Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Aug, 2020

By S&P Global

Japanese Prime Minster Shinzo Abe announced his resignation on Friday, Aug. 28—ending his tenure as the country’s longest-serving leader one year early due to worsening illness. The move comes as the coronavirus pandemic is yet to be controlled, economic conditions slump to historically low levels, and political uncertainty heightens.

“If I should err in an important political decision or fail to produce results in the midst of pain and imperfect health, that would be unacceptable,” Mr. Abe, 65, said at a press conference in Tokyo. He has long suffered from ulcerative colitis, an inflammatory bowel disease. “For almost eight years I controlled my chronic disease, however, this year in June I had a regular check-up and there was a sign of the disease. I made a judgment that I should not continue my job as prime minister. I need to fight the disease and need to be treated."

Mr. Abe previously resigned from the position in 2007, just one year into his first term as Japan’s prime minster, due to the illness. He was re-elected for a second term in 2012, during which he launched his “Abenomics” program of increased government spending, monumental monetary stimulus, and structural reforms to reinvigorate Japan’s economy. Over the course of Mr. Abe’s third term in 2017 and fourth term in 2019, the aggressive three-pronged plan yielded mixed results of economic stability rather than dramatic growth. The pandemic ultimately wiped out those gains. The world’s third-largest economy contracted 7.8% in the second quarter, the biggest GDP decline on record, as the pandemic shuttered shops and constricted consumption.

“It’s highly unlikely in our view that any successor will pursue policies that are going to be vastly different from the current direction,” Kathy Matsui, vice chair of Goldman Sachs Japan, told Bloomberg Television. “We continue to expect any successors continue with aggressive fiscal and monetary easing.”

“With a big job still left to do to pull Japan out of its COVID-19-induced recession, this is obviously a difficult time for a change in prime minister. But we would caution against thoughts that this will usher in some even easier policy from the Bank of Japan,” ING’s regional Head of Research for Asia-Pacific, Robert Carnell, said in a research note. “Abe's ‘Abenomics’ policy of massive fiscal, monetary support, and economic reforms may not have achieved all of its aims, but it wasn't an unmitigated failure either, and Japan has made some important progress under his leadership.”

Considering that the Liberal Democratic Party will retain its majority power and the next generation election will take place next year, Mr. Abe’s resignation is unlikely to lead to major energy policy shifts, according to JY Lim, an oil markets adviser at S&P Global Platts Analytics.

During his resignation speech, Mr. Abe acknowledged signing free-trade agreements with neighboring Asian nations and the E.U., establishing Japan’s strong defense, and reducing unemployment before the pandemic as accomplishments of his tenure. He said the inability to amend Japan’s pacifist constitution, gain the return of disputed islands off northern Japan from Russia, and return home abducted Japanese people from North Korea were his three regrets.

“With Japan at the center, we have created an economic zone that is free and fair,” Mr. Abe said. “It is gut-wrenching to have to leave my job before accomplishing my goals.”

Japan’s Liberal Democratic Party is likely to elect a successor by mid-September. Mr. Abe said he will remain in office until the next premier is named—and to stay a lawmaker even after.

Today is Thursday, August 31, 2020, and here is today’s essential intelligence.

Listen: Take Notes: Not-For-Profit Health Care SBPA-Backed VRDOs During COVID-19

Analysts Anne Cosgrove, Alex Gombach, and Santos Souffront join our host Tom to discuss U.S. public finance health care variable-rate demand obligations (VRDOs). We first introduce and detail what standby bond purchase agreement (SBPA)-backed VRDOs are and how we rate them. We then look at how not-for-profit health care providers can turn to this form of financing to help offset their significant operating losses and negative cash flow impacts due to COVID-19, as well as discuss our outlooks for both the health care sector and the SPBA market.

—Listen and subscribe to Take Notes, a podcast from S&P Global Ratings

Checkup On Not-For-Profit Health Care SBPA-Backed VRDOs In The COVID-19 Era

The U.S. public finance health care sector currently accounts for about $7 billion or 10% of the $69.8 billion VRDOs backed by SBPAs that S&P Global Ratings rates. S&P Global Ratings’ sector outlooks for all public finance sectors are now negative, and, as of July 31, S&P Global Ratings had negative rating outlooks on 26% of the stand-alone not-for-profit health care providers and 17% of the not-for-profit health care systems. Not-for-profit health care providers in the 'AA' rating category continue to have access to the SBPA market, though pricing has increased somewhat and tenors have shortened. Although unlikely, remarketing failures and draws on SBPA providers could increase if bondholders elect to tender their bonds due to impact of the pandemic and investors' concerns about obligors' overall credit quality and the potential loss of put options if SBPAs terminate without notice.

—Read the full report from S&P Global Ratings

How Business Strength Varies Across The Top Pharma Companies

The top branded pharmaceutical companies have strong investment-grade ratings based on an attractive and highly profitable business model, combined with conservative levels of adjusted net debt leverage and strong cash flow generation. These companies' business models share many positive characteristics, including limited sensitivity to the business cycle, high barriers to competition, and very healthy profitability, with EBITDA margins averaging 30%-40%. This is more than any other industrial sector. Earnings and revenues, however, can be volatile, as they are subject to abrupt declines upon patent expirations. Moreover, sustaining revenues over the long-term requires a high-level of reinvestment in R&D, M&A, or partnerships and alliances. S&P Global Ratings differentiate between the business strength of these companies based on several factors, including long-term strategies and effectiveness at developing new drugs fast enough to sustain and grow revenues, diversity of drug portfolios, and operating scale.

—Read the full report from S&P Global Ratings

Energy Transfer bore brunt of midstream institutional investors' Q2 selloff

All but one of the top publicly traded energy pipeline companies in North America saw institutional ownership decrease during the second quarter — even though they recorded better than expected financial results for the period — an S&P Global Market Intelligence analysis of U.S. Securities and Exchange Commission filings shows.

—Read the full article from S&P Global Market Intelligence

Coking coal futures growth increasingly global: traders

Coking coal derivatives markets are developing liquidity and global trade volumes, with interest in the market seen globally, according to traders at the S&P Global Platts Singapore coking coal conference. Growth in participants and greater volumes across multiple market segments have helped liquidity and pricing indications on the forward curve, SSY Futures coal derivatives broker Stephanie Idulca said in a webinar at the event. "We've got quite a full spectrum of entities trading, all with different motivations, all with different views, which has really increased the liquidity we've been seeing in the market " Idulca said.

—Read the full article from S&P Global Platts

Dow Jones Industrial Average: 124 Years and It Keeps Changing

S&P Dow Jones Indices (S&P DJI) announced major changes to the 124-year-old Dow Jones Industrial Average® (The Dow®), effective on the same day (Aug. 31, 2020) as Apple’s (AAPL) four-for-one stock split. Specifically, Salesforce.com (CRM) will replace Exxon Mobil (XOM), Amgen (AMGN) will replace Pfizer (PFE), and Honeywell International (HON) will replace Raytheon Technologies (RTX). Issue reviews are constant in The Dow, with any change having its own investment rationale and impact. However, last month, Apple, the largest-weighted issue in the index, announced a four-for-one stock split, which would effectively change its weight in The Dow from 12.20% to 3.36%, increasing the weight of the other 29 members by 10.1% each and reducing the weight of the Information Technology sector from 27.63% to 20.35%. This action was a catalyst for the changes S&P DJI made, as it continues to align the index with the shifting nature of the U.S. economy.

—Read the full article from S&P Dow Jones Indices

NY focused on power grid reliability in wake of California blackouts

Extreme heat and a confluence of other factors recently led the California Independent System Operator to institute rolling blackouts in order to prevent wider power system failure. With New York drastically remaking its power grid to run on 70% renewable electricity resources by 2030 and carbon-free power by 2040, experts weighed in on how reliability can be ensured while transitioning to a cleaner power system. As details continue to emerge about the causes of the August 14-15 blackouts in California, state energy officials and experts have said the emergency measures were prompted by multiple interrelated conditions.

—Read the full article from S&P Global Platts

Illinois lawmakers face new pressure under Exelon's plan to retire 2 nukes

Exelon Corp.'s announcement that it plans to shutter two uneconomic nuclear-fired power plants in Illinois next fall could pressure state lawmakers to find ways to provide extra compensation to the emissions-free generators in the face of wholesale power market rules aimed at blunting state subsidies for clean energy. But the utility may face an uphill climb in securing taxpayer subsidies for the plants with its Chicago-based subsidiary, Commonwealth Edison Co., under increased scrutiny over an executive bribery scandal, analysts said.

—Read the full article from S&P Global Market Intelligence

Washington utility to install 5 MW electrolyzer to produce hydrogen

A Washington state public utility has recently purchased an electrolyzer to produce hydrogen using excess hydropower. The Douglas County Public Utility District, in East Wenatchee, Washington, is purchasing a 5-MW Proton Exchange Membrane electrolyzer built by Cummins that it hopes to have operational by late fall or early next year, said utility spokeswoman Megan Vibbert on Aug. 28. Vibbert said the utility plans to either sell the hydrogen or potentially use it as fuel for its vehicle fleet. She said the utility has yet to work out how it will price the green hydrogen. Green hydrogen refers to hydrogen that is produced without any carbon dioxide emissions. She added that the utility does not have plans to use the hydrogen to meet its own power demand.

—Read the full article from S&P Global Platts

Q&A Credit Risk Perspectives Series: Navigating Climate Scenario Analysis

Climate change is prompting investors to consider plausible climate-related scenarios and evaluate the potential impact on their portfolios. Dr Giorgio Baldassarri, Global Head of the Analytic Development Group (ADG) talks about the considerations for building climate change into scenario analysis. The following questions have been addressed from S&P Global Market Intelligence’s webinar hosted on May 05, 2020.

