Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Labor Concerns Impact Global Supply Chains

Global supply chains operate beyond a human scale. Today’s largest container ships are over 400 meters in length. Container port cranes can be 45 meters tall. The largest warehouses are over 100,000 square meters in size. Supply chain infrastructure dwarfs the tiny humans operating the cranes, trucks, ships and forklifts that make the system run. But despite numerous attempts at automation over the years, those tiny humans are vital to the smooth functioning of supply chains and are getting harder to hire. The supply of labor can be impacted by climate change, demographics, public health and corporate responsibility.

In anticipation of S&P Global’s TPM 24 conference, taking place March 3–6 in Long Beach, Calif., a group of researchers at S&P Global launched the latest report in the Look Forward series, this time focusing on the state of supply chains in 2024. Because supply chains are critical to the global economy, the Daily Update will focus on different aspects of this report throughout the week. Today’s update will look at “Labor: A critical component of supply chains under growing pressure.”

During the initial phases of the COVID-19 pandemic, labor shortages became an acute problem across many industries. Some of the supply chain disruptions that occurred during those years are correlated with labor shortages in factories and freight transport.

Demographic changes could impact supply chains going forward. In many countries that are central to global supply chains, an aging population will lead to a shrinking workforce. The 38 countries of the Organisation for Economic Co-operation and Development (OECD) will lose an estimated 98 million people from their working-age populations by 2050. Absent large-scale immigration, those countries will require an additional 15 million workers per year beyond normal growth rates to meet the needs of basic social infrastructure. With OECD countries representing 40% of global GDP, these missing workers will impact global supply chains.

Other factors that could affect labor in global supply chains include climate change and changing corporate responsibility mandates. Higher temperatures have been demonstrated to decrease worker productivity, which means rising temperatures will begin to chip away at working hours.

Globally, rules and regulations governing corporate social responsibility mandates are on the rise. These rules usually affect the length of the workday, vacation and paid leave policies. Changing regulations mean companies operating within global supply chains will be competing for fewer workers who will be working for shorter hours in higher temperatures.

Today is Thursday, February 29, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

US Inflation Descent Outpacing That Of Europe According To Flash PMIs

February's flash PMI surveys brought mixed news on inflation, with European prices looking stickier than in the US. The UK was also notable in seeing a greater incidence of supply chain delays, linked in part to Red Sea shipping disruptions, which is a potential harbinger of higher prices in the coming months.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Capping The Cap Rates: How Hong Kong Office Landlords Are Managing

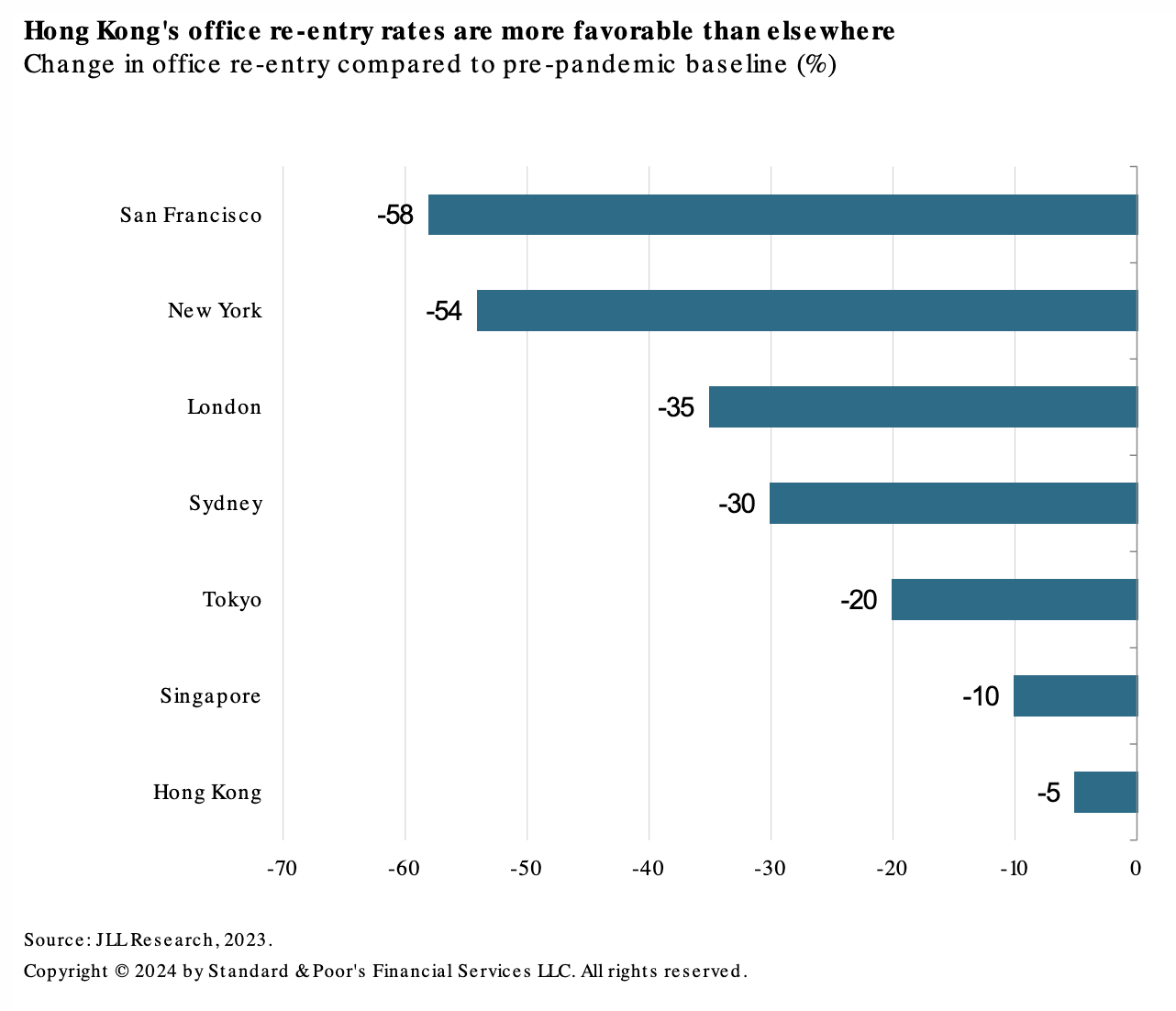

Hong Kong's major landlords are benefiting from past conditions and actions. Strong balance sheets and good financial management are protecting against elevated vacancies and falling asset valuations. S&P Global Ratings estimates that most office landlords would still have relatively low gearing even in a remote scenario where fair value dropped by another 30%.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

Listen: LNG Exports, Pauses, Climate Impacts: Are We Having The Wrong Debate?

The US Department of Energy in late January hit "pause" on its work issuing key LNG export permits. About 30 million mt/year of probable export capacity additions in the US and Mexico are at risk because of the permitting hold. Climate activists have celebrated the White House decision as a massive win, while industry groups have warned that it could endanger future LNG projects and undermine the role of the US as an LNG exporter. But Arvind Ravikumar, co-director of the Energy Emissions Modeling and Data Lab and a professor within the University of Texas at Austin’s Department of Petroleum and Geosystems Engineering, believes this is the wrong debate to be having.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

