Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Feb, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

U.S. corporate borrowers powered into 2022 fueled by favorable financing conditions, and economic and credit tailwinds. But as high prices persist and omicron variant threatens to chip away at growth in the world’s biggest economy, American companies still face challenges on the road to recovery.

Now three years into the coronavirus pandemic, the U.S. economic recovery remains intact, even as the spread of the omicron variant has slowed economic activity and inflation has damped consumers’ purchasing power. Many sectors have seen corporate borrowers enjoy recoveries that have helped business activity return to pre-pandemic levels somewhat sooner than expected, but several have yet to experience such regeneration and remain at risk to further COVID-caused disruption. Ongoing supply-chain bottlenecks and corresponding elevated input prices, inflationary pressures that are pushing the Federal Reserve to begin an aggressive cycle of interest rate increases, growing geopolitical risks, and the concentration of corporate debt at the low end of the speculative-grade scale all pose downside risks, according to S&P Global Ratings’ 2022 U.S. corporate credit outlook.

The Fed made clear after its Federal Open Market Committee meeting on Jan. 26 that the U.S.’s expansive growth, strong labor market, and extremely elevated inflation will make for the central bank’s most aggressive tightening of monetary policy since the 1990s. S&P Global Economics anticipates the Fed to raise rates by 25 basis points at least three times this year, followed by five additional increases through 2024.

“The move to lift the cost of borrowing can, of course, be seen as a sign that the U.S. economy is healthy … For most sectors, the continuation of the economic rebound—which will add to revenues—is far more crucial to boosting their bottom lines,” S&P Global Ratings said in its outlook. “It’s still too early to say for certain that 2022 will be characterized by restrictive financing conditions along with more downgrades and defaults … For now, favorable financing conditions prevail, amid the continuing economic rebound, investor hunt for yield, and a recovery in credit quality.”

S&P Global Ratings expects the U.S. trailing 12-month speculative-grade corporate default rate to be 2.5% by September—lower than the long-term 4% average but above the 1.5% rate seen at the end of last year. U.S. corporate debt issuance is likely to shrink this year, marking a second consecutive year of declines. Still, the majority of near-term debt maturities is investment-grade and the aggregate amount of debt coming due to the market—$479 billion this year and $657.5 billion in 2023 for nonfinancial corporates—will be manageable. While some of the nearly $60 billion in ‘BBB’ category corporate debt is at some risk of becoming fallen angels, those sliding into speculative-grade territory would still be below the $65 billion annual average seen in the last decade, according to the outlook.

“Last year, U.S. corporates benefited from an easy credit environment—buoyed by strong economic growth, highly favorable lending conditions, improved performance arising from the pent-up consumer demand, and general optimism around business conditions,” S&P Global Ratings said in the report. “But now, “the concentration of newly rated corporate issuers at the low end of the speculative-grade scale, along with high levels of debt-financed M&A and dividends, continue to weigh post-default recovery prospects. High debt leverage tends to be inversely correlated with recovery rates, as more debt seeks recovery from the same collateral/assets.”

Analysts project that large U.S. companies will look past their looming levels of debt and prioritize growth and returning cash to shareholders in 2022, according to S&P Global Market Intelligence.

"We expect M&A and all sorts of shareholder remuneration; repurchases [buybacks] and dividends and other ways," Gregg Lemos-Stein, global head of analytics and research at S&P Global Ratings, told S&P Global Market Intelligence in an interview. "In some cases, these are risky behaviors, in some cases not … More often than not, M&A is not positive for credit. It leads to downgrades, a combination of more debt, a higher-rated entity bought by lower-rated, or it just doesn't work out that well.”

Today is Tuesday, February 1, 2022, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Data: High Prices Dampen Economic Activity And Moods

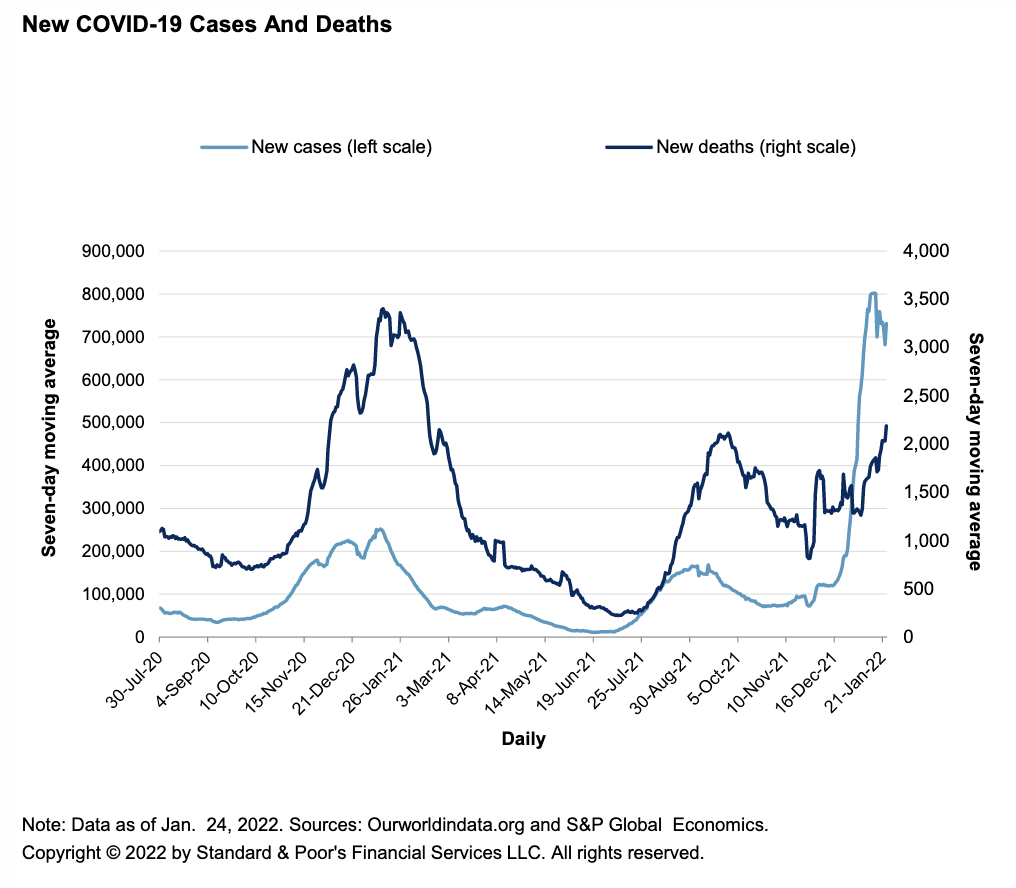

The U.S. economy continues to decelerate in January as omicron slows economic activity and inflation takes a bite out of purchasing power. Since S&P Global Ratings' real-time economic report on Jan. 14, new COVID-19 cases have moderated though are still at extremely high levels. Although it's still a workers' market, initial unemployment benefit applications and absenteeism picked up since late December, weighing on productivity and economic activity this quarter. Fortunately, real-time mobility and economic indicators S&P Global Ratings tracks appear to have stabilized at their recent low levels.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

U.S. Corporate Credit Outlook 2022: New Year, New Risks (Beyond, Of Course, Inflation)

With the third year of the coronavirus pandemic upon us, U.S. corporate borrowers still face a handful of hurdles, including ongoing supply chain disruptions and the elevated input prices that go along with them, as well as inflationary pressures that are pushing the Federal Reserve to begin what promises to be an aggressive cycle of interest rate increases. For now, favorable financing conditions prevail, amid the continuing economic rebound, investor hunt for yield, and a recovery in credit quality.

