Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Strong Demand, Favorable Government Policies Propel Green Steel

Green steel is made with a much lower carbon-intensive production process than traditional steelmaking. While the carbon intensity of steel production has dropped in recent years, overall emissions from steelmaking have increased with global demand. Many steel producers are looking for ways to replace the fossil fuels used in steelmaking with greener methods. Early demand for green steel appears to be quite robust, and governments in the US and the EU have created incentives and policies that allow green steel to compete with traditional steel, despite the cost premium. Two recent podcasts from S&P Global Commodity Insights — “Building out green steel for the energy transition” and “How is Europe’s steel industry rising to the challenge of energy transition” — focused on green steel.

There is no single, agreed-upon definition of green steel. Most people involved in the steel industry base their definition on the carbon intensity or footprint of the steel, rather than the technology used. Steel can be made from either recycled scrap or iron ore, with 70% of global steel made from ore, typically using a blast furnace. The high temperatures required by blast furnaces are provided by coke, which is a carbon-intensive, coal-based fuel. Using natural gas for blast furnaces cuts emissions up to 50%, but greenhouse gases are still emitted from upstream methane leakage and carbon burning. Swapping out the natural gas with green hydrogen cuts emissions for primary steelmaking by up to 90%, depending on how the hydrogen is produced.

In the US, where there is plentiful scrap, the collection of which has become very efficient, 70% of steelmaking comes from recycled scrap. Because the processing of recycled scrap is based on electricity, the steel industry is less emissions-intensive in the US. The other 30% of production, primary steel, accounts for most of the emissions for the sector. Over the next decade, 50% of primary production facilities in the US will have to decide whether to continue using coal and natural gas or to retrofit manufacturing facilities for lower emissions. The Inflation Reduction Act and other Biden administration policies in the US create a pathway that makes it cost competitive to retrofit facilities.

US demand for green steel from the private sector, especially automakers, is important for the development of green steel facilities. The certainty provided by contracted buyers allows for investment in clean production assets. According to some estimates, over 5 million tons of green steel will be required by 2030, enough volume to warrant multiple green steel production facilities.

The European steel industry is more advanced than the US’ in developing a market for lower CO2 emission steel. Because of the emissions rules codified in the EU's impending Carbon Border Adjustment Mechanism scheme, steelmakers in the region have been investing in new equipment and less carbon-intensive production routes to cut emissions. Now, many are looking for a return on their investments in the form of premiums for certified carbon-accounted steel over standard material. Swedish company H2 Green Steel is already building a large-scale production facility using green hydrogen instead of coal. Northern Sweden, where the facility is located, has an abundance of hydropower and onshore wind, plus high-grade iron ore, which allows H2 Green Steel to produce green hydrogen and use it on-site to produce green iron, a key ingredient in green steel.

Especially in Europe, steel producers are finding that there is a big appetite to pay the price premium for green steel. As European companies confront their scientifically determined emissions targets, they have realized they require green steel, though there still isn’t much green steel available.

Today is Friday, August 4, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Worldwide Producer Prices Deflation Slows in July Amid Rising Wage Pressures

Average prices charged by factories for their goods fell worldwide for a third month in a row in July, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global. However, the rate of decline moderated, as deflationary forces from falling raw material and energy costs, as well as weaker demand-pull forces, were partially countered by increasingly elevated wage pressures. The data therefore hints at some stubborn stickiness of core inflation globally.

—Read the full article from S&P Global Market Intelligence

Access more insights on the global economy >

Listen: Leveraged Finance & CLOs Uncovered Podcast: LSF10 XL Investments S.a.r.l. (Xella)

In this latest episode of our Leveraged Finance & CLOs Uncovered Podcast is out. This time, we discuss how rising interest rates and decreasing consumer confidence led to a downgrade of building material maker LSF10 XL Investments S.a.r.l. (Xella).

—Listen and subscribe to Leveraged Finance & CLOs Uncovered, a podcast from S&P Global Ratings

Access more insights on capital markets >

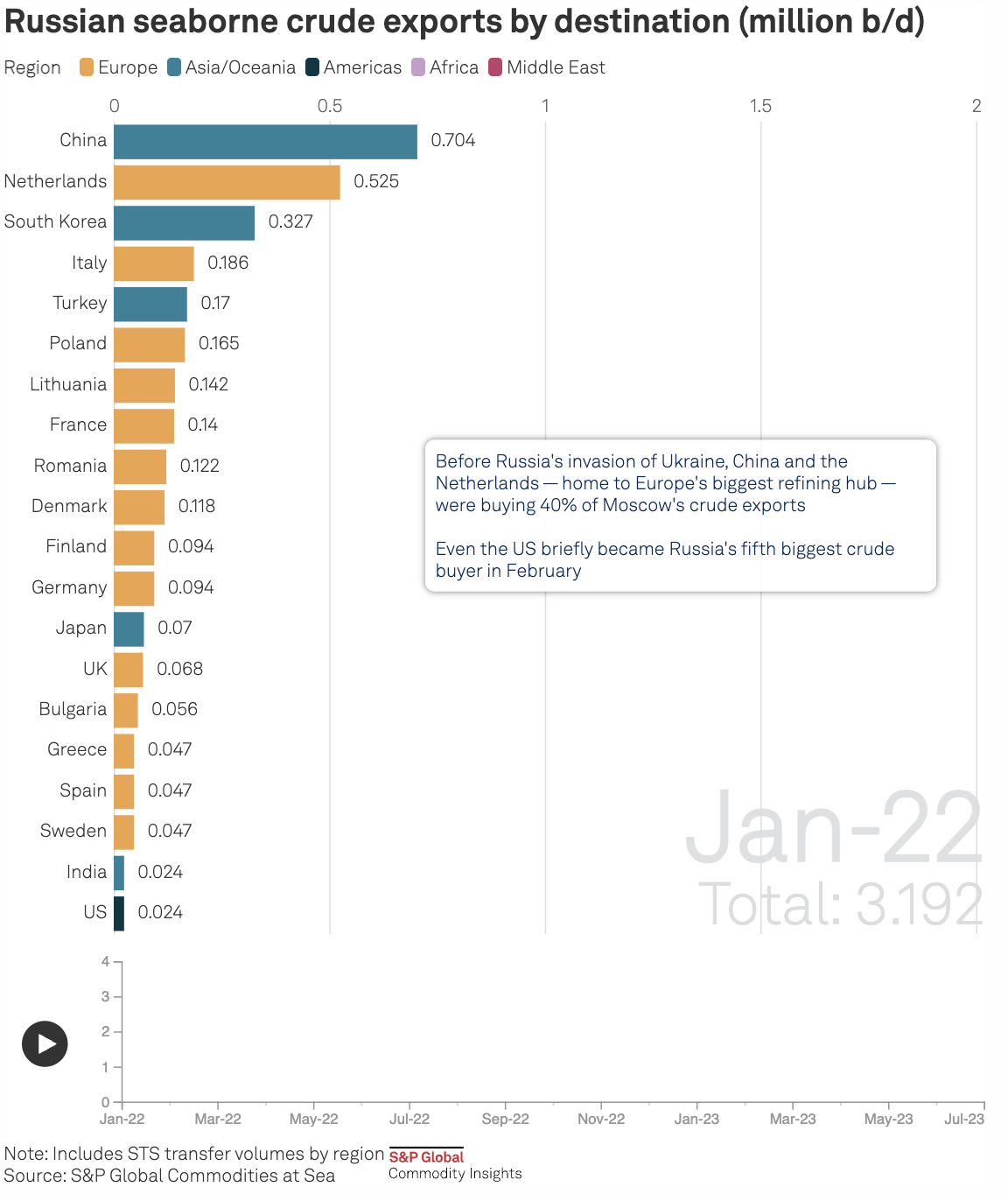

Global Oil Flow Tracker: Recording Changes to Russian Oil Exports and EU Oil Imports Since the War in Ukraine

Russia’s war in Ukraine has triggered a major upheaval in the global oil markets, forcing Moscow to find alternative buyers and Europe to source new supplies as Western sanctions seek to clamp down on Moscow’s vital oil revenues.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability Insights: California’s Evolving Insurance Market Has Mixed Impacts

The recent move by a few major insurers to discontinue writing new homeowners' business in California is not unique compared with the wider U.S. insurance market. Higher insurance premiums in California could exacerbate homeowner affordability pressures, potentially leading to weaker credit quality in the long term for USPF entities.