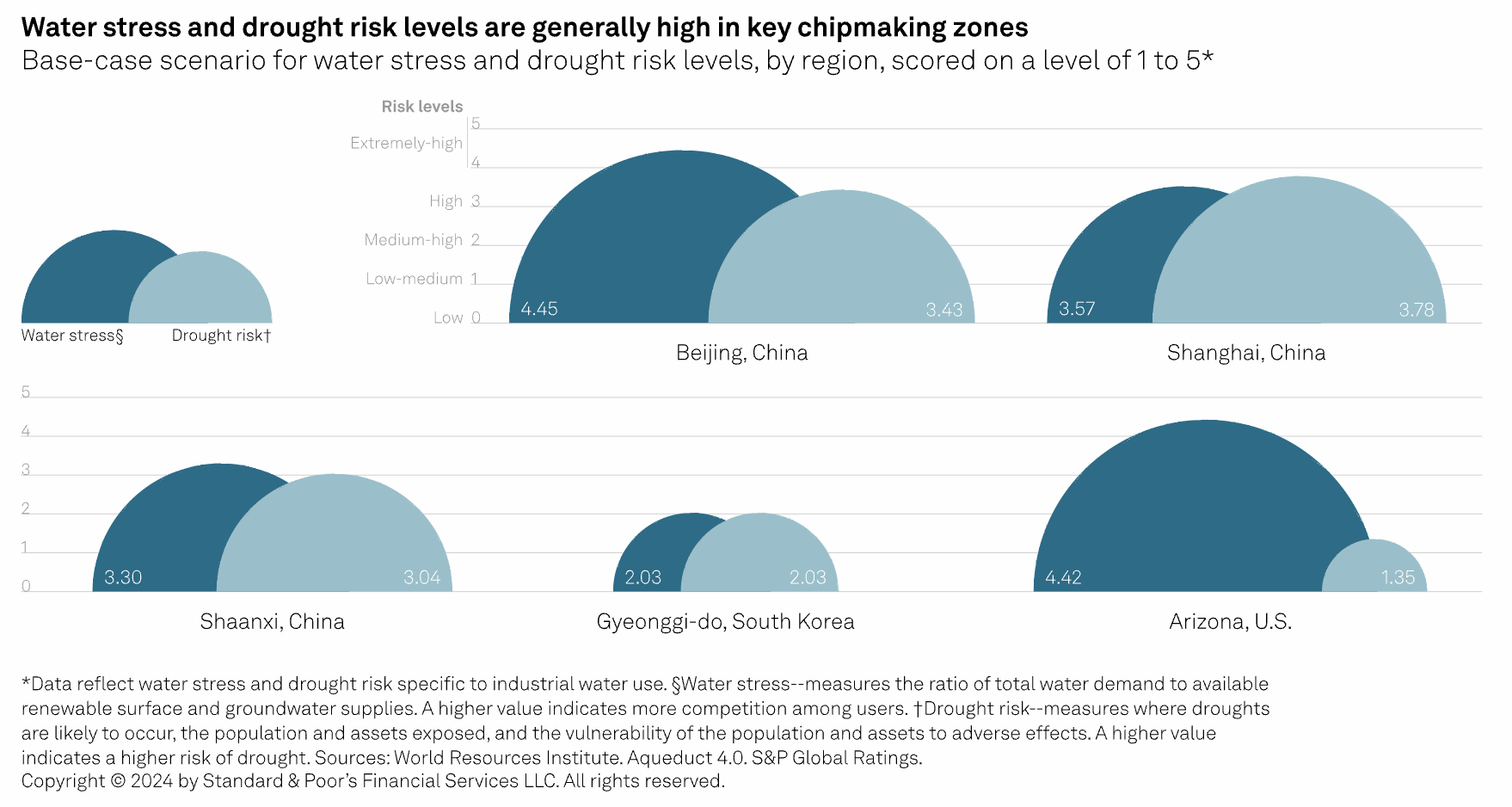

Sustainability Insights: TSMC And Water: A Case Study Of How Climate Is Becoming A Credit-Risk Factor

S&P Global Ratings views water scarcity as a risk in the coming decade for the tech hardware industry, particularly the water-intensive semiconductor subsector. Mishandling of such a risk could hit a chipmaker's operations and creditworthiness. S&P Global Ratings looks at the sector leader TSMC's risk exposure to water supply as a case study. It believes water shortage will not have a meaningful effect on the foundry's operations and credit profile within the next three years.

