Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Dec, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Panama Canal Restrictions Affect LNG Trade

Low water levels exacerbated by drought conditions have generated a logjam of vessels traversing one of the world's busiest canals. Billions of dollars in global trade cross the 51-mile Panama Canal each year, but drought has reduced water availability for the canal's lock system, which relies on millions of gallons of water to usher ships from ocean to ocean.

The Panama Canal Authority imposed water-saving restrictions earlier in the year, began capping the number of daily ship traversals and placed restrictions on ship weight. These conditions and subsequent restrictions have significantly affected energy commodities, as the canal is a key route for exports from the US East Coast to Asia.

Vessels carrying LNG and petroleum products are seeking alternative routes amid the Panama Canal restrictions. Several LNG importers in Asia have looked to the Suez Canal as one such alternative; however, these carriers must consider additional risk factors on these routes, such as maritime disruption or war risk premium stemming from conflict in the Middle East.

These alternative routes would greatly extend travel time for cargo from the US to Asia ahead of winter, when electricity consumption and LNG imports are high. Moving cargo from the US Gulf Coast to Japan via the Panama Canal, for example, would take about 20 days, compared to over a month via the Suez Canal or about 40 days via the Cape of Good Hope. Time is money when it comes to transit costs. Rather than take the longer voyage through alternative routes, LNG vessels are participating in pricey auctions to expedite their transit through the Panama Canal. One vessel paid nearly $4 million for an open slot in an auction in early November.

The number of Very Large Gas Carriers transiting the Panama Canal is projected to almost halve by February 2024, and there are concerns that those transits will reduce to zero come January. Liquefied petroleum gas ships get lower priority than LNG ships for booking slots, prompting priority transit negotiations. These, on top of high auction prices, can price out other ships and increase concerns over premiums that lifters face in renegotiating term LPG contracts for US cargoes.

El Niño's return to the Pacific brings warmer, drier conditions as Panama faces its driest rainy season in decades, raising concerns of prolonged canal bottlenecks. The Panama Canal Authority plans to spend between $800 million and $900 million building a new reservoir, which could be operational in five years. But costs are mounting as carriers auction for transit spots and traverse longer alternative routes.

Today is Wednesday, December 20, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

Flash PMIs Point To Widening Growth Divergences As 2023 Draws To A Close

Early PMI survey data for December from S&P Global showed the major developed economies collectively stagnating. However, trends varied, with the eurozone slipping deeper into decline to signal a recession, but modest growth was seen in the UK, Japan and US. The surveys continue to indicate that service sector growth remains very subdued in the G4 on average relative to the growth surge seen in spring and summer, but looser financial conditions — based on expectations of lower interest rates in 2024 — have benefitted the US and UK in particular as 2023 draws to a close. Manufacturing, in contrast, remains firmly in decline, with output falling across all four economies, dropping most notably in the eurozone.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

US REIT Capital Offerings Skyrocket In November

US equity real estate investment trust capital market activity soared in November, with the industry pulling in $5.06 billion during the month, a massive increase from $1.32 billion raised in October. The total was 89.3% higher than the $2.67 billion the industry collected in November 2022, according to S&P Global Market Intelligence data. Nearly all of the capital raised in November came via debt as REITs secured $5.05 billion through note offerings. Common equity offerings accounted for $2.7 million, while the remaining approximately $900,000 was obtained through preferred equity offerings.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Guyana Is A Wildcard In Venezuelan Sanctions Picture: Consultant

In October, the US agreed to ease sanctions on Venezuela in exchange for progress toward a fair election next year. But Venezuela has not fully held up its side of the US sanctions deal, and now it is threatening to annex the oil-rich Essequibo region of neighboring Guyana. David Goldwyn, president of Goldwyn Global Strategies LLC, joins the podcast to discuss the status of US sanctions on Venezuela and what comes next.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

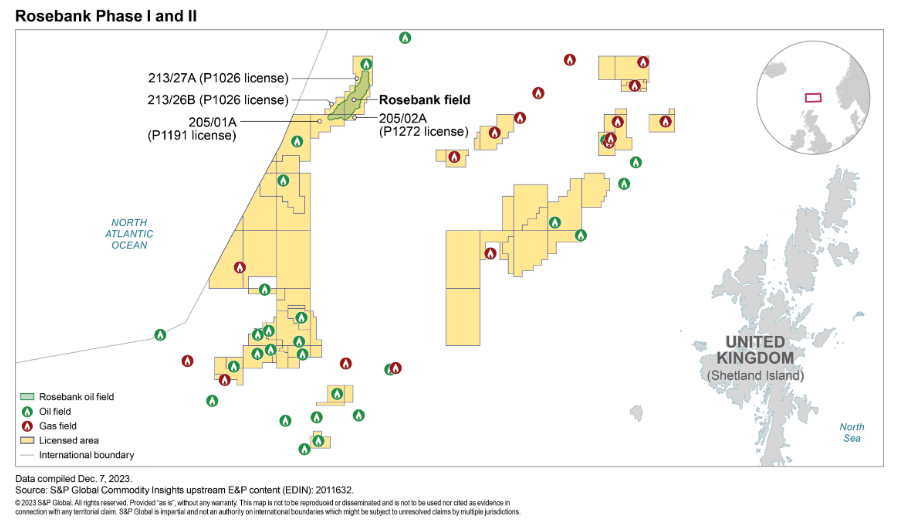

Rosebank Field, Strategic Development In The UK For Decarbonization And Energy Security

The escalating global demand for hydrocarbons, fueled by a growing population and intensified industrialization, has taken a toll on the environment and poses substantial environmental challenges. Projections by the International Energy Agency indicate a demande surge of an annual average of 102 million barrels per day this year, climbing by 2.2 million barrels daily from 2022 values. Recognizing the pressing need for sustainable practices, innovative solutions and low-emissions projects is imperative.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

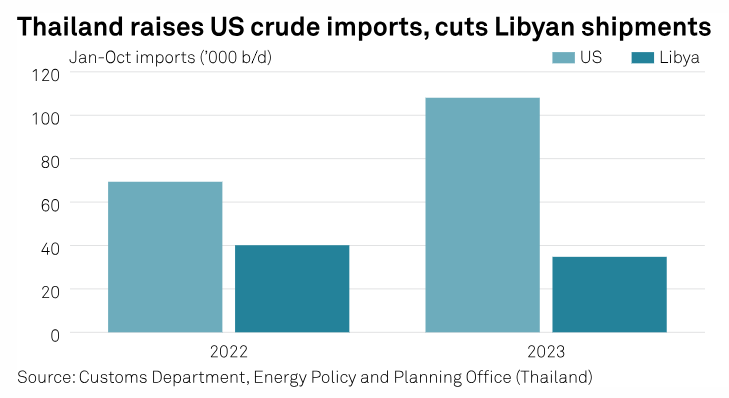

Some Asian Refiners Mull Non-Red Sea Routes To Bring In North African, Mediterranean Crude

A few Mediterranean and North African crude grades that regularly feed several East Asian refiners could take the Cape of Good Hope shipping lane for delivery instead of the regular Suez Canal route, with Thai, Indonesian and South Korean refiners looking to avoid Red Sea shipping risks and safely bring CPC Blend, El Sharara, Saharan Blend and Azeri Light crude home.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech Episode 144: The Technology Demand Indicator

Vectors have an important property — they have both scale and direction. A new research product, the Technology Demand Indicator, offers this perspective in evaluating tech trends, and research director Liam Eagle and analyst Malav Parekh join host Eric Hanselman to discuss how it was developed and where it can be used. The panels built from the 451 alliance generate insights that can provide direction.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence