Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Fall Redemption Rush Forces BREIT to Close Gates

Blackstone Inc., the world’s largest alternative asset manager, captured headlines in recent weeks after its nontraded real estate investment trust closed the redemption gate on the fund at the start of December 2022. The move followed a surge of fund outflows in the fall as wealthy investors withdrew billions from Blackstone Real Estate Income Trust Inc., known in the industry as BREIT. The nontraded REIT was forced to gate redemptions after withdrawal requests exceeded the monthly limit of 2% and quarterly cap of 5%.

The wave of redemptions and the subsequent gating — the process of temporarily halting withdrawals from a fund — came as a bit of a surprise given BREIT’s outperformance relative to its publicly traded REIT counterparts and the S&P 500. Since its launch, BREIT’s returns have averaged 13% per year, which is three times the return of the REIT index, Blackstone Chairman and CEO Stephen Schwarzman said in a Dec. 7, 2022, conference presentation. Last year, BREIT's Class I shares returned 9.3% through Oct. 31, 2022, while the S&P 500's total return performance fell 17.7% in the same period, according to Robert A. Stanger & Co. Inc.

But BREIT’s strong performance could be the very reason why some investors rushed to pull money from the fund. It would allow them to cash out of BREIT at higher returns and reinvest in publicly traded REIT stocks at better valuations. Stanger CEO Kevin Gannon explained that investors may be heading for the exit to rebalance their portfolios or because they are concerned about the subdued outlook for real estate, particularly the potential for inflation-driven interest rate hikes to impact property values and real estate debt refinancing costs. Publicly traded REITs also traded at a nearly 17% discount to net asset value as of the end of November 2022, which may signal to some investors that nontraded REITs are overdue for a markdown, Gannon added. A $4 billion investment from the University of California announced this week may serve as a backstop against further redemptions.

Blackstone’s Schwarzman said the redemptions primarily came from investors in Asia who have margin debt and were looking for liquidity after Hong Kong stocks plummeted. Blackstone reiterated that BREIT’s performance stayed "rock solid" and that its portfolio, which largely comprises rental housing and industrial assets in the U.S. Sun Belt region, is "well positioned for the future."

Blackstone entered the nontraded REIT arena with the launch of BREIT nearly six years ago, a time when the segment faced an existential threat. The sector had fallen out of favor because of a 2014 accounting scandal that took the then-largest nontraded REIT sponsor out of the picture, as well as regulatory changes around fee transparency and fiduciary standards. Blackstone’s arrival helped improve the reputation of nontraded REITs and was described as a legitimizing event for the sector.

Fast forward to 2022, BREIT has turned into a $70.4 billion juggernaut with a portfolio of more than 5,000 properties, according to S&P Global Market Intelligence data. BREIT is structured as a daily net asset value REIT, a type of nontraded REIT that offers retail investors partial liquidity and regularly updated valuations. Thanks to Blackstone’s vaunted reputation in real estate and BREIT’s semiliquid nature, the trust appealed to retail investors and quickly became a force to be reckoned with in the nontraded REIT sector. It carved out a market share that hit 72.9% in 2019, its banner year. Despite a slowdown during the COVID-19 pandemic, Blackstone continued to dominate the nontraded REIT fundraising scene, giving BREIT ample capital to pursue blockbuster acquisitions.

BREIT’s gating, which sent Blackstone’s shares tumbling on the NYSE, will be “an educational experience” that offers lessons on liquidity and retail investing for all stakeholders, Oppenheimer & Co. Inc. senior analyst Chris Kotowski told S&P Global Market Intelligence.

Today is Wednesday, January 4, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

