Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Data-Intensive Applications Drive High Emissions

Most people associate carbon emissions with heavy industries like steel or cement. While it is true that these sectors struggle to decarbonize at scale, digital industries have their own emissions problem. Generative AI, blockchain technology and most cloud-based applications require massive processing power provided by hyperscaler datacenters. These datacenters are packed floor to ceiling with servers processing the bits and bytes of our digital age. Datacenter staff wander the long, humming corridors wearing shorts and t-shirts in all seasons since the servers generate massive amounts of heat. This heat provides a clue to the massive energy consumption of datacenters. Carbon emissions are the unacknowledged elephant in the server room as companies pursue digital transformation.

Due to the popularity of data- and compute-intensive technologies such as generative AI and large language models, S&P Global Market Intelligence projects year-over-year datacenter industry revenue to grow by 14% in Europe and by 18% in the US in 2024. This rapid growth provides a rare silver lining for the institutional investors who play in real estate markets. However, many of these institutional investors, such as pension funds, must comply with sustainability commitments as part of their investment mandates.

The environmental impact of having many energy-intensive processors radiating large amounts of heat is well known to the companies that own, operate or lease datacenters. In a 2022 survey of IT decision-makers conducted by S&P Global Market Intelligence, 44% of respondents indicated that energy consumption offset by 100% renewable sources is the most important goal to achieve. While the focus remains on achieving carbon neutrality through renewable energy sources, factors such as diesel generation and water usage are becoming more important.

Amazon, Apple, Google, Meta and Microsoft, the largest datacenter operators (known as hyperscalers), have a financial interest in promoting data- and compute-intensive technologies that require the use of datacenters. These five companies are acutely conscious of the emissions footprint of their datacenters. As a result, they account for over 45 GW of corporate renewable purchases worldwide — over half of the global corporate renewables market.

Datacenters are also sensitive to the impacts of climate change. Datacenters must be heated, ventilated, air conditioned and cooled. An S&P Global Sustainable1 study of real assets that would be affected by climate change found that in communications services 10% or more of those assets are datacenters, and datacenter assets have the highest average financial impact for this sector at 8.3%.

The environmental impact of AI and cryptocurrency has been studied for years. As the cryptocurrency ecosystem matures, some market participants are attempting to leverage blockchain technology to further sustainability efforts. A group of researchers at S&P Global recently looked at a framework that can be used to define a sustainable cryptocurrency enterprise. Bringing an environmental, social and governance framework and associated due diligence to cryptocurrency-related enterprises may allow investors to make informed decisions in a challenging sector underpinned by a variety of architectures and business models.

Today is Monday, February 12, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Monthly PMI Bulletin: February 2024

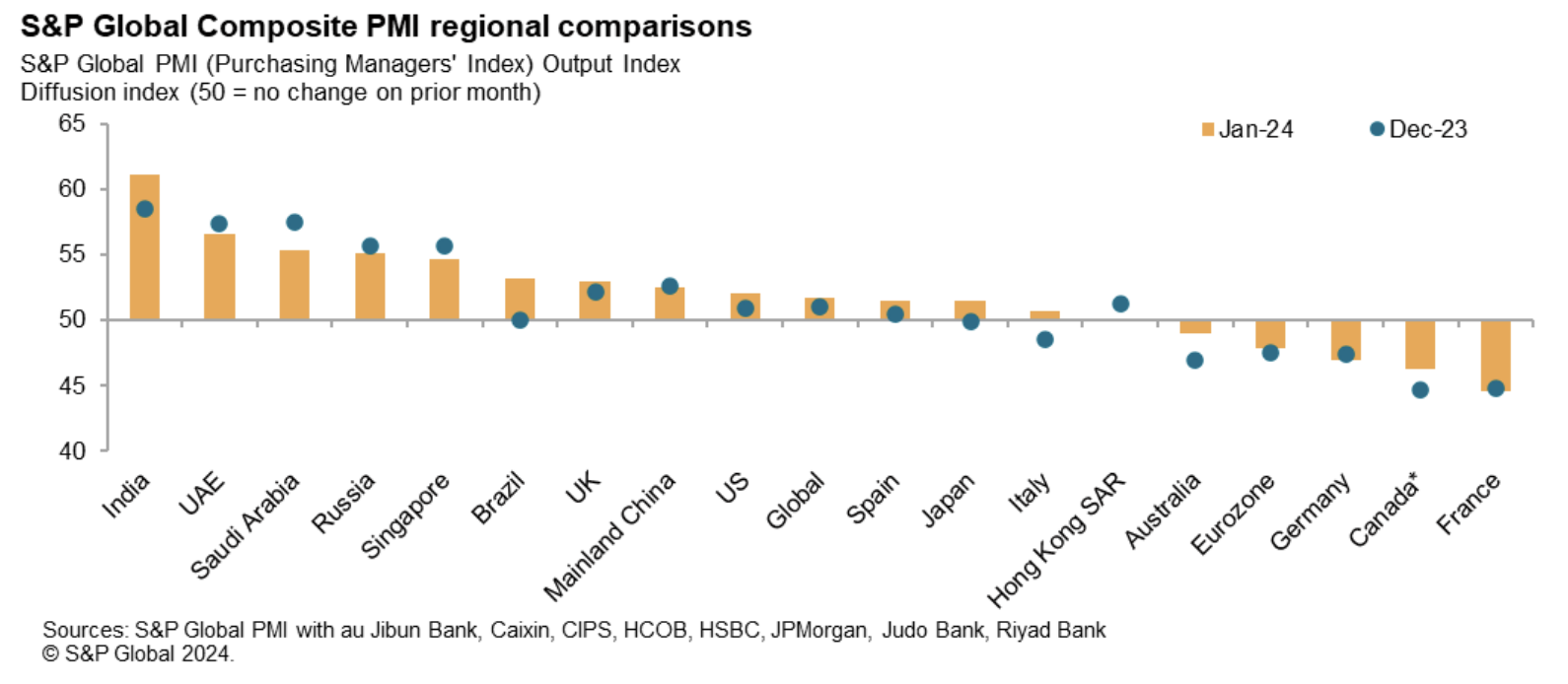

The global economic expansion accelerated for a third straight month in January amidst renewed manufacturing output growth and faster services activity expansion. Additionally, an easing of selling price inflation was a welcome sign. Though risks of prices rising amid higher shipping costs will be worth monitoring in the months ahead.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

The Hare and the Tortoise — Assessing Passive’s Potential in Bonds

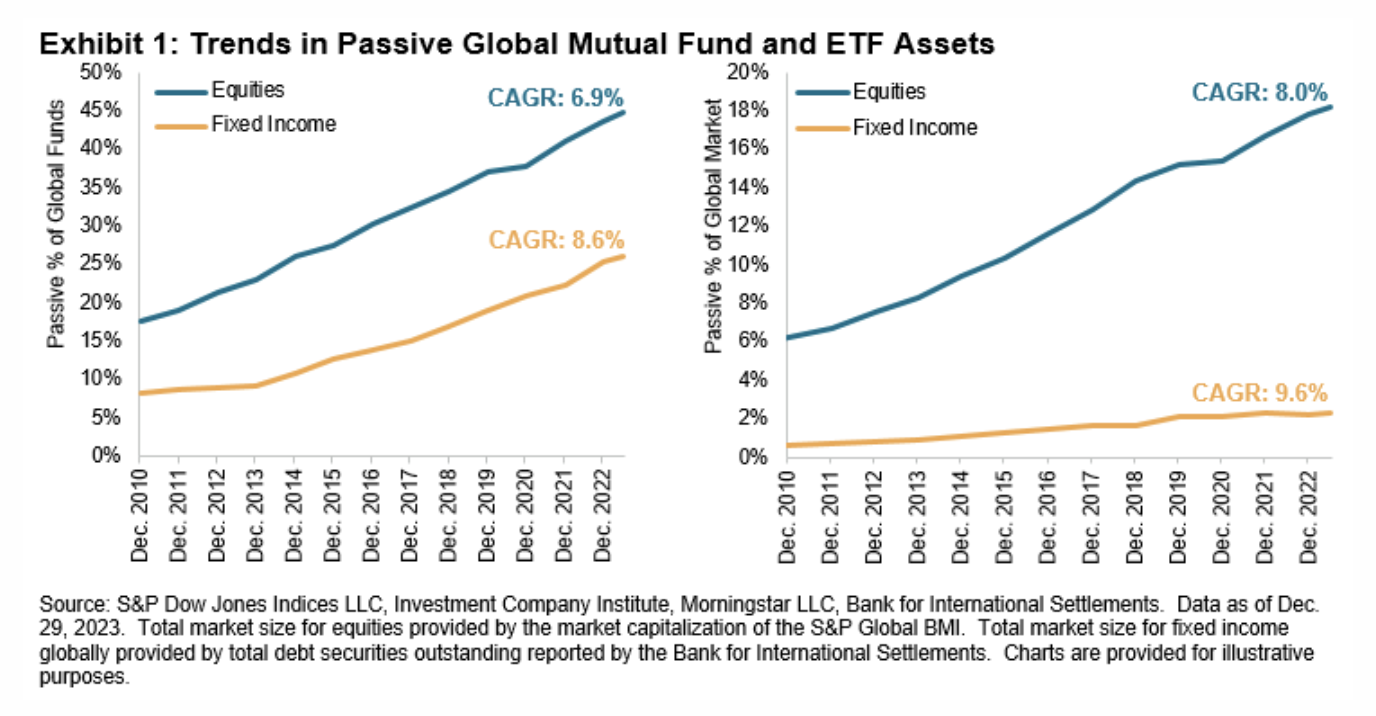

After the ATM, the index fund has been claimed by some to be the most useful invention the financial sector has ever created. The relative success of index funds in equities faced a tide of professional skepticism, but they nonetheless became popular. A similar revolution may be due to occur in the bond markets, where passive investing appears to be climbing a path paved by the equity markets around a decade or so earlier.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

US Thermal Coal Exports Jump 26.4% On Year To 44 Million Mt In 2023: Census

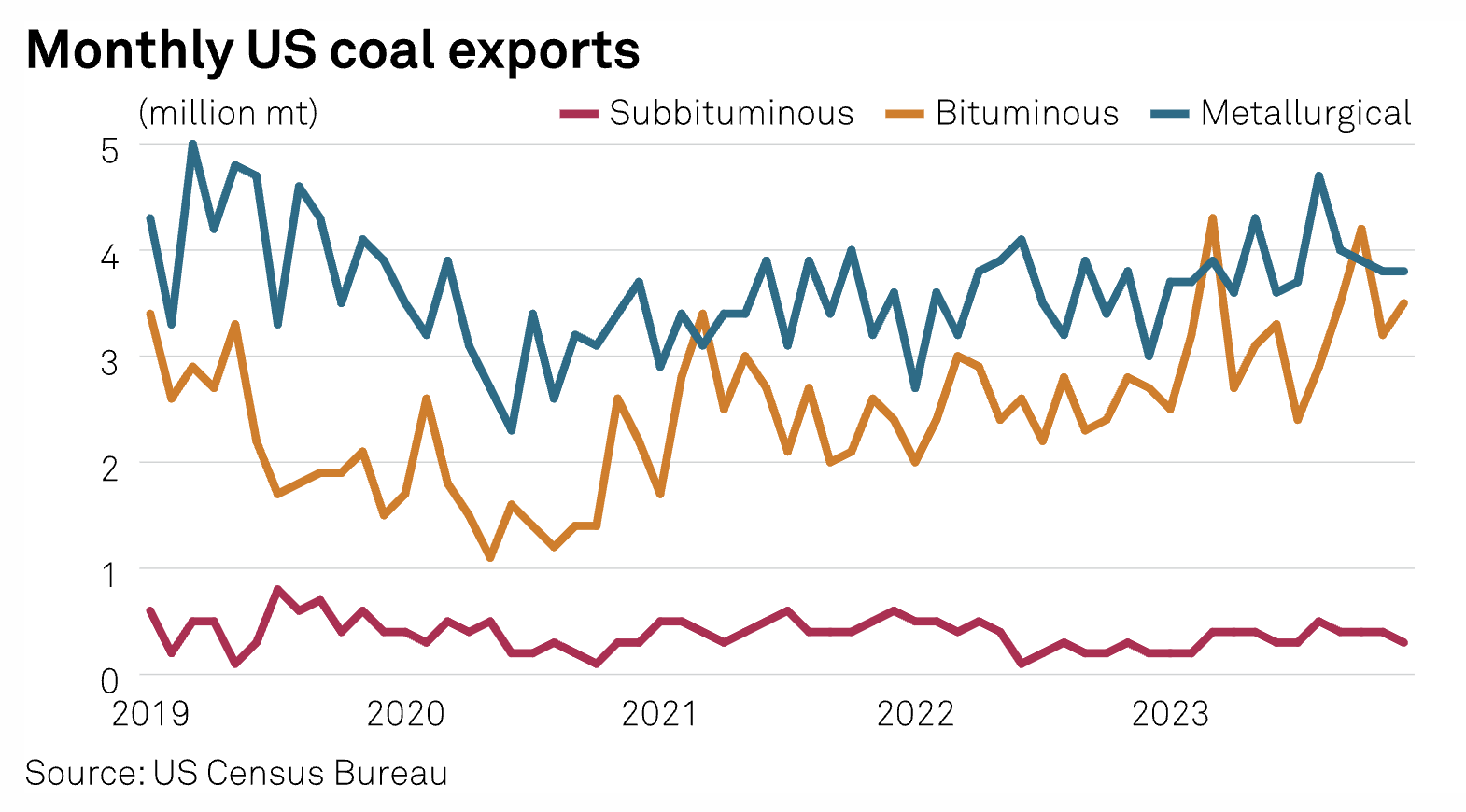

The US exported 44 million mt of thermal coal in 2023, up 26.4% from 2022, according to US Census Bureau data released Feb. 7. Baltimore was the top thermal coal loading port in 2023 at 17.1 million mt, followed by New Orleans at 9.8 million mt. Other top thermal coal loading ports in 2023 were Norfolk at 5.6 million mt; Seattle, 5.5 million mt; and Mobile, 2.7 million mt.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Watch: See The Big Picture: Sustainability In 2024

Climate change will impact access to water and force many countries to modify how they manage resources. Governments and businesses will face heightened physical risks and economic effects, including restricted electricity generation, agricultural losses and supply chain disruption. This is the big picture for sustainability in 2024.

—Watch the video from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: Oil Companies Talk Up Slowdown In US Production Growth

Following a 1 million b/d growth in US oil output in 2023, oil producers and service companies have been warning of slowing growth this year during their fourth quarter earnings calls. Will production surprise to the upside? And what would that mean for US refiners? In this episode of the Platts Oil Markets podcast, senior upstream editor Starr Spencer, senior refinery editor Janet McGurty and midstream editor Binish Azhar discuss these questions and more with host Jeff Mower, Americas oil news director.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Broadcast TV Fees Burden Monthly Consumer Bills In 2024

Six of the nine legacy multichannel distributors tracked by S&P Global Market Intelligence Kagan raised their broadcast TV fees from the first quarter of 2023 to January 2024. The upward pull resulted in a 12.8% increase in the group's weighted national average to about $21.48 worth of broadcast fees per monthly consumer bill. The slowed growth (versus 2023) comes during heavy subscriber losses and terse carriage deals, such as the new agreement between Walt Disney Co. and Charter Communications Inc. following a high-profile dispute.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language