the InvestEU program. The idea is that the guarantees help mobilize much higher levels of private and other public investment by lowering potential projects’ financial risk.

—Read the full article from S&P Global Platts

Analysis: West Tracker: Prices rebound on summer heat, increased load as reopening continues

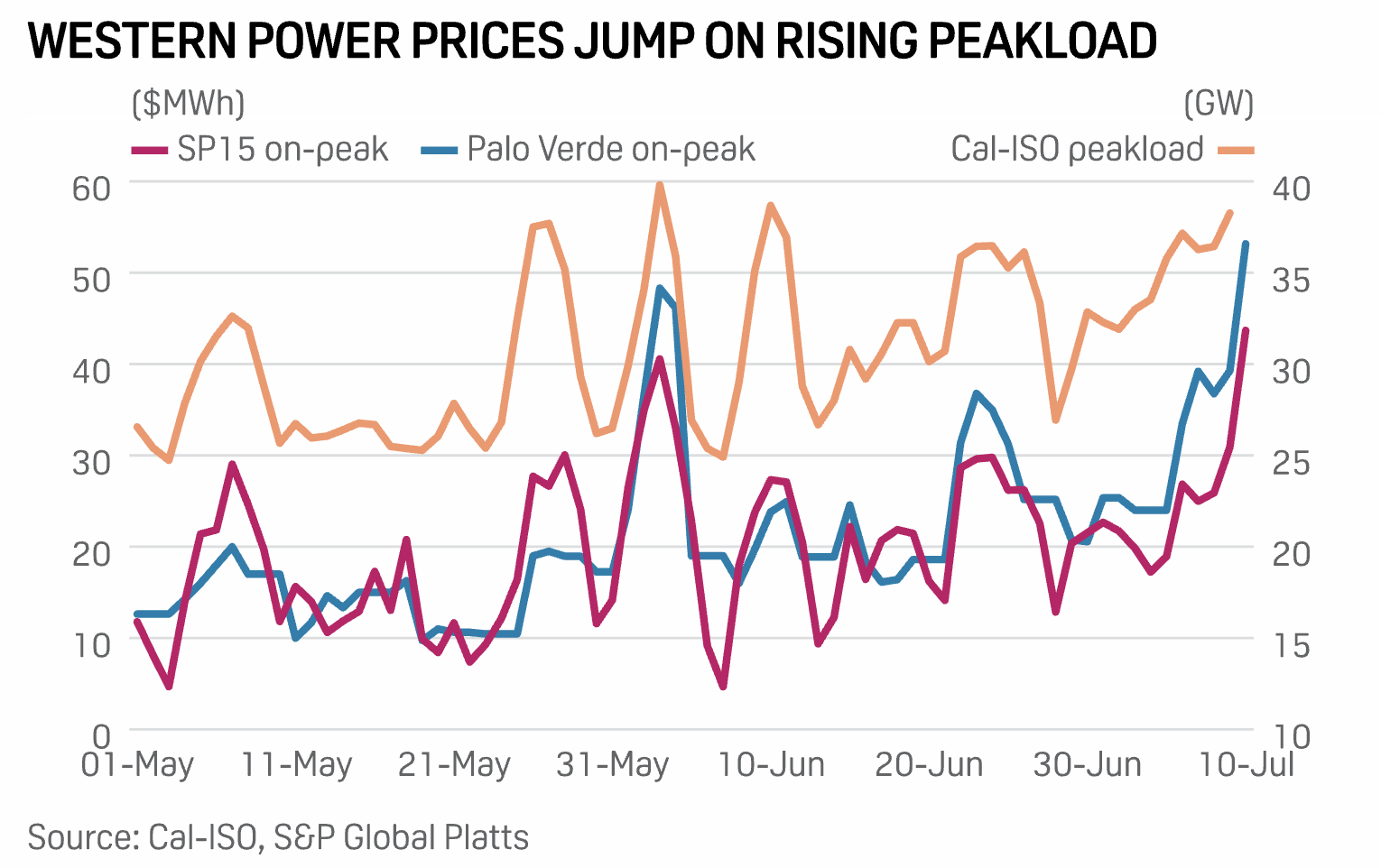

Western wholesale power prices in June jumped on average 26% month on month as demand increased with the continued reopening of businesses and with warmer weather moving into the region. Meanwhile, forward packages plunged on continued weak gas prices despite temperatures forecast to be above normal during the summer months, according to the three-month outlook from the US National Weather Service.

—Read the full article from S&P Global Platts

Q2 oil conference calls to focus on 2020 production, H2 activity as recovery proceeds

US companies that had shut wells over the past few months will be expected during upcoming second-quarter earnings calls to give some estimates on production, forward activity plans and when they will restore output shuttered from the coronavirus pandemic. "A lackluster second quarter is on tap with lots of focus on how the industry digs out from here," Evercore ISI analyst Stephen Richardson said in a July 9 investor note. "Overall, second-quarter looks to be something to be endured… Discussions of when and how much volumes return [will] be topical, if less relevant, while the trajectory of second-half 2020 volumes and looming 2021 capital allocation decisions are likely to take center stage," Richardson said. "Considering Q2 will be a mess for volumes and price, it's the outlook and trajectory that will win the day."

—Read the full article from S&P Global Platts

Listen: A new benchmark for American crude to move on from a negative experience

The American crude benchmark NYMEX WTI went negative in April, an event that sparked global questions of How and Why. Now, the US crude industry is looking to the future, with Platts American GulfCoast Select touted as an alternative yardstick against which crudes from Canada down to Argentina could be measured. Platts US crude market experts Matt Eversman and Laura Huchzermeyer speak with John-Laurent Tronche about the recent past, present and future of US crude pricing. Read more about Platts AGS assessment here.

—Listen and subscribe to Global Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language