Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Macro Trends Caught Up With Private Equity in 2022

Rising interest rates, reduced leverage, an ice-cold market for initial public offerings, and weak fundraising conspired against private equity funds in 2022. Increasingly, private equity is a story of haves and have-nots, with the biggest firms getting bigger while smaller firms lose out. Many funds are sitting on capital they have not yet committed to portfolio companies – known as “dry powder” in the industry – sparking fears that a weak market will lead to fewer profitable exits and more bankruptcies. This could negatively impact the cycle of fundraising that private equity firms depend.

Dylan Thomas, private equity reporter at S&P Global Market Intelligence, analyzed these changes in a recent article titled “Longer hold times put private equity strategies to the test”.” Looking at historical trends, he illustrated that the weaker market for exits in 2022 was partly a factor of the unusually strong market in 2021. Put in a larger context, the performance was consistent with 2019 and 2020. However, fewer exits mean private equity firms are forced to hold investments for longer. This can be good for active managers, giving them time to improve their portfolio companies, but private equity firms that relied on excess leverage to be profitable in a bull market are going to be hurting.

In addition to fewer exits in 2022 than in 2021, the mix of exit types also changed. While IPOs and secondary sales of private equity assets were weak, trade sales increased. This may mean companies are opportunistically purchasing competitive or complementary assets during the down cycle. Private equity fund launches were also down for 2022. Large institutional investors, which funded much of the growth in private equity in the last couple of years, were slower to invest in 2022, partly because an overall decline in the value of their portfolio meant their percentage allocations to private equity were also lower in absolute terms.

For some private equity-backed companies, waiting out the cycle in hopes of a profitable exit was no longer practical. Bankruptcies of these companies increased in 2022, with 49 private equity portfolio companies filing for bankruptcy, including marquee names such as Revlon and cryptocurrency-related firms such as FTX, West Realm Shires Services, Voyager Digital and BlockFi.

For private equity firms with dry powder, these market dislocations can offer an opportunity to pick up assets on the cheap. As of 2022-end, private equity firms were sitting on record reserves of dry powder, estimated to be $1.96 trillion.

"Times of dislocation can be fantastic times to deploy capital with the right managers with the right skill sets with the right strategies that can embrace this complexity and try to capitalize on it," said Mark Perry, head of alternatives manager research at Wilshire Advisors.

Today is Thursday, January 12, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

