Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Climate Change – A Glass Half Empty

Human activity is intimately tethered to Earth's natural resources. We brilliantly leverage these resources to simplify and elongate our lives, from the metals and minerals that enable advanced medical and consumer technologies to the irrigation systems watering crops that feed billions. But we have pushed the bounds of this planet's natural endowments too far.

Policy choices today influence the environment of tomorrow; even the choice to do nothing and accept unmitigated emissions. Globally, physical risks are projected to worsen as net emissions grow, and these physical risks erode and disturb global economic productive capacity, according to a recent report from S&P Global Ratings. Climate risks can be physical and related to the energy transition. Accepting climate change, engineering a rapid transition to net-zero or anything in between all carry certain risks. The supply side would most acutely feel the shocks from simply accepting climate change; doing so would damage physical capital and lower productivity. The demand side would feel the shocks from a rapid transition.

There are other associated risks with these energy transition scenarios, rapid or otherwise. Notably, the transition requires massive expansions in rare mineral supply, and companies are exploring hundreds of new sites to meet this heightened demand. More than 1,270 mine sites interact with Key Biodiversity Areas, almost 30% of which contain mine sites for minerals necessary to realize energy transitions. Accessing more of these minerals can create pressure on biodiversity and undermine ecosystem services.

Processing and refining also create waste byproducts such as tailings, a slurry of pulverized rock, water and leftover extraction chemicals that must be treated on-site. Such tailings are stored in dams that can fail, polluting downstream waters and creating a maelstrom of consequences. According to S&P Global's Corporate Sustainability Assessment, most accessed mining firms report and audit their active tailings sites. Still, little progress has been made on tailings management activities, such as decommissioning procedures, to mitigate biodiversity impacts.

Agriculture is another sector where humans have pushed the bounds or, in this case, the yields. Human ingenuity has promulgated seed variants to tolerate extreme conditions, among other agricultural advancements, but that ingenuity can only take us so far. Doubts remain as to whether these advancements can continue offsetting the adverse impacts of climate change, S&P Global Commodity Insights wrote in a special report on climate change and crop supply and demand. One of the driving forces behind the warming climate is rising emissions.

While it’s common knowledge that plants require carbon dioxide and that more CO2 can be good for the growth of some crops, there is saturation at a certain point where the positive response to more CO2 levels off. And higher carbon levels are not necessarily positive for crops because CO2 can reduce nutrient quality. So, there may be less nutritional value even with greater yields. Climate change impacts on food are happening now, and extreme events are becoming more intense, protracted and frequent.

The risks of multi-breadbasket failure are increasing, and developing countries are particularly vulnerable. All countries' food security is at risk. Import reliance amplifies that risk across trade partners for countries that turn to imports to satisfy domestic demand. It's difficult to draw direct causal lines between climate change and human activity, given the complexity of systems interactions. Nonetheless, there are now 8 billion of us (and growing); we're consuming and producing more, emitting more CO2, and the climate is undoubtedly warming.

Today is Friday, January 27, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

Economic Research: U.S. Business Cycle Barometer: Constrained By Tight Monetary Policy And Global Slowdown

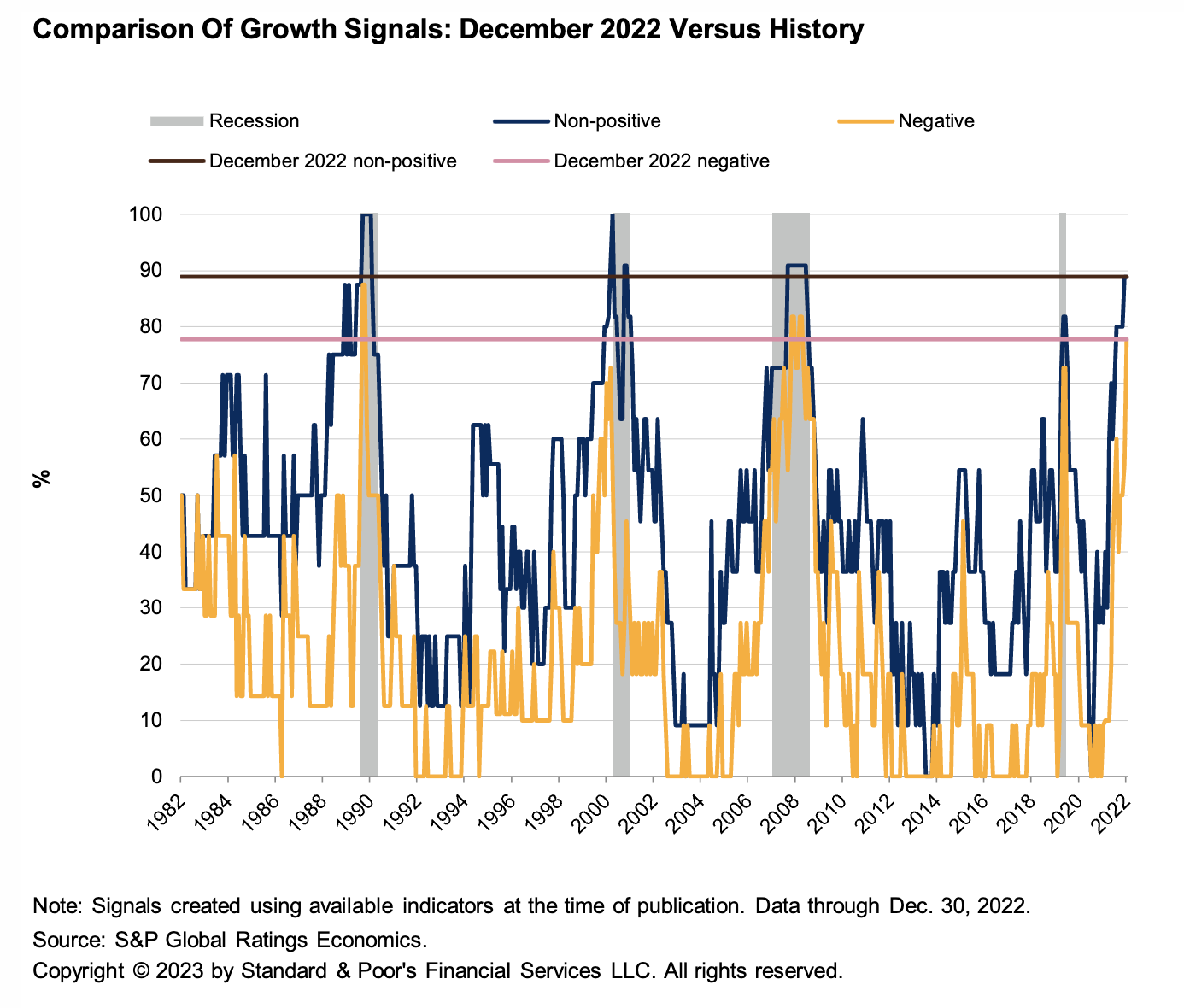

Key yield spreads are signaling that a U.S. recession is more likely than not over the next 12 months. For example, S&P Global Ratings’ quantitative assessment of recession risk, when using the 10-year/three-month spread, puts the probability of recession at 59%. Consumer sentiment may be improving, raising hopes that it will soon flash neutral. A closely watched measure of consumer sentiment posted a surprisingly high preliminary reading for January, largely because of lower gas prices.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Building A Passive Bridge Across The Pond

At over 300 years old, the British government bond and stock markets are among the world’s oldest. They are also among the largest globally; ranked by float-adjusted market capitalization, the U.K. gilt market and U.K. stock market are the fourth and third biggest, respectively. The British investment industry has existed for centuries, with the country’s (and world’s) oldest collective investment scheme launched over 150 years ago. Despite this long history, U.K. investment funds have been just as likely to suffer from home country bias as their international peers.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