—Read the article from S&P Global Ratings

Access more insights on sustainability >

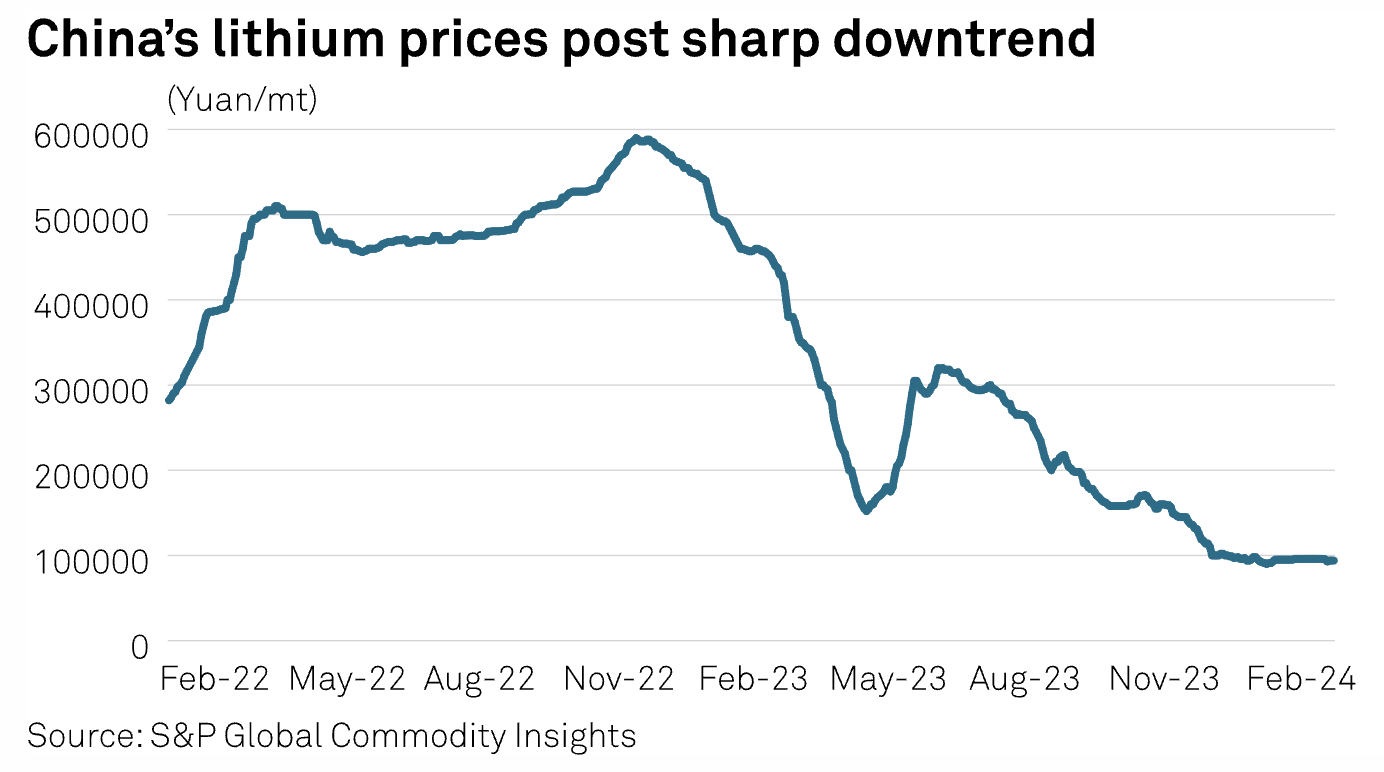

China's Lithium Market To Remain Lackluster Despite Output Cuts

China's physical lithium market is expected to remain bearish in the coming months as sluggish demand is likely to offset the recent production cuts announced at lithium mines in Australia and potential production disruption in China, market sources said Feb. 26. Over the past few months, China's end-users have reported weak demand for lithium, leading to a plunge in lithium spot prices and impacting the margins of industry players.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

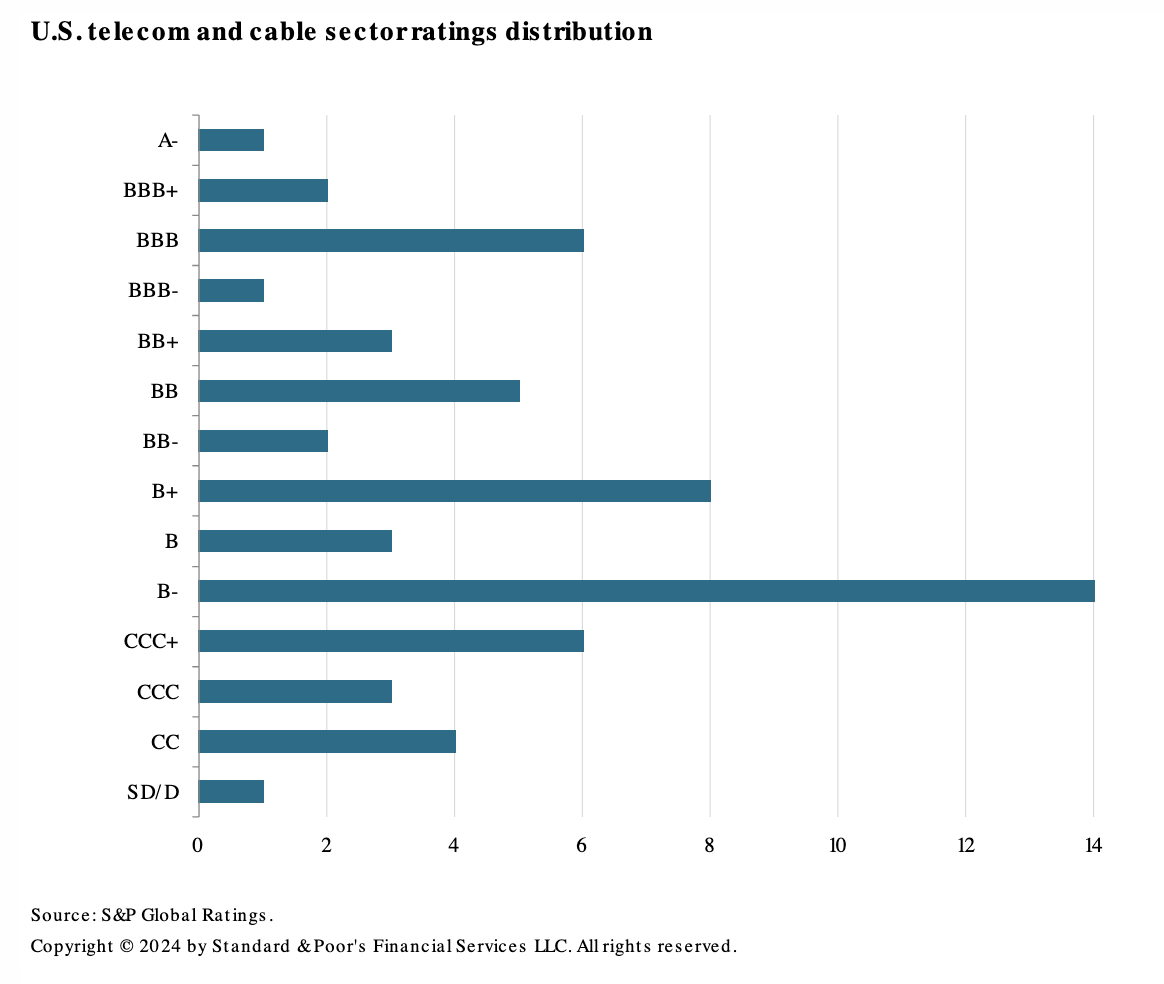

High Interest Rates And Massive Debt Burdens Will Pressure US Telecom And Cable Speculative-Grade Ratings In 2024

Despite solid industry fundamentals, driven by demand for wired and mobile connectivity, ratings among US telecom and cable speculative-grade issuers ('BB+' or below) were pressured in 2023. S&P Global Ratings expects this trend will continue in 2024 in the face of high interest rates and elevated debt.

—Read the article from S&P Global Ratings