—Read the full article from S&P Global Market Intelligence

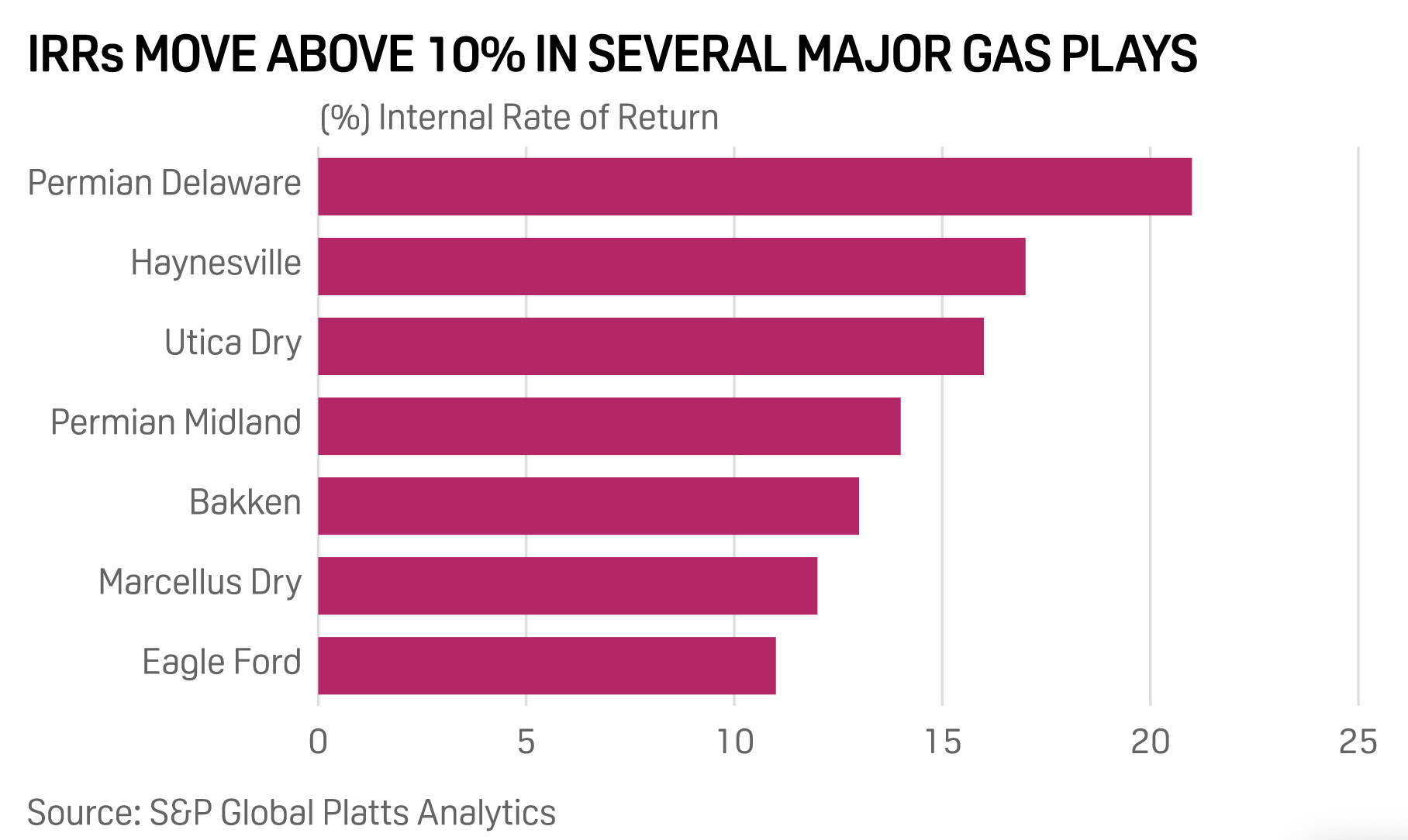

Analysis: Stronger Henry Hub forward prices push up returns in major US dry gas plays

The Henry Hub 12-month forward curve has increased by more than 40 cents over the last month to $2.88/MMBtu, propelling multiple gas plays to boast internal rates of return per well above 10%. Approaching winter demand could push the curve even higher despite elevated US storage levels.,/p>

—Read the full article from S&P Global Platts

Interview: Minimal disruption to grain supply from Beirut blast: FAO representative

The agriculture industry in Lebanon is recovering as the Beirut port, which was rocked by a massive blast Aug. 4, is now partially functional, while the Tripoli port has emerged as an alternative to support some shipments, Maurice Saade, the UN's Food and Agriculture Organization's representative in Lebanon, said. Beirut is the main port in Lebanon, followed by the second busiest -- the port of Tripoli. Lebanon imports nearly 85% of its food supplies, including major grains like wheat and corn, and Beirut port is essential to the country for that. "The disruption caused by the blast is not as prolonged as we had thought earlier," Saade told S&P Global Platts in an interview.

—Read the full article from S&P Global Platts

Analysis: Japan's August motor fuel demand lowest in decades on coronavirus, slowing economy

A resurgence of the coronavirus pandemic hit Japan's peak summer holiday demand for gasoline and gasoil in August, bringing down the motor fuels' demand to the lowest level in decades, with market sources expecting slow recovery in coming months amid stagnant economic activities. Japan's August gasoline demand is estimated at 4.38 million kiloliters, or 888,688 b/d, down 9% year on year, while gasoil demand is estimated to have dropped 6% year on year at 2.66 million kl, or 539,705 b/d, the country's largest refiner ENEOS said Aug. 28.

—Read the full article from S&P Global Platts

FEATURE: Russian steel demand showing signs of recovery as COVID-19 restrictions ease

The first three weeks of August saw Russian consumers' expenses restored to the level they were a year ago, Sberbank reported, and Russia's Purchasing Managers' Index, which had collapsed to 34 in April-May, recovered to 49 in June-July. The second half of 2020 remains challenging. However, mills said they were determined to maximize sales in Russia, the market where they normally sell most of their high margin products, and hence make most of their profit.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language