—Read the full report from S&P Global Ratings

Access more insights on capital markets >

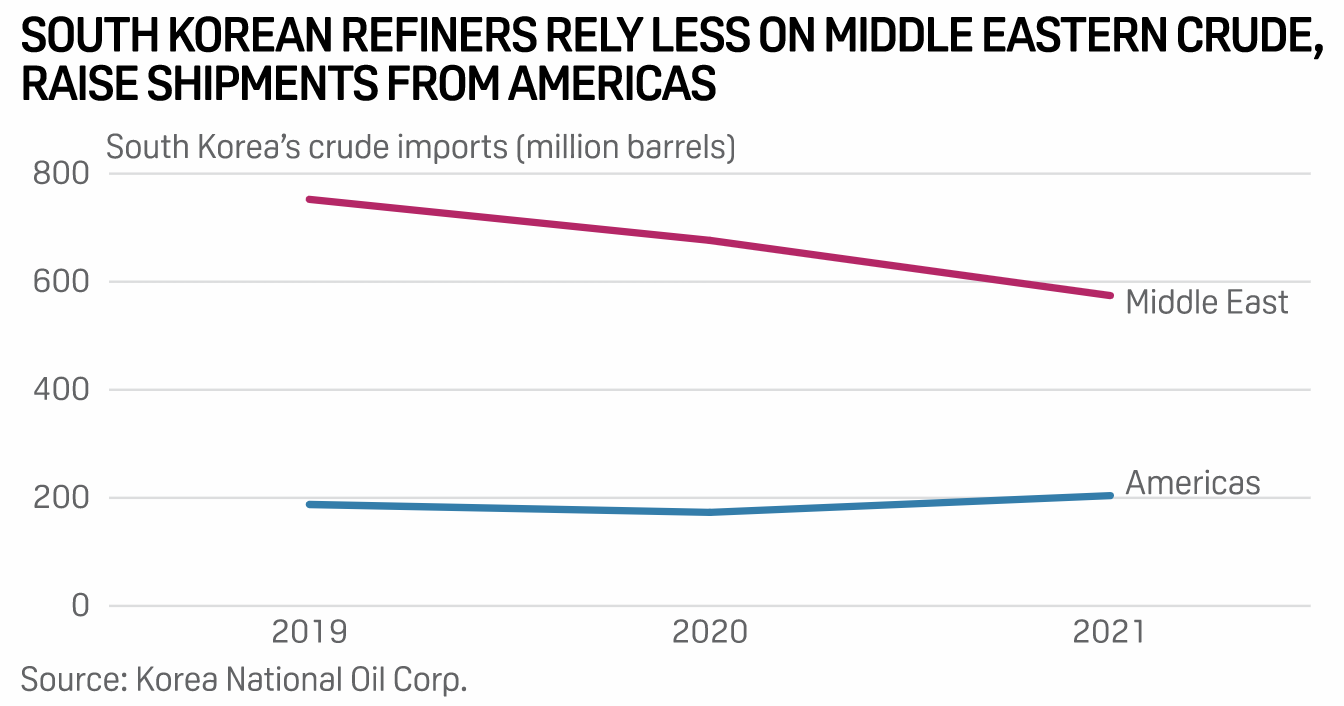

South Korea's Dependence On Middle Eastern Crude Hits 25-Year Low In 2021

South Korea's dependence on Middle Eastern crude hit a 25-year low in 2021, latest data from state-run Korea National Oil Corp. showed, reflecting the country's growing interest in cheap and abundant supplies in the Americas amid tight Persian Gulf production and expensive official selling prices. The world's fifth biggest crude importer bought 574.4 million barrels from Middle Eastern suppliers in 2021, accounting for 59.8% of 960.2 million barrels refinery feedstock purchased during the year, the lowest since 59.4% in 1986, the KNOC data showed.

—Read the full report from S&P Global Ratings

Access more insights on the global trade >

Listen: What The Gas And Nuclear Debate Around The EU Taxonomy Means For Investors

At the beginning of January 2022, a key element of the EU’s sustainable finance policy came into effect—the green taxonomy, a kind of dictionary of sustainable activities. Investors must now disclose how their funds meet taxonomy climate-related requirements, while large companies need to report on how much of their business is in line with the taxonomy. To find out how investors are viewing the debate, ESG Insider speaks to Rachel Ward, policy programme director at the Institutional Investors Group on Climate Change, Matthias Fawer, a senior analyst for ESG & Impact Assessment at Vontobel Asset Management, and Alexander Lehmann, head of the Sustainable World Academy at Frankfurt School of Finance and Management.

—Listen and subscribe to the Essential Podcast, a podcast from S&P Global Sustainable1

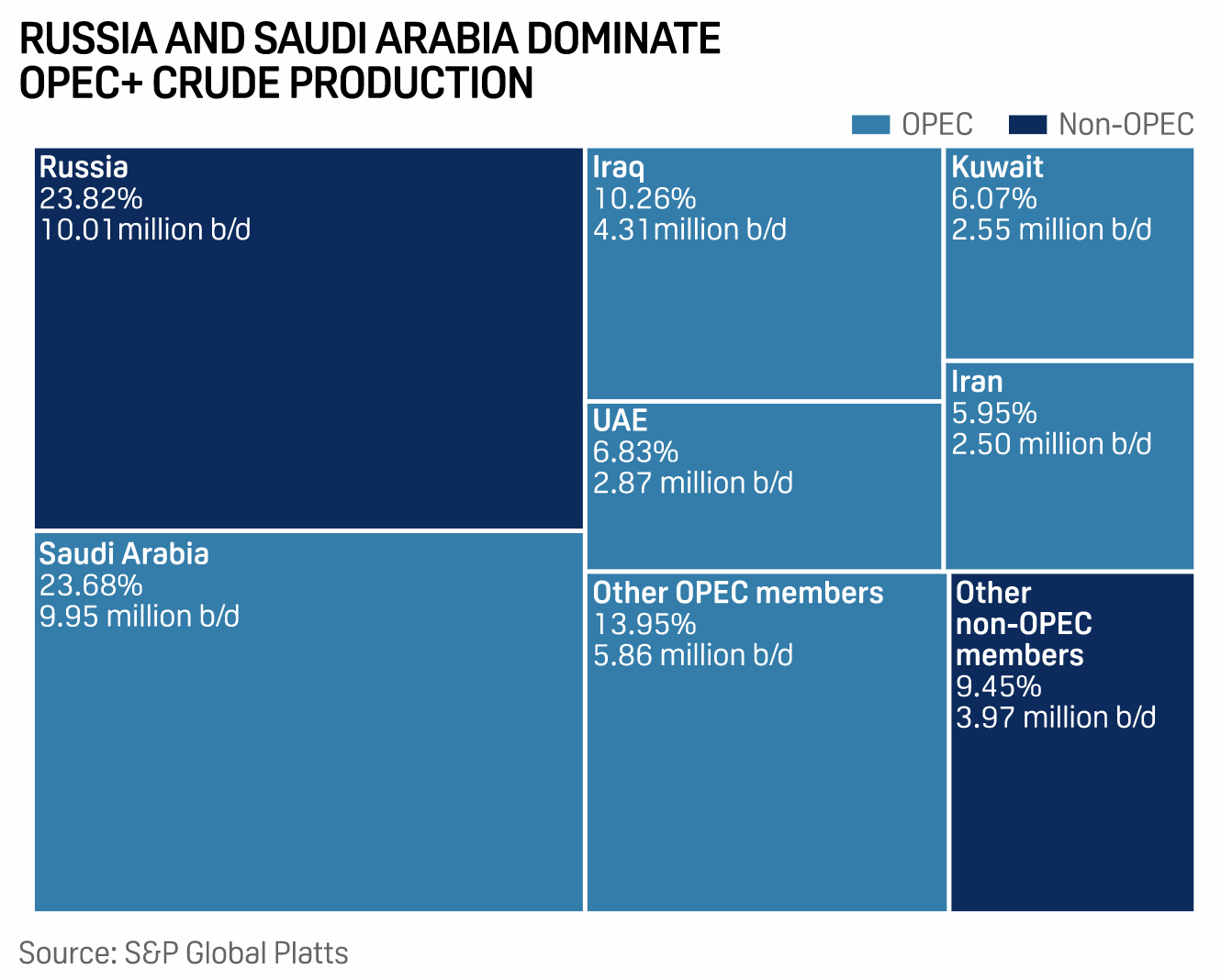

OPEC+ Ministers To Set March Oil Quotas Under The Cloud Of Potential Russia Sanctions

OPEC and its allies are largely expected to affirm another 400,000 b/d hike in crude oil production quotas for March when they meet Feb. 2, but sure to be weighing on the virtual discussions will be the elephant in the room—potential Western sanctions on Russia. Should those sanctions come to pass, the oil market could be suddenly cut off from the world's second largest producer behind the U.S., at a time when global demand is roaring back from the pandemic.

—Read the full report from S&P Global Platts

Access more insights on energy and commodities >

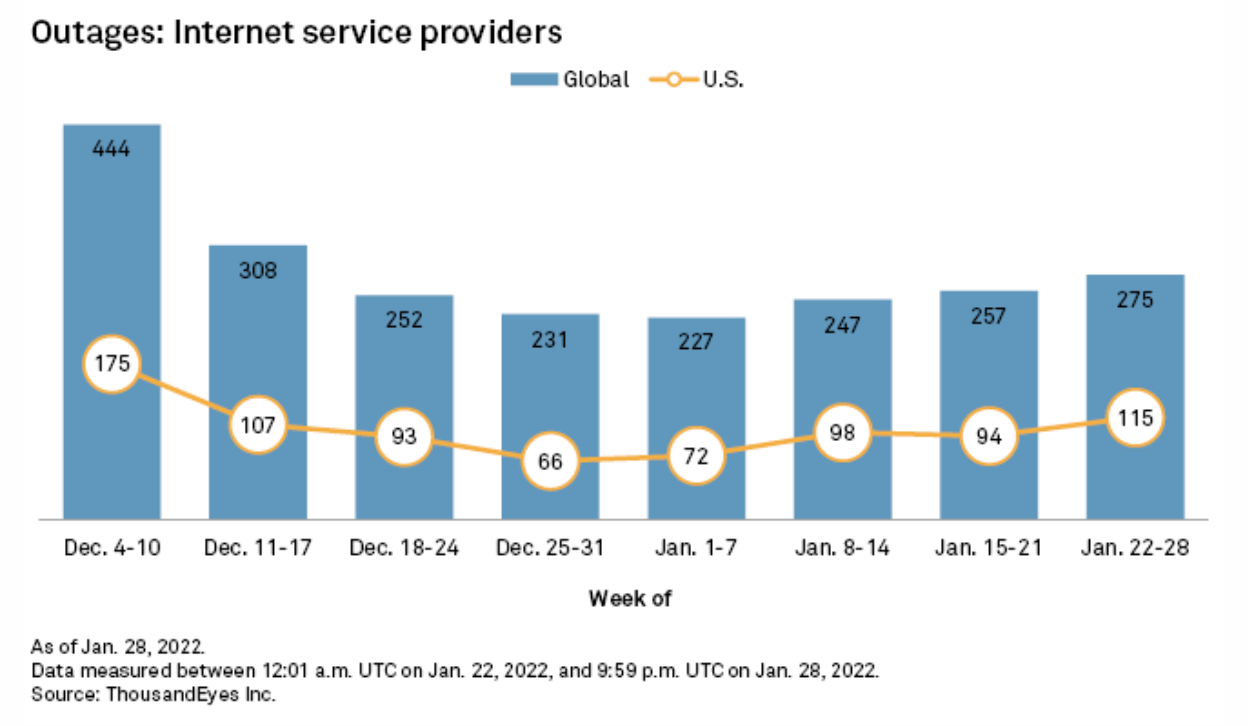

U.S. Internet Outages Surge 22% In 3rd Week Of January

The number of global internet outages continued to increase in the week of Jan. 22, rising 7% to 275, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. U.S. disruptions surged 22% to 115 from 94 in the preceding week. The current total comprised 42% of all global disruptions, an increase from 36% in the week of Jan. 15.

—Read the full article from S&P Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.

Content Type

Location

Language