Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The unemployment crisis in the U.S. is scarring both the country’s job market and recovery from the coronavirus-caused economic downturn.

The U.S. economy added just 49,000 non-farm payroll jobs in January, according to data released on Feb. 5 by the U.S. Bureau of Labor Statistics. This marked a paltry increase from the 227,000 jobs lost in December 2020 and indicates signs of deepening concern rather than steady progress.

“If it weren't for temporary help services and state and local education, employment would have fallen for a second month in a row,” S&P Global Ratings U.S. Chief Economist Beth Ann Bovino said in a research report following the BLS report. “The economy barely added jobs in January. It remains 9.9 million jobs short of the pre-pandemic peak, and we estimate it is 11.5 million jobs below its pre-pandemic trend.”

While the unemployment rate fell 40 basis points, to 6.3%, S&P Global Economics estimates the actual unemployment rate to be closer to 9.4%, as the headline rate doesn't fully capture COVID-19-related job market distortions.

Expectations are rising that the unemployment rate will stay above full-employment levels until the fourth quarter of 2023. If employment increases at the current pace moving forward, “it will take more than two years to recover all jobs lost,” Dr. Bovino said. “The unemployment rate should continue to decline this year, but at a tempered pace, as the return of people to the labor force should pick up through the year.”

Other economies around the world have recovered many, if not most, of the jobs lost during the coronavirus emergency periods last year. For example, Asia’s lockdowns were instated in combination with specific policies that kept workers employed and on payrolls, which caused minimal unemployment and ultimately boosted a rebound in hiring. The U.S., however, has experienced climbing coronavirus cases alongside declining federal stimulus—leaving the country in a precarious position to support the millions of Americans without work.

Women and people of color have suffered the most job losses during the pandemic. Women accounted for all of the 140,000 net jobs lost in December, with the majority having belonged to Black women, according to a National Women’s Law Center analysis of BLS data. The organization’s analysis of the latest BLS jobs report found that an additional 275,000 women left the workforce in January—pushing women’s labor force participation down to 57%, its lowest level since 1988. In all of 2020, BLS data showed that women lost 5.4 million jobs, compared to 4.4 million lost by men. Additionally, new research released Feb. 9 by the New York Federal Reserve found that labor force “participation fell more severely for the Black population at the onset of the pandemic and has since recovered more slowly.”

This structural damage could become widespread and permanent. Nearly 42% of the 10.1 million Americans that remained unemployed in January were permanently displaced from their jobs, in addition to nearly 40%, or 4 million individuals, who have been jobless for at least 27 weeks, according to Dr. Bovino.

“Permanent layoffs are still more than triple the pre-pandemic average of 1.3 million but remain well below the 6.8 million peak in the Great Recession of 2008-2009,” she said in her report. “There is evidence, especially from the aftermath of the global financial crisis, that folks permanently displaced from their previous jobs are vulnerable to having a hard time finding jobs, or are likely to drop out of the labor force for a longer time period or suffer a reduction in wages.”

However, the passage of U.S. President Joe Biden’s $1.9 trillion stimulus package could spur a speedier recovery. Previous research conducted by Dr. Bovino found that if passed, the aid would have the strongest impact on the country’s economy this year.

“There’s absolutely no reason why we should suffer through a long, slow recovery,” U.S. Treasury Secretary Janet Yellen said in a Feb. 7 CNN interview. “I would expect that if this package is passed that we would get back to full employment next year.”

Today is Wednesday, February 10, 2021, and here is today’s essential intelligence.

Remote Work Trends Jam the Printing Industry, and the Latest on Xerox

Work-from-home trends accelerated digital transformation and the structural decline in the printing industry. A recovery path to pre-COVID-19 demand levels is uncertain.

—Read the full report from S&P Global Ratings

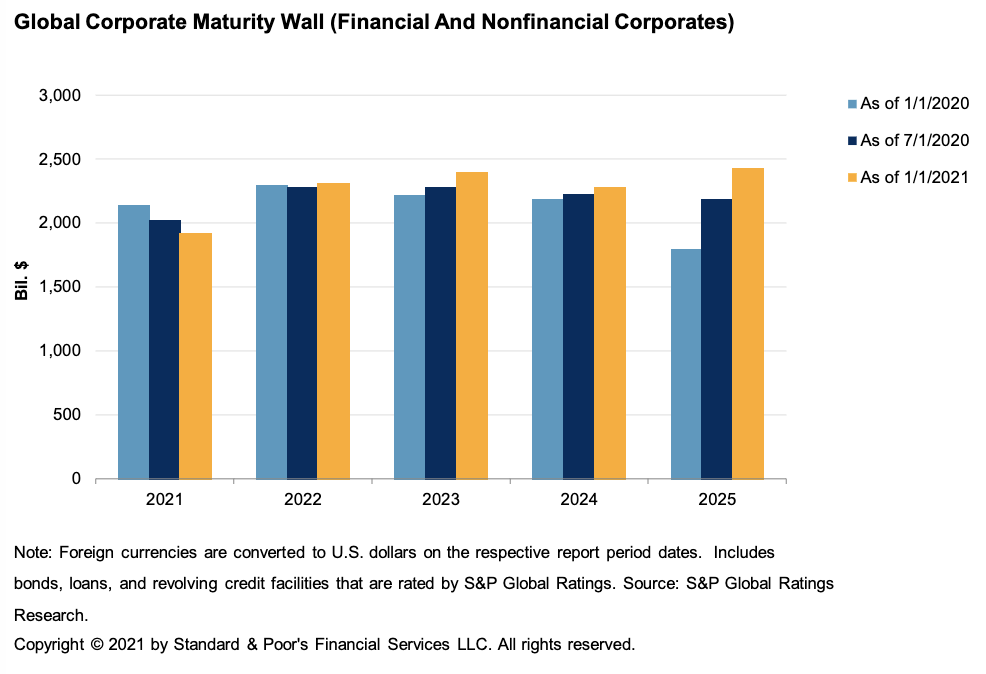

Global Refinancing--Rated Corporate Debt Due Through 2025 Totals $11.3 Trillion

About $11.3 trillion in corporate debt rated by S&P Global Ratings is scheduled to mature globally through 2025. Maturities have been lengthened after record issuance in 2020, with maturities rising to a peak of $2.42 trillion in 2025 from $1.9 trillion in 2021.

—Read the full report from S&P Global Ratings

European Structured Finance Market Accelerates Transition from LIBOR

The transition from the British pound sterling London Interbank Offered Rate (LIBOR) is gaining momentum in Europe's structured finance market, ahead of the phase-out date at year-end. S&P Global Ratings expects the transition process across rated transactions to speed up this year, though with significant variation.

—Read the full report from S&P Global Ratings

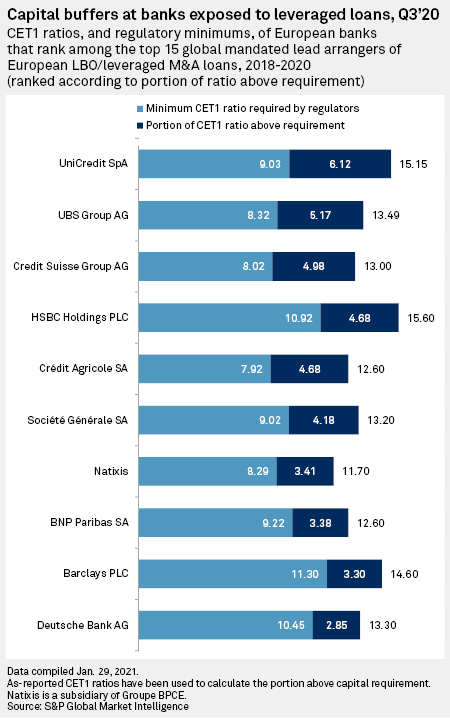

ECB Has Acted Over Banks' Highly Leveraged Loan Exposures, Says Enria

The European Central Bank's top supervisor has said the central bank has clamped down on banks it considers overexposed to the leveraged loan market, resulting in increased capital charges.

