Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

US Utilities Look for a Credible Net- Zero

As sustainability becomes increasingly important to consumers and shareholders, companies around the globe have pledged to reach net-zero emissions by 2050. This includes all major US electric utility companies — But according to the Net Zero Tracker, only one has a “credible” plan for meeting this goal.

The Net Zero Tracker is a group that analyzes the integrity of net-zero targets set by companies, countries and cities. The results of its 2023 global survey were released June 12 at the Bonn Climate Change Conference in Germany. Of the 15 largest US electric utility companies included in the survey, Duke Energy. is the only one with a credible and detailed plan, the Net Zero Tracker said.

The Net Zero Tracker defines such a plan as “one that is publicly available and sets progression milestones, measures all emission categories covered by reduction targets, disseminates timely information about those reductions, specifies the means to cut emissions and regularly reviews mitigation measures and their effect on emissions,” wrote Karin Rives, senior climate and energy reporter at S&P Global Market Intelligence.

However, like most surveyed US companies, Duke Energy doesn’t have a “complete” strategy to address Scope 3 emissions, indirect emissions that still occur in a business’s value chain. According to S&P Global data, Scope 3 emissions make up 75% of US power companies’ total emissions as of 2019.

Some industry leaders believe that the US power grid will need to grow much more than expected to meet the demand that will come with the energy transition. At the Edison Electric Institute’s June 13 conference, Tesla CEO Elon Musk said that demand will reach “3x [the] current [load] … around 2045ish.” Others made similar predictions. Bill Gates believes that a net-zero US electric grid will face a load about 2.5 times greater than today’s. and Commonwealth Edison CEO Gil Quiniones said his company estimates that the grid will double to triple in size.

"As we move forward, the ability to execute fast enough is going to test all of us," Maria Pope, CEO of Portland General Electric, after a tour of Tesla’s partially completed gigafactory in Austin, Texas.

On the bright side, in May. The outlook became negative in 2020, but falling natural gas prices and lower inflation have since turned things around. The decline in natural gas prices has eased pressure on customers’ bills, which will strengthen utility companies’ arguments to regulators that the billions spent on decarbonization will reduce customers’ exposure to gas prices, CreditSights analyst Andrew DeVries wrote in an April report.

Although the outlook has improved, the power sector still faces serious risks. Over the past three years, the US endured its highest-ever level of damages from storms, wildfires and extreme temperatures, all of which can injure utilities’ credit quality. Utility companies are also expected to increase capital spending over the next decade to maintain safety and reliability and to support the energy transition. “Although this growth is vital for utilities to meet their goals, if they don't sufficiently fund it in a credit-supportive manner, their credit measures and credit quality could decline,” S&P Global Ratings analysts noted.

Overall, the US utilities industry is in better shape than it was a few years ago, but it still has lots of work to do on its climate goals. "There's certainly enough here to get the organizations started on mapping out their transition plans," said Kaya Axelsson, a co-author of the Net Zero Tracker report. "However, it's incredibly important that to level the playing field and in order to avoid confusion ... that regulation and policy step in to close these gaps."

Today is Tuesday, July 11, 2023, and here is today’s essential intelligence.

Written by Claire Delano.

China's Stimulus Struggles to Lift Economy as Key Commodity-Intensive Sectors Take Backseat

Roughly six months since China lifted its pandemic-related social restrictions, the challenges faced by its economy have started to become clearer. Several data points indicate that boosting the economy this time around won't take a quick fix.

—Read the full article from S&P Global Commodity Insights

Access more insights on the global economy >

Global Private Equity Entries Plunge YOY in Q2

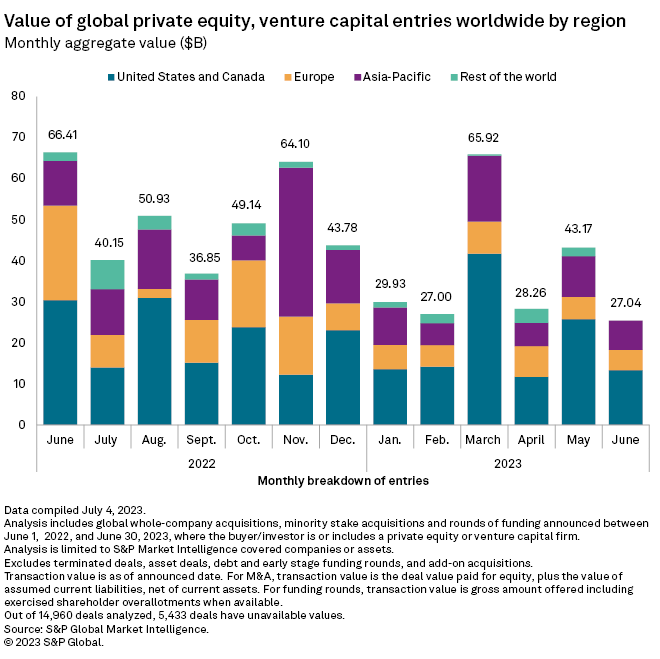

Global private equity and venture capital deal value and volume recorded a year-over-year decline in both the month of June and the second quarter, according to S&P Global Market Intelligence data. Overall private equity entries in June totaled $27.04 billion, down 59.3% from $66.41 billion in the same month a year ago. The number of deals dipped to 847 from 1,536 transactions a year prior.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Black Sea Grain Deal Fate Uncertain Days Ahead of One-Year Anniversary

The Black Sea Grain Initiative is again in jeopardy, just days before its one-year anniversary, as both Russia and Ukraine expressed concerns on whether the agreement could be extended beyond July 18.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

How Good Human Capital Management Creates Competitive Advantage

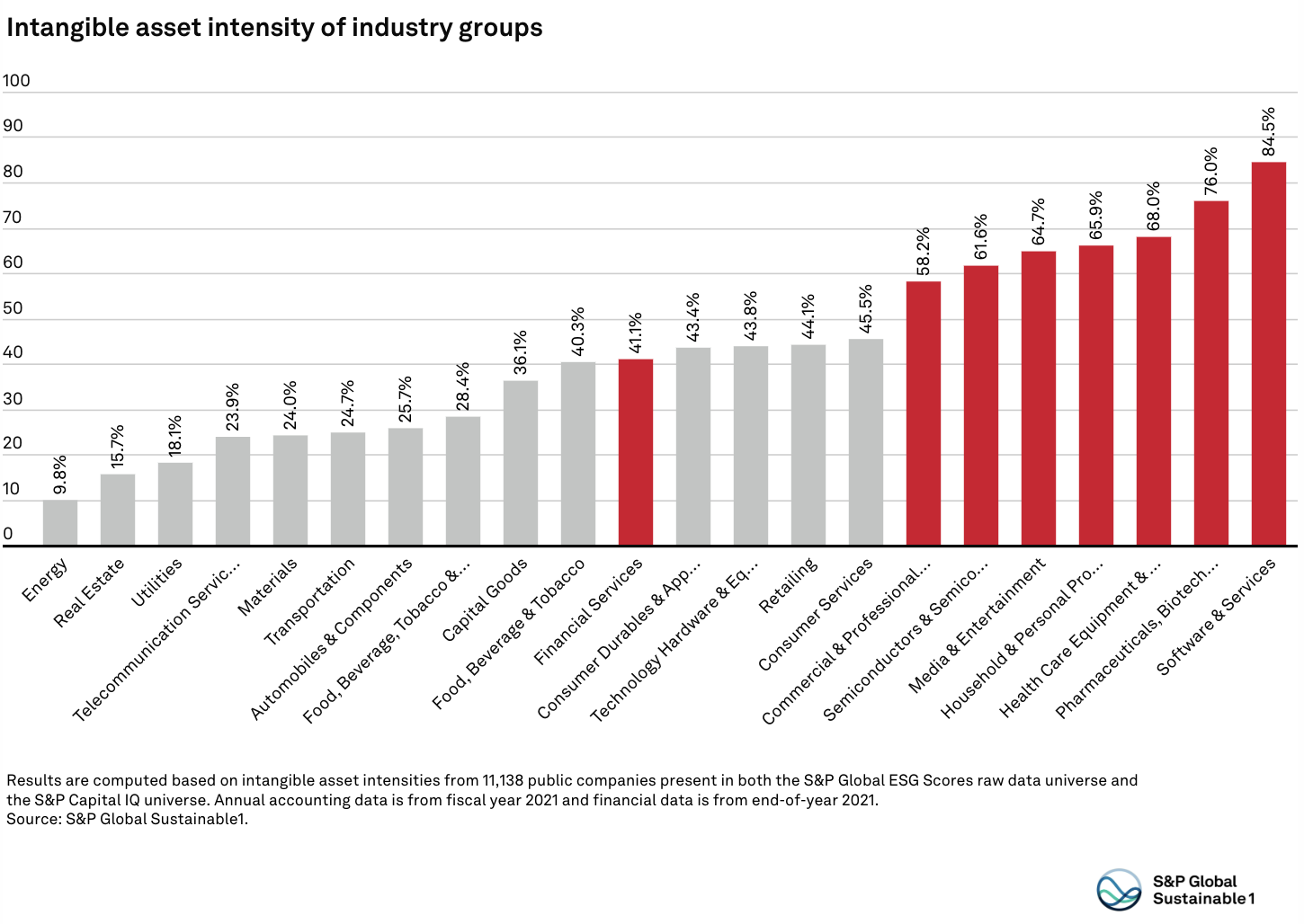

As intangible assets grow to represent an increasing share of corporate value, managing human capital — a key intangible asset — becomes more important for industry groups focused on innovation.

—Read the full report from S&P Global Sustainble1

Access more insights on sustainability >

Listen: What the Russian Uprising Could Mean for US Oil Policy

An aborted rebellion by the Wagner mercenary group last month, although short-lived, highlighted potential political instability within the Kremlin and resurfaced energy security concerns after a softening of prices had allowed for some complacency among oil importers. Geopolitical experts have said it would be naïve to think the turmoil in Russia is over.

—Listen and Subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next in Tech | Episode 123: Generative AI markets

In the midst of wild enthusiasm for generative AI, it’s worth taking a thoughtful look at technologies, vendors and what the realities of the market are today and what they could become. Research director Nick Patience returns to discuss the results of the recently published Market Monitor with host Eric Hanselman. While it’s just half a year since the release of ChatGPT, the market for foundation models, text and image generation, and the nascent code generation segment are expanding rapidly.

—Listen and Subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Location

Segment

Language