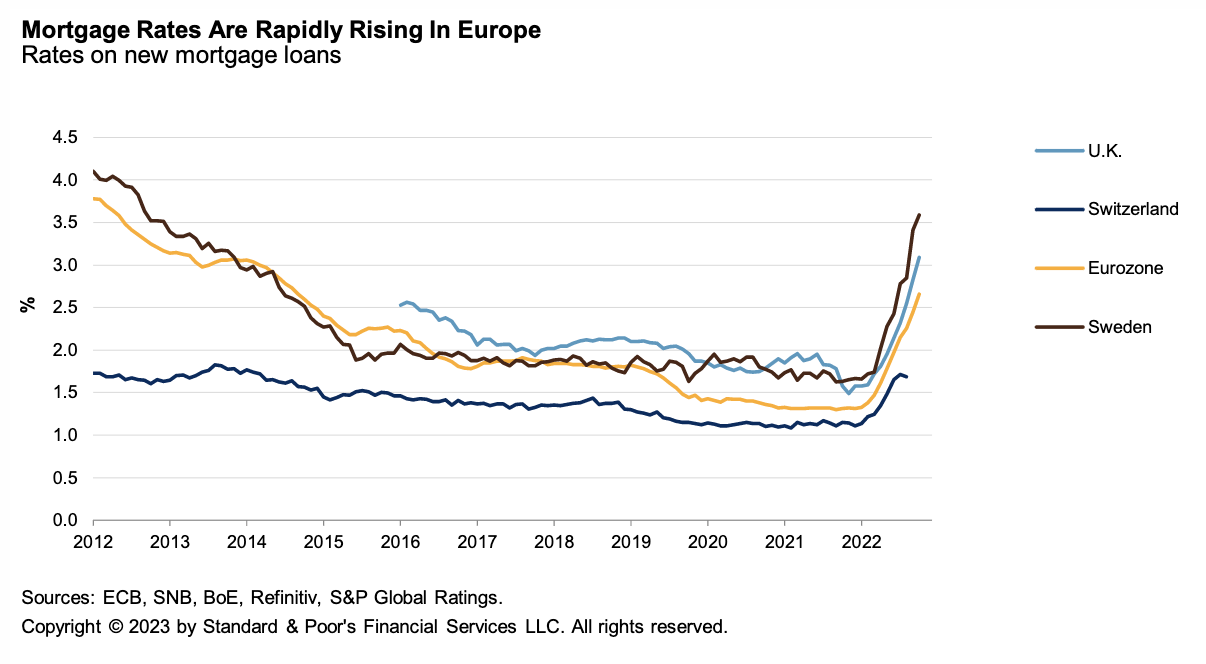

Economic Research: European Housing Prices: A Sticky, Gradual Decline

The European housing market is likely to sag but not shake at its foundations, despite higher mortgage rates. The economy is weathering external shocks better than expected, especially to the labor market, and inflation has not peaked — but is close. So, it is not surprising that central banks in Europe have not laid down weapons. While several of them — the Swiss National Bank, the European Central Bank and the Bank of England — have slowed down rate hikes, proceeding with steps of 50 basis points (bps) rather than 75 bps at previous meetings, they all signal more rate hikes to come this year.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

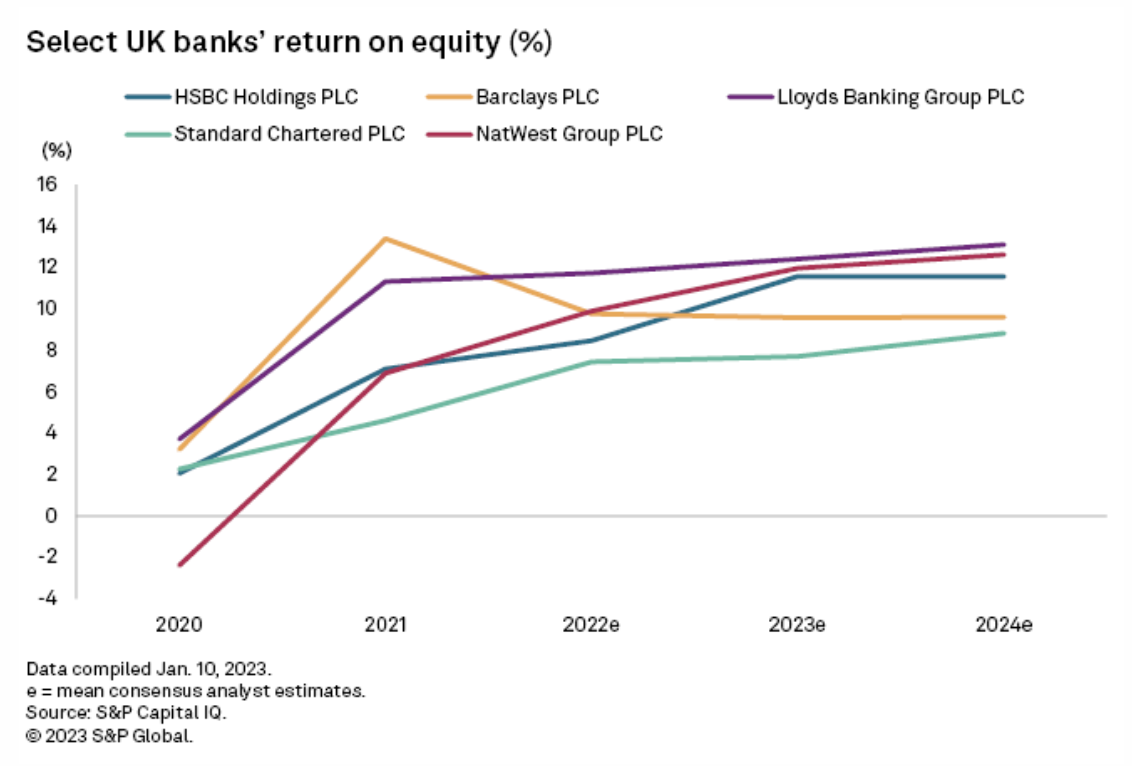

U.K. Banks To Enjoy Higher Profits In 2023 Despite Macro Headwinds

U.K. banks are forecast to navigate a worsening economic environment and achieve higher profits in 2023, according to S&P Global Ratings. The rating agency's base case scenario for 2023 is one of moderate growth in the sector's earnings as higher net interest income, or NII, exceeds rising operating costs and impairment charges. The NII surge seen in 2022 will continue through 2024 but at a slowing rate, Ratings said, noting that the major U.K. banks have passed on a relatively small portion of interest rate raises to depositors so far.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

