Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

While optimism surrounding the global COVID-19 vaccine rollout has propelled hopes for a recovery in the global travel and tourism industries, new coronavirus variants have clouded the outlook.

The pandemic has devastated travel and tourism as economies continue to experience various levels of lockdowns, communities shelter in place and social distance, and travel restrictions remain in effect to stop the contagion. Depressed demand has had direct implications for global oil markets, as the collapse in demand for transport fuel has caused refiners to reduce operations. Last year was the worst on record for the global tourism industry, according to the U.N. World Tourism Organization (UNWTO), which found that international arrivals shrank 74% year-over-year in 2020. This resulted in an estimated $1.3 trillion decline in export revenues, or more than 11 times what was lost during the financial crisis of 2008-2009. Last year also saw the sharpest decline in international air travel, with global passenger demand contracting 76%, according to the International Air Transport Association.

“The overall prospects of a rebound in 2021 seem to have worsened,” the UNWTO said in a recent report. Almost four-fifths (79%) of experts surveyed expect that a rebound for the industry could occur this year, but more than 40% said the full return to pre-pandemic levels wouldn’t occur until 2024 or later.

S&P Global Ratings projects that this year’s global air traffic and revenue will likely reach 40%-60% of 2019 levels—as the recovery will largely depend on curtailing the new mutations of the virus.

In Europe, where coronavirus containment measures remain in place, and the regional vaccination effort has suffered from too little supply, travel and tourism are likely to endure continued uncertainty. "Given the strict lockdown restrictions in Europe, the outlook for air travel continues to be dim," S&P Global Platts Analytics said in a recent note.

This year, European air passenger traffic and revenue will recover to just 30%-50% of levels prior to the crisis in 2019, according to S&P Global Ratings.

“If the EU can accelerate vaccine production and rollouts, we think it could achieve widespread immunization by the end of the third quarter, enabling air passenger traffic to recover more meaningfully later in 2021,” S&P Global Ratings said in a report last week. Nonetheless, “air travel in Europe is unlikely to return to pre-pandemic levels until at least 2024.”

Across Asia, where economies such as China have established more control over the coronavirus, travel demand is likewise depleted. Festivities celebrating the Lunar New Year—typically one of the region’s busiest travel periods—didn’t spur a resurgence in travel demand as governments heightened restrictions due to the new COVID-19 variants. According to S&P Global Platts Analytics, China's domestic air traffic at the beginning of this month contracted to 37% below pre-pandemic levels after recovering fully since August.

Travel in the Middle East, however, is already taking off toward a return to normal. The world’s busiest airport for international travel in pre-pandemic times, Dubai International Airport, has recently enjoyed a steady rise in activity, as reported by S&P Global Platts. The IATA projects that, in the absence of additional restrictions and if borders remain open, the region’s air passenger traffic could recover 43% this year. S&P Global Platts Analytics expects the region's jet fuel consumption to rise nearly 24%, to 400,000 barrels per day, in 2021—a slight climb that would still be 34% lower than 2019 levels.

“Optimism that the arrival and initial distribution of vaccines would lead to a prompt and orderly restoration in global air travel have been dashed in the face of new outbreaks and new mutations of the disease,” IATA Director General and CEO Alexandre de Juniac said in a report earlier this month. “The world is more locked down today than at virtually any point in the past 12 months and passengers face a bewildering array of rapidly changing and globally uncoordinated travel restrictions.”

Today is Monday, February 22, 2021, and here is today’s essential intelligence.

Outlook And Medians for U.S. Independent Schools: Pandemic Tests All, but Weaker Credits May Need a Booster

Although many of S&P Global Ratings’ rated independent schools are weathering the COVID-19 pandemic reasonably well, issuers with weaker demand and less financial flexibility are expected to face greater stress in 2021.

—Read the full report from S&P Global Ratings

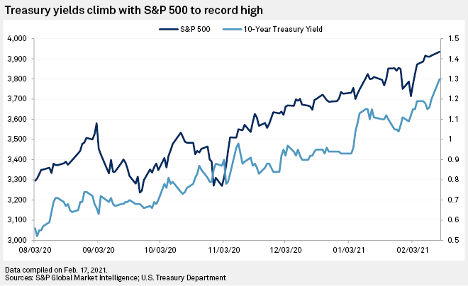

Surging U.S. Treasury Yields Threaten Stock Market Rally

U.S. Treasury yields remain well below historic levels, but their recent, rapid move up has analysts warning of a quick end to the rally in U.S. equities.

—Read the full article from S&P Global Market Intelligence

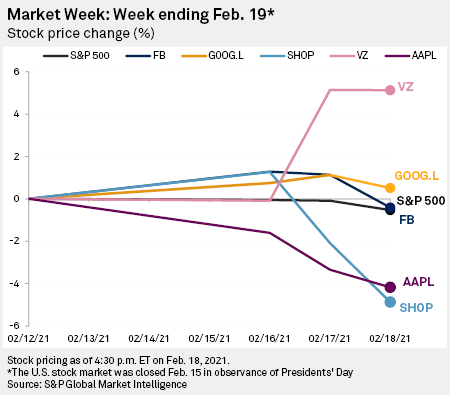

Big Tech and Publishers Face Off; Verizon Boosted by Warren Buffett's $8.6B Bet

Simmering tensions between big tech and news publishers boiled over last week, weighing on Facebook Inc. shares. Meanwhile, business tycoon Warren Buffett grabbed headlines after revealing a multibillion-dollar stake in Verizon Communications Inc. while reducing his position in longtime favorite Apple Inc.

—Read the full article from S&P Global Market Intelligence

Outdated Systems, Reliance on Outsourcing Exacerbate IT Risk at UK Banks

Bungled IT change is a leading culprit for outages and disruptions at U.K. financial institutions, and an overreliance on legacy systems and outsourcing could make the problem worse, according to market participants.

—Read the full article from S&P Global Market Intelligence

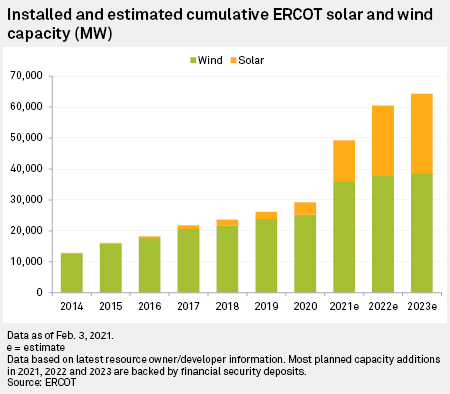

As Texas Digs Out, Plans Proceed to Add 35 GW of Solar, Wind Capacity to Grid

As Texas power plant operators and grid managers revive the state's storm-battered electric system and prepare for an uncertain future, one thing appears unlikely to change: the rapid proliferation of renewable energy resources in the nation's largest power market.

—Read the full article from S&P Global Market Intelligence

Many Rich Countries Lag In Efforts to Steer COVID-19 Stimulus to Green Projects

Many of the world's largest countries are lagging in the effort to use COVID-19 stimulus spending to accelerate the shift toward a more sustainable global economy, whether it is to tackle climate change more aggressively, cut pollution or safeguard the world's rainforests and oceans, new research suggests.

— Read the full article from S&P Global Market Intelligence

U.S. Financial Industry Lays Out Low-Carbon Vision As Regulators Weigh New Rules

Key financial trade groups laid out a vision Feb. 18 for shifting the U.S. to a low-carbon economy, saying that the industry can play a leading role in limiting the risks that climate change poses to the system.

— Read the full article from S&P Global Market Intelligence

The S&P 500 ESG Index: Defining the Sustainable Core

The launch of the S&P 500 ESG Index in April 2019 signaled an evolution in sustainable investing. Indices based on environmental, social, and governance (ESG) data were no longer simply a means for companies to declare their sustainability credentials or tools to manage tactical investments playing a minor role in investors’ portfolios. This paper outlines the characteristics of the S&P 500 ESG Index that have appealed to investors.

—Read the full article from S&P Dow Jones Indices

Listen: As U.S. Reenters Paris Accord, 'Controversial' Climate Actions Needed

The question is top of mind for energy and climate hawks: What will a new U.S. climate target look like after the nation officially rejoins the Paris Agreement on climate change Feb. 19 under President Joe Biden? Several experts weighed in on this question and the implications for the energy transition already underway on the latest episode of "Energy Evolution," a podcast by S&P Global Market Intelligence.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

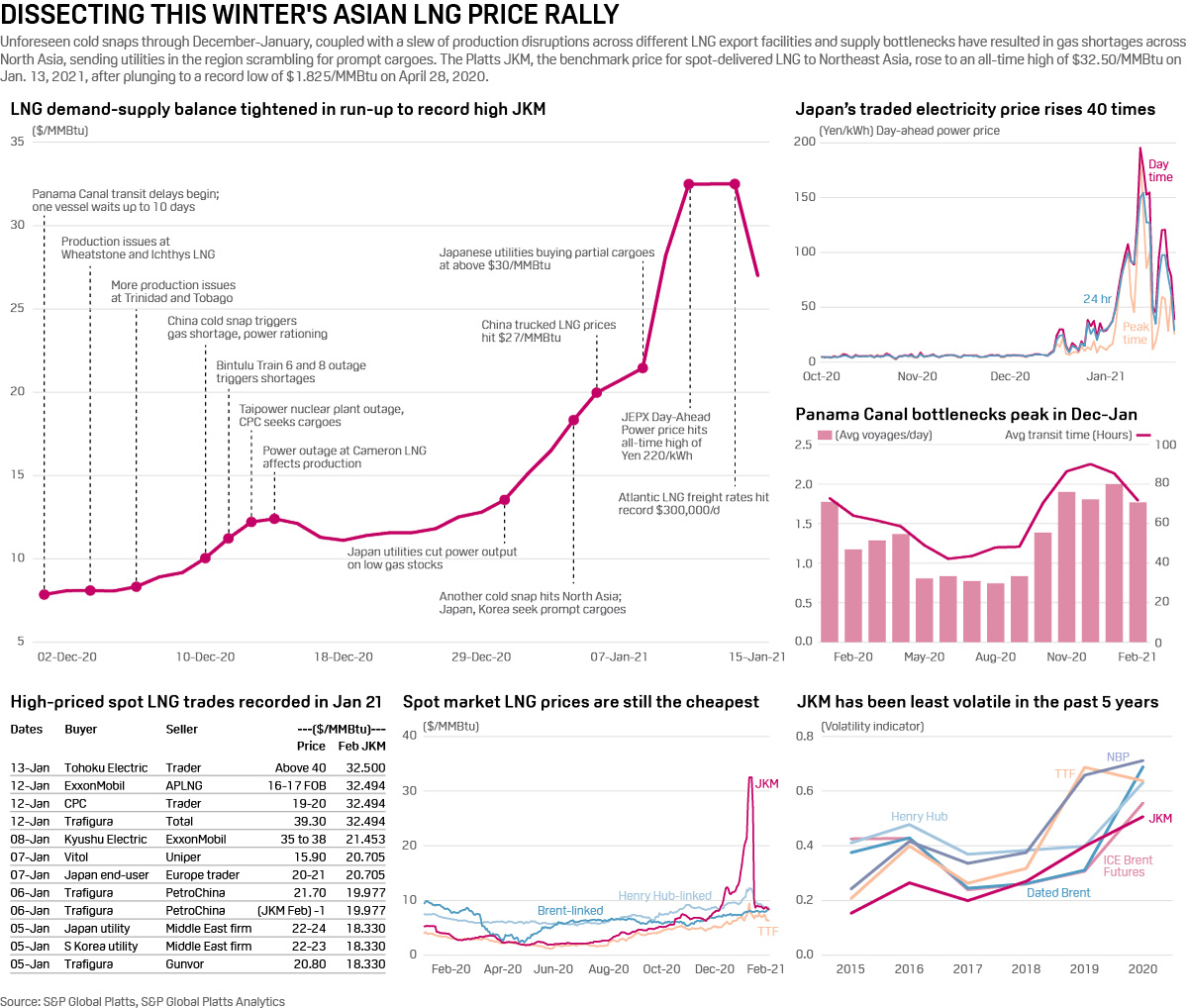

Infographic: Dissecting This Winter's Asian LNG Price Rally

Unforeseen cold snaps through December-January, coupled with a slew of production disruptions across different LNG export facilities and supply bottlenecks, resulted in gas shortages across North Asia, sending utilities in the region scrambling for prompt cargoes.

—Read the full article from S&P Global Platts

Analysis: Bunker Fuel Market Vexed by Many Hurdles Even After COVID-19 Recovery

Despite volatility in some commodity markets, marine fuel prices are already rising, tracking in part gains in crude oil prices.

—Read the full article from S&P Global Platts

Discharge of Several Australian Met Coal Shipments In China Unlikely A Change of Policy: Sources

The recent discharge of several Australian coal vessels in northern China may have left some market participants hopeful that a change in policy is near, but Chinese steelmakers said the discharge did not mean that Australian coals will receive customs clearance and they will continue to steer away of Australian material in the near term.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language