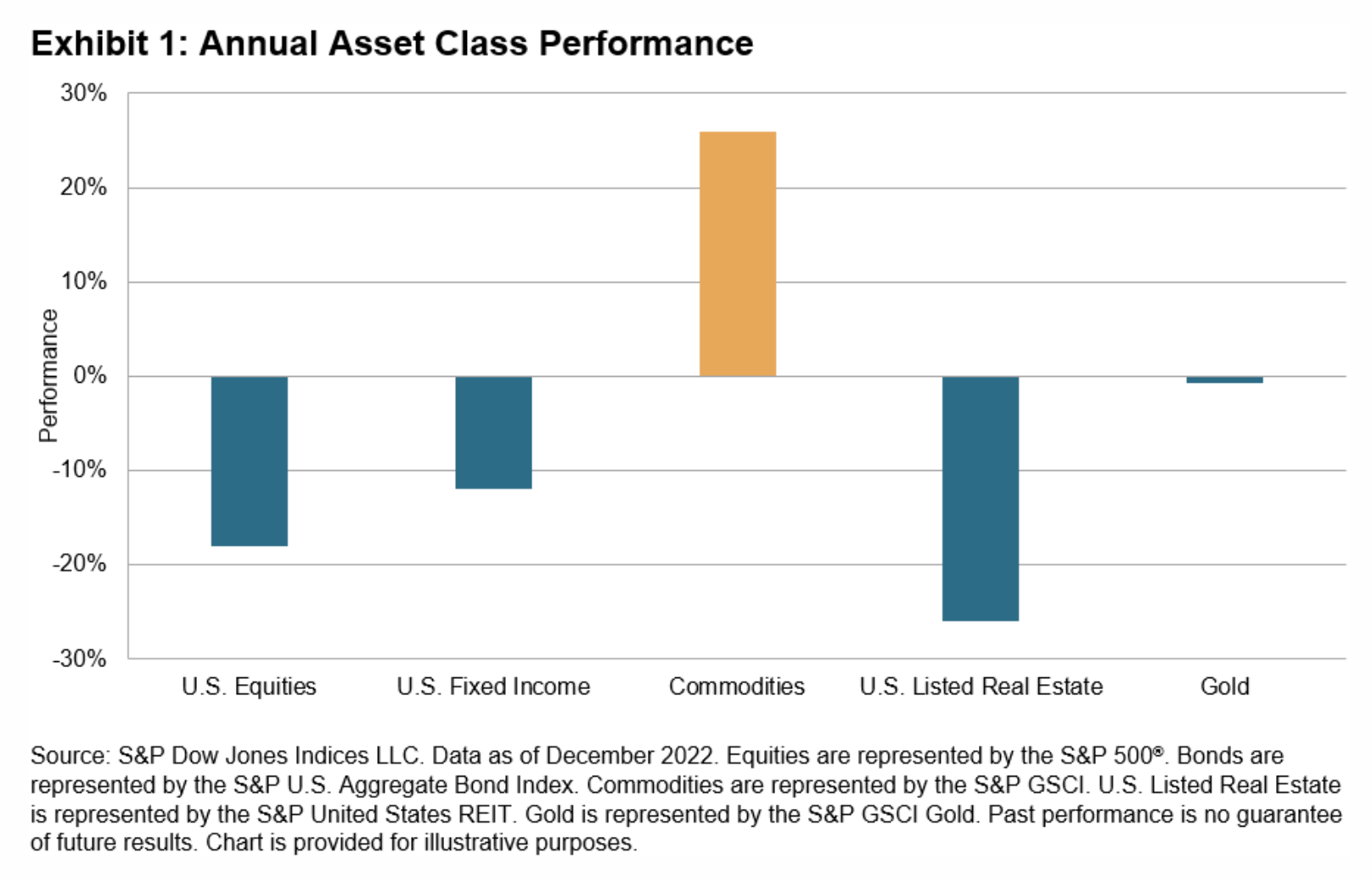

Commodities Outperform For The Second Year In A Row

The market standard commodities benchmark, the S&P GSCI, performed admirably in 2022, rising 26%, outpacing other commodities indices and asset classes, as well as defying higher interest rates and growing fears of a prolonged global economic slowdown, while high inflation provided a solid backdrop for one of the most inflation-sensitive asset classes. Commodities has been the best-performing major asset class for each of the past two years.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

Steep Drop In Private Equity Fund Launches In 2022

A total of 481 private equity funds were launched globally year-to-date through Dec. 19, 2022, representing a 67% decline from 2021 when 1,464 funds launched, according to S&P Global Market Intelligence data. Some factors that slowed the pace of new funds were macroeconomic, such as record-high inflation, multiple interest rate increases and slowing growth that shaped the worldwide economic landscape in 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

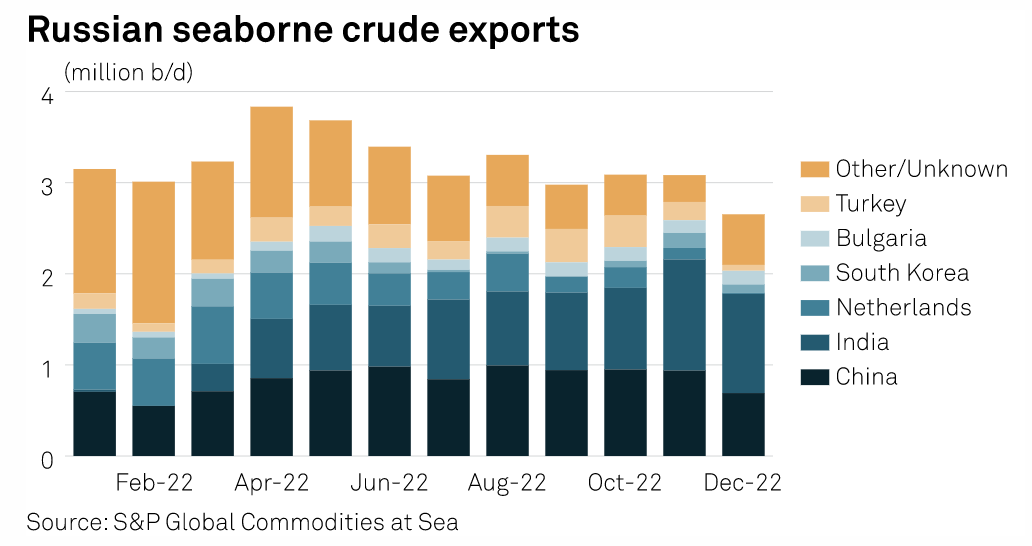

Russian Crude Exports Sink To Two-Year Low As Market Eyes Shadow Fleet

Russian seaborne crude exports fell to a two-year low in December, according to tanker tracking data, as Moscow struggled to redirect to Asia oil displaced by sanctions in European and G7 countries. Russian-origin crude loadings from Russian ports averaged 2.65 million b/d in December, down 431,000 b/d, or 14%, from November levels, according to data from S&P Global Commodities at Sea.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

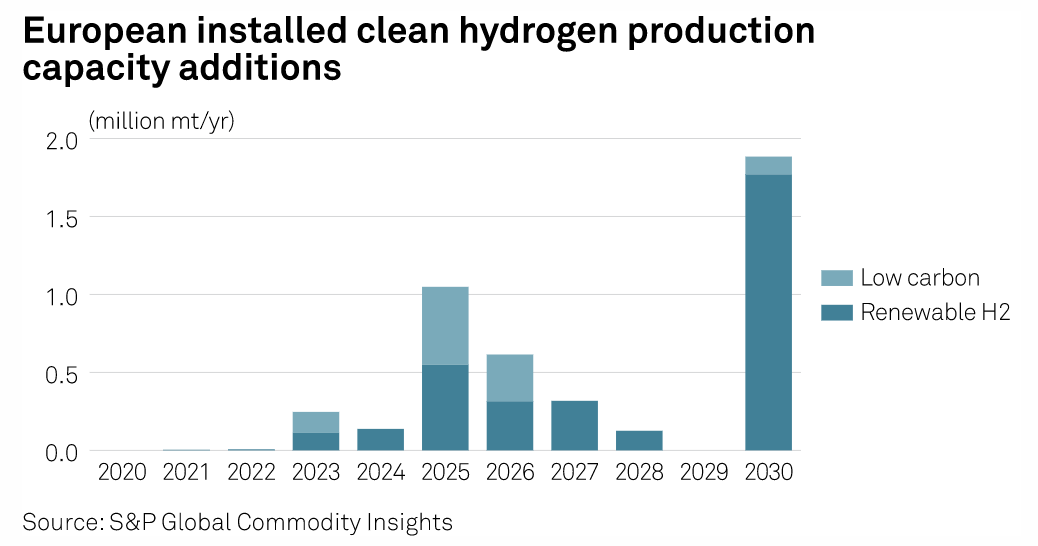

Commodities 2023: Europe Struggles To Maintain Hydrogen Momentum

Policymakers in Europe are struggling to maintain renewable hydrogen momentum going into 2023 as political delays, financial uncertainty and supply chain issues hamper project development. Developers put final investment decisions on hold in September after a vote in the European Parliament effectively scrapped a key policy framework setting out rules on renewable hydrogen proposed by the European Commission.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability

Commodities 2023: Lower Palm Oil Prices Likely But Markets Wary Of Supply, Recession Risks

Crude palm oil prices may ease in 2023 after hitting record highs last year, but "wild cards" such as Malaysia's labor crunch at its palm plantations, China's re-opening and looming recession fears could upend forecasts, industry sources warned. Third-month crude palm oil futures on Malaysia's commodity exchange are expected to be at around MR 3,800/mt ($859.24) in 2023, according to the median estimate of eight leading industry analysts and trade bodies polled by S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Distribution Deals Crucial For Asia's Growing Insurance Technology Companies

Choosing distribution models and partners will be key for Asia's insurance technology companies as they seek to expand their reach, but experts said would-be disruptors should think twice before entering into any long-term arrangements. Insurtechs in the region face a "ground-up, growth grind," according to George Kesselman, president of Insurtech Asia, with startups racing to educate and tailor insurance products to new consumers. In particular, embedded business-to-business-to-consumer arrangements are increasingly becoming popular across Asia as they open new and potentially scalable distribution channels, Kesselman said in an interview. But one drawback is distribution platforms capture the lion's share of the value in such arrangements.

—Read the article from S&P Global Market Intelligence