Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

U.S. companies are largely driving the ongoing decline of global corporate credit conditions.

Eight corporates around the world have defaulted in 2021, as of Feb. 5, according to S&P Global Ratings’ latest tally. Of the total, seven were U.S. corporates. The two latest to default were North Carolina-based department store chain Belk Inc. and Missouri-based coal mining company Peabody Energy Corp.

In January, 45 U.S. companies filed for bankruptcy, up from 39 in the previous month, according to S&P Global Market Intelligence data.

This marks a continuing trend from last year, during which the coronavirus pandemic’s severe contractions to global economic activity and mobility resulted in 226 global corporates defaulting—up 91% year-over-year to an 11-year high, according to S&P Global Ratings. The majority, or 146, were U.S. companies. In the U.S. alone, 630 companies across a wide spread of sectors filed for bankruptcy, according to S&P Global Market Intelligence.

While the global vaccine rollout and governments’ fiscal stimulus packages are laying a favorable foundation for an economic recovery, the COVID-19 crisis’ implications for companies are likely to keep elevated downside risks constant.

“Although it's still early in the year, the global default tally is below the year-to-date totals for each of the past three years (at 10 each),” S&P Global Ratings said in the report. “Despite a slower start to the year, we expect the number of defaults to pick up, with the U.S. trailing-12-month speculative-grade default rate increasing to 9% as of September 2021.”

The rate of defaults in the U.S. may not be as severe this year as it was in 2020 due to the Federal Reserve’s lowering of borrowing costs by cutting interest rates and purchasing corporate bonds to support liquidity.

"The risks have probably fallen for those that have made it this far. But investors still have to be discriminating," David Lefkowitz, head of equities Americas for UBS Global Wealth Management, told S&P Global Market Intelligence. "Some businesses may have to contend with more permanent changes in consumer and business behavior that were unleashed by the pandemic. Not all businesses that were negatively impacted by the pandemic may bounce back."

Today is Monday, February 8, 2021, and here is today’s essential intelligence.

CLO Spotlight: How COVID-19 Affected U.S. Middle-Market And BSL CLO Performance In 2020

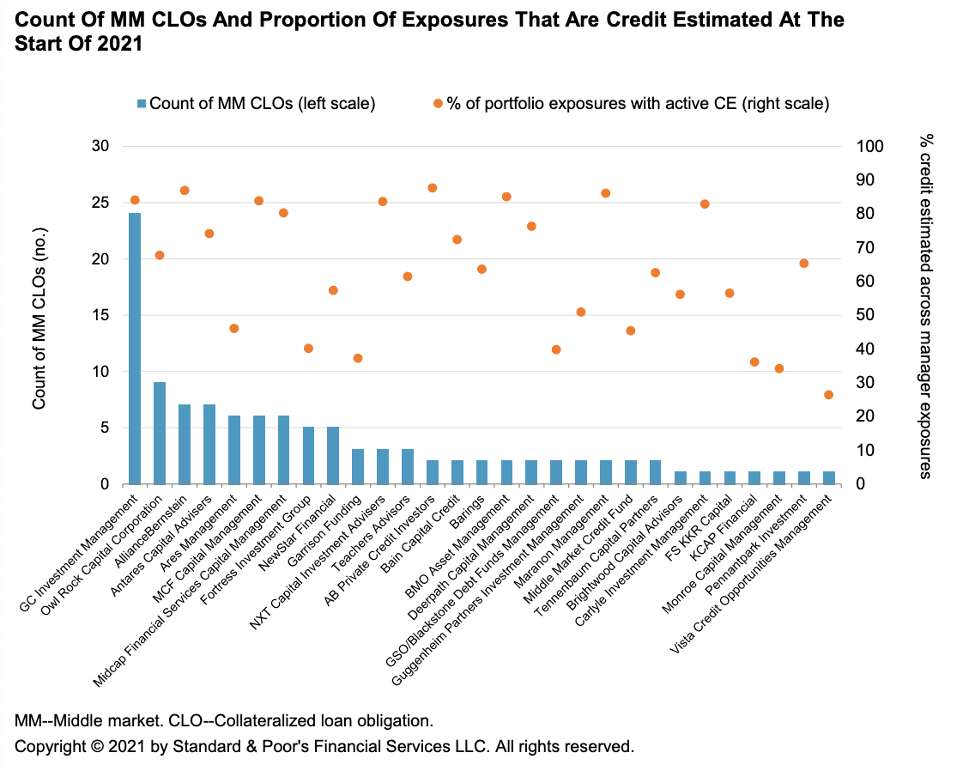

Both U.S. broadly syndicated loan collateralized loan obligations (BSL CLOs) and middle-market (MM) CLOs experienced credit stress due to the pandemic, but most transactions saw material improvement in the second half of the year (though not enough to make up for the deterioration from the first half).

—Read the full report from S&P Global Ratings

U.S. Tech's Sweet Spot: Good Demand, Low Inventory, And Tight Supply

Demand is strong in most technology end markets, including automotive, industrial, hyperscale, 5G, and PCs. Enterprise information technology spending is the exception and remains weak, but S&P Global Ratings expects increasing confidence in the economic recovery to result in higher spending as the year progresses. Factory utilization is running very high, and some components are in short supply, contributing to firm pricing. Inventories have been drawn down, setting up a restocking cycle that may last through the year.

—Read the full article from S&P Global Ratings

Listen: The Upgrade Episode 8: A Credit Focused Discussion on GameStop and AMC Entertainment, incl. CLO Exposures

In this episode of The Upgrade podcast, analysts from S&P Global Ratings’ U.S. Corporate Ratings Retail, Media and Entertainment and CLO teams discuss credit fundamentals for GameStop and AMC Entertainment including CLO exposures.

—Listen and subscribe to The Upgrade, a podast from S S&P Global Ratings

Going With The Flow: The Competitiveness of Battery Storage Economics In the Power Sector

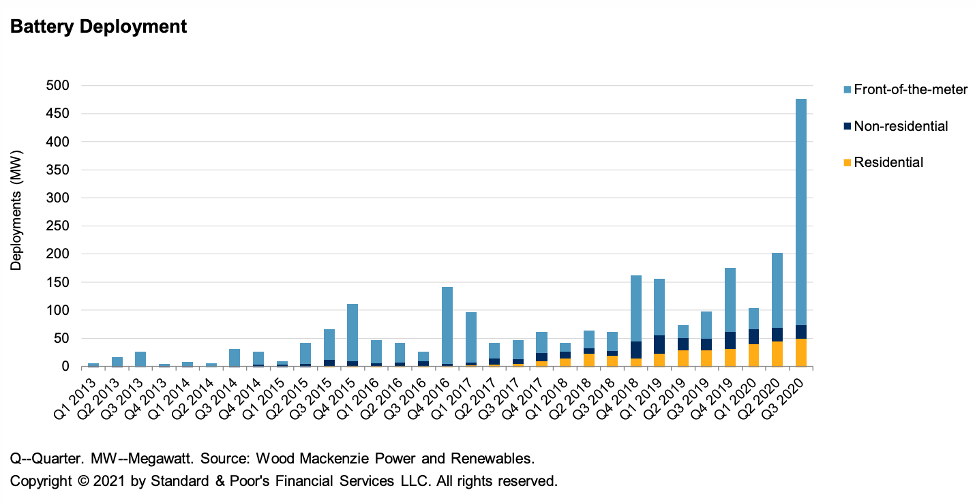

S&P Global Ratings expects total capital investment in North American battery storage to exceed $3 billion annually starting in 2024. For context, capital investment in U.S. wind power averaged only $2 billion annually between 2000 and 2006.

—Read the full report from S&P Global Ratings

Energy Storage Must Present Itself as a Solution To Renewable Integration Woes: Mccarthy

The energy storage industry must craft a better deployment strategy and do more to raise awareness of its role as a solution that will allow for greater integration of renewable energy, Gina McCarthy, national climate adviser for President Joe Biden, said Feb. 3 at an industry forum.

—Read the full article from S&P Global Platts

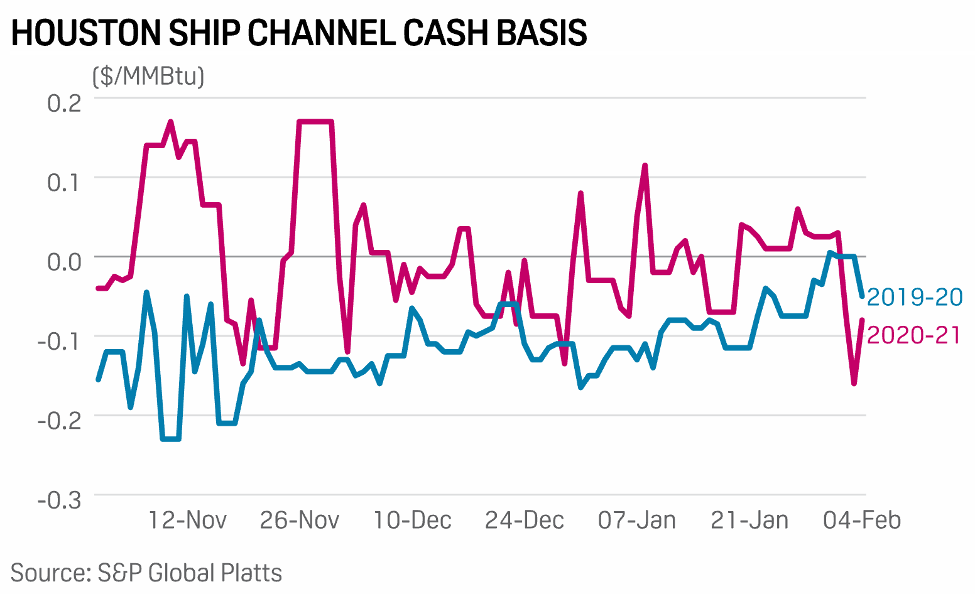

ANALYSIS: Permian End Users Bid Up Basis Prices as Shifting Market Dynamic Stokes Rivalry

Mounting competition for Permian gas has put upward pressure on cash basis at hubs in the Southwest and East Texas recently as limited West Texas supply gets pulled in opposing directions.

—Read the full report from S&P Global Platts

Glick Renews FERC's Commitment to Working With The States on Energy Policy

Though there are likely to be some bumps on the road going forward, Federal Energy Regulatory Commission Chairman Richard Glick said Feb. 4 he was committed to working with state energy officials to ensure their voices are heard and that their policies are accommodated as much as possible.

—Read the full article from S&P Global Platts

Oil's Peak Seen Nowhere Near In India Despite Energy Transition

India's peak oil demand will come much later than what the rest of the world might anticipate, creating enough room to pursue refinery expansions and secure crude supplies through diversification drives, speakers at the S&P Global Platts South Asia Commodities Virtual Forum said Feb. 4-5.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language