Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Falling Unemployment, Rising Wages and Other Misfortunes

During a rate hike cycle, good news becomes bad news. One of the core mandates of a central bank is to control inflation, because inflation makes it difficult for individuals and businesses to budget and plan with confidence. However, measuring inflation is difficult. Numbers on inflation tend to come out slowly and can contradict one another. Inflation is seen more in the trend lines than in point-in-time metrics. If central bankers wait to see the trend line, they may respond too slowly. Some observers think that is what happened at the U.S. Federal Reserve and other central banks during the first half of 2022.

The gravity of inflation means central bankers need to respond to readily available metrics that indicate if inflation could worsen. More people working for higher salaries may mean that consumers are willing to pay more for goods and services — since more money is now chasing the same amount of goods and services — which will drive up inflation. So, good news on employment and wages could be bad news for inflation. In a cycle like this, central bankers end up raising rates in response to a positive jobs report. This makes it look like they are punishing the economy for paying more workers more money.

By any measure, the January jobs report was unusually good, and therefore, bad. The unemployment rate fell to 3.4%, the lowest rate in 54 years, according to S&P Global Market Intelligence. In addition, hours worked increased, as did the labor force participation rate. Hourly wages are up 4.4% year over year and there are over 11 million unfilled jobs in the U.S. economy, which will further pressure businesses to pay their employees more. Business confidence has jumped to an eight-month high since 2023 began, leading firms to continue to hire despite an anticipated economic downturn.

Economists at S&P Global Market Intelligence continue to project a recession, forecasting real gross domestic product growth of negative 1.2% in the first quarter of 2023. According to S&P Global Market Intelligence, retail sales are weakening, continuing the trend of relatively soft holiday retail sales. Consumer credit is also experiencing tepid growth, and banks are tightening their credit requirements across the board. According to a recent survey, 90% of CEOs at U.S. companies expect a recession during 2023, assuming the Fed continues its hawkish posture on inflation.

“A continued hot jobs market remains a concern for the Fed, which indicated that it's easing its foot off the pedal,” according to Beth Ann Bovino, chief U.S. and Canada economist at S&P Global Ratings. “Since the Fed indicated more moderation, it may stick with a 25-basis-point rate hike in March. Either way, with still-hot pricing pressure amid unfettered demand for workers who remain elusive, our forecast of a 5.00%-5.25% fed funds exit rate by May seems increasingly likely.”

Today is Thursday, February 16, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Economic Research: U.S. Real-Time Data: Health Care Crisis Moderating While Consumer Confidence Improves

