Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Dec, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Methane Stinks

Much of the news coming out of the fractious 2023 UN Climate Change Conference in Dubai, United Arab Emirates, seems to reflect one point of agreement: methane stinks. The largest component of natural gas, methane is a colorless, odorless gas. It therefore does not literally stink. It is also useful and adaptable, an important feedstock for hydrogen, fertilizers and other useful chemicals, and produces significantly less carbon emissions than coal or oil when burned. So, why the turned-up noses?

Methane’s public relations problems all come back to the same issue: It's a greenhouse gas that impacts global warming, by some estimates, 80 times more than CO2. While methane releases CO2 when burned, it causes much more damage when released into the atmosphere without burning, through flaring or when leaked through energy infrastructure.

This makes the reduction of methane emissions something that most stakeholders at the UN conference can agree upon. Oil and gas companies are happy to sign up for methane emission reduction pledges. The top 50 companies have committed to setting interim targets that would reduce methane emissions to 0.2% of oil and natural gas production by 2030 and end routine flaring. State oil companies have also committed to lowering methane emissions. Indonesia's Pertamina committed to a 7.6% reduction in methane emissions, a 5.5% reduction in carbon emissions and a 16.7% reduction in utilization of flares. Countries such as China have promoted their efforts at methane emission reduction at the conference and have offered to help other emerging market economies reduce their methane emissions. John Kerry, US special presidential envoy for climate, endorsed methane emission reductions as the "easiest, quickest, fastest, cheapest way” to make progress against global warming.

Of course, reducing methane emissions so that more methane can be burned for energy is something of a paradox for climate activists: Even the best possible use of methane contributes to climate change.

Today is Tuesday, December 12, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

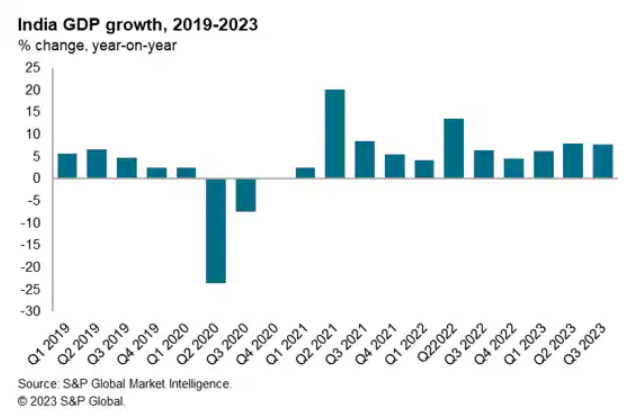

India Seizes Crown Of Fastest Growing G20 Economy

As 2023 draws to a close, India is set be the fastest growing economy in the G20 grouping of large nations. After rapid economic growth of 7.2% in the 2022-23 fiscal year, India's GDP growth rate in the fiscal year 2023-24 is forecast to be 6.9%. GDP growth remained buoyant in the July-September quarter of 2023, at 7.6% year-over-year (y/y), after growth of 7.8% y/y in the April-June quarter.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

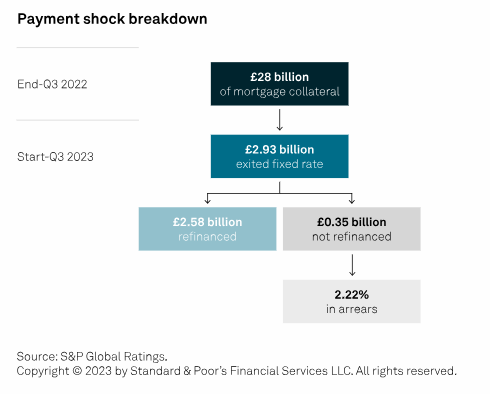

UK RMBS Is Set To Withstand Payment Shock

The UK Bank of England base rate has been increasing steadily since December 2021, now standing at a 15-year high of 5.25%. Although mortgage rates have fallen in recent weeks, a higher for longer rate environment looks a realistic scenario. In this report, S&P Global Ratings takes a closer look at how owner-occupied borrowers backing UK prime residential mortgage-backed securities (RMBS) transactions who have faced payment shock have performed since their monthly payments have increased.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

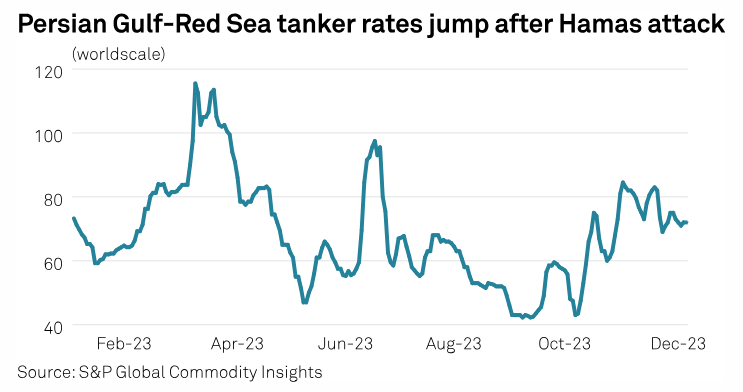

Shippers Avoiding Red Sea Transits After Attacks, Watching Suez Canal Traffic

Shippers are diverting from Middle East transit routes in response to a growing number of drone attacks in the Red Sea and Gulf of Aden, shippers and industry have warned. Some shippers are avoiding the region entirely and instead choosing to transit around Africa, and this is adding about two weeks to their voyages and increased emissions, David Loosley, secretary general of shipping industry group Bimco, said Dec. 10 on the sidelines of the Shaping the Future of Shipping summit held at the Museum of the Future in Dubai.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

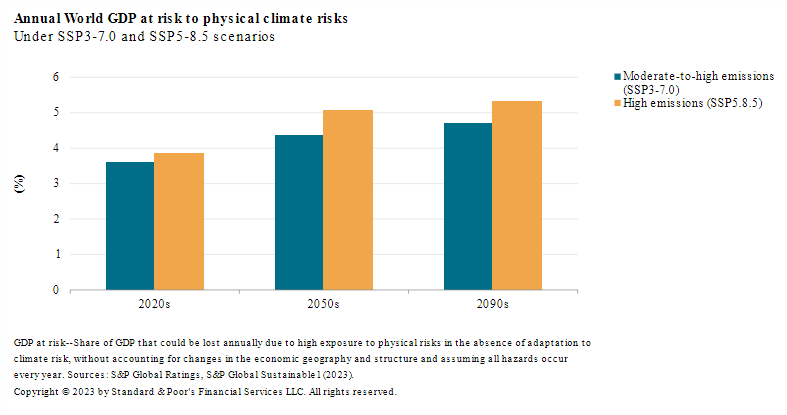

Sustainability Insights: GCC Sovereigns Can Manage Physical Climate Risks For Now

Water stress and extreme heat events are the climatic hazards most likely to worsen in the Gulf Cooperation Council (GCC) by the middle of this century. S&P Global Ratings views these as compound climate hazards, with extreme heat events likely to exacerbate water stress, potentially leading to loss of productivity. Adaptation and resilience measures to reduce related impacts are largely in place, but as climate hazards intensify, they will increasingly pose challenges for the region.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Listen: Oil Sector Advised To "Be Vigilant, Not Afraid" In Facing Wave Of Climate Lawsuits

There are more than two dozen cases filed by US cities and states pending, with allegations that Big Oil knew about the dangers of burning fossil fuels and actively hid that information from consumers and investors. Lauren Varnado, an oil and gas trial lawyer and Houston office managing partner at the law firm of Michelman & Robinson, joined the podcast to talk about this new form of climate litigation and its impacts on the oil industry.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

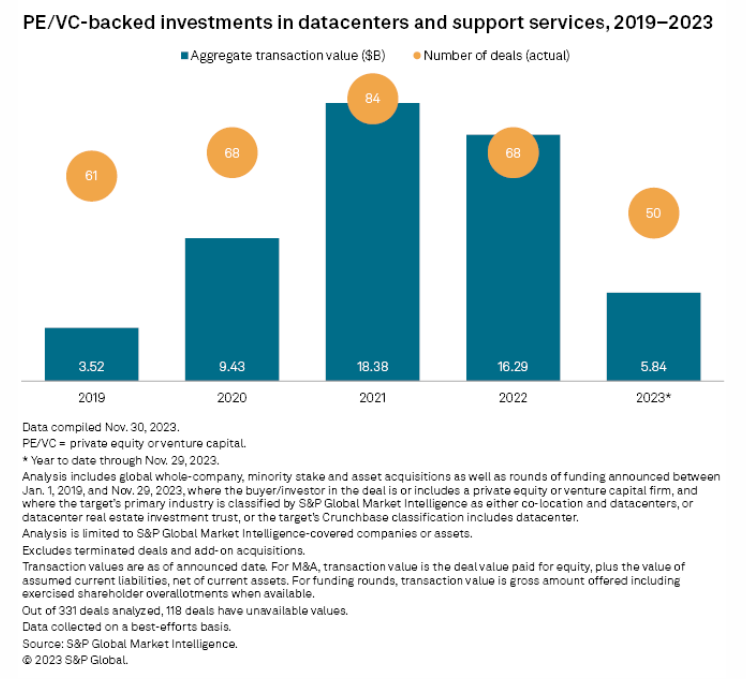

Private Equity Bets On AI Gold Rush With Billions Pumped Into Datacenters

The financial rewards promised by bets on artificial intelligence have grabbed investor attention, but private equity appears to be more attracted to datacenters that house the computing capacity enabling AI. The strategy could be described as a picks-and-shovels investment amid an AI gold rush. Private equity remains the dominant force in datacenter M&A, drawn by a growth trajectory expected to persist through both good and bad economic times and now supercharged by the proliferation of AI.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language