Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Mounting Cost of Climate Change for Insurers

Climate-related disasters are leading to increased claims across the insurance industry. As floods, heat waves, fires and extreme weather become more common, insurers are reevaluating their exposure. The recent impact of Hurricane Ian on the southwest coast of Florida has created significant catastrophe losses for insurance and reinsurance companies.

Hurricane Ian slammed into Florida on Sept. 28, 2022, bringing over 10 inches of rain and 150-mph winds. Insurance providers such as Berkshire Hathaway, Citizens Property, Chubb, Allstate and Progressive reported catastrophe losses in the billions of dollars. Reinsurance companies Munich Re and Swiss Re, which allow insurers to mitigate their financial exposure, had losses of $1.61 billion and $1.30 billion, respectively.

In December 2022, an unusually severe winter storm caused damage assessed at about $5.4 billion across 42 U.S. states. After reporting losses related to the storm, Hanover and Allstate stocks fell by 6.14% and 4.09%, respectively, and Travelers' stock price fell 5.19%. All told, the cost of climate-related disasters hit $165 billion in 2022, the majority of which was borne by insurance and reinsurance companies.

According to S&P Global Market Intelligence, the effects of climate change are causing many insurers to reevaluate their appetite for covering property losses in coastal areas exposed to hurricane risk. Progressive and other insurers are attempting to pivot from high-risk areas by raising rates, expanding underwriting eligibility restrictions and engaging in targeted nonrenewals. Florida, Texas and Louisiana are high on the list of states believed to be exposed to the greatest risk of losses.

Federal and state government agencies have been looking to provide targeted reinsurance to encourage insurance providers to continue coverage in those states. While property insurance is already costly and hard to purchase in Florida, Louisiana is not far behind in losing coverage. Reinsurance companies are taking a cautious approach to property catastrophe insurance because increased volatility due to extreme weather could amplify profits and losses.

A recent environmental, social and governance materiality map for the insurance industry, created by S&P Global Ratings, indicated that climate transition and physical climate risk are among the most material factors affecting the industry. Beyond their exposure to losses related to extreme weather, insurance companies own about 10% of globally invested assets. This means that a catastrophic event affects payments to beneficiaries and the underlying assets that fund those payments. Presumably, this exposure has galvanized the insurance sector into promoting climate change adaptation.

Today is Friday, February 24, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

