Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Economies’ enormous efforts to counteract the coronavirus pandemic’s crippling constraints on their activity and output have sent global debt surging to unprecedented levels.

The response to the COVID-19 crisis added $24 trillion in public and private sector debt last year—bringing the global total to $281 trillion, according to the Institute of International Finance. The global economy’s debt-to-GDP ratio climbed 35 percentage points from the previous year, to 356%.

"The upswing was well beyond the rise seen during the 2008 global financial crisis," the IIF said in a report this week. "Back in 2008 and 2009, the increase in global debt ratio was limited to 10 percentage points and 15 percentage points, respectively."

The IIF pointed to governments’ stimulus programs as the primary drivers of the debt mountain, having contributed to half of the deficit, followed by firms (which added $5.4 trillion), banks ($3.9 trillion), and households ($2.6 trillion).

An additional $10 trillion in global debt is expected to materialize this year, according to the IIF. But governments may begin to gain control of their debt burdens in the medium-term. S&P Global Ratings estimates that more than two-thirds of developed and emerging economies are likely to stabilize or reduce their high debt-to-GDP ratios within the next few years.

“According to our projections, nearly half of developed sovereigns (14 out of 32) will manage to put their ratios of debt-to-GDP on a solid downward path by 2023, with 11 of these 14 located in the eurozone,” S&P Global Ratings said in a report earlier this month. “In emerging markets, 27 out of the 60 largest sovereigns are set to put debt-to-GDP on a solid downward path, according to our projections, and another 13 should either stabilize or slightly lower debt-to-GDP by 2023.”

However, 20 emerging market economies still won’t be able to stabilize their public finances within the next several years, nine of which will experience increased debt-to-GDP ratios through 2023, according to S&P Global Ratings.

The increased debt could threaten economies’ efforts to build back better from the crisis due to the potential that investments in future projects could be deemed too costly or inhibitive if current conditions grow worse.

One comparably small but demonstrably brighter area of the debt markets has been the swell in issuance of sustainable bonds, which are used to fund projects with environmental and social impacts and are expected to grow further. Countries’ expanding net-zero emission targets, the Biden Administration’s climate agenda, and sustainability-minded EU regulation may all further support the green bond market on its upward trajectory, while the pandemic’s implications have put greater emphasis on social bonds for their use in financing affordable housing and health and education projects, according to S&P Global Market Intelligence.

Localities will play a meaningful role in the growth of sustainable finance. Last year, the overall municipal bond market saw a record $474 billion in issuances, with municipal issuers adding $27.6 billion in debt with green, social, or sustainability labels—more than double 2019's level, according to S&P Global Ratings.

“We expect the municipal sustainable debt market to grow in 2021, building on momentum and substantial growth in social and sustainability labeled bonds,” S&P Global Ratings said in a report this week. “We estimate municipal green-labeled debt issuance of about $18 billion and total municipal sustainable debt issuance potentially surpassing $30 billion.”

Today is Friday, February 19, 2021, and here is today’s essential intelligence.

The Essential Podcast, Episode 30: On a Knife's Edge — The Breakdown of Trust in American Society

Bruce Mehlman, founding partner of the bipartisan Washington, D.C. lobbying firm Mehlman, Castagnetti, Rosen & Thomas, joins the Essential Podcast to discuss his latest quarterly review of the U.S. political and social landscape. He explores the greatest threat we face in 2021, which, to give a hint, isn't the coronavirus.

—Listen and subscribe to the Essential Podcast, from S&P Global

For Mexico's Housing Sector, Recovery Remains Elusive

In 2020, Mexico's housing starts and inventory levels reached a 10-year low due to another sharp cut in the federal housing subsidy program and the pandemic that triggered a severe recession. The sector should benefit from a modest economic recovery in 2021, mortgage financing availability, and a higher housing subsidies than last year. However, the recent resurgence of the pandemic in large urban areas across the country and the rising unemployment could delay the sector's rebound.

—Read the full report from S&P Global Ratings

Europe's 2021 Air Passenger Traffic Likely To Stall At 30%-50% Of 2019 Level

Governments across Europe are finding it more difficult to control the COVID-19 pandemic, as numerous new virus variants have emerged which appear more transmissible and have led to concerns over vaccine efficacy. This has prompted a new round of lockdowns and tighter travel restrictions.

—Read the full report from S&P Global Ratings

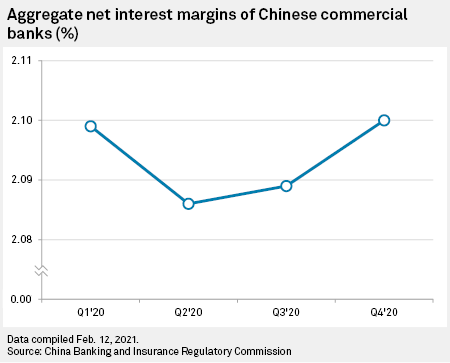

China's Latest Data Suggest Bank Earnings are Set to Rebound More In 2021

Improving margins and asset quality of China's banking sector amid the nation's economic recovery have set the stage for the lenders' earnings to rebound further this year, analysts say.

—Read the full article from S&P Global Market Intelligence

UK Banks' COVID-19 Loan Debts Could See Costs Increase Amid Tax Hike Fears

Banks in the U.K. face a sharp increase in costs to recover state-backed loans, while widespread defaults could also lead to tax hikes, said analysts.

—Read the full article from S&P Global Market Intelligence

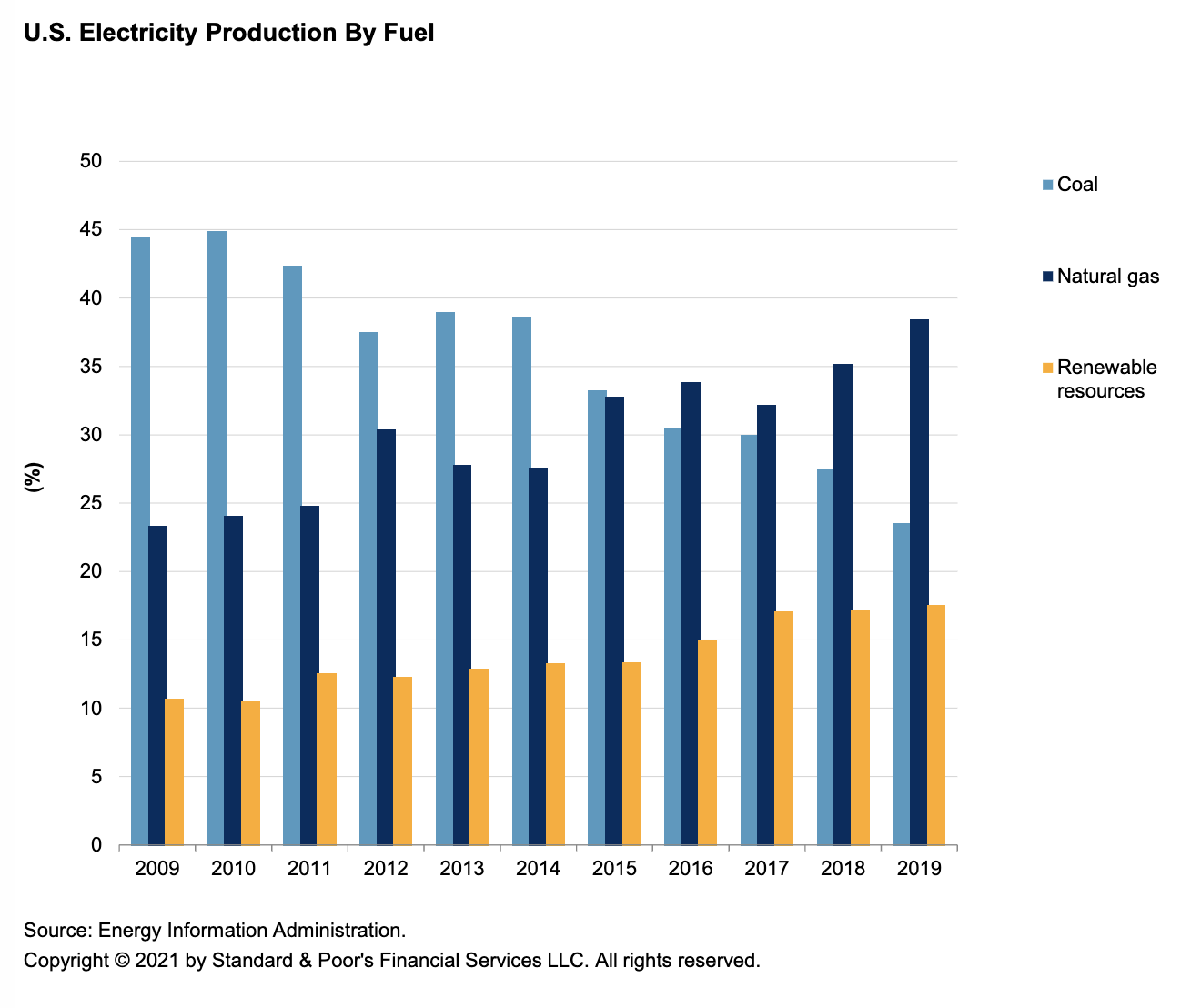

U.S. Electric Cooperative Utilities’ Decarbonization Initiatives Improve Some ESG Risk Attributes

Several carbon-intensive electric cooperative utilities are adopting decarbonization strategies. S&P Global Ratings believes decarbonization initiatives could reduce the environmental exposures associated with utilities' environmental, social, and governance (ESG) attributes.

—Read the full report from S&P Global Ratings

Analysis: For Green Hydrogen to Catch Up with Blue, It's A Long Ride In India

India has unveiled a national hydrogen mission to accelerate plans to generate the carbon-free fuel from renewables, but analysts said that green hydrogen will struggle to compete with fossil fuel derived hydrogen at least until the end of the decade on cost, potentially creating challenges in lifting demand.

—Read the full article from S&P Global Platts

Global Hydrogen Projects Accelerating with $300 Billion Proposed Investment: Report

Hydrogen initiatives are accelerating globally, the Hydrogen Council said Feb. 17 in a report coauthored with consultancy McKinsey.

—Read the full article from S&P Global Platts

Voluntary Carbon Markets: Why They Matter and the Next Steps To Scale Up

Nearly five years after the signing of the Paris Agreement, the urgency of the global climate crisis is more apparent than ever before, and with that urgency has come a stronger move towards collective action to mitigate the worst impacts of climate change.