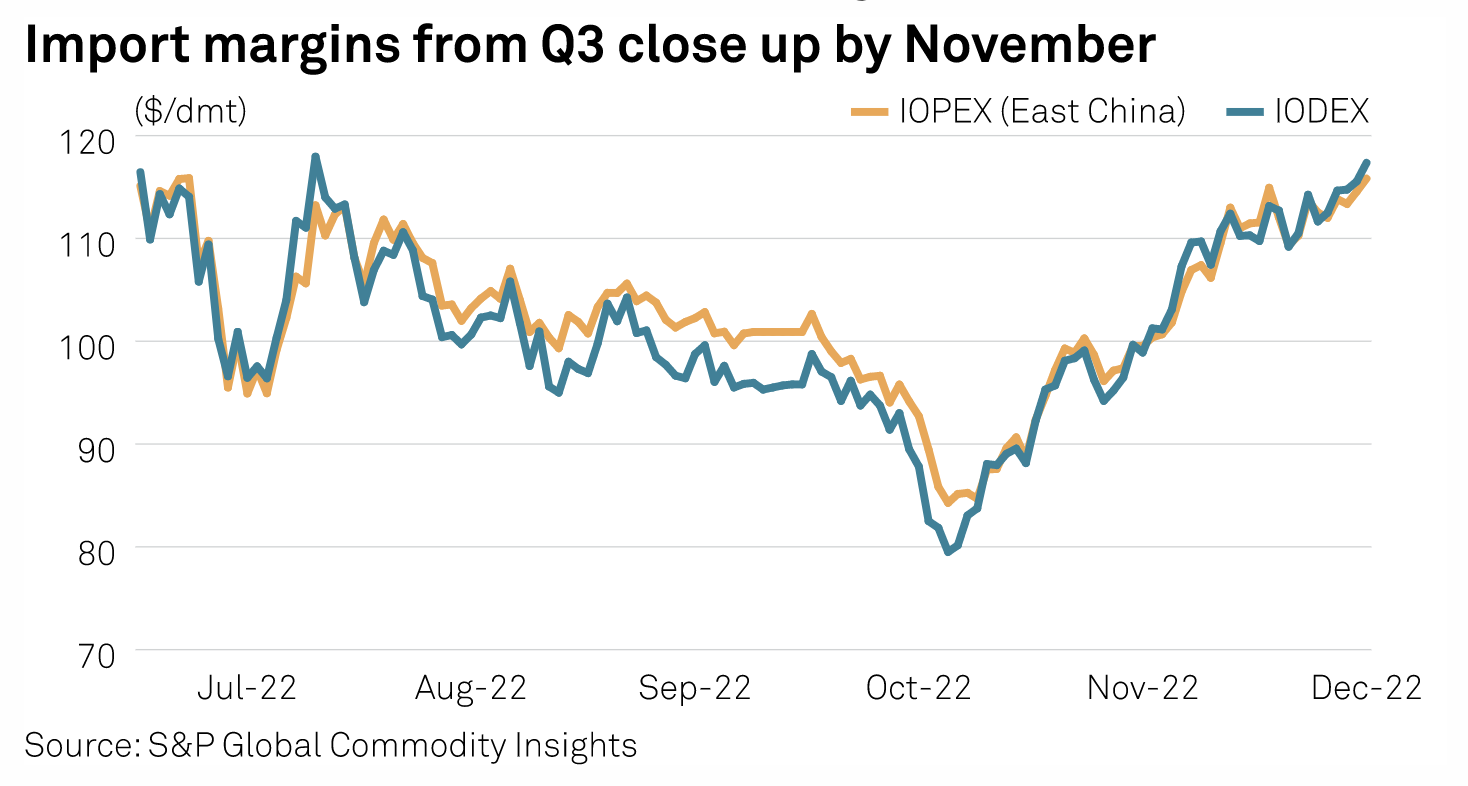

Trade Review: Signs Of Better Downstream Demand Key To Iron Ore Price Recovery In Q1

Steelmakers, having experienced at least eight months of weak margins may finally be seeing a light at the end of the tunnel come first-quarter 2023, driven by hopes of a near-term improvement in downstream demand. Underpinning these expectations are India's removal of export duties for pellet mid-November, China's abandonment of its zero-COVID policy and its expressed aim of reviving the property market.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Results From The Recent S&P 500 Net Zero 2050 Paris-Aligned Sustainability Screened Index Rebalance

S&P Dow Jones Indices recently completed the rebalancing of all indices that aim to meet the minimum requirements for EU Climate Transition and EU Paris-Aligned Benchmarks.1 This includes the rebalancing of the S&P 500 Net Zero 2050 Paris-Aligned Sustainability Screened Index, which is designed to measure the performance of eligible equity securities from the S&P 500, selected and weighted to be collectively compatible with a 1.5ºC global warming climate scenario at the index level, among other climate, environmental and sustainability objectives.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

Listen: Copper Markets Eye Easing Concentrate Supply In 2023, But Short-Term Market Is Tight

Copper prices reached six-month high in December on a weakening U.S. dollar and news of China relaxing its zero-COVID control policy, but copper cathode end-users reduced term contracts coverage for 2023. Copper concentrate supply is expected to be in surplus this year, but there was spot tightness just in the start of the year. S&P Global Commodity Insights' experts Yuen Cheng Mok, Han Lu and Jesline Tang discuss the driving factors for recent copper market and expectations for the new year.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

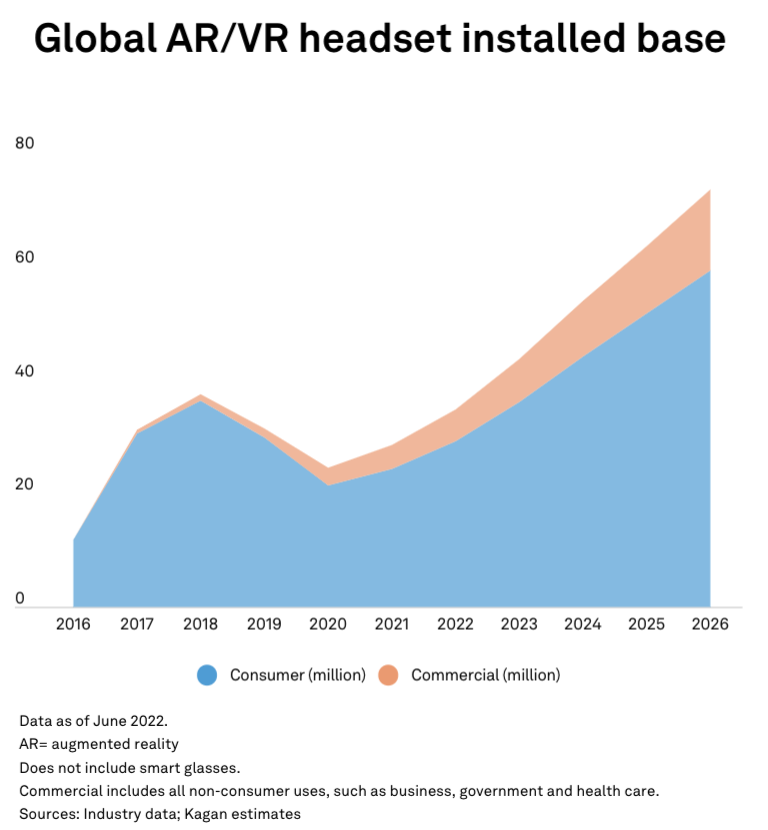

Infographic: The Big Picture 2023 — Tech, Media & Telecom Outlook

As game technology helps create the metaverse, enterprises consider role of virtual worlds. We anticipate that augmented and virtual reality (AR/VR) device adoption will grow steadily over the next five years as Big Tech companies underline the hardware’s potential as a conduit to the metaverse. The tantalizing vision of virtual transformations of experience will continue to drive opportunities that many industries will be chasing over the coming year and beyond.

—Read the article from S&P Global Market Intelligence