Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

US Election To Shift Auto Industry’s Gears

With the 2024 US presidential election, the automotive industry is bracing for substantial shifts to the regulatory landscape and momentum of the electric vehicle transition. These sudden lane changes in the automotive industry, with its complex and interwoven supply chain, can cause potholes in the greater global economy and financial markets.

The Biden administration’s Inflation Reduction Act and the Bipartisan Infrastructure Law (BIL) led to $100 billion of US battery and EV manufacturing initiatives in 2022, with 24 battery plants currently planned or under construction that could increase the US’ annual capacity to 732 GWh. The Inflation Reduction Act, BIL and a waiver allowing California to set more stringent regulations has put zero-emission vehicles sales in the US on a path to make up 50% of light vehicle sales by 2030.

The current administration also recently announced about $325 million in new funding for EV chargers and battery research to meet a goal of deploying 500,000 such chargers across the country by 2030.

If a Republican-led White House and Congress gain control, they are likely to curb these laws and change or eliminate federal funding and subsidies.

Under these circumstances, fully electric automakers, including Tesla, Rivian, Fisker and Lucid, will have no choice but to stay the course and may see declining consumer demand with reduced tax incentives. S&P Global Mobility expects General Motors, Volkswagen and Hyundai Motor Group to stick with their EV transition plans, albeit at a slower pace. Stellantis, BMW and Mercedes-Benz are working on flexible platforms that could accept internal combustion engines, EVs, plug-in hybrids or even fuel-cell EVs, providing a faster way to adapt to a shifting regulatory landscape.

Either way, the US automakers agreement with the United Auto Workers on higher pay will spur cost-reduction efforts and lower research and development spending on self-driving vehicles to mitigate large margin declines in 2024 and 2025.

S&P Global Ratings estimates that the transition to electrification remains a key risk for most global automakers and could be cash-flow dilutive as they aggressively seek vertical integration with battery technology partners.

By the end of 2024 there will be almost 100 battery EV models available, double that of 2022. S&P Global Mobility forecasts the US’ EV market share to be closer to 45% in 2030 and assumes that original equipment manufacturers will succeed in lobbying efforts that reduce emissions targets and allow for more alternative powertrains. If there are drastic changes to the Inflation Reduction Act, BIL or manufacturer and consumer incentives, S&P Global Mobility expects EV market share to drop even further to 37% by 2030.

The 2024 US presidential election could mark a significant turning point for the automotive industry. Amid these uncertainties, the industry's near-term focus on costs and the EV transition will be key in determining the pace of innovation and growth.

Today is Wednesday, February 21, 2024, and here is today's essential intelligence.

Written by Ken Fredman.

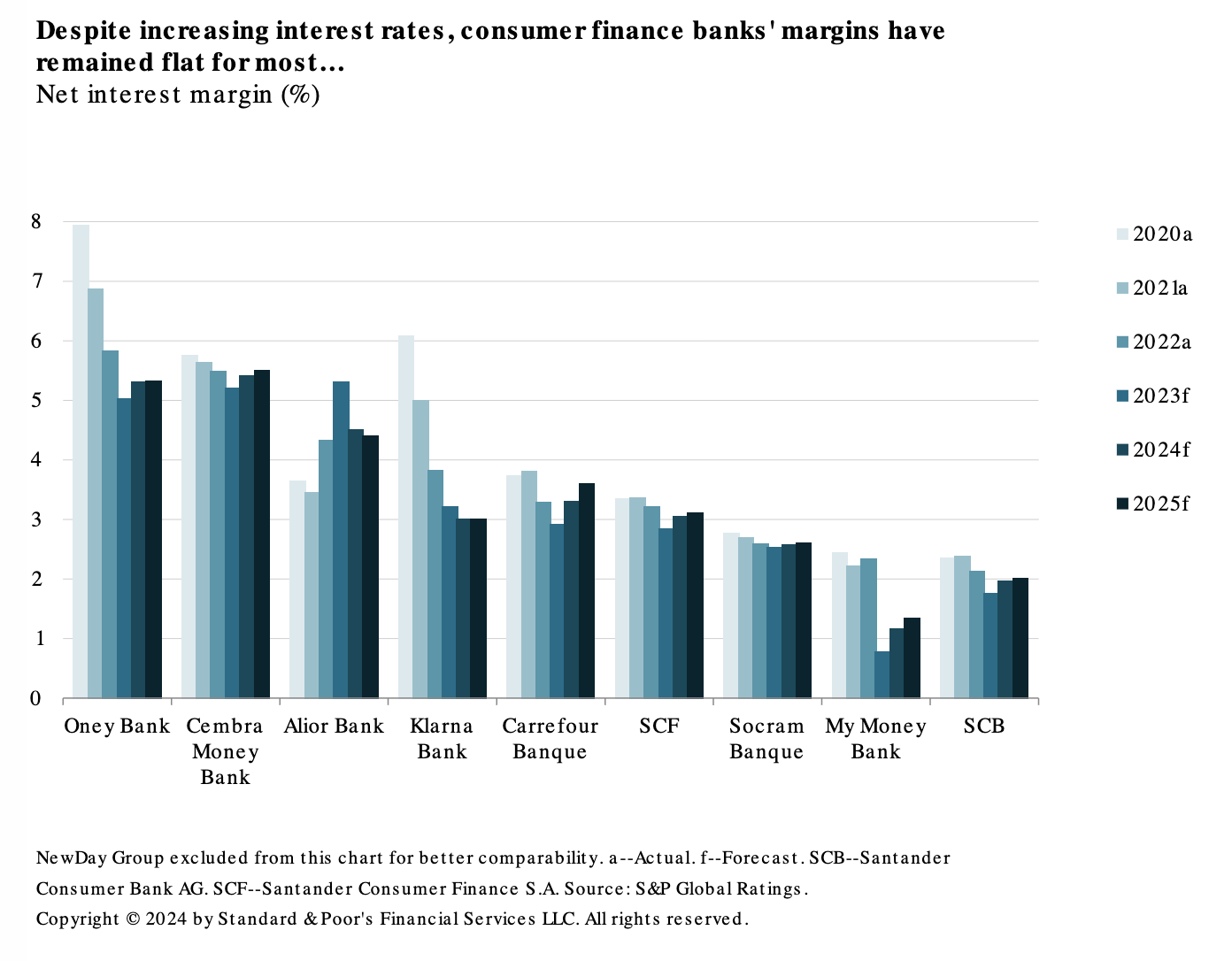

European Consumer Finance: New Economic Reality Is A Litmus Test For Business Models

The operating environment for European consumer finance banks has changed significantly in the past few years. In S&P Global Ratings' opinion, rising inflation and the monetary policy shift in the euro area following Russia's invasion of Ukraine has impinged more on the consumer finance markets than on other banking industry subsegments. It doesn’t expect consumer finance banks to benefit from higher interest rates as much as their universal banking peers.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

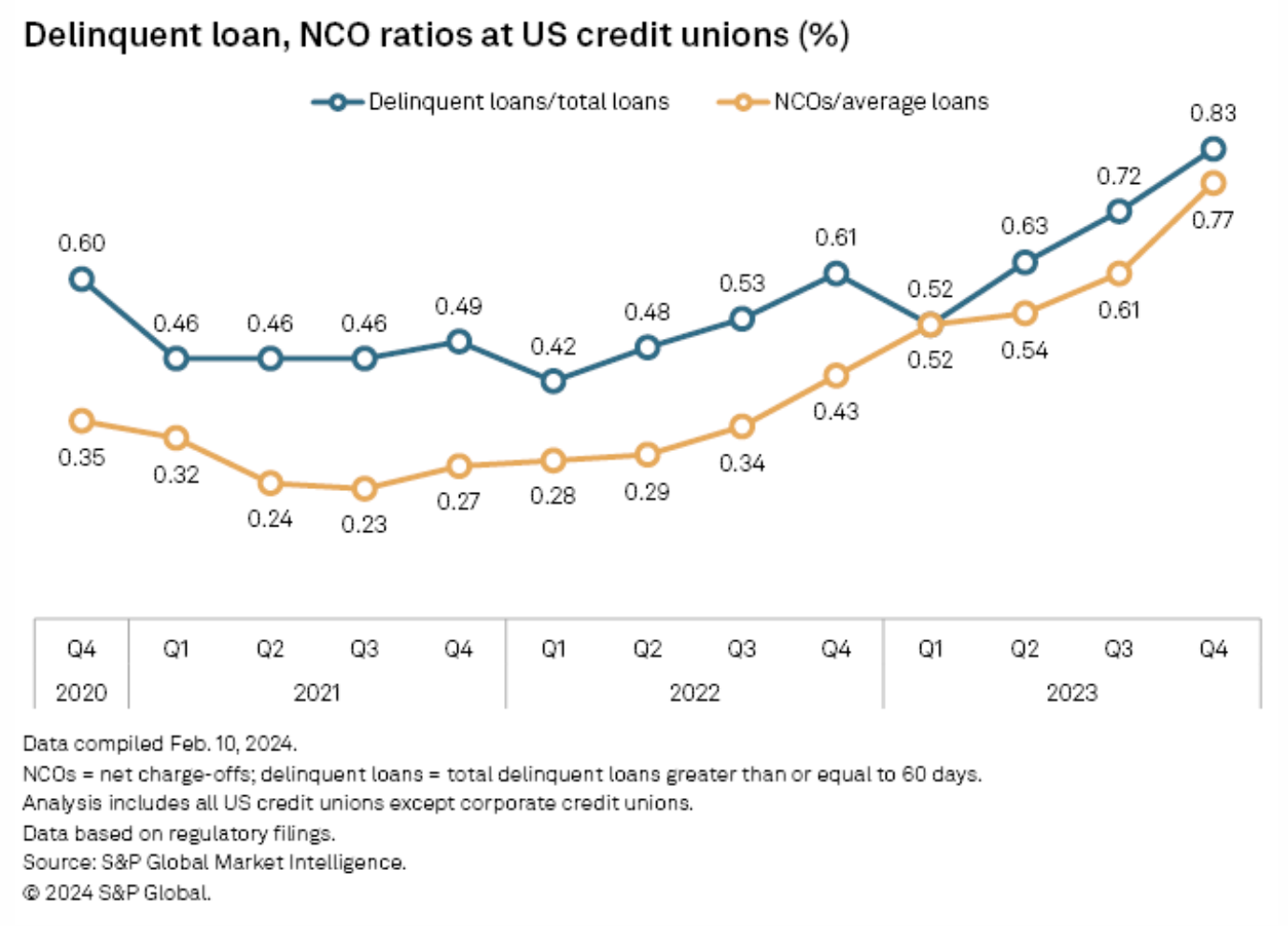

Credit Union Net Charge-Off Ratio Surges To Decade High

US credit unions are grappling with a rapidly rising level of problem loans, in a similar fashion to their banking brethren. In contrast to banks, however, the credit union industry reported slower loan growth in the fourth quarter of 2023, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

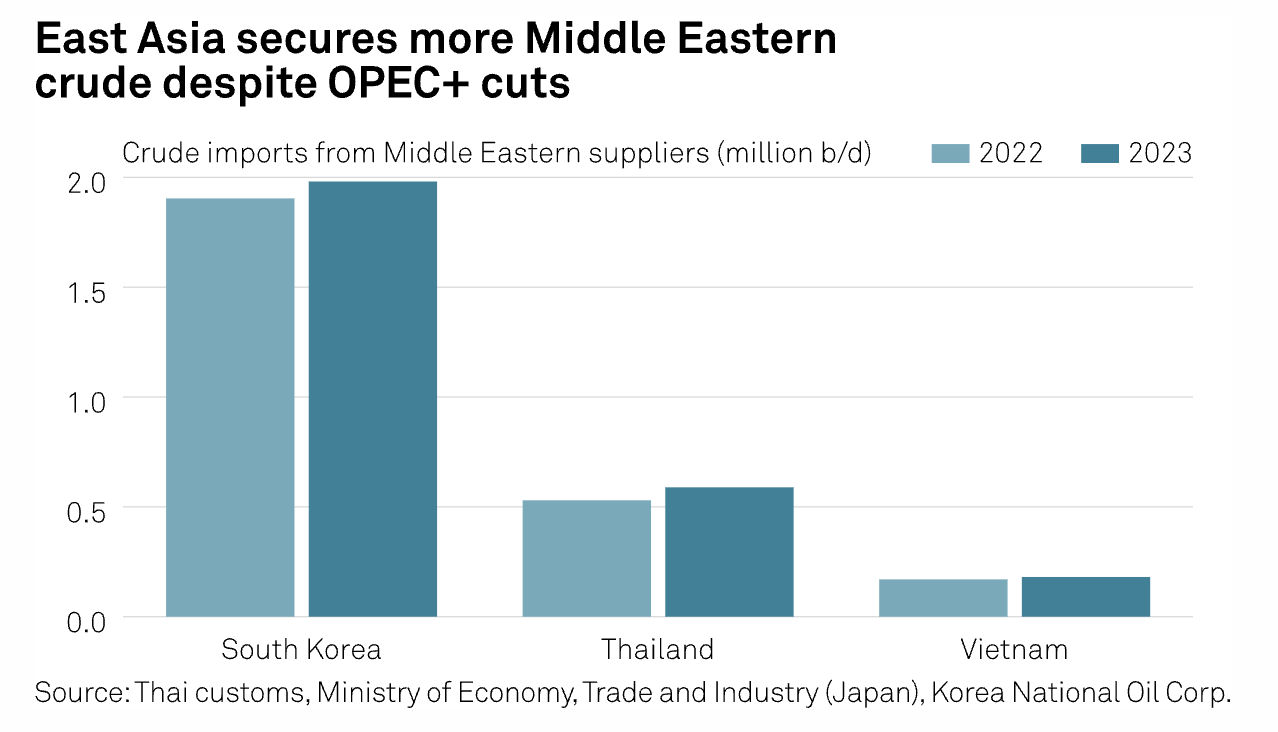

South Korea Refiners Cautiously Upbeat On Refining Margins, Bag Ample Saudi Crude In Jan

South Korea's crude oil imports in January climbed 8.6% from a year earlier, as refiners gradually increase run rates on expectations of improvement in margins, while feedstock managers continued to secure ample Saudi barrels despite the OPEC kingpin's production cut commitment throughout the first quarter. The world's fourth-biggest crude importer took 88.63 million barrels, or 2.86 million b/d, of crude oil last month, compared with 81.63 million barrels a year earlier, marking the fifth consecutive month of year-on-year increase, latest data from Korea Customs Service showed.

—Read the article from S&P Global Commodities Focus

Access more insights on global trade >

Listen: How One Of World’s Largest Food Companies Is Rethinking Supply Chains

In this episode of the ESG Insider podcast, we sit down with Mars, one of the largest food and confectionary companies in the world, on the sidelines of the GreenBiz conference in Phoenix. Kevin Rabinovitch, global vice president of sustainability and chief climate officer at Mars, explains how the company is rethinking its supply chains as part of its decarbonization strategy and to address climate change and nature-related risks.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

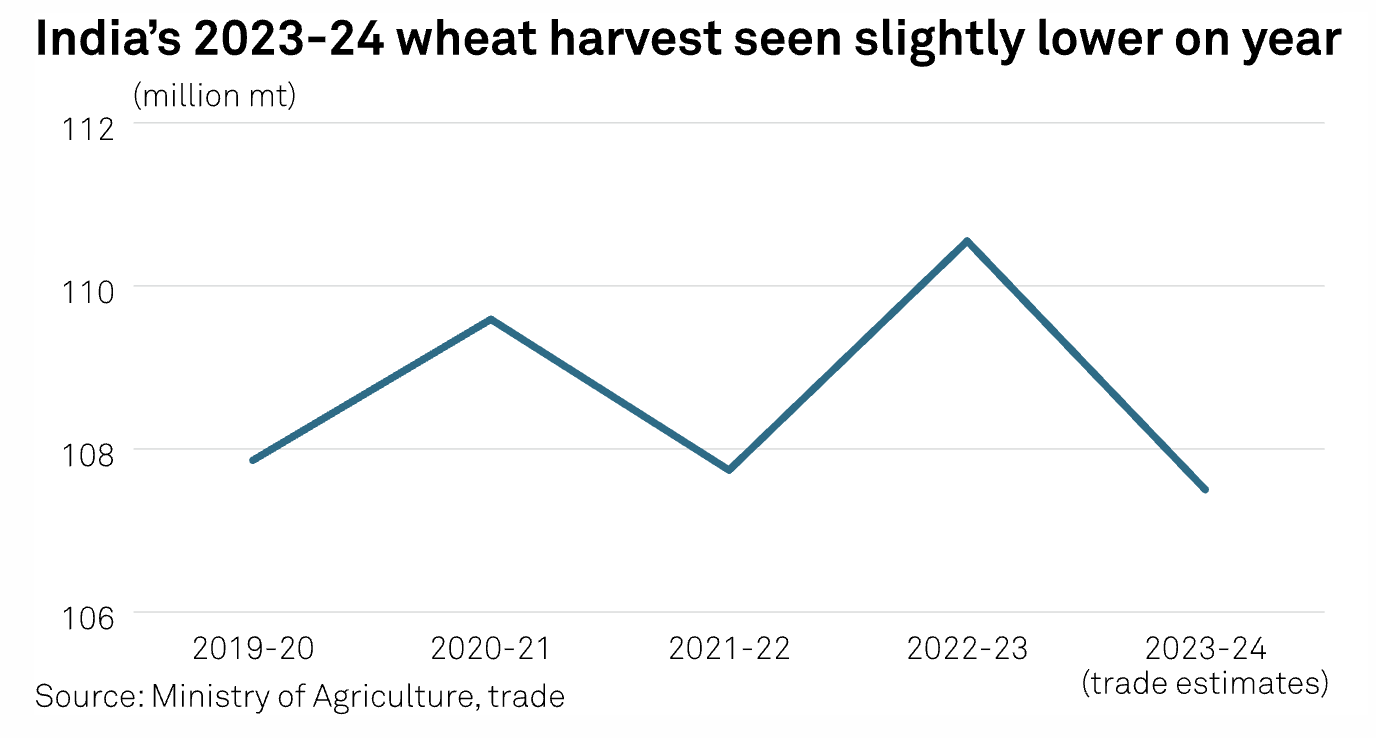

India's 2023-24 Wheat Crop Seen Slightly Lower On Year, Below Govt Estimates

India's wheat harvest in marketing year 2023-24 (April-March) is likely slightly lower year on year, at 107 million-108 million mt, as market participants saw a slight drop in yields despite steady acreage under the crop, an S&P Global Commodity Insights survey of 13 analysts and traders found. The trade estimate is lower than the Ministry of Agriculture's MY 2022-23 estimate, at 110.55 million mt. For MY 2023-24, the ministry targeted wheat output at 114 million mt.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 154: Supply Chain Is Back

Many thought that supply chain woes faded with pandemic concerns, but they’re back and with new dimensions. Analyst Mark Fontecchio returns to explore its cyclic nature and the challenges technological approaches are facing with host Eric Hanselman. Shippers and logistics firms are refocusing on digitizing core processes and data handling. ROI justifications have become critical gates to projects.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Location

Language