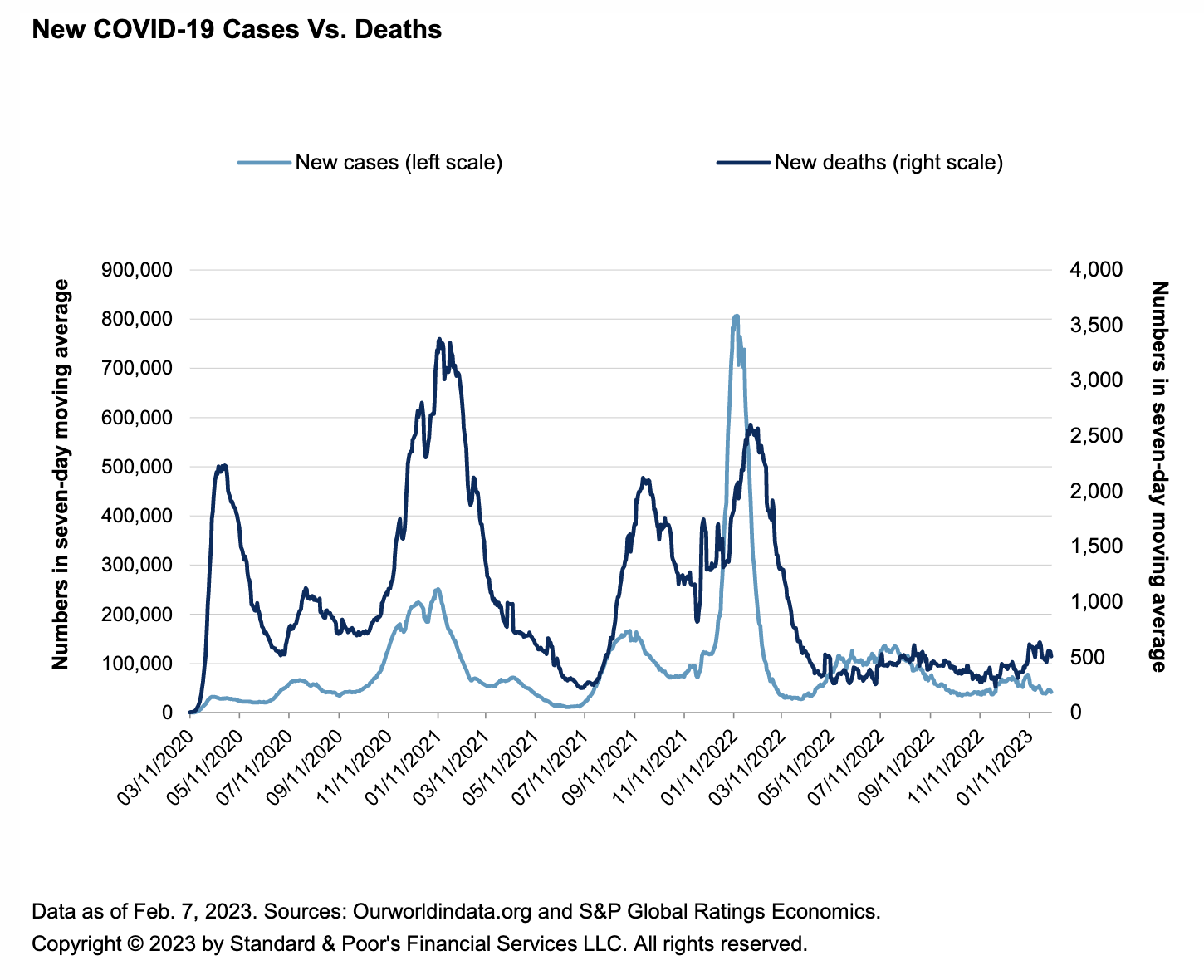

While the U.S. economy still faces challenges in the new year, fortunately, the health care crisis seems to be moderating. Various measures of health conditions moderated further over the last two weeks, with new cases, hospitalizations and deaths for COVID-19 on the decline since Jan. 23. That helps explain why some of the indicators we watch for mobility have improved, with in-room dining still holding above pre-crisis levels. Air traffic also improved as health conditions improve and mobility increases.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Global Private Equity Entries Plummet In January

The volume and value of global private equity and venture capital entries got off to something of a weak start in January, according to S&P Global Market Intelligence data. Deal value stood at $25.32 billion, down 62.1% year over year from $66.88 billion. Total entries were 921, representing a 44.6% decrease from 1,663 in January 2022. North America recorded the highest deal volume in January with 320 transactions, followed by Asia-Pacific with 285 deals and Europe with 269.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Trade Survey Sees India's 2022-23 Wheat Crop Below Ministry's Forecast Of Record High

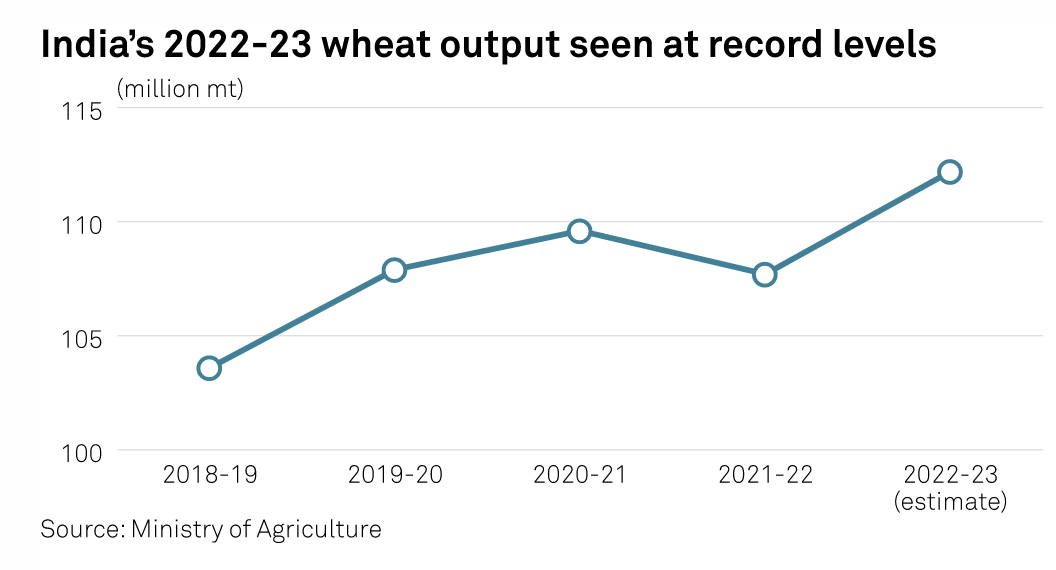

India's wheat harvest is expected to rise to 107 million-108 million mt in the marketing year 2022-23 (April-March) from 102 million mt a year ago on the back of higher yields and favorable weather, an S&P Global Commodity Insights survey of 11 analysts and traders has found. The trade estimate is lower than the Ministry of Agriculture's projection on Feb. 14 of 112.2 million mt, a record high. Trade estimates for India's wheat output in the previous year were also lower than the government's initial projection of 111.3 million mt, which was subsequently lowered to 107.7 million mt.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Energy Evolution | How Big Are The Implications Of The Nuclear Fusion Ignition Breakthrough?

