Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

EV Supply Challenges to Continue in 2023

Supply chain issues have dominated the spotlight in the automotive industry since COVID-19 ambushed the global economy. From chips to lithium, governments and businesses alike are racing to secure the material supply chains for electric vehicle manufacturing, but 2023 may be the year demand-side considerations supplant the supply-side woes of the early 2020s.

In the second half of 2022, the automotive industry subsumed the chip capacity of once chip-hungry industries like telecom and consumer electronics. Meanwhile, electrification is increasing the average chip content per vehicle. Demand from other industries will eventually pick up, so a chip capacity deficit will emerge in 2023 despite investments in adding semiconductor capacity, which will not bear fruit until 2024 and 2025.

A tight semiconductor chip market in 2023 is a key concern for automakers, but it's one of many. The raw materials for EV batteries present a staggering array of challenges. Recessionary fear and inflationary pressure may force a pivot to lower-tech batteries with cheaper cost structures, which could compromise vehicle range. However, lower-tech cathode chemistries still require metals and minerals with precarious supply chains and tight markets, and the global economic malaise negatively impacting near-term metals demand has led to annual downgrades across the board for metals consensus price forecasts in 2023.

Lithium, on the other hand, has reached record-high prices, and S&P Global Commodity Insights expects lithium chemical demand to surpass 1.5 million tonnes lithium carbonate equivalent in 2026 from 690,000 tonnes in 2022. Market tightness and delays in several projects may help maintain high lithium prices, which could incentivize miners to advance new projects to meet increased demand.

Aside from mining more lithium, there are other avenues to meet increased demand, such as recycling. Li-Cycle, a lithium-ion battery recycling company, minimizes waste in making lithium-ion batteries by leveraging a hub-and-spoke model. The spokes are regional facilities close to battery facility hubs, which minimize transport costs for recycling battery materials. At the regional facilities, Li-Cycle breaks down the material and extracts intermediate products containing the critical materials, which the company transforms into battery-grade materials.

While companies like Li-Cycle innovate and the automotive industry works to secure materials supplies, governments are planning infrastructure to support EV growth. Infrastructure planning is tough with a fluctuating EV market making projections far from certain. S&P Global Commodity Insights forecasts passenger EV sales growth in 2023 to decelerate almost 19 percentage points from 2022 levels. So, how many charging stations does the U.S. need to build, and when?

S&P Global Mobility data shows that U.S. charging infrastructure is not nearly where it needs to be to support a maturing EV market. The U.S. must quadruple its EV chargers between 2022 and 2025 to match sales forecasts, and by 2030, the number of charging stations must increase more than eightfold, even after accounting for home charging.

The automotive industry's fixation with supply-side concerns may soon shift to demand-side issues as a lackluster global economic outlook and fears of recession drag EV sales. Meanwhile, the once chip-hungry telecom and consumer electronics industries will return to compete with the automotive industry in a tight chips market. Nevertheless, supply chain issues remain, and even if the supply chains were all ironed out, there are only so many charging stations to go around … for now.

Today is Monday, February 6, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

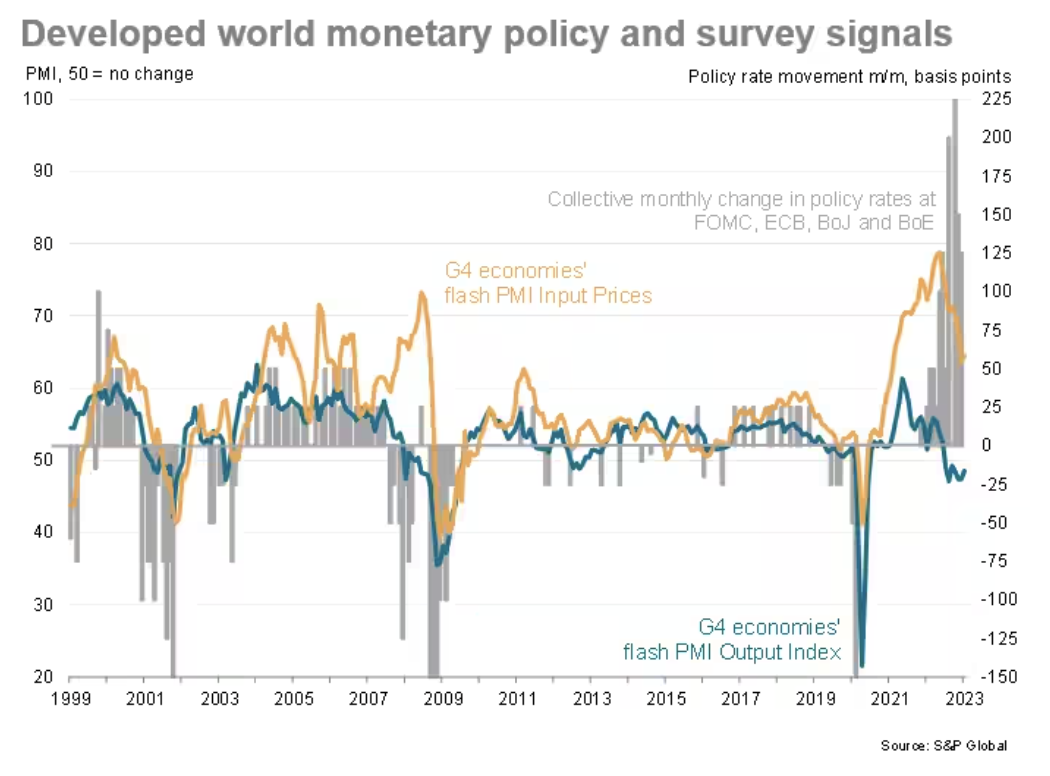

Week Ahead Economic Preview: Week Of Feb. 6, 2023

Central bank meetings in Australia and India will be closely watched post the Fed meeting while comments from Federal Open Market Committee speakers are also in focus. Meanwhile, inflation figures from Germany, mainland China, Taiwan and the Philippines will be assessed for indications of inflationary pressures, especially in gauging any impact from the easing of COVID-19 restrictions in mainland China. December output data from the U.K. are also a highlight for the coming week, with U.K. recruitment data also likely to be of value in assessing the next move by the Bank of England. In the eurozone, Germany's inflation and industrial performance come under scrutiny.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit FAQ: Alibaba Stares Down Competitive Threats

A whopping fine for anti-monopoly breaches, an economic slowdown and slowing growth in customer management revenues. China's e-commerce giant Alibaba Group Holding Ltd. has had its fair share of challenges. While the worst may be over, Alibaba faces other obstacles that could pressure its credit profile beyond the next two years. Growth in ecommerce is stalling and competition is rising. More people are shopping online for a wider variety of goods and formats, particularly through increasingly popular short-form video platforms.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: The Future Of Naphtha And Diesel Flows After EU Sanctions

What will replace Russian diesel and naphtha flows to Europe after EU sanctions take effect on 5 February? Where will Russian supply go instead? In this episode of the Platts Oil Markets Podcast, S&P Global Commodity Insights editors Rowan Staden-Coats and Vinicius Maffei join Joel Hanley to discuss the expected impact of the upcoming sanctions, what uncertainties remain about replacement supply and whether Russian production will have to be cut after Feb. 5, and what impact this could have on global supply and prices.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

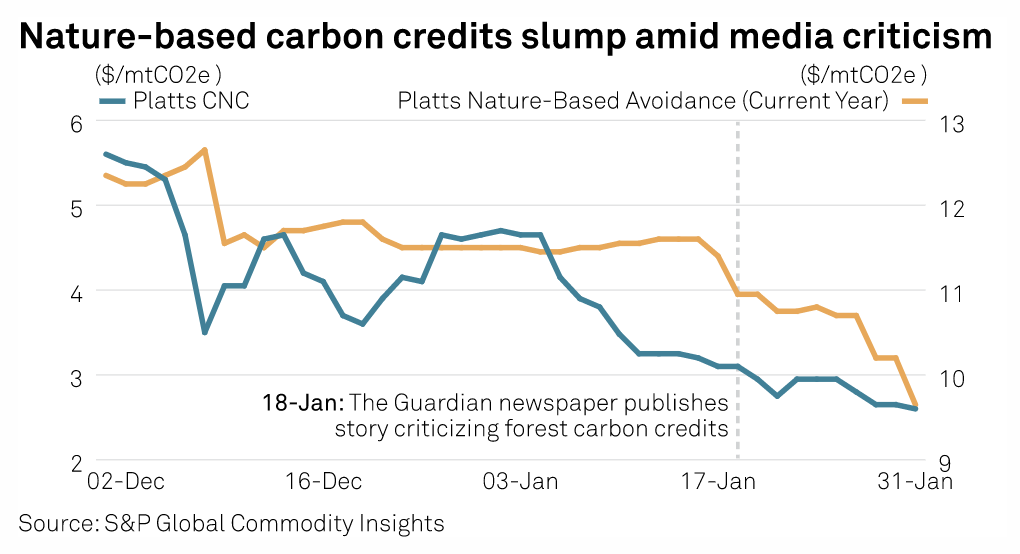

Interview: Confidence In Carbon Markets Will Grow As Initiatives Gather Pace: Verra

This year will be pivotal for the voluntary carbon markets, with more clarity expected around the definitions and integrity of carbon credits amid recent criticism of rainforest offsets, the head of the world's largest certifier of carbon credits told S&P Global Commodity Insights in an interview this week. "The market as a whole is undergoing a transition, but I think when all is said and done, we will see a much more robust and strong carbon market because it will have clear guidelines on what kind of claims you can make and what kind of credits you can [use]," Verra CEO David Antonioli said Jan. 30.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

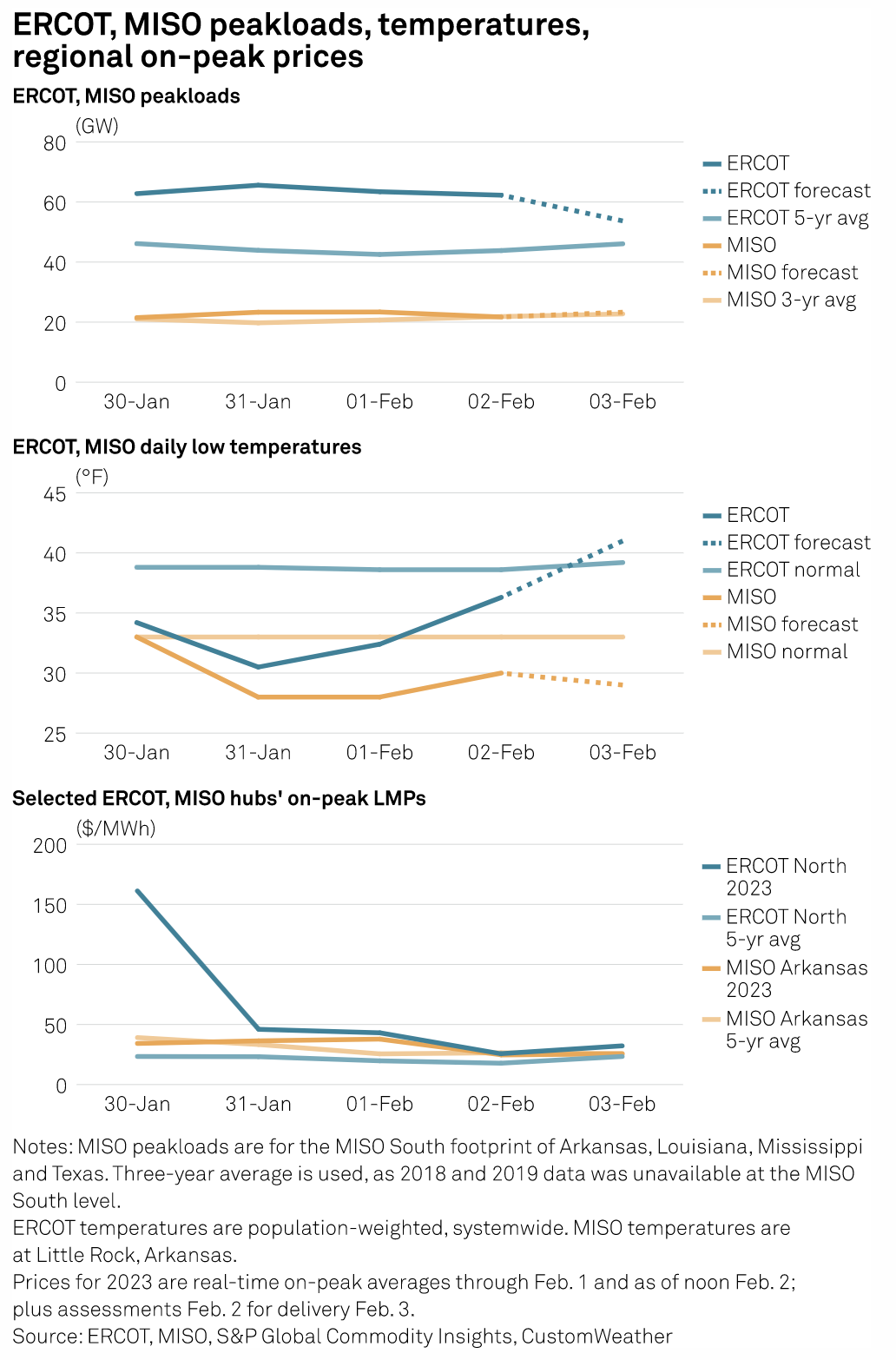

Almost 460,000 Customers Lack Electricity In Southern U.S. In Ice Storm's Wake

Almost 460,000 electricity customers remained without service the afternoon of Feb. 2 across four U.S. South-Central states in the wake of a brutal ice storm that knocked out service to more than 500,000 that morning, which lightened loads and weakened power prices in the region. Electric Reliability Council of Texas North Hub real-time on-peak power was just $25.64/MWh around 1 pm on Feb. 2, down sharply from Feb. 1's average of $43.08/MWh, as outages weakened power demand. Similarly, the Midcontinent Independent System Operator's Arkansas Hub real-time price was just $24.73/MWh around 1 pm on Feb. 2, down from the Feb. 1 average of $37.87/MWh.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Kilroy Realty Expects Occupancy To Dip Due To Amazon, DIRECTV Departures

Office landlord Kilroy Realty Corp. expects its occupancy to decline in 2023 due to two big tenants moving out. "We expect occupancy for the full year to average between 86.5% and 88%, a 400-basis-point decline from the fourth quarter [of 2022]. Most of this decline can be attributed to the Amazon and DIRECTV move-outs," Kilroy Chief Investment Officer Eliott Trencher said on the real estate investment firm's fourth-quarter 2022 earnings call Feb. 2.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek