Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Twin Earthquakes Disrupt Trade in Turkey

On Feb. 6, a pair of devastating earthquakes hit Turkey and Syria, less than a year after Russia’s invasion of Ukraine. Beyond huge human losses, the earthquakes inflicted significant damage to critical infrastructure and disrupted domestic trade, mainly in Turkey, with the potential for global impact.

The twin quakes — a magnitude 7.8 mainshock and a magnitude 7.5 aftershock — left a trail of destruction across southern Turkey and northwest Syria. Considered among the strongest to strike the region in about a century, the earthquakes caused disruptions that could spell long recovery times for some sectors.

Global markets quickly responded to the quakes with a brief spike in oil prices, as the impact of the disaster triggered supply concerns. Owing to a power outage and tank damage in the immediate aftermath of the earthquakes, operations were halted at the Ceyhan oil terminal in Turkey, a major export route for refiners based in the Mediterranean. As a result, certain crude exports from Azerbaijan and Iraq were suspended. According to S&P Global Commodities at Sea, seaborne crude exports from Azerbaijan and Iraq via the Ceyhan oil terminal averaged about 1 million barrels per day in January.

Crude loadings have since resumed in the Ceyhan oil terminal after damage to the Iraq-Turkey oil pipeline, one of the pipelines that passes through the earthquake zone, was repaired. The Baku-Tbilisi-Ceyhan pipeline, meanwhile, remained intact, and crude oil was being stored at the oil tanks in the Ceyhan hub, a spokesperson for operator BP told S&P Global Commodity Insights. Global oil prices steadied a few days after the spike, and stock trading in Turkey resumed Feb. 15 after a brief pause.

Due to Turkey's important maritime position between the Mediterranean Sea and the Black Sea, the damage caused by the earthquakes is also impacting the shipping sector. Turkey’s Iskenderun port, on the Mediterranean coast, suffered substantial damage from the quakes and a subsequent container fire, which brought operations to a standstill and affected shipments for global logistics companies such as Maersk.

"It's not yet known how long recovery efforts will take and when the port can undergo a full inspection of the damage. At this time, we are not accepting any new bookings to and from Iskenderun," Maersk said.

Steel production also halted in Turkey's earthquake-ravaged areas, given highway and port damage as well as electricity and natural gas flow cuts. Steel mills in the affected locations discontinued output and shipments following the quakes to conduct damage assessments and rescue efforts, with plans to restart production soon. More than 30% of Turkey's steel production originates from large steel manufacturers in the earthquake zone, Veysel Yayan, general secretary of the Turkish Steel Producers' Association, told S&P Global Commodity Insights. As the mills are likely to remain shut for a while, scrap and steel pricing could be affected. However, reconstruction activities should lift steel demand and prices, sources told S&P Global Commodity Insights.

In Syria, the situation is already dire as the area affected by the earthquakes had been torn apart by years of war and terrorism. Home to an internally displaced population and refugees, the Arab country’s northwest region is largely dependent on humanitarian aid. But as assistance is delivered mainly via southern Turkey, where roads were damaged by the quakes, help could not come quickly enough.

For both countries, the earthquakes stand to compound their economic challenges, and the road to recovery will likely be gradual and costly.

Today is Wednesday, February 22, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

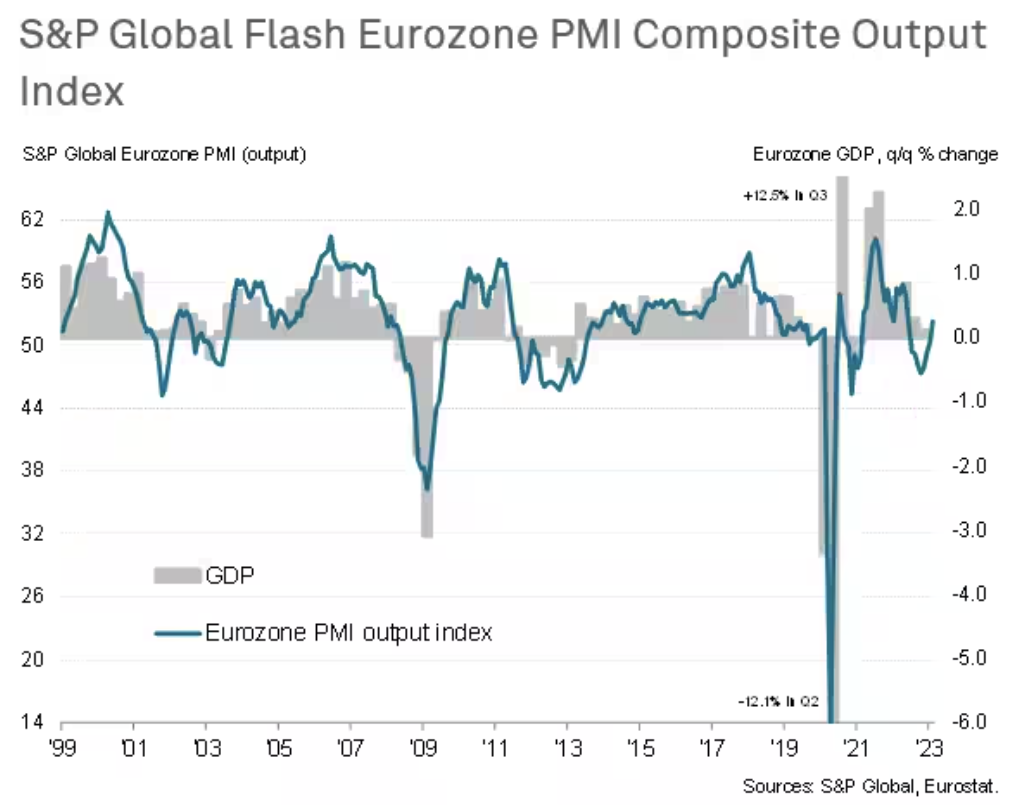

Recession Fears Fade As Eurozone Flash PMI Registers Accelerating Economic Growth In February

Eurozone business activity growth accelerated to a nine-month high in February, reflecting an improved performance of the service sector and a return to growth of manufacturing output. Growth has been buoyed by rising confidence as recession fears fade and inflation shows signs of peaking, though manufacturing has also benefitted from a major improvement in supplier performance. Input cost inflation meanwhile cooled further, notably in the manufacturing sector. However, the survey hints at persistent elevated price trends in the service sector which, alongside accelerating output growth, will encourage a further hawkish stance among ECB policymakers.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

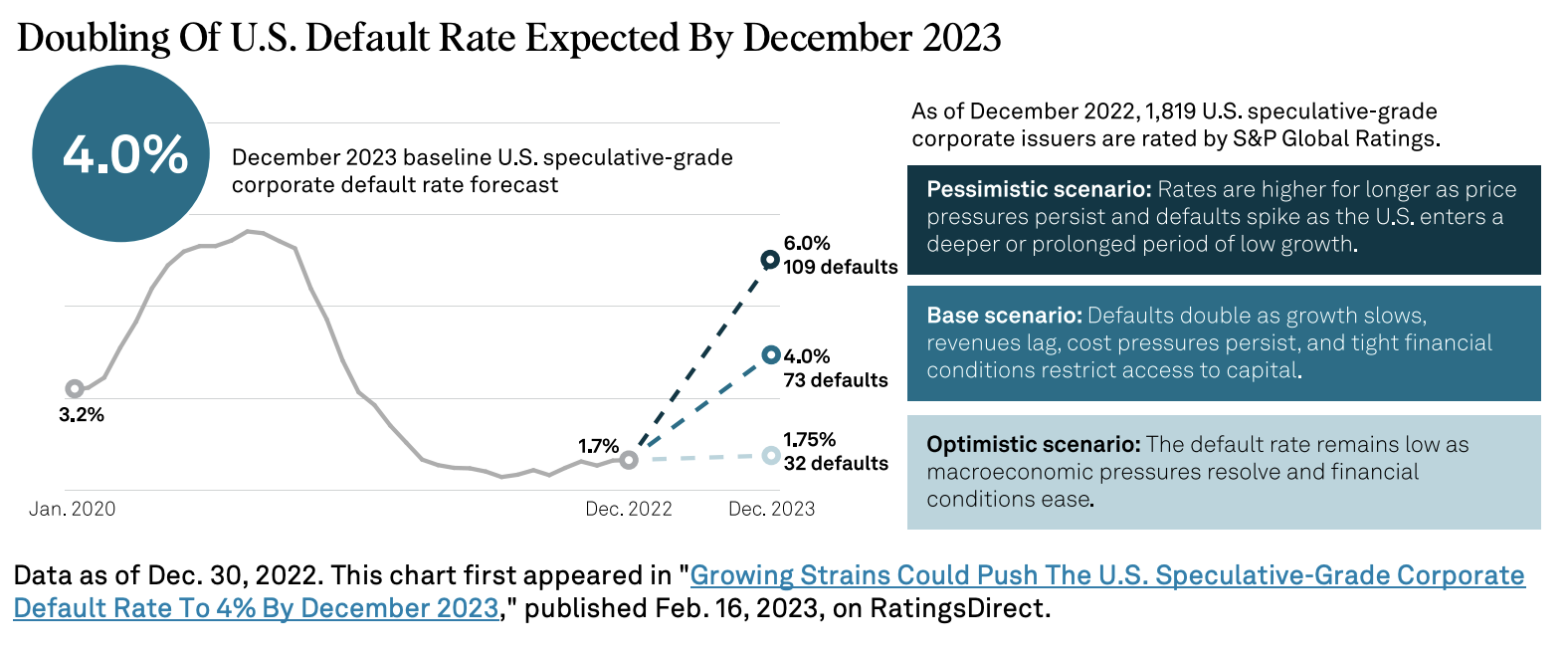

This Week In Credit: Recent Data Exacerbate Uncertainty (Feb. 20, 2023)

Consumer products rating trends seem analogous to the overall economic picture. The sector led an increase in overall upgrades last week, but its prospects appear far more uncertain, with the net outlook bias (negative 15.8%) continuing to deteriorate, implying more negative rating pressure ahead. On a macroeconomic level, data releases added to proof that global economic growth is not slowing as quickly as feared.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

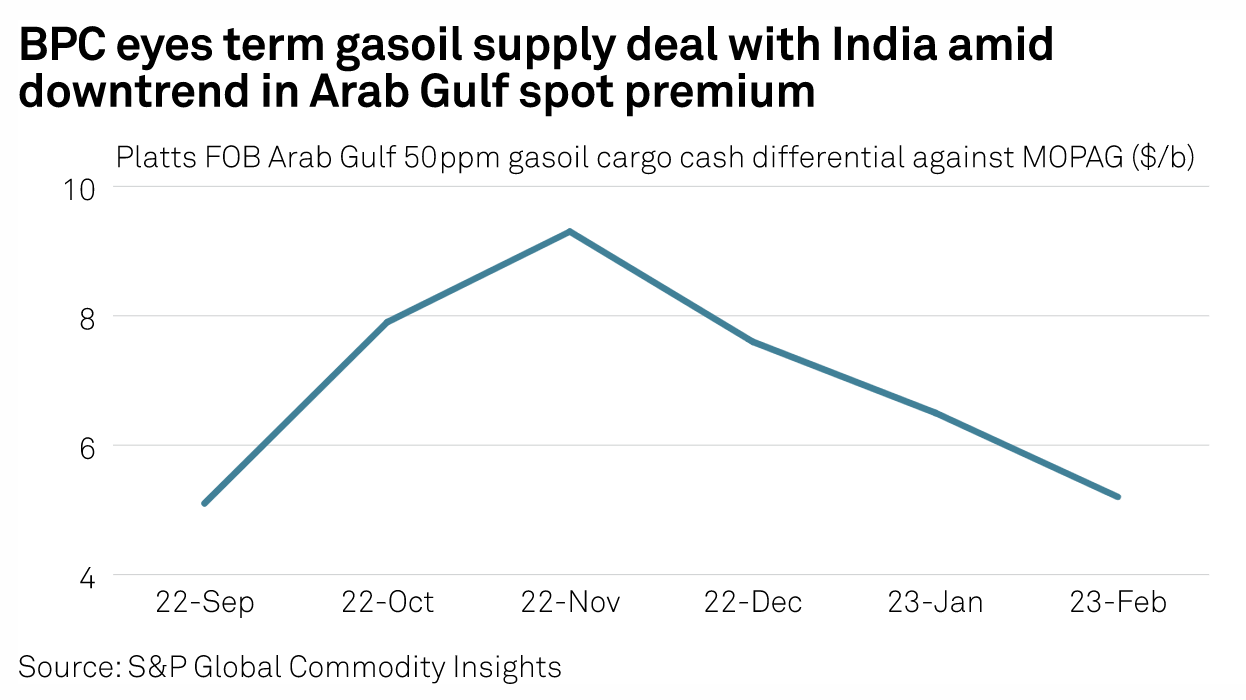

Bangladesh To Start Pipeline Gasoil Imports From India In March, Says BPC Chairman

Bangladesh is set to import 0.005% sulfur gasoil from India via the maiden oil pipeline connecting the two countries from March, state-run Bangladesh Petroleum Corporation chairman ABM Azad told S&P Global Commodity Insights Feb. 20. "Construction of the pipeline, which began in early 2020, has already been completed and the facility now waits to be commissioned to carry gasoil from India," he said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