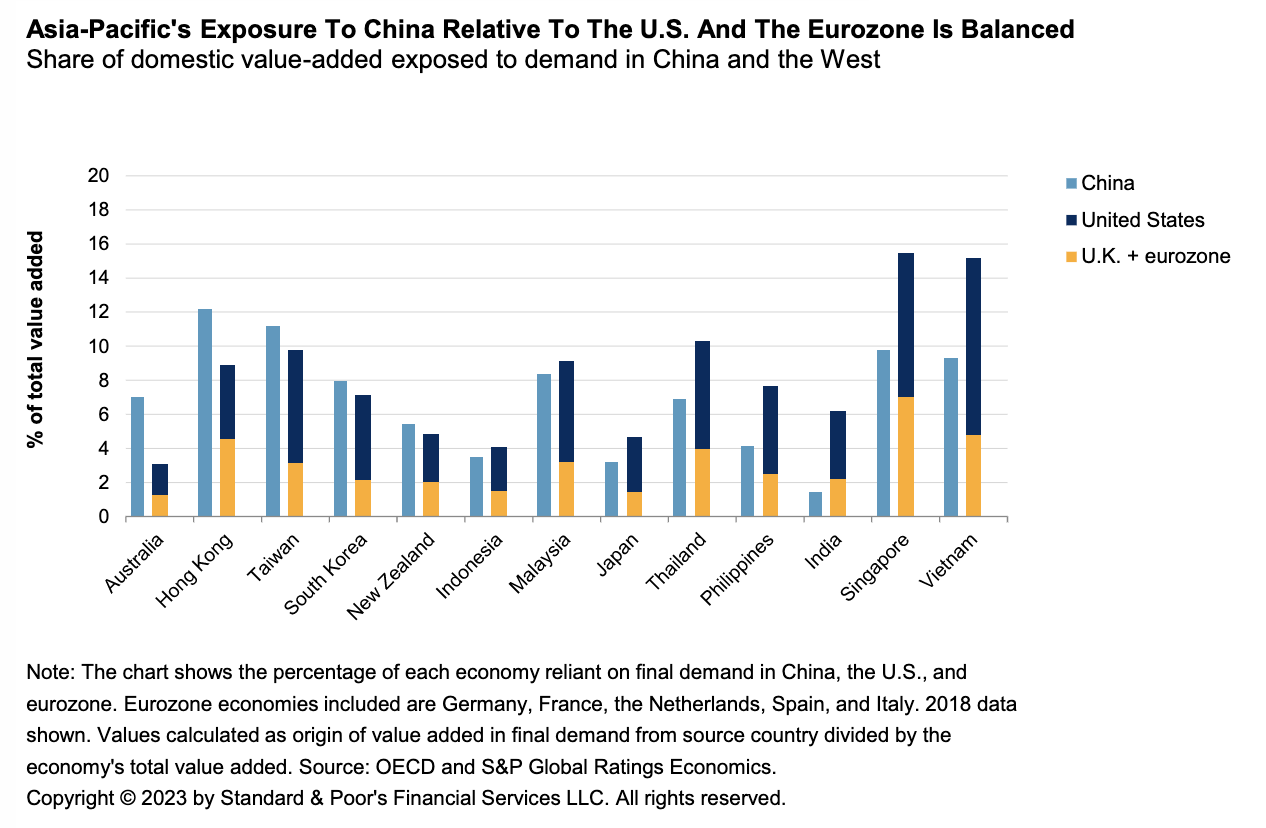

Economic Research: Asia-Pacific In 2023: China Rebound Cannot Offset Western Slowdown

A global growth rotation is underway. China's GDP is picking up as it exits COVID controls, while Western economies are slowing down. While the Chinese recovery should dampen the effect of the Western slowdown, the net impact on export demand should generally be negative this year. S&P Global Ratings expects the deceleration in the U.S. and Europe to exceed the acceleration in China. Moreover, the West remains more important as a source of demand for most Asia-Pacific economies. This is according to its analysis of the value added in each country in regional supply chains, as some imports are processed and subsequently reexported before reaching an end market.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