In December, the U.S. Department of Energy announced that researchers at the Lawrence Livermore National Laboratory achieved nuclear fusion ignition, a major scientific breakthrough and a potentially big step for clean energy. Joining this episode to discuss the scientific, commercial and climate implications of this breakthrough are Tammy Ma, a plasma physicist at the Livermore National Lab, and Andrew Holland, CEO of the Fusion Industry Association.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

Access more insights on sustainability >

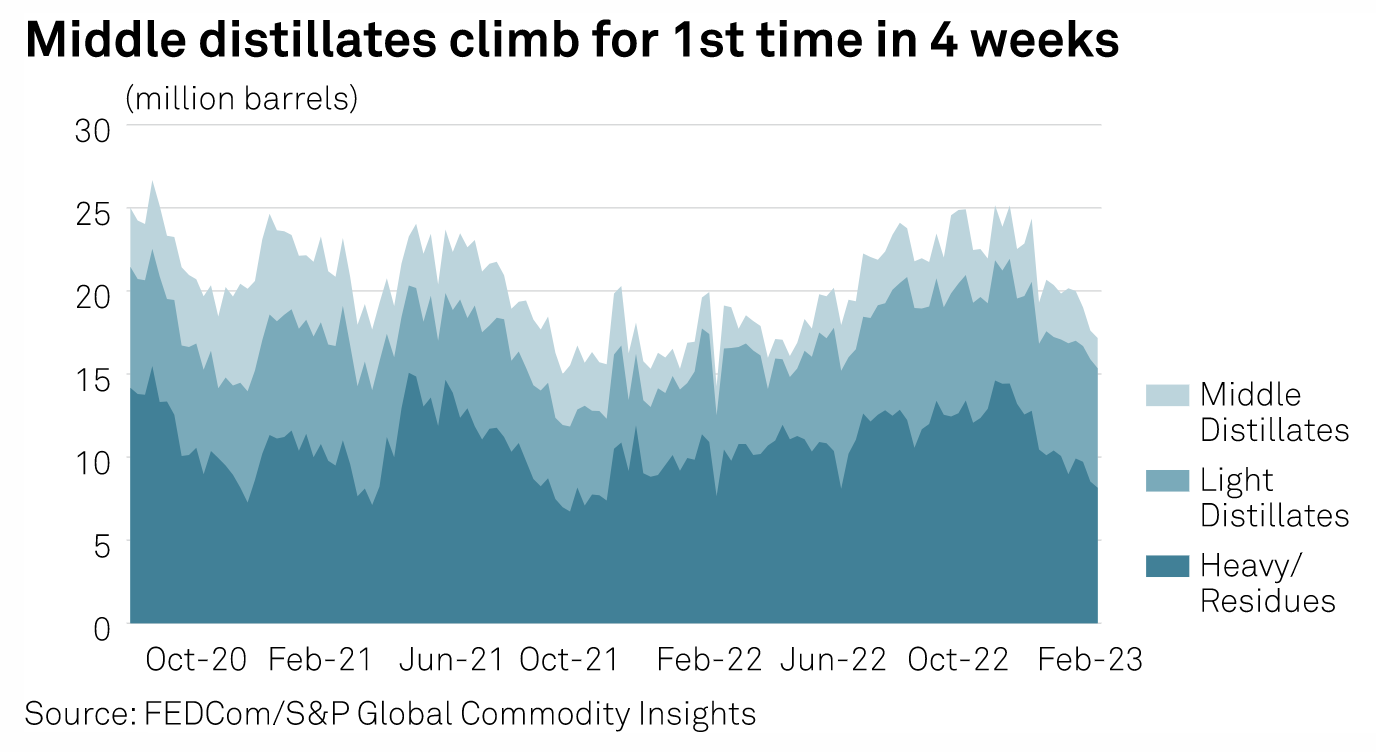

Oil Product Stocks Extend Drop, Heavy Distillates At Eight-Month Low

Oil product stockpiles at the UAE's Port of Fujairah dropped 2.6% in the week ended Feb. 13, extending their slide to a nine-month low with heavy distillates now at an eight-month low, according to Fujairah Oil Industry Zone data published Feb. 15. The total inventory was 17.17 million barrels on Feb. 13, the lowest since May 2, 2022. Heavy distillates — used as fuel for power generation — and marine bunkers dropped 4.4% to 8.158 million barrels, the lowest since June 13, 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 103: Data in AI

Hidden behind all of the buzz around ChatGPT is the dependence on the nature and quality of the data that built the models that run it. Peter Licursi and Chris Tanner join host Eric Hanselman to discuss how data drives the model’s capabilities but can also create unwanted bias and scaling issues driven by the large compute requirements. Is generative AI the single most compelling piece of computational technology that humanity has seen? So much of what it can do comes down to the data.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join Daniel Yergin, Carlos Pascual and Atul Arya for a live webinar discussing the CERAWeek 2023 main themes, in the lead-up to this year’s conference on March 6-10 in Houston, Texas.

—Register for CERAWeek 2023