Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

While the outlook for banking industries varies across different countries, digitalization, a heightened focus on sustainability, consolidation, and changing interest rates are set to transform the global banking landscape this year as the omicron coronavirus variant casts a shadow.

In the Asia-Pacific region, Australian banks are likely to face record-low interest rates, tighter lending requirements, and the risk of a cooling housing market, while Chinese banks are confronting rising credit risk, slowing loan growth, and slimming margins, according to S&P Global Market Intelligence. Banks in China may also be burdened with new property-development stresses this year, as S&P Global Ratings estimates that roughly one-third of China’s property developers are in some form of financial trouble and property is weighing more heavily on smaller and weaker banks’ asset quality.

In contrast, some European banks are looking forward to a brighter year. Analysts and lenders interviewed by S&P Global Market Intelligence believe that France's largest lenders have rebounded remarkably from the coronavirus-caused disruption and that banks in the Czech Republic will likely enjoy buoyant performance in 2022. British banks could see their provisions prevail over loan losses and their margins on mortgage lending remain solid, even if the Bank of England raises interest rates.

Banks in emerging market are facing unique challenges and opportunities, according to S&P Global Market Intelligence. Kenyan banks are exposed to the African country’s fragile real estate market. Russia’s are reaping rewards from the healthy equity capital market in the Eastern European economy. In Brazil, banks may be able to rebuild their profitability even as credit expansion slows. Overall, Latin American banks appear strong and solid moving into 2022.

Against this backdrop, banks appear to be investing in digital adoption and turning to mergers and acquisitions to strengthen their growth prospects in the third year of the COVID-19 pandemic—and preparing for the future by taking environmental efforts more seriously.

An S&P Global Market Intelligence analysis found that Italy-headquartered UniCredit’s potential acquisition of the Russian bank PJSC Bank Otkritie would create the fourth-largest bank in Russia, with assets totaling nearly 5 trillion rubles ($65.4 billion). Whichever firm buys the French retail banking division of Danish lender ING Groep will yield part of a unit that generated €266 million in 2020. As part of Citigroup’s efforts to prioritize wealth management and corporate banking operations by exiting retail operations in 13 markets, the New York-based firm on Jan. 11 moved to sell its expansive and profitable Mexico unit. In addition, it recently agreed to sell its franchises in Indonesia, Malaysia, Thailand, and Vietnam to Singapore-headquartered United Overseas Bank in a nearly $3.6 billion acquisition.

Worldwide, consumer behavior changed by the coronavirus pandemic has accelerated the use of digital channels for banking. In an example of how deal-making is pushing digital adoption forward, the French bank BNP Paribas has said it will transition its focus on investing in the technology space after selling its Bank of the West unit.

How global banks act on their net-zero pledges this year may be decisive for the future. In the face of investor pressure and finance executives’ calls for ESG investment standards, many megabanks have continued to fund clients in high-polluting industries despite their promises to achieve carbon neutrality. Approximately 100 banks around the world are signatories to the Net-Zero Banking Alliance, which requires banks to commit to curbing emissions linked to their portfolios to net-zero by 2050 and create short-term goals within 18 months of signing on.

Today is Tuesday, January 18, 2021, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Data: Economic Activity Slows As Omicron Takes Center Stage

The fast-spreading omicron variant has slowed mobility in the U.S., softening real-time economic measures at the start of 2022. Consumer sentiment also softened in January: While weekly same-store retail sales remain robust, inflation readings indicate people are buying fewer items at higher prices. Pricing indicators are mixed: Industrial metal and lumber prices have climbed higher, though the Baltic Exchange Dry Index drifted lower in early January. Supply constraints have eased in recent months, though new lockdowns could reignite disruptions.

—Read the full report from S&P Global Ratings

PE Managers Expect Another Boom Year In 2022

Private equity deal-making and fundraising is expected to continue apace in 2022, although midmarket managers in both the U.S. and Europe are mindful of high valuations and inflationary pressures as they deploy record amounts of cash.

—Read the full article from S&P Global Market Intelligence

2022 Expected To Be Slow Year For Corporate Bankruptcies

U.S. corporate bankruptcies are expected to remain low until late 2022 or 2023 despite a month-over-month uptick in December 2021, experts say. As a whole, there were fewer bankruptcy filings in 2021 than in 2020, with 418 in 2021 compared with 641 the previous year.

—Read the full article from S&P Global Market Intelligence

Access more insights on the global economy >

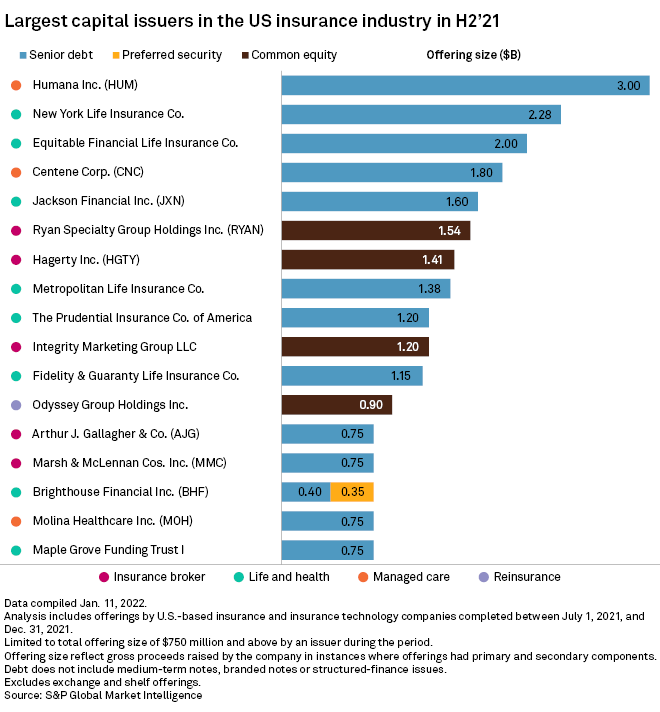

U.S. Insurance Companies Raise $35B From Debt, Equity Offerings In H2'21

U.S.-based insurance and insurtech companies raised about $35.0 billion from capital markets in the second half of 2021, according to an analysis by S&P Global Market Intelligence, down from $58.17 billion in the first half of 2021, but slightly up from $34.31 billion in the prior-year period.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Commodities 2022: Middle East LPG Exports Seen Higher As Contest Heats Up For Asia Demand

LPG exports from major Middle Eastern producers in 2022 are expected to increase 6.6% from 2021 as competition for the growing Asian markets intensifies amid expanding supply from other producers, led by the U.S., traders, producers, and analysts said. Total exports from Qatar, the United Arab Emirates, Saudi Arabia, Kuwait, and Iran are estimated to rise to 38.9 million mt in 2022, up from 36.5 million last year, the sources said.

—Read the full article from S&P Global Platts

Turkey's Currency Crisis Squeezes Out Private Wheat Importers

As the world's largest exporter of flour, Turkey is one of the largest wheat importers. However, the Turkish lira's sudden depreciation has forced many private players to watch from the sidelines, as the state grain board absorbs losses of more than $100/mt in the name of food security.

—Read the full article from S&P Global Platts

Shipping Efficiency Targets Could Prompt Slower Speeds And Reduced Capacity: Market Sources

Forthcoming, escalating energy efficiency targets will mean slower speeds in much of the global fleet and this could limit de facto capacity by 3-5%, according to market sources. The likelihood of this is higher freight rates, although the implications of this vary across sectors, with containers near record highs at present while dirty tankers saw a weak 2021 and face lack of clarity in 2022.

—Read the full article from S&P Global Platts

Access more insights on global trade >

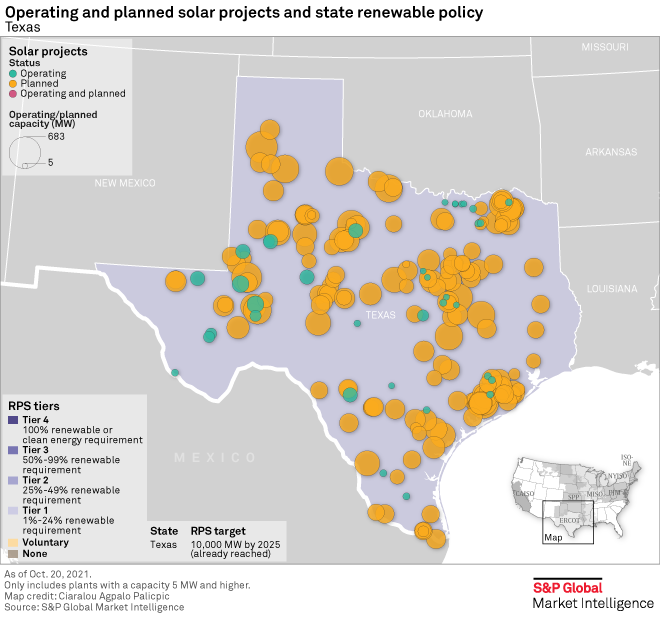

Texas Solar Pipeline Booming Despite Tame Financial Outlook

At the end of 2019, there were just over 2,800 MW of operating solar in Texas. In the last two years, that figure has nearly tripled as nearly 5,000 MW of solar have been installed in the state since 2020. This recent ramp-up in solar interest is just the beginning.

—Read the full article from S&P Global Market Intelligence

Constellation Spin-Off Underscores Nuclear's Role In U.S. Decarbonization Effort

Constellation Energy Corp.'s spin-off from Exelon Corp. arrives at a pivotal moment for nuclear power, with the new company signaling it could be on the hunt for assets and as state and federal policy begins to reflect the technology's value as a carbon-free power source.

—Read the full article from S&P Global Market Intelligence

Ethanol Touted As Complementary Decarbonization Solution To EVs At House Hearing

Emissions reductions benefits from electric vehicles are poised to make a big dent in the U.S.'s carbon footprint over the long term, but the long lead time to overturn the fleet and other challenges demand that policymakers look to other complementary solutions to decarbonize transportation by midcentury, a biofuels advocate said Jan. 12.

—Read the full article from S&P Global Platts

Uranium Price Rally Spurs First Exploration Increase Since 2011

Uranium exploration budgets rose 10.7% year over year in 2021, with Canada leading the pack and budgeting $67 million, followed by the U.S. at $10.1 million, according to S&P Global Capital IQ data. Globally, uranium exploration budgets for juniors reached about $94.3 million in 2021, while majors' exploration budgets for uranium totaled approximately $22.7 million, an S&P Global Market Intelligence analysis found.

—Read the full article from S&P Global Market Intelligence

Russian Military Drills On Ukraine Border Spark Commodity Price Fears

Faltering NATO talks and Russian military exercises on Ukraine's border Jan. 14 have again raised concerns over a possible invasion of the gas transit hub and fears of more commodity price volatility.

—Read the full article from S&P Global Platts

Winter Olympics May Upset Throughput Plan Of China's Independent Refiners

The refineries in China's eastern Shandong province are being asked by the government to cut throughput ahead of the Winter Olympics in an effort to keep emissions under control, a move that could reduce independent refineries' appetite for crude oil even further, refinery sources told S&P Global Platts.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

Netflix Shares Slide As Streamer Tees Up Q4 Earnings

Netflix Inc. on Jan. 19 will report fourth-quarter 2021 earnings, and investor sentiment has rarely been as dour. While some analysts still believe Netflix can shake off the naysayers and generate growth amid the highly competitive shift from traditional TV to streaming video, other analysts and many investors increasingly believe the company is overvalued.

—Read the full article from S&P Global Market Intelligence

Chip Shortage To Persist Through 2022 As Smaller Players Feel Bigger Impact

While analysts and experts expect chip shortages to continue throughout the remainder of the year, they believe the big chip companies have been able to adapt. Smaller tech players, meanwhile, are feeling more of a pinch.

—Read the full article from S&P Global Market Intelligence

Julia Haart On The Future Of Tech, Talent, And Social Media

Utilizing emerging technologies in fashion has allowed talent to make a lasting impact on their brands and followers, Elite World Group CEO Julia Haart told S&P Global Market Intelligence in an exclusive interview. Avatars of EWG's talent and other "metaverse" technologies have played a big role in the success of one of EWG's major clients, Steve Madden. To create a healthier, more inspirational social media environment, Haart teaches her talent to use social media to campaign for causes they care about—and she says Congress can help in these efforts, too.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.

Content Type

Location

Language