Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The EV Market Experiences Growing Pains

On a recent Sunday afternoon, freezing rain soaked the parking lot of a New Jersey shopping mall. The lot held few cars, as most people had chosen to forgo a trip to the mall due to the unpleasant weather. But a glut of cars surrounded the five electric vehicle chargers in a corner of the parking lot. A line of drivers waited for available chargers while the lucky few doom-scrolled on their phones as their vehicles slowly charged. To EV skeptics, this scene provides further evidence of the impracticality of EV adoption. However, an alternative interpretation is that a line of cars at a charging station is evidence of a market that is rapidly outgrowing its infrastructure.

According to S&P Global Mobility, the percentage of EVs among new light-vehicle registrations topped 10% in the US last year. In the EV market, the US is a laggard. In key European markets, 24% of registrations were EVs in 2023, and the percentage for China was 34%. S&P Global Mobility believes that the EV share of light-vehicle sales will continue to experience rapid growth, reaching between 39% and over 50% of the market by 2030. The range of percentages in that projection is notably large. But there are a variety of outcomes for the EV market based on regulatory stringency, consumer acceptance and battery costs. Notably, even at the low end of that range, well over a third of vehicles sold globally will be electric.

The growth of the EV market will have implications for oil demand. According to a recent analysis by S&P Global Commodity Insights, by 2030, EVs could displace more than 3 million barrels per day of oil demand. To put that number into some perspective, Saudi Arabia alone produces more than 12 million b/d of oil. The global fleet of light vehicles with internal combustion engines (ICEs) is expected to peak in the next few years. That peak will be roughly concurrent with peak gasoline and diesel demand.

Much of the growth in EV demand is being led by government policies, including the EU’s CO2 regulation for light vehicles, which requires automakers to cut CO2 emissions 100% by 2035; California’s zero-emissions vehicle mandate, which requires automakers to sell 100% light zero-emissions vehicles, also by 2035; and the US’ Inflation Reduction Act.

Despite these incentives, more gasoline households in the US considering a transition away from ICEs are choosing hybrid models, rather than pure electric. According to S&P Global Mobility, from January through October 2023, 8.3% of gasoline households that returned to the market for a new vehicle acquired a hybrid model. The number is lower for EVs, although the trend line is rising. The reason that new adoption of EVs is lower than the 10% of new light-vehicle registrations mentioned above is that US consumers who buy EVs tend to be repeat purchasers of EVs. Most of this loyalty is driven by EV manufacturer Tesla.

A final factor that may hinder EV adoption in time is the availability of critical battery metals. Lithium prices surged in 2021 and 2022 before settling down in 2023. According to S&P Global Commodity Insights, lithium supply will exceed demand over the next few years, although further rapid growth in the EV market could put price pressure on lithium supplies.

Today is Thursday, February 1, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

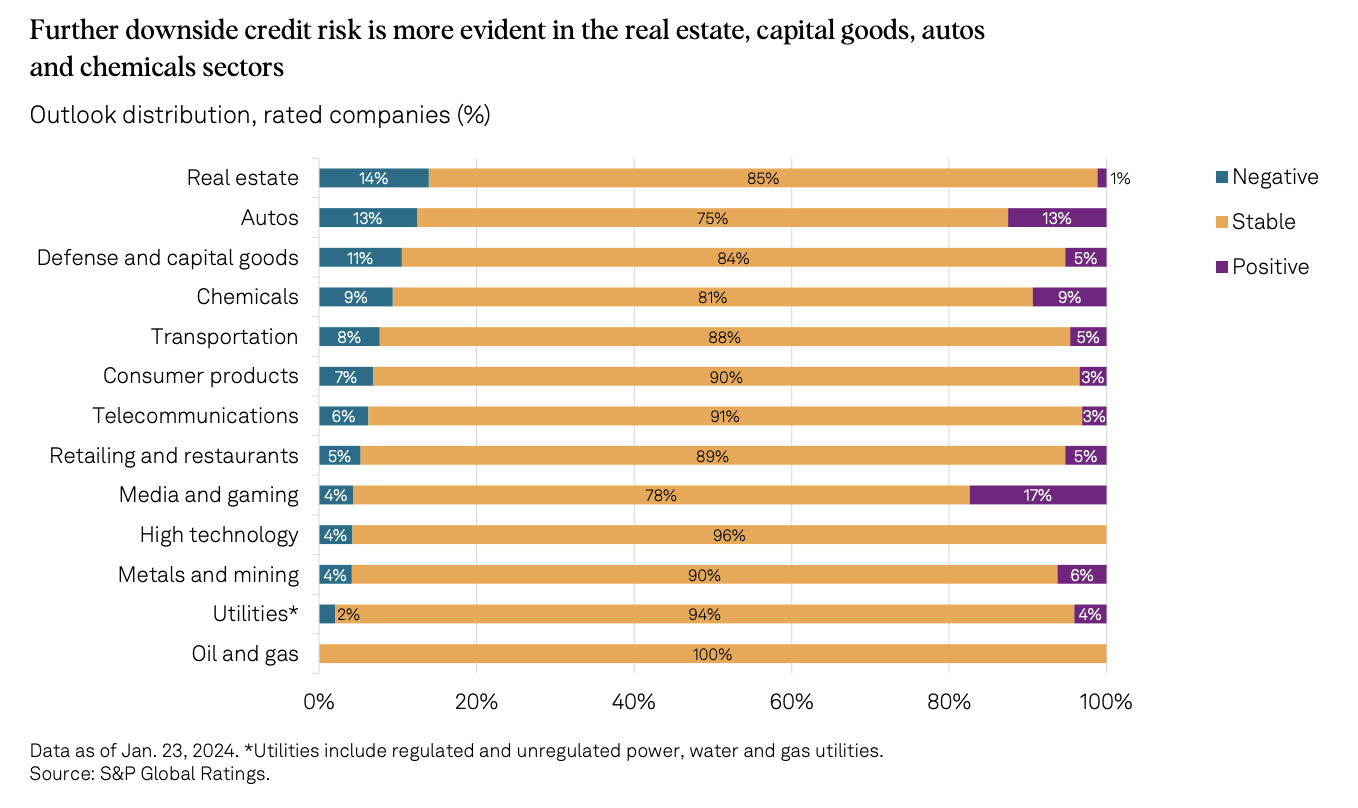

Asia-Pacific Corporate Credit In 2024: Taking The Slow Road

Rating trends in Asia-Pacific are turning more positive, with diminishing default risk for rated companies. Profit growth and rating upside in 2024 are limited by the continued slowdown in consumer demand in China, soft GDP growth in key export markets in Western economies and input cost pressures. The issuance trend is more positive for 2024 than 2023, amid greater clarity on the trajectory of US interest rates. Funding is likely to stay selective for speculative grade issuers.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Philippine Banks Outlook 2024: Better Economic Prospects Will Bolster Sector

This could shape up into a better year for Philippine banks. The sector's metrics should stay relatively healthy at a time when real GDP growth is among the highest in the region.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

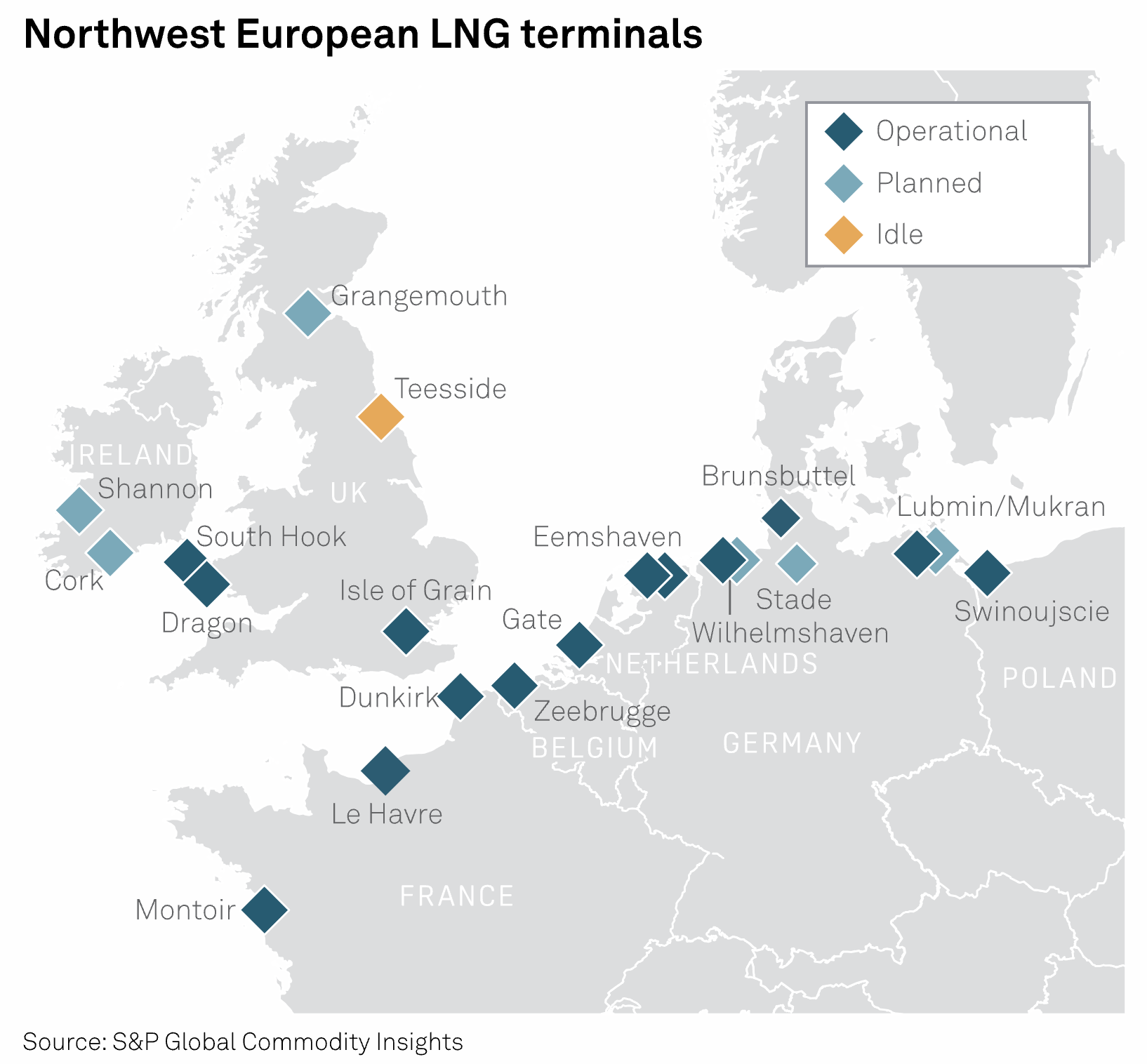

German Gas Industry Group Slams US 'Pause' On New LNG Export Permits

German gas industry group Zukunft Gas has slammed the White House's decision to "pause" new US LNG export permits, saying the move would have a particularly negative effect on the market. Germany has turned to LNG — with three floating import terminals already operational and three more set to be deployed in the coming months — to replace lost Russian pipeline gas. The US has been the dominant LNG supplier to Germany since the first terminal came online at the end of 2022, with US LNG deliveries totaling 4.1 million mt last year, or 82% of total imports, S&P Global Commodity Insights data showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Nature Was Front And Center On The Davos Agenda — Here’s Why

Last week, the World Economic Forum convened leaders from business, government and academia to discuss solutions to society’s biggest challenges. The annual Davos meeting provides insight into some of the key ideas that will shape the year ahead, and this episode of the ESG Insider podcast brings you on-the-ground interviews about one of the biggest topics on the agenda — nature.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

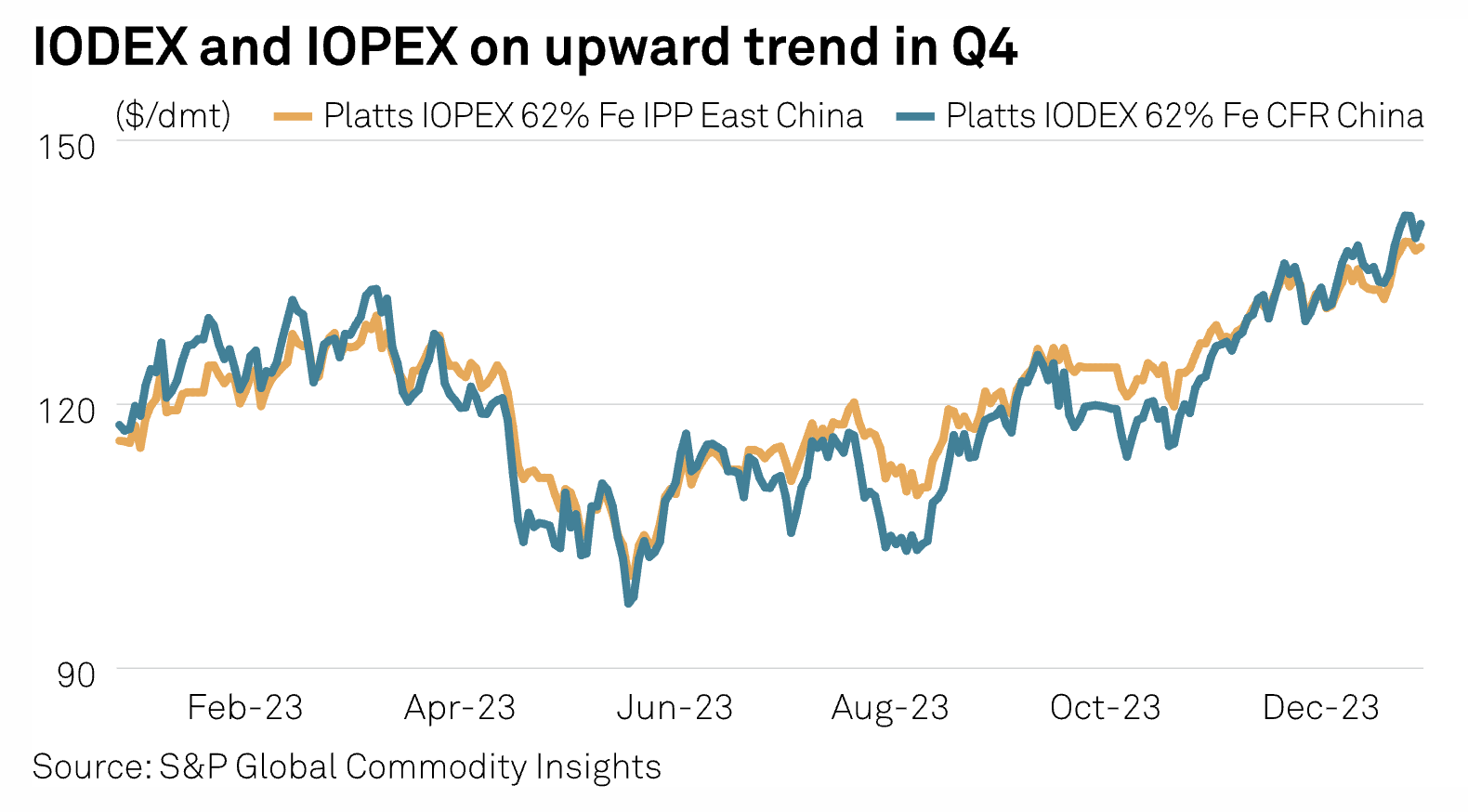

Asian Iron Ore Demand Hangs In Balance With Focus On Q1 Steel Margins

Chinese steelmakers' appetite for seaborne iron ore at the end of Q1 hangs in the balance, with steel margins, thus far held up by the absence of seasonal state-mandated output cuts, to play a decisive role. If steel output leading to China's Lunar New Year continues to be spared from the government curbs, iron ore demand may be secured, market participants said. However, the stock buildup during the holidays could pressure finished steel prices and dampen production margins if domestic demand fails to see an immediate pickup.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

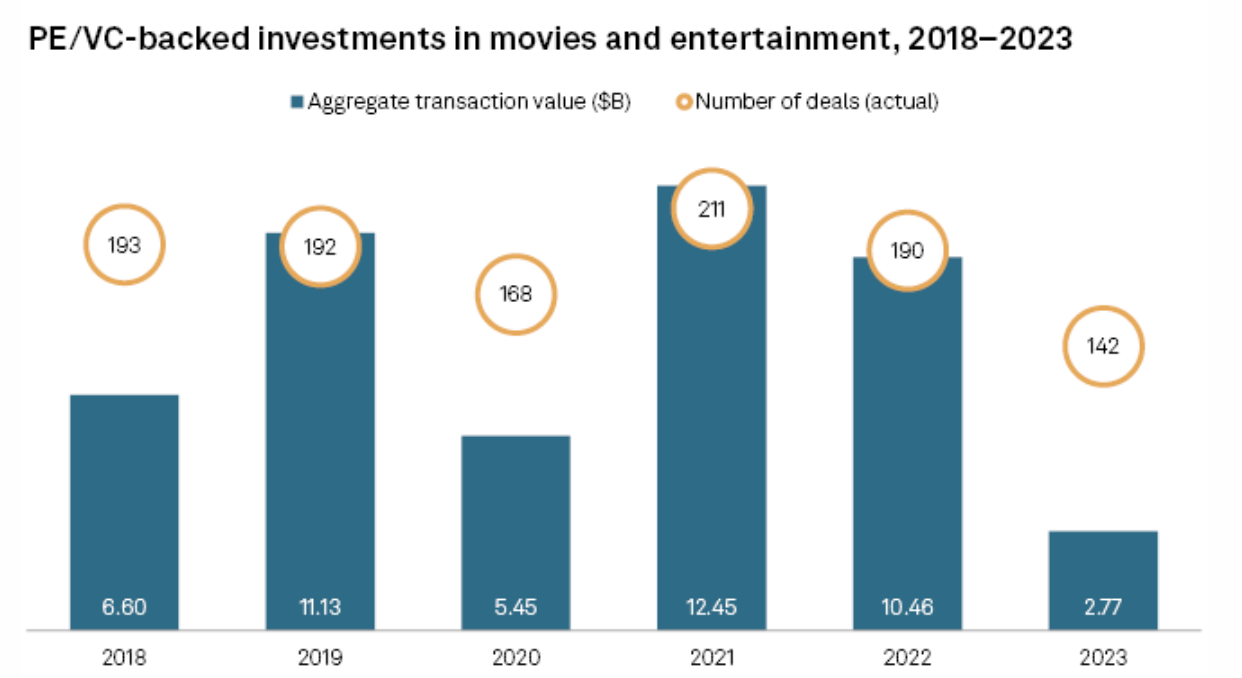

Private Equity Investment In Movies, Entertainment Plunges To 6-Year Low In 2023

Private equity and venture capital investments in movies and entertainment slumped to its lowest level in at least six years in 2023 due to several factors, including the shift to streaming, continued weak advertising and regulatory scrutiny, according to industry sources. Transaction value totaled $2.77 billion, down 73.5% from the $10.46 billion announced in 2022, according to S&P Global Market Intelligence data. The number of deals declined to 142 from 190.

—Read the article from S&P Global Market Intelligence