—Read the full article from S&P Global Ratings

Access more insights on sustainability >

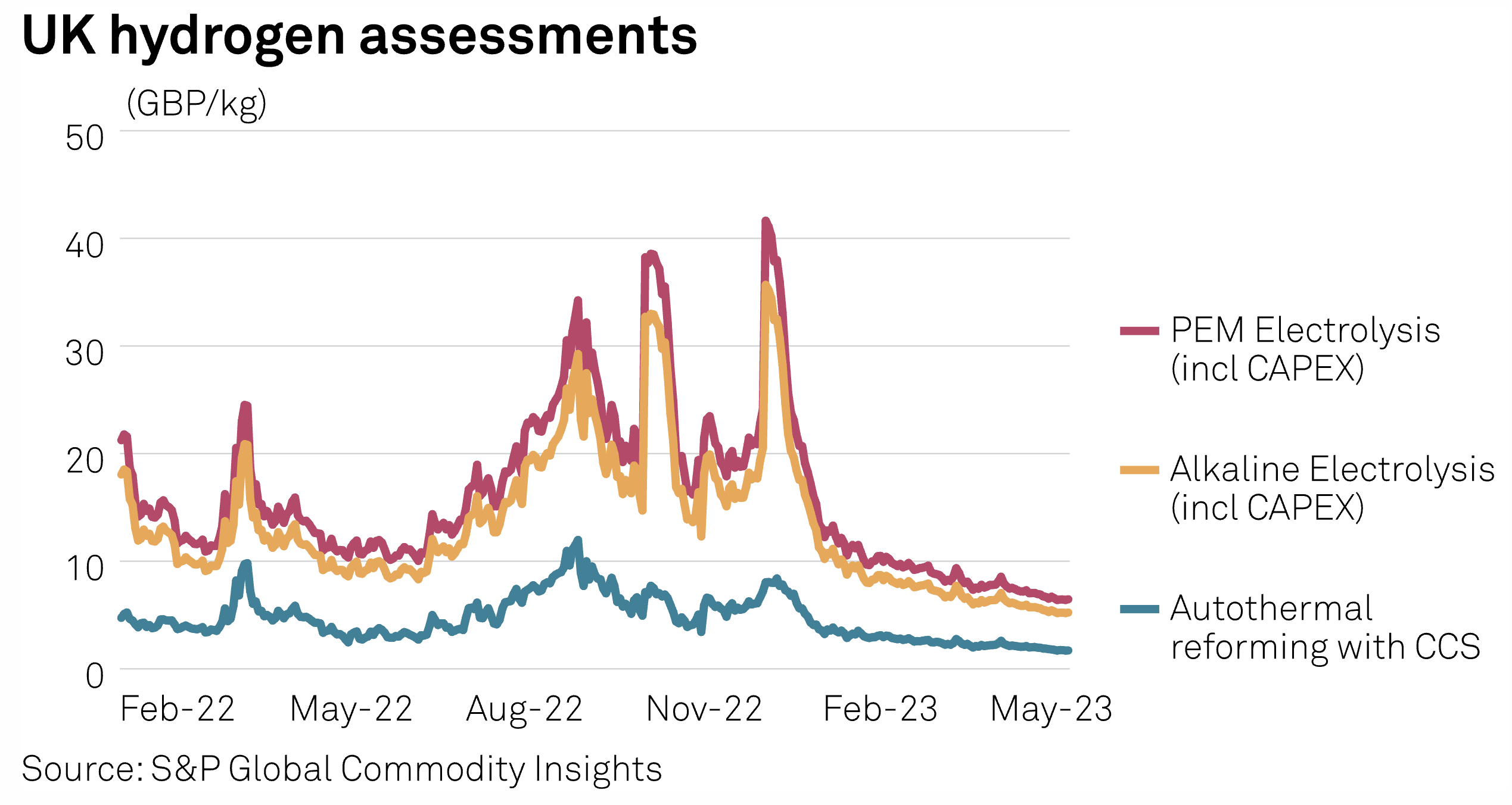

UK's Updated Hydrogen Strategy Confirms 750-MW Allocation Round

The UK government is to launch a second hydrogen allocation round (HAR2) later this year with contract awards of up to 750 MW in 2025, it confirmed in an updated hydrogen strategy document Aug. 2.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

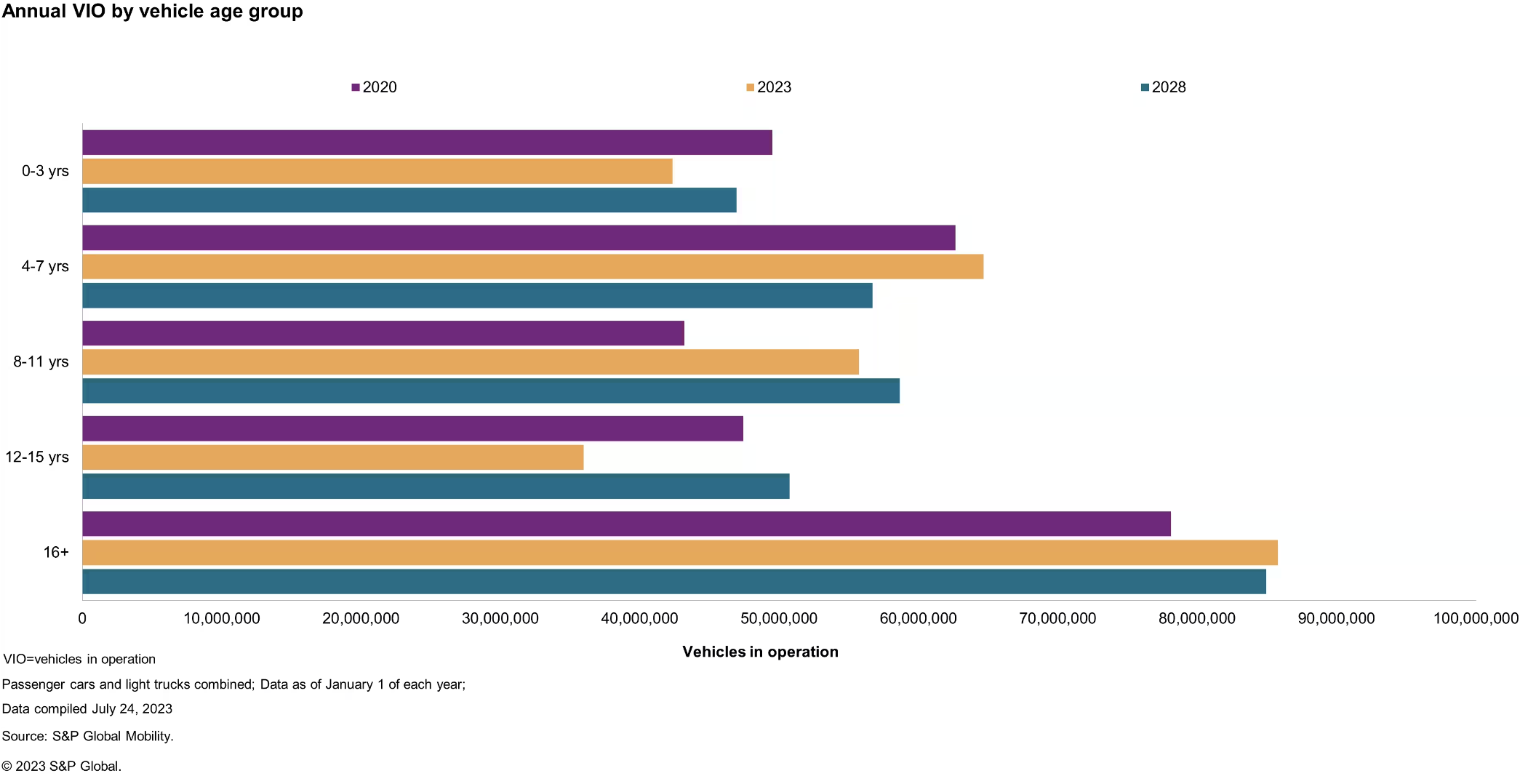

As America Becomes a Nation of Old Cars, Mechanics and the Aftermarket May See Boom Times

With a record-high average vehicle age in the US, the aftermarket is likely to see robust growth in repair and maintenance work, as older cars will see even more miles driven than traditionally expected, according to analysis by S&P Global Mobility.

—Read the full article from S&P Global Mobility

Content Type

Theme

Segment

Language