—Read the full article from S&P Global Market Intelligence

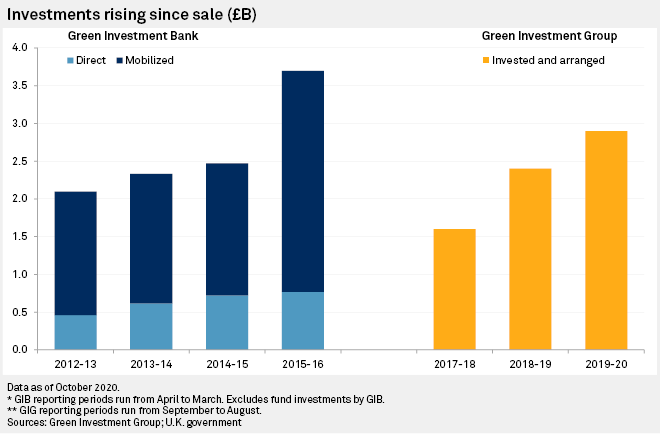

Contentious Macquarie Sale Back in Focus as UK Plans New Green Investment Bank

As the U.K. government plots how to achieve its net-zero emissions target, ministers are preparing to launch plans for a new national infrastructure bank to drive money into low-carbon sectors — once again putting the spotlight on the country's former state-owned Green Investment Bank and its controversial sale to Macquarie Group Ltd

—Read the full article from S&P Global Market Intelligence

Total Lines Up Green Rebrand but Sticks with Target to Grow Oil, Gas Output

French energy major Total unveiled a name change Feb. 9 to underscore its pivot to cleaner energy, but pledged to maintain a previous target of growing its oil and gas production in the near term to fund its green investment drive.

—Read the full article from S&P Global Platts

A CEO's Look at US Battery Storage Development Strategies, Opportunities and Barriers

In this edition of the Platts Commodities Focus podcast, Jared Anderson, senior writer with S&P Global Platts, speaks with Jeff Bishop, CEO of energy storage developer Key Capture Energy, about the most valuable US energy storage markets, the accessibility of those markets, policy barriers, preparing for market changes, federal regulation to watch in 2021, and more.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

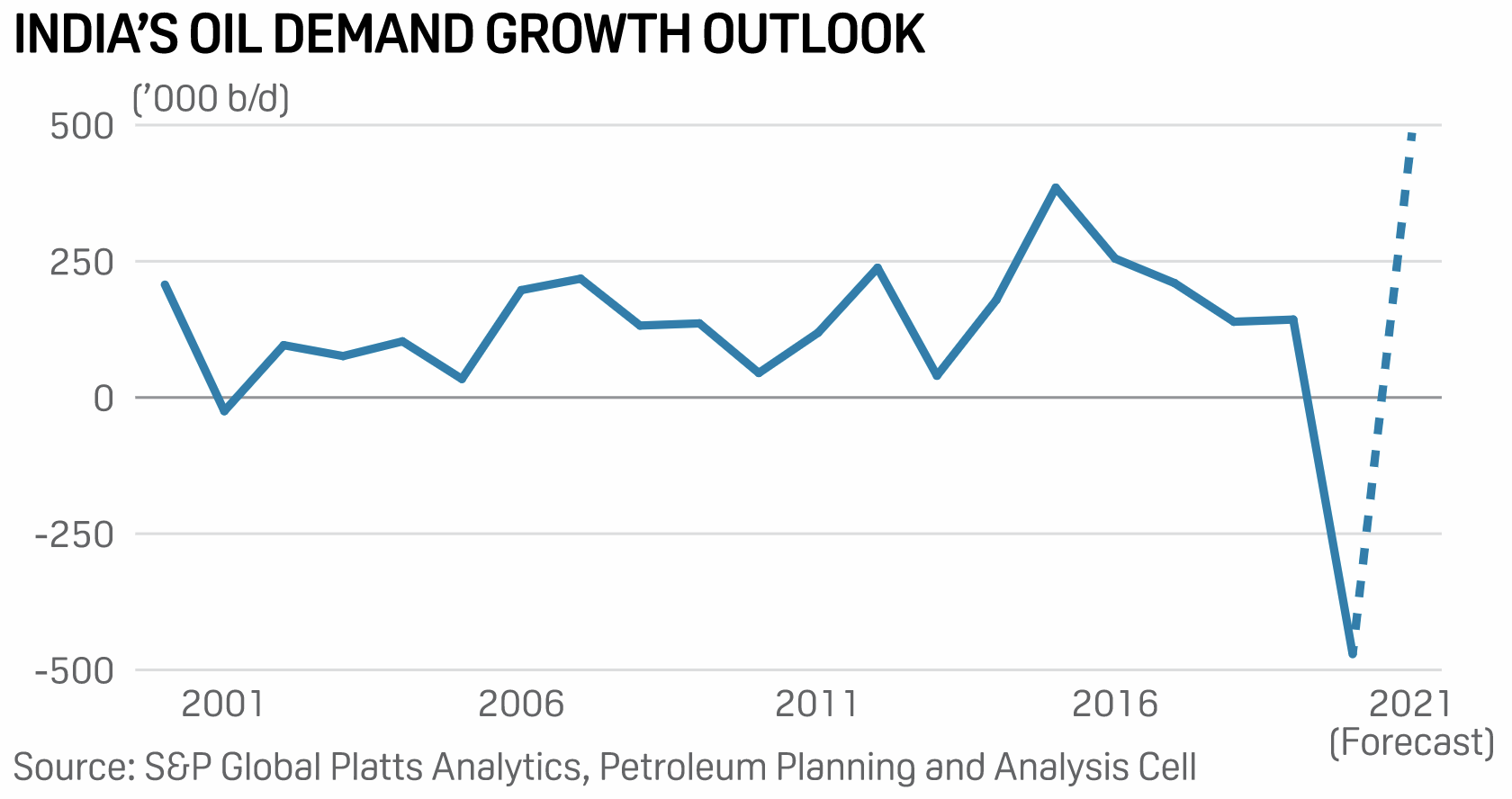

India to Lead World Energy Demand Growth, Oil to Play Key Role: IEA

India is set to witness the biggest increase in energy demand in the world over the next 20 years, with the potential for oil consumption rising as high as 4 million b/d at 8.7 million b/d by 2040, the International Energy Agency said in a report Feb. 9.

—Read the full article from S&P Global Platts

Iran Activates Game Plan for Oil Comeback in 2021 in Test for Biden Administration

Emboldened by the change in US presidency, Iran is pushing more oil onto the market, even as sanctions remain in place, as it looks ahead to a full return to the global oil market as demand recovers from the pandemic.

—Read the full article from S&P Global Platts

Fuel for Thought: Biden Moves Fast on U.S. Oil and Gas Campaign Pledges

As a Democratic presidential candidate, Joe Biden pledged to cancel the decade-in-the-making Keystone XL Pipeline and, not so shockingly, he followed through on his first day as US president by revoking the Canadian heavy oil pipeline's permitting.

—Read the full article from S&P Global Platts

Closures, More Volume Declines Hitting Powder River Basin Coal Region in U.S.

A sharp decline in coal demand from the U.S. power sector is wreaking havoc on the Powder River Basin as mine operators in the region scaled back production during 2020 with few indications of improved prospects for volumes.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language