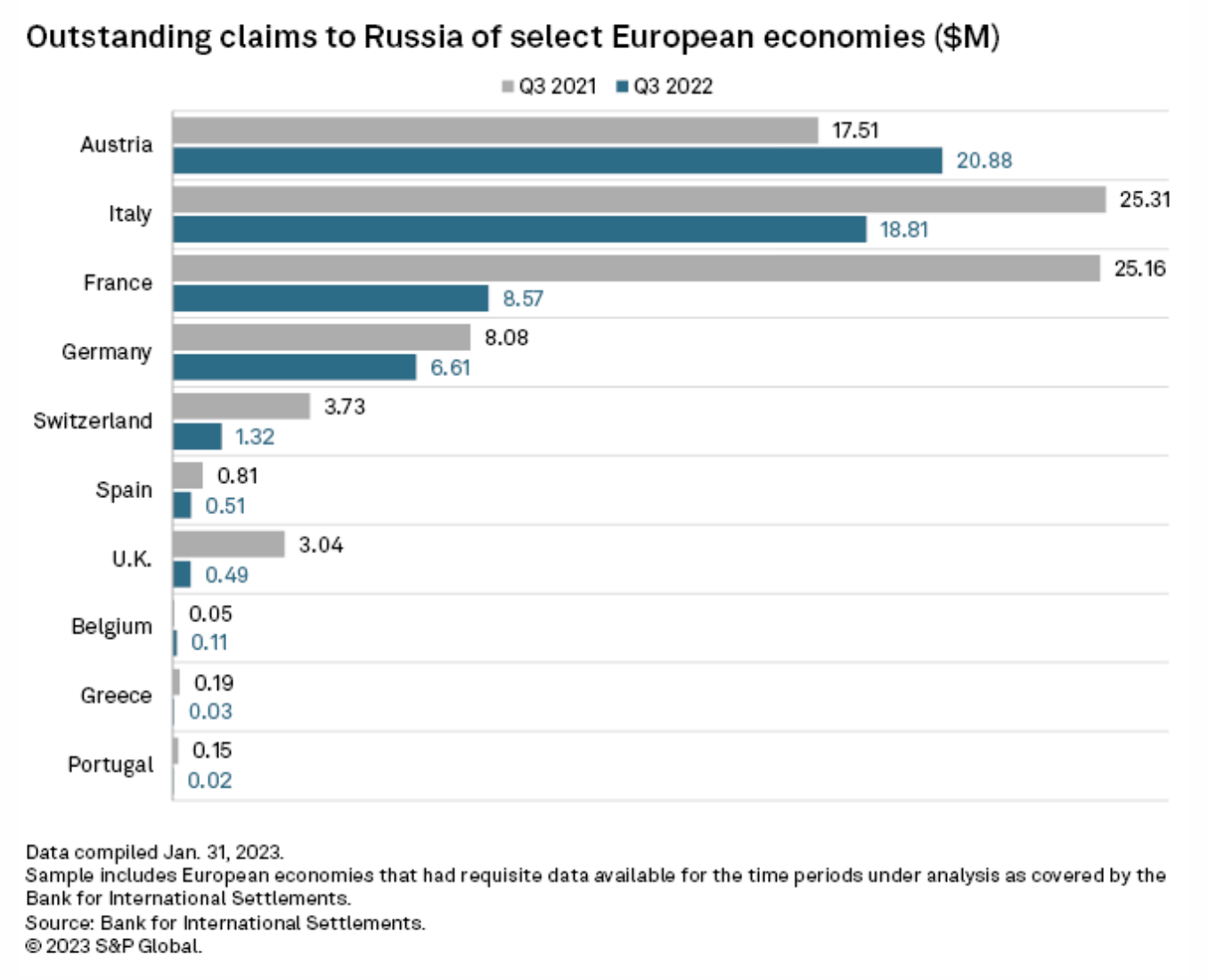

Russia-Ukraine War Splinters Europe's Banking Industry

The war in Ukraine has prompted a rupture between the Russian and European banking systems, heightening risks for lenders on both sides of the divide. Western banks' exposures to Russia are at their lowest level in nearly 20 years, while big Russian lenders have had to abandon other European markets amid a slew of western sanctions. Russian banks have taken big financial hits since the invasion of Ukraine 12 months ago, and many western banks have withdrawn from the Russian market, often booking heavy losses in the process.

—Read the report from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Asia Prepares For Two-Way Oil Product Flows As EU Ban Takes Effect

With the European Union's ban on Russian oil products coming into effect, the spotlight is now on Asia as the market tries to find answers to the extent to which the region can absorb Russian products displaced from Europe and how Asian refiners can take advantage of the product vacuum in other regions of Europe. In a wide-ranging discussion with Asia Energy Editor Sambit Mohanty, S&P Global Commodity Insights senior experts Jonathan Nonis, Wendy Cheong and Zhuwei Wang discuss the outlook for potential changes in product flows, such as diesel, naphtha and LPG, that Asia could see, as well as the pricing, shipping and logistics challenges that could arise with long-distance product shipments.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

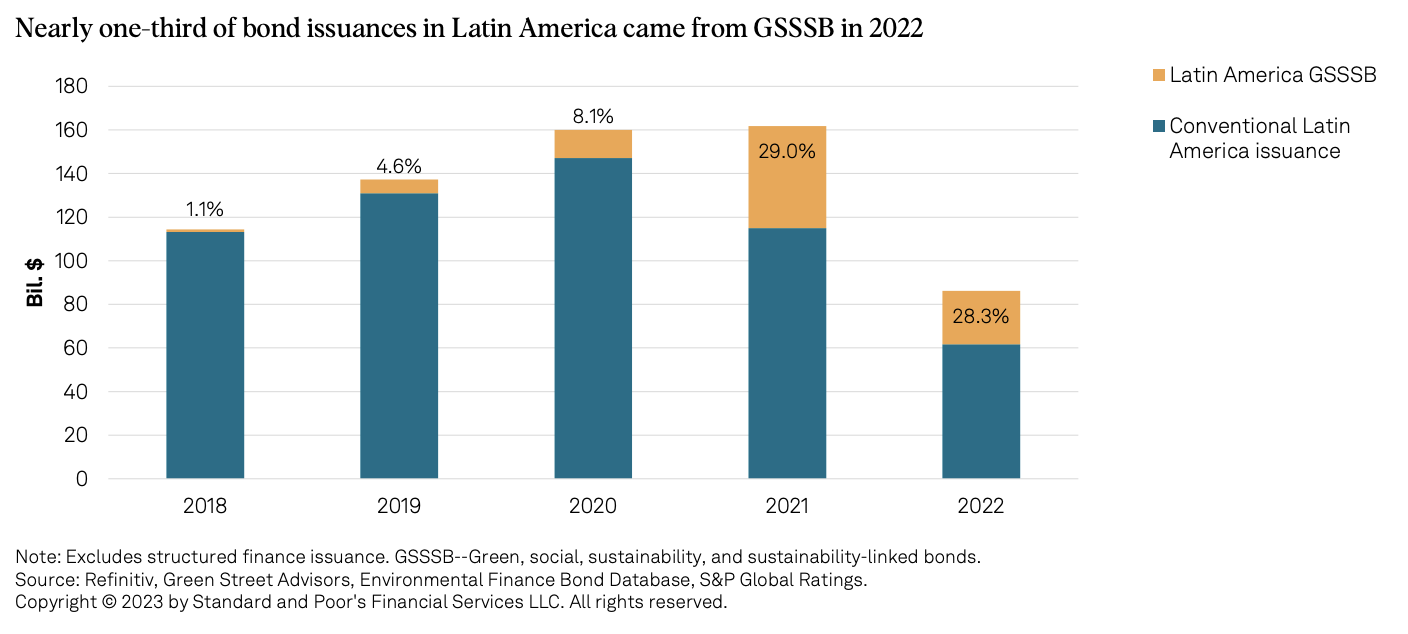

Sustainability Insights: Research: Latin America Sustainable Bond Issuance To Recover In 2023

S&P Global Ratings believes green, social, sustainable, and sustainability-linked bonds (GSSSB) issuance in Latin America will return to growth this year, although not reach the record-setting levels of 2021. It expects issuers to further advance their sustainability agendas and put decarbonization plans into action, which should foster GSSSB momentum. S&P Global Ratings also expects to see greater use of GSSSBs in the region in view of industries' heightened interest in addressing sustainability issues and closing project-financing gaps.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Black Sea Agriculture Trade Tilts In Russia's Favor After One Year Of War In Ukraine

Russia's share of trade in the international agriculture markets has risen one year after it invaded Ukraine, with the country's wheat and sunflower oil exports overshadowing slowing Ukrainian volumes, an analysis of trade data by S&P Global Commodity Insights showed. Ukraine's wheat exports have slumped by more than a third in marketing year 2022-23 (July-June), while its sunflower oil shipments are hovering near a five-year low as its seaports were virtually shut over March-July 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

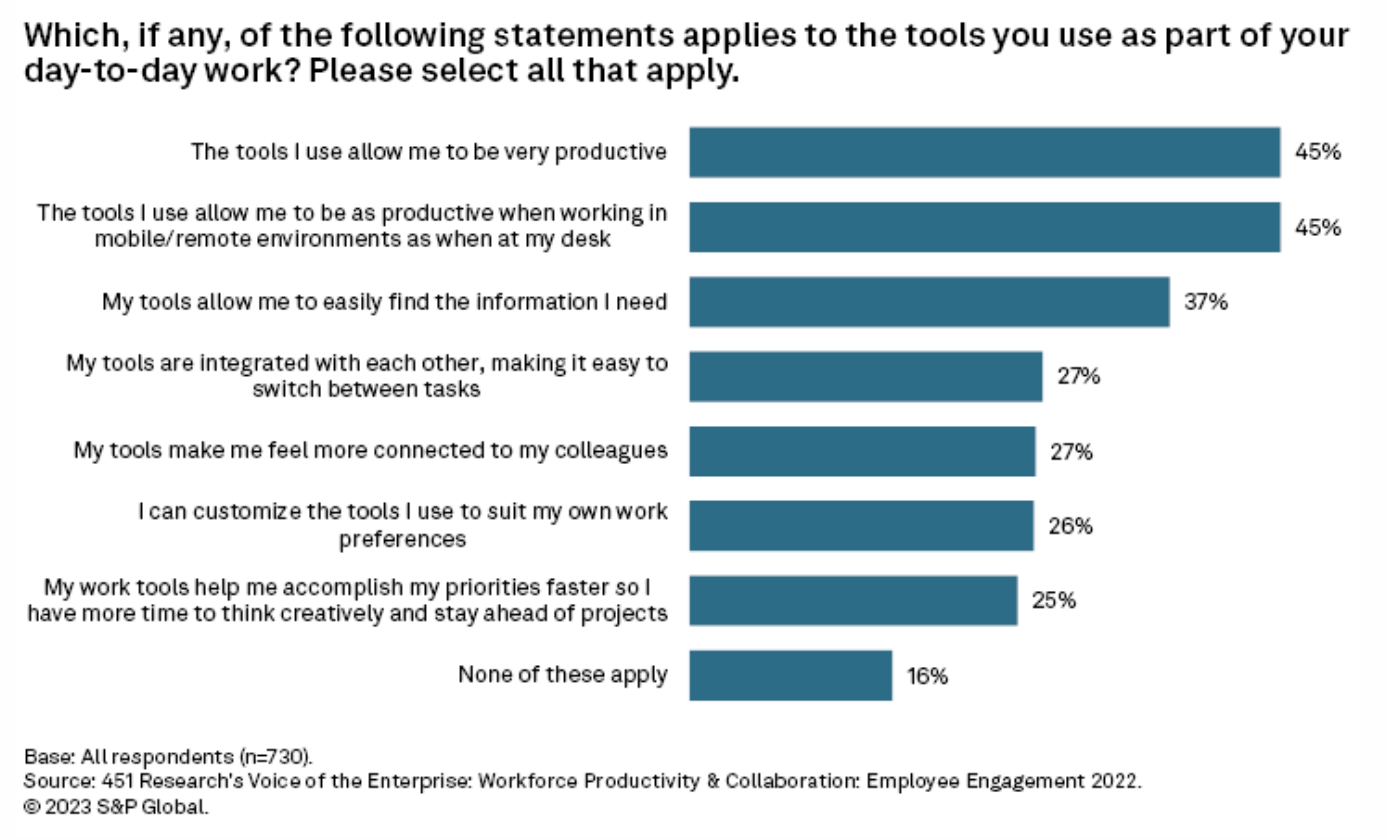

How Organizations, Vendors Can Address The Top Workplace Technology Challenges

According to analysis by 451 Research, part of S&P Global Market Intelligence, workplace technology is falling short in several ways, and organizations need to address these weak points to support the productivity and engagement of their employees. Organizations should take seriously how they reexamine their tech strategies as access to better day-to-day technologies ranks as one of the top 10 reasons employees would be willing to leave their current jobs.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek