Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Jan, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As the intensity of the coronavirus pandemic increases, so too does the growth of a “great divide” exacerbating economic inequality and other social issues. How countries and companies come together to create a more socially equitable world may determine whether the global economy can build back better in 2021.

Infecting more than 100 million people and killing more than 2.2 million worldwide, according to Johns Hopkins University data, the pandemic has disproportionately weighed on the health, mortality, and economic standing of vulnerable populations—including people of color, women, and non-binary people, lower-income households, and other less advantaged communities. Despite calls and commitments for increased workforce diversity, women and family caregivers are burdened with additional stress and responsibility to the point of dropping out of the workforce. Poverty is increasing and income inequality is deepening at an alarming pace. The global COVID-19 vaccine rollout is putting into stark relief the inequitable access that developing and emerging nations face when seeking access to medicines.

Against this backdrop of a widening social divide, “companies are increasingly adopting stakeholder capitalism, focusing on long-term value creation for customers, employees, society, and the environment rather than just short-term value for shareholders,” S&P Global Ratings said in a recent report. “In response to the pandemic, governments have provided substantial support to corporations to prevent economic collapse. This in turn has raised expectations about corporate responsibility and the purpose of corporations.”

Asset managers such as State Street Global Advisors are advocating for companies to disclose nonfinancial racial diversity data, going so far as to describe racial inequity as “a systemic risk.” Firms around the world that implemented policies to increase their workforce diversity have ramped up their efforts as the public demands that companies take greater action as the pandemic puts pressure on the global economy. Investment banks including Goldman Sachs and stock exchanges like Nasdaq are beginning to push companies they fund or list to diversify their boards and management teams. Even governments are joining in. U.S. President Joe Biden is pushing to pass a stimulus package that would expand benefits for workers by increasing safety standards and paid leave policies for American employees. Germany passed legislation earlier this month that introduces a minimum quota for women on listed large companies’ boards. Chief executive officers are frequently speaking out on social issues—an action unprecedented in history—and are expected to continue to do so.

"More and more, employees, investors and consumers are expecting public companies to respond to social and other ESG issues," Gary LaBranche, the president and CEO of the trade group National Investor Relations Institute, told S&P Global Market Intelligence. "This is especially the case for larger consumer-facing companies.”

The movement creating a business case of equity and inclusion within environmental, social, and governance risks and opportunities has momentum.

“The purpose of a corporation is being redefined. The aim is to increase economic and societal resilience by accelerating inclusive economics and societies (creating jobs, re-skilling, lowering unemployment) while shaping a new concept for economic integration and digital revolution,” S&P Global Ratings said. “A more inclusive and holistic approach is even more crucial during the current volatile times in which many people are without their jobs and companies are forced to shut. The values that a corporation embraces can be as important as the value that it creates. From a stakeholder perspective, the two are inextricably linked.”

Today is Wednesday, January 27, 2021, and here is today’s essential intelligence.

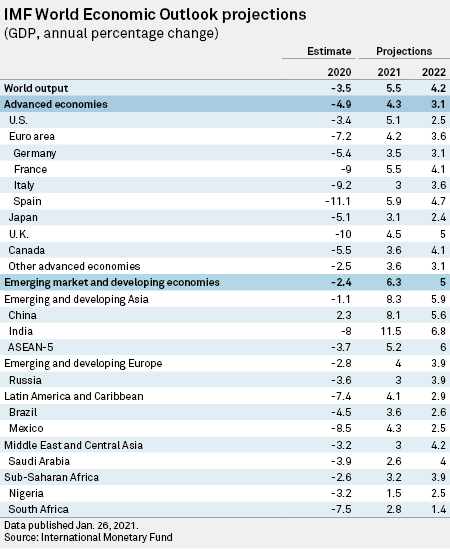

IMF Raises 2021 Global GDP Outlook on Vaccine Rollout, Policy Measures

The International Monetary Fund upgraded its 2021 global economic outlook amid expectations that the rollout of vaccines and additional policy measures would propel activity, though it flagged concerns about new coronavirus variants.

—Read the full article from S&P Global Market Intelligence

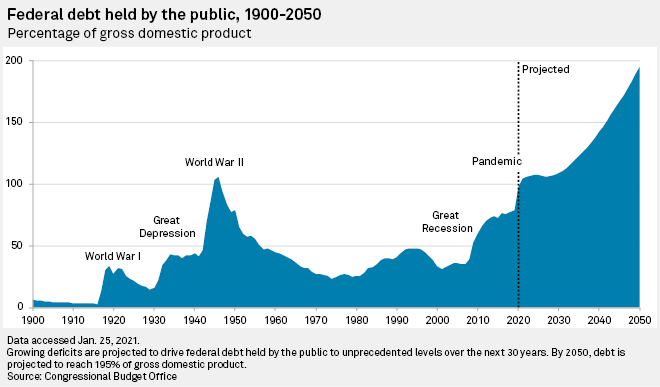

Yellen Faces Major Hurdles to Issue of 50-year Bond that Mnuchin Passed Over

There are plenty of reasons why the U.S. Treasury has not issued a 50-year bond since 1911. Fixed-income strategists point to limited demand, the potential to drain liquidity from other corners of the bond market, an unwanted steepening of the yield curve, and a disruption to the Treasury's long-standing "steady and predictable" bond issuance mantra.

—Read the full article from S&P Global Market Intelligence

Fed's Powell to Stick with Dovish Tone as New Coronavirus Strains Emerge

The Federal Reserve will be happy to end its two-day policy meeting by making little news, other than promising to continue providing accommodative monetary policy for some time despite a brighter economic outlook.

—Read the full article from S&P Global Market Intelligence

Oil Majors' Credit Ratings Under Threat from Growing Climate Risks: S&P Global

S&P Global Ratings said Jan. 26 it is considering downgrading its credit ratings on a number of major oil and gas producers, including ExxonMobil, Shell and Total, to reflect a growing risk to their businesses from the energy transition, price volatility, and future profitability.

—Read the full article from S&P Global Platts

A Different Kind of Bubble

Information Technology was the top-performing sector in 2020, up 44%, while Momentum (up 28%) was the second best-performing factor. These two results are reminiscent of the bubble we experienced two decades ago.

—Read the full article from S&P Global Dow Jones Indices

UK Banks' Deposits Rise Amid Pandemic, but Margins Likely to Be Squeezed

British banks are expected to make extensive use of cheap Bank of England loans in the next few months even as deposits from businesses and households rise amid the pandemic, according to analysts.

—Read the full article from S&P Global Market Intelligence

U.S. Banks Could See More Regulation but Playing Leveled Field with Nonbanks

Banks will face greater regulatory scrutiny under the Biden administration but could also see the playing field leveled with some of their nonbank counterparts.

—Read the full article from S&P Global Market Intelligence

China G-SIBs Unlikely to Trigger Lehman-like Global Financial Crisis: Experts

Despite rising global systemic risk scores of Chinese megabanks, their predominantly domestic footprint and the limited overseas use of the yuan suggest a low likelihood of them triggering a Lehman-like global financial crisis in an event of a bank failure, experts say.

—Read the full article from S&P Global Market Intelligence

2021 Technology Preview – A Pivotal Year in IT in Preparation for a Post-Pandemic ‘New Normal’

How will the prospect of a post-pandemic world impact the technology industry, which has itself played no small part in helping the developed world at least get through the last year? We can banish any ideas about getting back to the ‘old normal'; this is good news for this industry, where change is a constant. Change will drive opportunity, which technology entrepreneurs are particularly good at exposing and attacking.

—Read the full article from S&P Global Market Intelligence

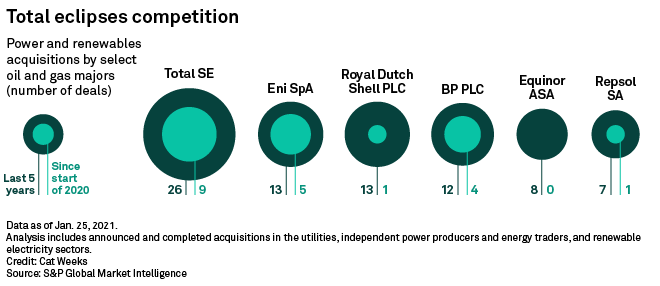

France's Total Outpaces Oil Peers with Green Acquisition Spree

Total SE has pulled ahead of the competition in reinventing itself as a broader energy company, deepening its push into renewable energy by buying up companies and assets at a much faster pace than any of its peers in the oil and gas industry.

—Read the full article from S&P Global Market Intelligence

BlackRock's Fink Presses Companies to Start Planning for a 'Net Zero World'

Larry Fink has issued a new call to action on climate change for companies around the world: Start planning for a net-zero economy.

—Read the full article from S&P Global Market Intelligence

European Commission Approves Second European Battery Project

The European Commission has given the green light to the continent's second battery project, with executive vice president Margrethe Vestager announcing Jan. 26 that Eur2.9 billion ($3.5 billion) of state aid by 12 member states had been approved to support 46 projects designed by 42 companies.

—Read the full article from S&P Global Platts

Storage Companies Seen Pivotal for Mitigating Energy Transition Risk

Storage companies are in prime position to take advantage of the transition to alternative fuels, with ESG providing new opportunities and costs, delegates said at S&P Global Platts European Oil Storage Virtual Conference.

—Read the full article from S&P Global Platts

Market Movers Americas, Jan 25-29: Soybean prices turn volatile; fog, weather impact several markets

In this week's Market Movers Americas, presented by Joshua Pedrick: Soybeans volatile after prices back away from highs, fog prompts standoff in Aframax market, WTI MEH/Midland spread narrows despite production decline, muted demand and heavy sea fog weaken Henry Hub, cooler US Northeast weather pushes up power demand, prices.

—Watch and share this Market Movers video from S&P Global Platts

Biden's Planned Moratorium on Oil and Gas Leasing Picks Winners and Losers, Critics Argue

The moratorium on new oil and gas leases on federal lands and waters that President Biden is expected to announce Jan. 27 would hurt US production and pick winners and losers between states, industry and state critics said Jan. 26.

—Read the full article from S&P Global Platts

Endangered Species Signoff Puts LNG Facility in Alaska Closer to Handling Imports

The oldest LNG export facility in the US, dormant since 2015, is a step closer to being brought back online to handle imports to power a nearby refinery.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language