—Read the full article from S&P Global Platts

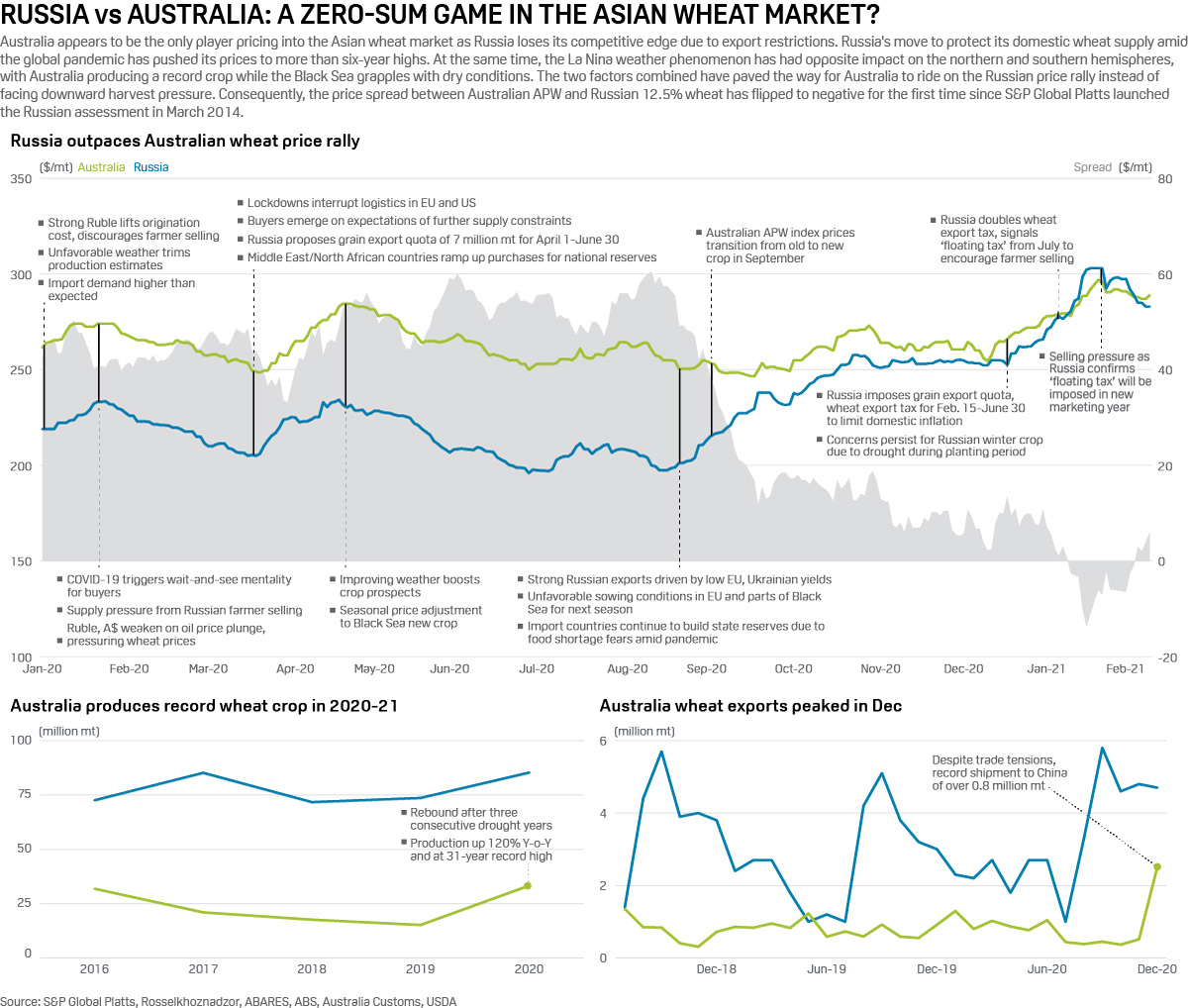

Infographic: Russia Vs Australia: A Zero-Sum Game In the Asian Wheat Market?

Australia appears to be the only player pricing into the Asian wheat market as Russia loses its competitive edge due to export restrictions.

—Read the full article from S&P Global Platts

ANALYSIS: Global Crude Supplies Set for Quality Shift as OPEC+ Unwinds Pandemic Cuts

Oil supplies from OPEC and its key producer allies are set to begin flooding back to the market this year, triggering a shift in global crude quality which could bring welcome relief to swathes of embattled refiners struggling to turn a profit in the wake of the pandemic-trigged demand collapse.

—Read the full article from S&P Global Platts

Energy Transfer Execs Remain Confident Dakota Access Pipeline Will Stay Open

Energy Transfer executives expressed confidence the much-litigated Dakota Access Pipeline will remain open as it faces potential closure from pending lawsuits and a heightened US Army Corps of Engineers review under the new Biden administration.

—Read the full article from S&P Global Platts

ERCOT Leaders Claim Actions Averted Blackout Lasting 'Months'; Outages Continue

Electric Reliability Council Of Texas Inc. representatives said Feb. 17 that the grid operator is still shedding about 13,000 MW of load as workers race to restore power to more than 3 million customers amid below-freezing temperatures.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language