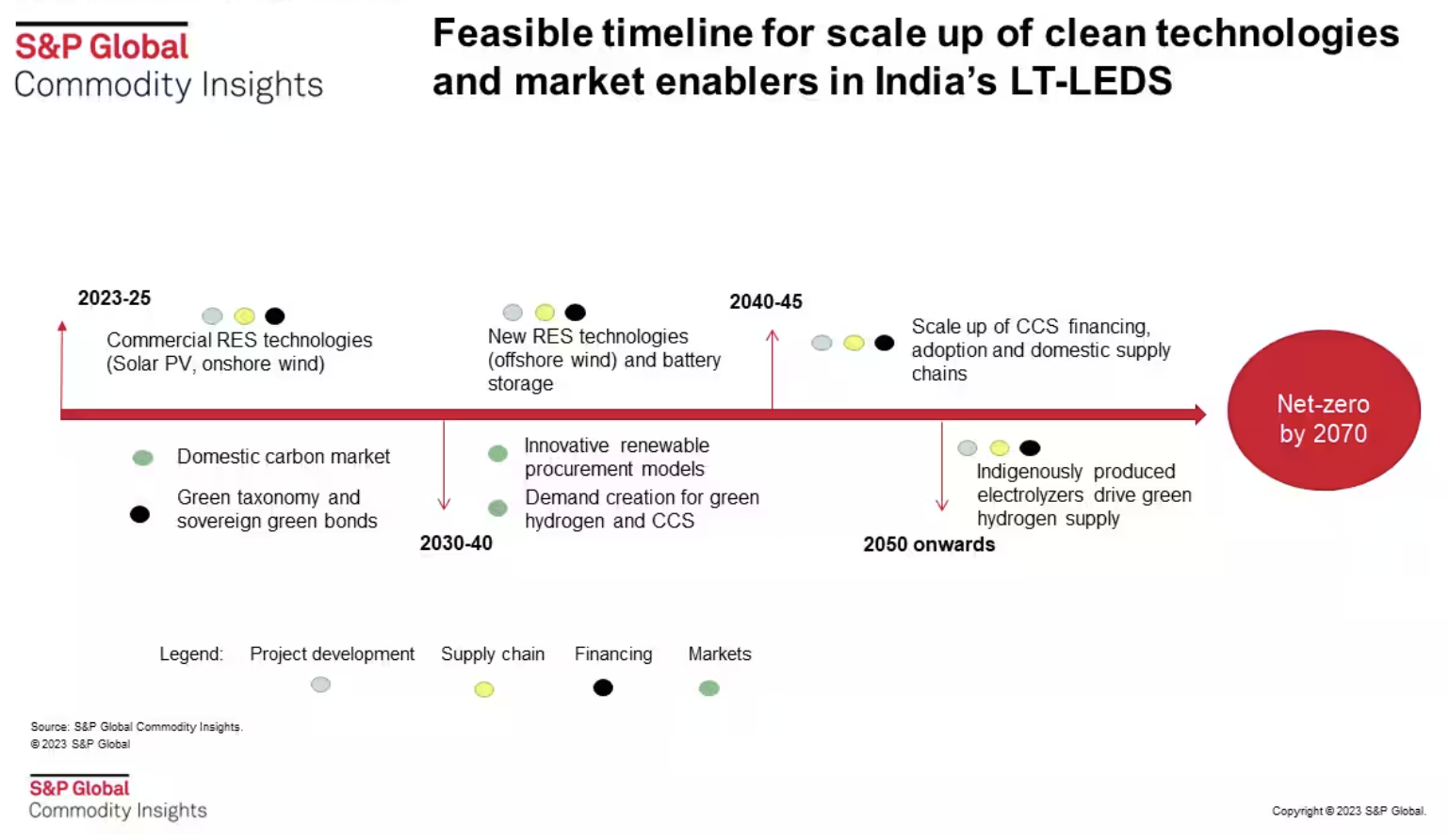

India Is Banking On Emerging Green Technologies For Long-Term Emission Neutrality But Requires The Groundwork For Cost-Effective Implementation

At the 27th Conference of Parties in Egypt in November 2022, implementation strategies for the updated nationally determined contributions announced by member countries in prior COP were in focus. To this end, India submitted its Long-Term Low Emission Development Strategy. It highlighted key priorities and challenges around seven key areas in the power sector, including electrification of end uses in industry and transport, renewable energy, battery storage and green hydrogen.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

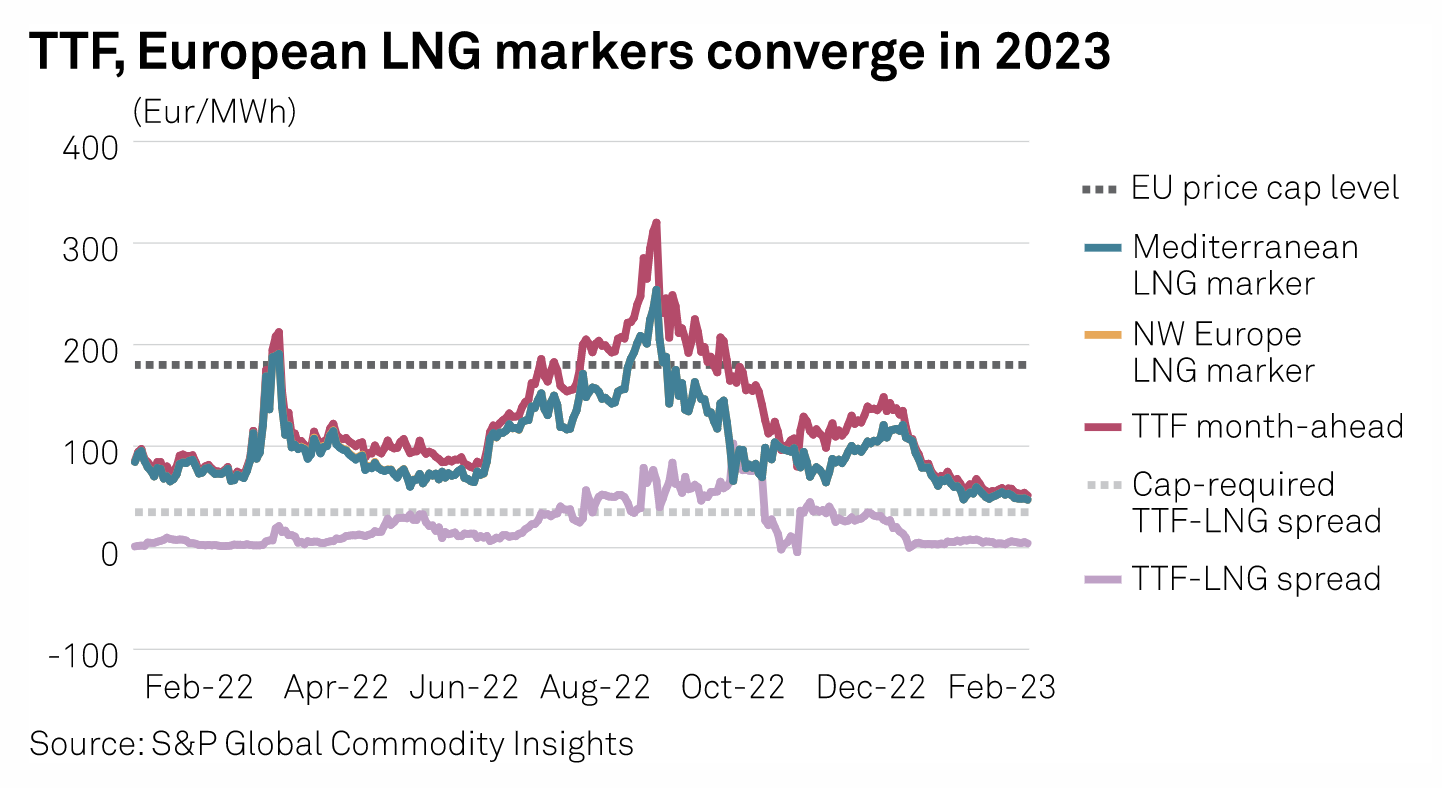

ICE Launches New TTF Gas Futures, Options Market In London As Planned

Exchange operator ICE on Feb. 20 launched as planned a new market for TTF gas futures and options contracts on its London-based exchange, an ICE spokesperson said. CE announced on Jan. 27 that it would launch the new market, saying it would run in parallel to TTF trading on its ICE Endex platform based in the Netherlands. The new London market was designed to offer market participants an "insurance option" in the event the EU's new gas market correction mechanism is at risk of being triggered.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Fuel For Thought: The Old Way Of Selling Cars Won’t Work Anymore

The easy days of selling from low inventories are over. Brands, dealers and salespeople need to start fighting for auto buyer attention and consideration once again, and need to work together to win. As inventories continue to move toward pre-pandemic levels, customers are finding themselves with more freedom when it comes to selecting a vehicle, the price they pay and how they shop. Nowhere was this looming trend more evident than on the NADA show floor in Dallas, where thousands of dealers, vendors and automaker reps came together to discuss the near- and long-term future of automotive retail.

—Read the article from S&P Global Mobility

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek