Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Having agreed to a definitive merger in a $44 billion all-stock transaction that includes $4.8 billion of net debt, New York-based S&P Global and London-headquartered IHS Markit’s deal will, subject to regulatory review, bring together two of Wall Street’s largest financial data providers in the biggest acquisition this year.

"We looked at how could we leapfrog and accelerate and actually be transformative with providing data and analytics to our customers in all these spaces that we see as the fastest growth areas. We identified IHS Markit as a partner," S&P Global President and CEO Douglas Peterson, who will lead the combined company, said during a Nov. 30 call with investors and analysts.

"This transaction is a win for both IHS Markit and S&P Global as we leverage our respective strengths in information, data science, research, and benchmarks," Lance Uggla, chairman and CEO of IHS Markit, said in a Nov. 30 statement.

While global mergers and acquisitions (M&A) have declined steadily during the coronavirus crisis—indicating that some investors have been hesitant to pursue greater-sized deals—financial M&A deals in the U.S. and worldwide have increased.

On Oct., 11 M&A deals with U.S. bank and credit unions and mutual savings banks were announced, bringing the total number of deals in the industry to 92 but still below last year’s 219 in the same period, according to S&P Global Market Intelligence. If successful, the forthcoming merger of three state-owned Indonesian lenders’ Islamic banking units will create Indonesia’s seventh-largest bank.

While M&A transactions in global financials sectors increased 24.6% year-over-year in the third quarter, another S&P Global Market Intelligence analysis found that global deals overall declined 29.1%, and global transaction values dropped 53.2% in July- September. Similarly, upwards of $100 billion worth of M&A deals have been terminated during the first half of the year due to the pressures of the pandemic.

Deal-making across industries outside of the financials space, including insurance and oil and gas, have also not suffered during the downturn.

Full-year M&A activity in the U.S. insurance industry, according to S&P Global Market Intelligence’s forecast, is expected to slightly surpass last year’s total—creating the potential for prospective buyers and sellers to prioritize M&A in the sector as they respectively face challenges to top-line growth and needs to re-evaluate strategic priorities in light of current conditions. In the U.K.’s insurance market, the COVID-19 crisis has created a competitive environment with cost pressures that, combined with demands for technological innovation and economies of scale, has driven a surge of M&A activity, according to S&P Global Ratings.

Meanwhile, deal-making has increased tremendously across the oil and gas industry as the pandemic has pummeled demand. Many independent oil and gas companies, particularly in the U.S., have consolidated in order to stay afloat. Notable M&A deals this year occurred in October, including ConocoPhillips' $9.7 billion acquisition of Concho Resources, which includes $3.9 billion of debt; and Pioneer Natural Resources Co.'s all-stock acquisition of Parsley Energy, which, if the deal goes through, will solidify the combined company as the Permian Basin’s largest independent exploration and production player.

Across all industries, market participants anticipate environmental, social, and governance (ESG) issues to play a larger role in deal-making. In Asia, private equity firms are already emphasizing environmental risk as a key component of successful M&A agreements.

"Environmental issues are the biggest risk among ESG factors to avoid in pursuing a deal," Rokuro Hara, the chief executive officer of the Japanese private equity firm J-STAR Co. Ltd., told S&P Global Market Intelligence. "Investors want to entrust money to a manager [at PEs] that has developed an ESG policy.”

Today is Tuesday, December 1, 2020, and here is today’s essential intelligence.

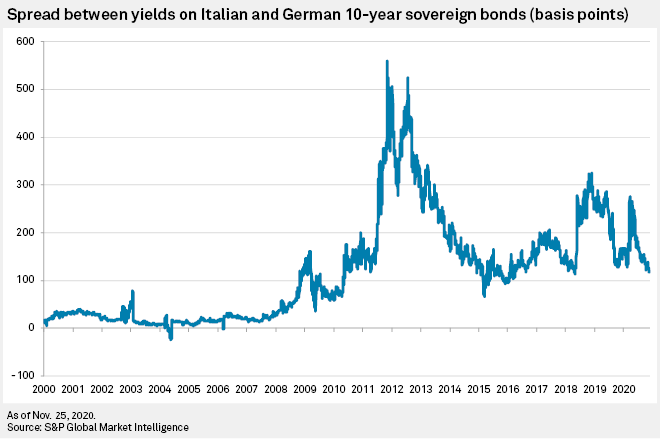

Even ECB Buying Cannot Return Euro-Area Sovereign Spreads To 2008

Euro area spreads have narrowed sharply as a result of asset purchases by the European Central Bank, but investors continue to demand a risk premium for holding the sovereign debt of countries such as Italy on the periphery of the eurozone over core members like Germany, even with the bank expected to reinforce its role as a backstop to the market by increasing its asset purchasing package in December.

—Read the full article from S&P Global Market Intelligence

U.S. Investment-Grade Credit Spreads Return To Pre-COVID Levels – Risk Monitor

As far as U.S. investment-grade corporate bonds go, the coronavirus pandemic is as good as over. The ICE Bank of America investment grade corporate spread narrowed by 2 basis points in the week to Nov. 26 to 116 bps. The spread has now reversed 96% of the widening experienced during March when the implications of the pandemic for U.S. financial markets hit home.

—Read the full article from S&P Global Market Intelligence

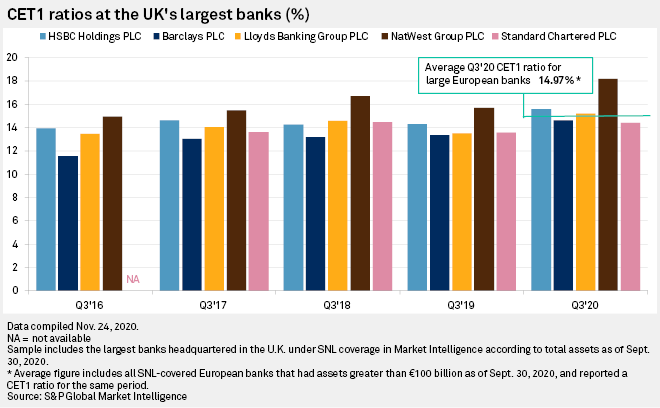

UK Banks' Capitalization Reaches New Highs, But Dividends Still On Hold

British banks have improved their capital levels over the past several years, helped by regulatory intervention, but there are doubts over when they will return to paying dividends.

—Read the full article from S&P Global Market Intelligence

Weak Demand A Bigger Problem Than Funding For India's Nonbank Mortgage Lenders

While recent policy changes in India have mitigated the liquidity pressure facing some of the housing finance companies, nonbank mortgage lenders may not see a significant turnaround unless the government rolls out more measures to boost demand for homes, experts say.

—Read the full article from S&P Global Market Intelligence

Listen: Street Talk Episode 71 - Hotel Sector Faces Tough Sledding Until Full COVID-19 Solution

Banks' credit quality remained quite strong through the third quarter. However, industries more exposed to the COVID-19 pandemic, such as the hospitality sector, have caused a headache for many institutions, and performance is unlikely to rebound soon.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

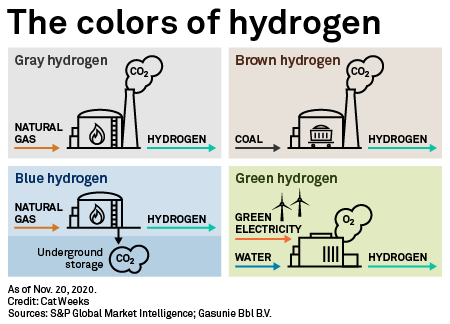

Hydrogen Era No Longer A Distant Mirage

The potential future of carbon-free energy is taking shape in an unlikely place: the Texas oil patch.

—Read the full article from S&P Global Market Intelligence

Colorado Operators To Face Most-Stringent Drilling Setbacks In U.S.

Colorado producers on Jan. 15 will face the most-stringent drilling setback rules in the US, when buffers quadruple to 2,000 feet as a backlog of 6,000 pending permits have built up in state regulatory offices over the past year.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Nov 30-Dec 4: OPEC+ To Make Crucial Decision, As European Steel Expects Italian Announcement

The highlights this week on S&P Global Platts Market Movers EMEA: OPEC+ in the driving seat with crucial output decision; ArcelorMittal Italia's looming public-private stake; second UK-France subsea cable in testing; European gas storage withdrawals pick up; and recycled plastics new tax boosts demand.

—Watch and share this Market Movers video from S&P Global Platts

Crude Oil Futures Fall After Stalemate Sees OPEC Delay Meeting

Crude oil futures fell during mid-morning trade in Asia Dec. 1 after OPEC members failed to agree on extending current output cuts and have delayed the second day of its meeting to later in the week.

—Read the full article from S&P Global Platts

Investor Jitters Persist As Canadian Natural Gas Outlook Improves

Improved prices and better access to markets do not appear to have allayed investor concerns that natural gas traded at Canada's benchmark hub could crash to sub-zero prices once more.

—Read the full article from S&P Global Market Intelligence

Nevadans Push For State Mining Tax Hike To Help With Pandemic Budget Crisis

Industries that have long reigned in Nevada, such as its famous gaming sector, have been rocked by the pandemic, burning a hole in the state budget in the process. Seeking to plug a $1.2 billion deficit, state Democratic lawmakers have targeted the mining industry, which has enjoyed a cap on its tax rate as old as the state itself.

—Read the full article from S&P Global Platts

Listen: The Road Ahead For Japan’s Crude And Refined Product Imports

The pandemic has pummeled Japan's oil demand and led to some dramatic drops in its crude imports and refinery runs. The onset of winter and subsequent rise in demand for heating oil has offset some of that collapse, but the road ahead continues to look uncertain. While crude imports are expected to pick up in the near term, sustainability of that trend very much depends on the severity of COVID-19. What is looking certain however is that Japanese refiners will continue to import refined products as refining economics favor imports and run rates remain low.

—Listen and Subscribe to Global Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language