Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

While the health of the global economy depends on the health of the global population, the world has entered the new year largely spared from adverse economic implications of the omicron coronavirus variant that is spreading quickly across several countries.

With preliminary data showing omicron to be more contagious but causing less-serious infections for vaccinated individuals, the newest variant could have mild effects on the global economic recovery, delaying—but not destroying—a return to pre-pandemic activity in 2022. This is evident in economists’ and forecasters’ short- and long-term outlooks for the year and financial market sentiment. Still, the hope that the global economy has learned to live with the pandemic must be balanced against the effectiveness of countries’ vaccination strategies and rapidly rising inflation.

“S&P Global Ratings believes the new omicron variant is a stark reminder that the COVID-19 pandemic is far from over … Nevertheless, we believe this shows that, once again, more coordinated and decisive efforts are needed to vaccinate the world's population to prevent the emergence of new, more dangerous variants,” S&P Global Ratings Chief Global Economist Paul Gruenwald said in his 2022 outlook. “COVID-19 is still with us, but the economic impact of the virus is weakening, at least for now. The new omicron variant is a wildcard at this juncture.”

Concerns about COVID-19 seem to be secondary for many investors. U.S. leveraged finance market participants see inflation remaining above 3% as their main concern, followed by supply chain disruptions and labor shortages, and the withdrawal of Federal Reserve liquidity, according to a recent survey by Leveraged Commentary & Data, part of S&P Global Market Intelligence. Most U.S. leveraged finance market participants said they expected periods of "mini volatility” instead of a correction in 2022. Additionally, Barclays analysts project that 2022 will bring bank stocks to “outperform” with loan growth and net interest margins benefiting from higher interest rates and low deposit betas, despite omicron’s economic effects.

Domestic and international travel has been most immediately affected by omicron, with many countries intensifying restrictions on cross-border movements of people from high-risk locations or who are unvaccinated. But the intensity of such effects is yet to be realized.

In the Asia-Pacific region, market participants across Australia, China, and India are waiting to see how the variant’s effects take shape, according to S&P Global Platts. Australian oil industry participants have warned of potential downside risks to recovering gasoline demand in the country if the government imposes new containment measures to control the spread of omicron. In China, the Hong Kong air carrier Cathay Pacific is preparing for omicron headwinds after experiencing challenging conditions at the end of 2021. An impending third wave of COVID-19 infections from the omicron variant across India has tempered hopes of a robust 2022 jet fuel recovery. Elsewhere, the European Organization for the Safety of Air Navigation, known as Eurocontrol, expects European airline traffic remain below 90% of pre-pandemic levels in 2022—while S&P Global Platts Analytics anticipates a "minimal improvement" in European jet fuel demand during the first half of the year as compared to 2019 levels. Coronavirus infections have not necessarily stopped travelers in the U.S., which started the year with world record of new daily cases.

"The [jet fuel] market was nervous about omicron and there were many flight cancelations. A knee-jerk reaction, but now things are looking steady [in Asia],” a trader based in Singapore told S&P Global Platts. “I think prices will rebound."

"Omicron triggered travel restrictions that constrained flights in the first half of December to 75%, but eased in the second half (81%) owing to the holiday period … The challenge for the first months of 2022 will be to stay close to the base scenario as countries ramp up booster campaigns and manufacturers look to modify vaccines to counter better omicron; progress on both will enable a progressive relaxation of travel restrictions,” Eurocontrol said in an outlook this week, according to S&P Global Platts. "The risk that new or tweaked vaccines may be needed to tackle emerging COVID variants, or that governments will return to reintroducing lockdowns, travel restrictions or other measures, cannot be ruled out.”

Just this week, OPEC+ suggested the oil market will be able to absorb more output in the coming months despite the current COVID-19 conditions and approved a 400,000 barrels per day increase in oil output on Jan. 4 for the upcoming month. The 23-country alliance reiterated that the "impact of the new omicron variant is expected to be mild and short-lived, as the world becomes better equipped to manage COVID-19 and its related challenges,” but warned that every quarter of 2022 could see an oversupply of oil in the market if the group maintains its monthly production hikes, according to an internal OPEC+ analysis seen by S&P Global Platts. Market participants have wondered whether omicron’s omnipresence in combination with an expected seasonal decline in oil consumption over the coming months could prompt OPEC+ to pause or decrease the size of its output increases.

Not all industries will be able to survive the prolonged pandemic without destabilization. The mining industry may not enjoy this bullish outlook in the near-term. If China can’t control the spread of omicron across the county, its mining industry’s logistics, mine production, and manufacturing could suffer notable disruption in the first two months of 2022, according to analysts from the from the U.K.-based research and consultancy firm SP Angel. In Canada, omicron has already prompted a gold mining company to shut down its Arctic operations and explore whether to delay deal-making, according to S&P Global Market Intelligence. "Entry into Canada is getting tougher so I think fewer will come to Vancouver or Toronto for conferences," said John-Mark Staude, CEO of Riverside Resources Inc., an exploration company that often partners with major miners on its projects, told S&P Global Market Intelligence. "This could negatively impact M&A, optioning of properties, and deal flows." Today is Thursday, January 6, 2021, and here is today’s essential intelligence.

Outlook For U.S. States: Federal Funds Fuel Spending; Will Inflation Impede The Impact?

States have all come through the first two years of the pandemic holding or even improving credit quality. Much of this is due to the consistent and generous flow of federal funds, but additionally the generally highly rated sector responded to crisis as expected: taking actions to balance budgets. But as the federal monies flow, additional risks remain. We see inflationary uncertainty, coronavirus variants, and ongoing supply chain and employment challenges as potential impediments to further improvement of credit conditions.

—Read the full report from S&P Global Ratings

WEST TRACKER: Winter Weather, Higher Demand, Gas Prices Drive Up Power Prices

U.S. Western wholesale power prices averaged 71% higher in December than a year ago, the biggest year-on-year jump across the nation, on increased demand from colder weather and higher gas prices, while the natural gas share of the fuel mix slipped.

—Read the full article from S&P Global Platts

Focusing on Factor Indices

Understanding performance differences across factor quintiles is critical to understanding index performance and optimizing index construction.

—Read the full article from S&P Dow Jones Indices

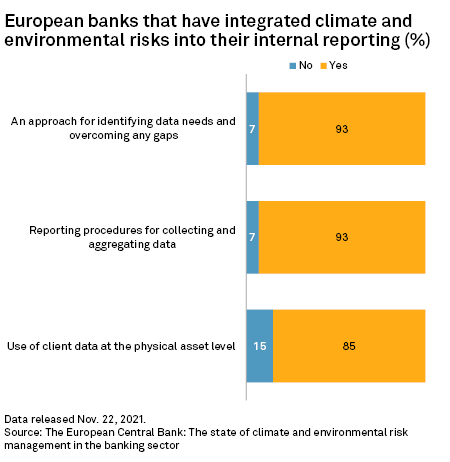

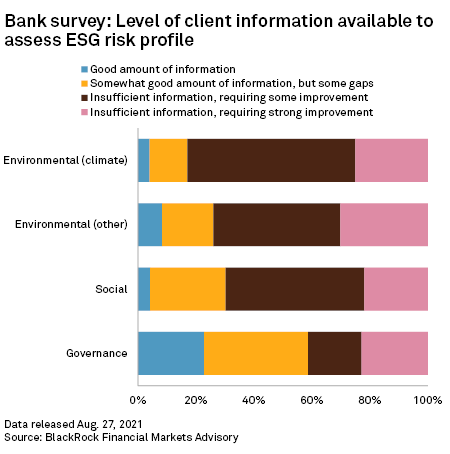

3 Sustainability Trends For European Bankers To Watch In 2022

Considerations about climate and the environment are becoming increasingly important in every banker's day-to-day work, and this focus will only intensify in 2022 as lenders, regulators and stakeholders step up their sustainability efforts and seek to bring long-term pledges to fruition.

—Read the full article from S&P Global Market Intelligence

Chinese Banks Face Slower Loan Growth, Squeezed Margins, Credit Risk In 2022

Beijing's latest attempts to free up more liquidity for lending are too modest to revive credit growth, which has slowed to its lowest pace in more than 15 years, analysts said. The easing measures, which include lowering banks' required reserve ratio and a 5-basis-point cut to a benchmark interest rate late last year, will also likely keep banks' net interest margins at multiyear lows.

—Read the full article from S&P Global Market Intelligence

Listen: Next In Tech | Episode 45: The Big Picture, Part 2 – Themes Across Security And Media

The recently released Big Picture reports cover topics like metals and mining, insurance, energy and finance. Despite that variety, common themes link them. Research directors and report authors Ian Olgeirson and Scott Crawford join host Eric Hanselman to discuss different aspects of M&A activity in media and security. The former is playing for reach, the latter is reaching for functionality.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Ajit Pai Says FCC-FAA 5G Spectrum Dispute Calls For Confirmation Of NTIA Head

A battle over spectrum is simmering between two federal agencies: the Federal Communications Commission and the Federal Aviation Administration. The FAA had threatened to impose flight restrictions as early as this week unless Verizon Communications Inc. and AT&T Inc. postponed their deployments of what is known as C-band spectrum. The carriers agreed to a two-week delay Jan. 3, but have repeatedly pointed to studies reviewed by the FCC showing C-band wireless deployments do not interfere with aviation equipment. S&P Global Market Intelligence recently spoke with former FCC Chairman Ajit Pai to get his views on the ongoing dispute and other spectrum matters. Pai is now a nonresident fellow at the American Enterprise Institute.

—Read the full article from S&P Global Market Intelligence

Libyan Crude Production Near 14-Month Lows As Election Doubts Grow

Libyan crude output is poised to fall to a 14-month low this week due to a blockade at its key western oil fields along with pipeline maintenance at the eastern Waha oil fields. This comes as Libya's political stability hangs in the balance, with still no clarity on when elections may occur after they were canceled on Dec. 24. The North African producer is pumping around 700,000 b/d at the moment, Libya-based sources told S&P Global Platts Jan. 4, a fall of around 500,000 b/d from mid-December.

—Read the full article from S&P Global Platts

China's First Batch Of Oil Product Export Quotas For 2022 Plunge 56% On Year

China's Ministry of Commerce, or MOFCOM, has allocated 13 million mt of oil product export quota in the first round to seven oil companies for 2022, down 55.9% from the same round for 2021, sources with knowledge of the matter said. The quotas are for gasoline, gasoil and jet fuel exports, according to the sources. The more than a half reduction from 29.5 million mt in the same round of last year set the falling range of China's oil product outflow in 2022.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language