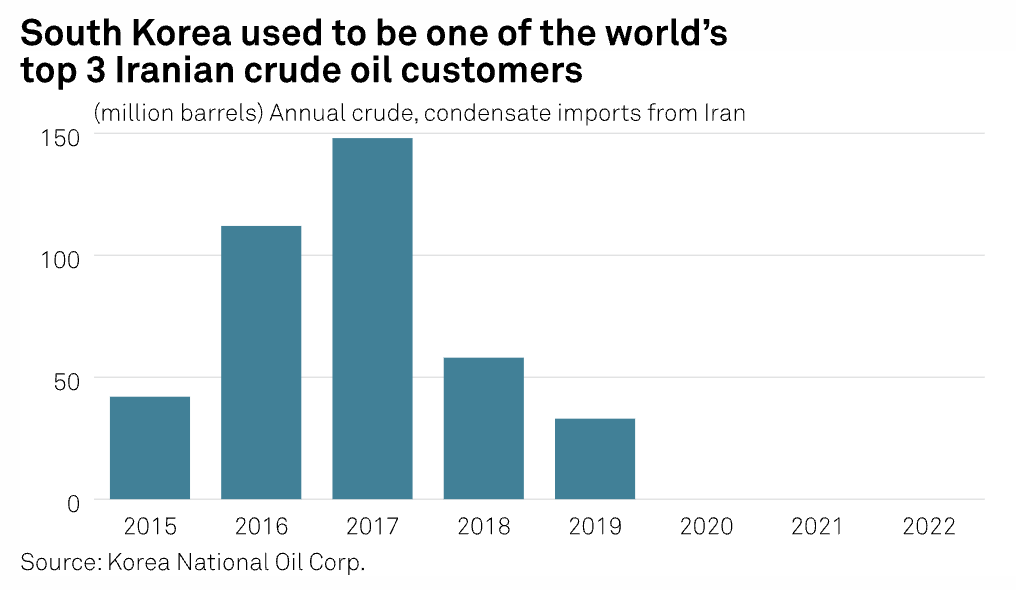

South Korean Refiners To Take Extra Caution In Persian Gulf Crude Logistics Amid Seoul-Tehran Spat

South Korean refiners would take extra caution to ensure safe voyage of their Middle Eastern sour crude oil shipments sailing through the Strait of Hormuz amid recent diplomatic spat between Seoul and Tehran, industry sources told S&P Global Commodity Insights Jan. 25. South Korea's shipping sector and refining industry are on their toes after the Korea Shipowners' Association issued a warning Jan. 18 to all vessels sailing in the Persian Gulf and the Strait of Hormuz to "remain vigilant," as diplomatic tensions between Seoul and Tehran raises the risk of potential detainment of South Korean flagged and/or South Korea-bound vessels sailing near Iran, container shipping sources based in Busan and feedstock logistics management sources at two major South Korean refiners said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

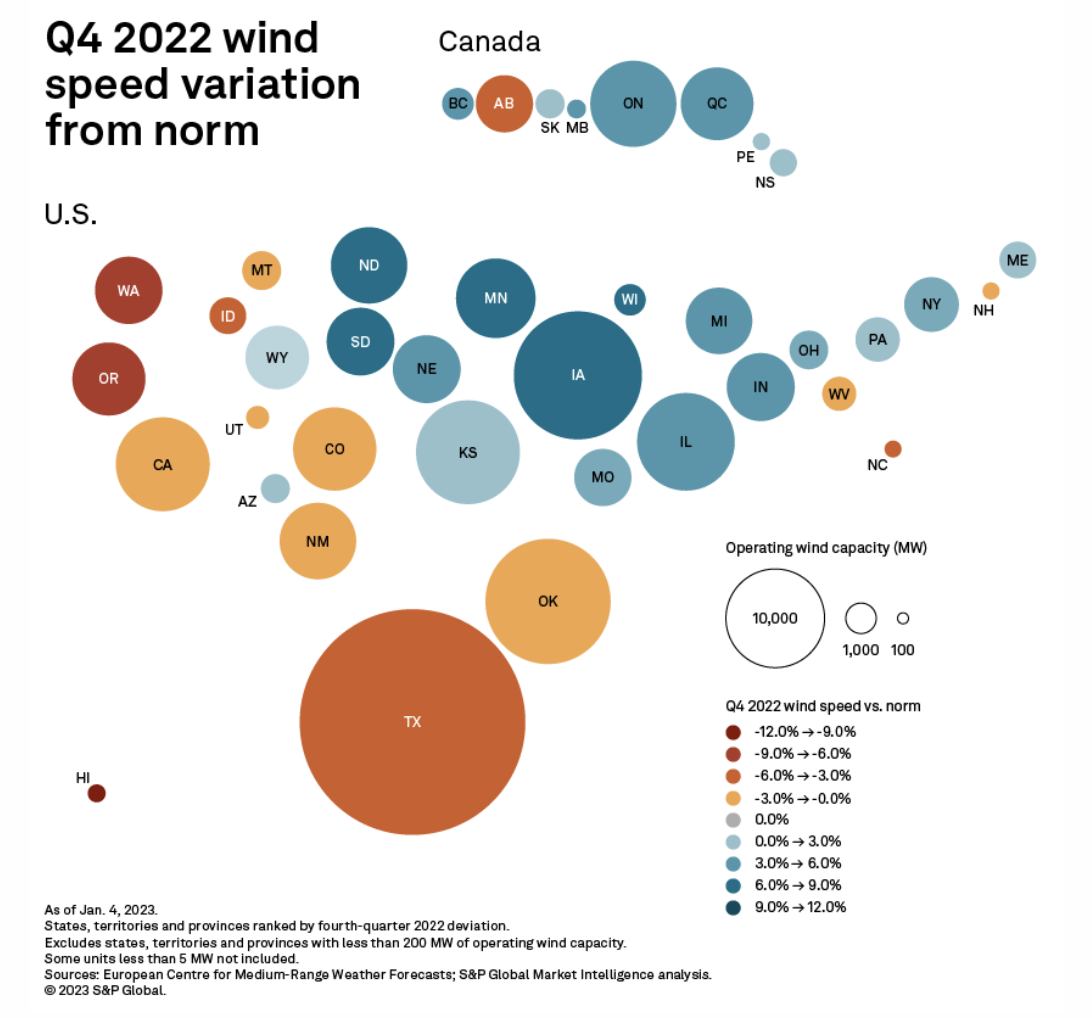

Swifter Wind Speeds Sweep Turbine-Strewn U.S. Midwest In Q4'22

Nearly half of the U.S. states, operating more than 200 MW of wind energy, experienced wind speeds below normal in the fourth quarter of 2022. Across areas in positive territory, however, states within the Midcontinent ISO and the Southwest Power Pool, where wind weighs heavily in the generation balance, experienced particularly dramatic jumps. This likely benefited portfolio owners with large stakes in the Midwest, including Allete Inc., Alliant Energy Corp., Berkshire Hathaway Inc. and Xcel Energy Inc.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

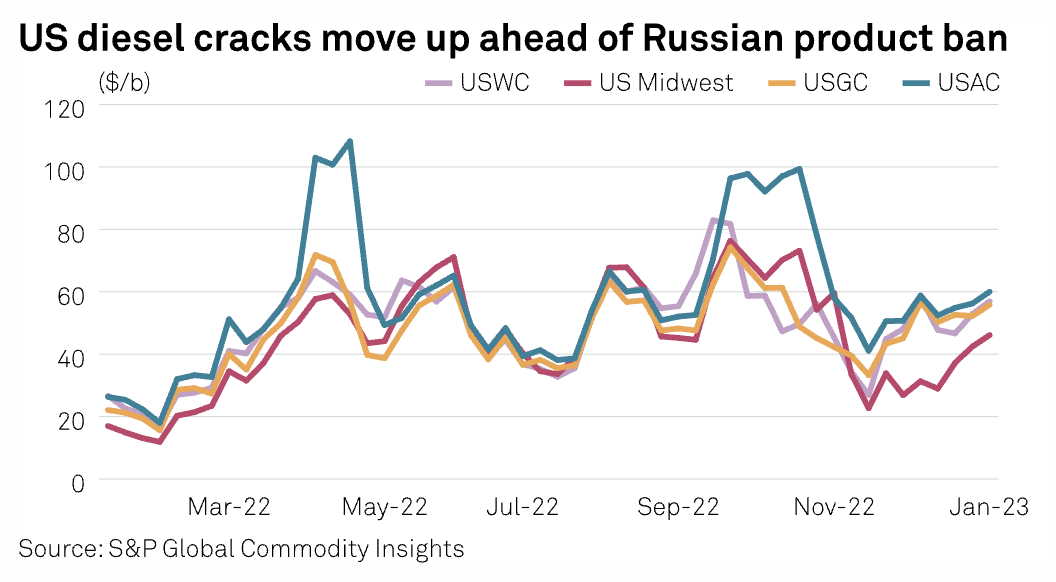

U.S. Refiners See Strong Q4 Earnings Continuing Into 2023 As Turnarounds Increase

U.S. refiners are expected to report elevated earnings for Q4 2022, which are spilling over into 2023 as demand remains healthy amid anemic inventories that are expected to fall on heavier-than-2022 turnarounds, an analysis from S&P Global Commodity Insights showed Jan. 25. "Refiners are looking at an excellent Q4 '22 thanks to extremely robust diesel cracks, widening heavy crude differentials, improving WTI market structure, and positive capture rate factors," said Matthew Blair, analyst with Tudor Pickering Holt, in a Jan. 23 pre-earnings research note.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

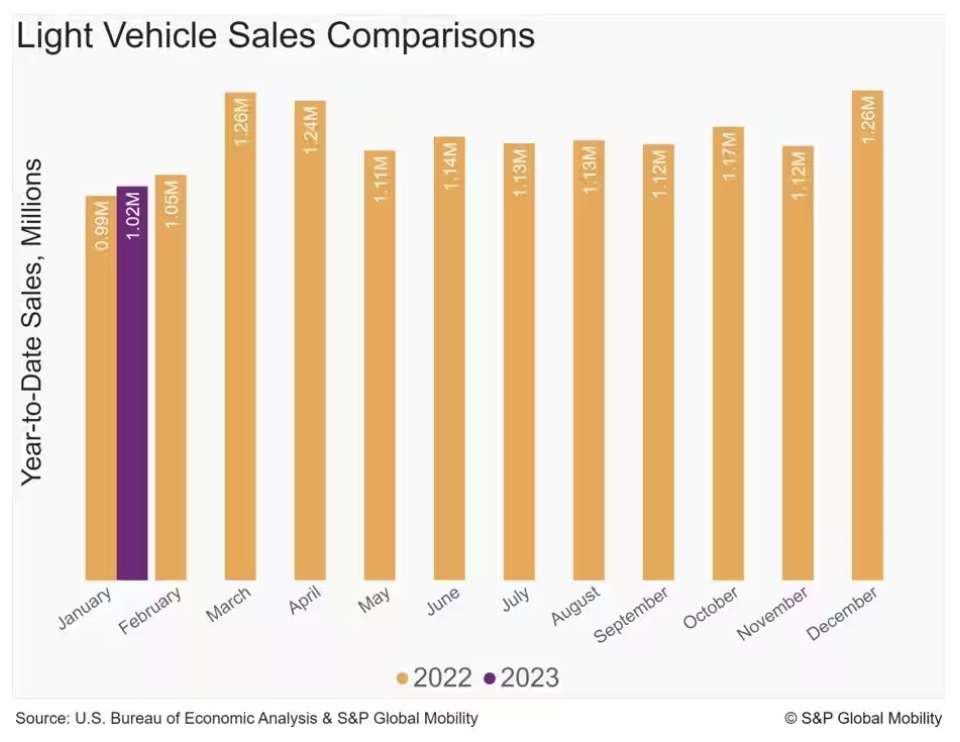

January 2023 U.S. Auto Sales Highlight Mixed Messaging

With volume for January 2023 projected at 1.015 million units, U.S. auto sales are estimated to translate to an estimated sales pace of 15.5 million units (seasonally adjusted annual rate: SAAR). While the SAAR reading would be the highest monthly level since May 2021, we've seen this pattern before and the underlying dynamics of the market remain in flux. "Auto consumers continue to be impacted by an uncertain purchase environment. While positive developments regarding mildly retreating vehicle prices and rising pockets of inventory bode well, interest rates remain high and economic headwinds persist," said Chris Hopson, principal analyst at S&P Global Mobility.

—Read the article from S&P Global Mobility

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy , Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek