Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Aug, 2020

By S&P Global

As the U.S. deals with historic wildfires and a one-two punch of tropical storms, signs that that the country’s climate risk is compounding are becoming undeniable.

In the Western U.S., California is sweating under soaring temperatures at the highest levels ever recorded, and dozens of wildfires have burned more than 1 million acres with no reprieve in sight. At the same time, a tropical storm and a hurricane have begun to batter the Gulf Coast simultaneously—threatening Texas and Louisiana in the Southern U.S. with destructive winds and flooding.

The California Independent System Operator, the state’s grid operator, reinstated restricted maintenance operations on Aug. 24 and 25, requiring generators and transmission operators to postpone any planned power outages in order to preserve the power grid. Last week, the debilitating heatwave caused rotating power outages that left residents without electricity as temperatures surpassed 110 degrees Fahrenheit in some parts of the state.

"Outages of higher voltage lines are more likely to have an impact on the bulk power transmission system and markets," S&P Global Platts’ senior manager of North American power analytics, Morris Greenberg, said Aug. 25. "This year has already been very active in terms of the number of fires and affected acreage. This is surprising given the dry winter that should have suppressed vegetation growth. Transmission and resource adequacy planning will increasingly account for fire-related outages."

Coupled with Tropical Storm Marco, which was downgraded from a hurricane before it made landfall in Louisiana on Aug. 24, the more ominous Hurricane Laura is expected to travel across the oil-producing Gulf of Mexico and refining epicenter near the Texas-Louisiana border after making landfall on Aug. 27.

"The 2020 Atlantic hurricane season, which has already produced 11 storms including three hurricanes, is forecast to result in 20 storms (9 hurricanes and 4 major ones)," S&P Global Platts Analytics said. "Year-to-date, [an annual average of] approximately 67,000 barrels per day of oil production has been disrupted, mainly from [Tropical Storm] Cristobal, with the potential to significantly increase since the peak, normally in mid-September, is yet to come."

After attempting to recover from the demand destruction brought on by the coronavirus pandemic, the Gulf Coast’s massive energy industry is preparing for the rare extreme weather event of simultaneous storms in the same location. More than half of the country’s refining capacity, totaling over 10 million barrels per day, is on Gulf Coast, according to S&P Global Platts Analytics. Refiners responsible for roughly 2.23 million barrels per day of energy capacity made arrangements to close their plants and reduce their runs on Aug. 25.

The chemicals company Sasol announced on Aug. 25 that it will shut Lake Charles, La., and Winnie, Texas facilities ahead of the hurricane’s landfall. That same day, Cheniere Energy, the liquefied natural gas firm, temporarily shut down production and evacuated its staff at its Sabine Pass LNG export terminal in Louisiana. Phillips 66 shut down its nearly refinery with capacity of 250,000 barrels per day in Lake Charles, La. Oil conglomerate Royal Dutch Shell has shut at least eight of its operated production platforms in the Gulf of Mexico. Chevron said it has secured its terminals, closed its pipeline systems, and shuttered its production in the region. BP evacuated the entirety of its personnel and shut down production in its four facilities there. The energy firm Motiva will close its 600,000 barrels per day refinery and chemical operations in Port Arthur, Texas, where Total is also closing its 225,500 barrels per day refinery. ExxonMobil will shut down its 366,000 barrels per day refinery in the nearby town of Beaumont.

Sources told Platts said that the rare dual storms would likely have a limited impact on the global LNG market, due to the low rate of cargo loadings from facilities in the area that have been prompted by cargo cancellations throughout the summer.

Extreme weather events like the heatwaves, wildfires, and simultaneous storms seen in the U.S. currently will likely become more frequent if nations’ climate commitments fail to reduce global emissions levels, according to recent research by Trucost, part of S&P Global Market Intelligence.

Today is Wednesday, August 26, 2020, and here is today’s essential intelligence.

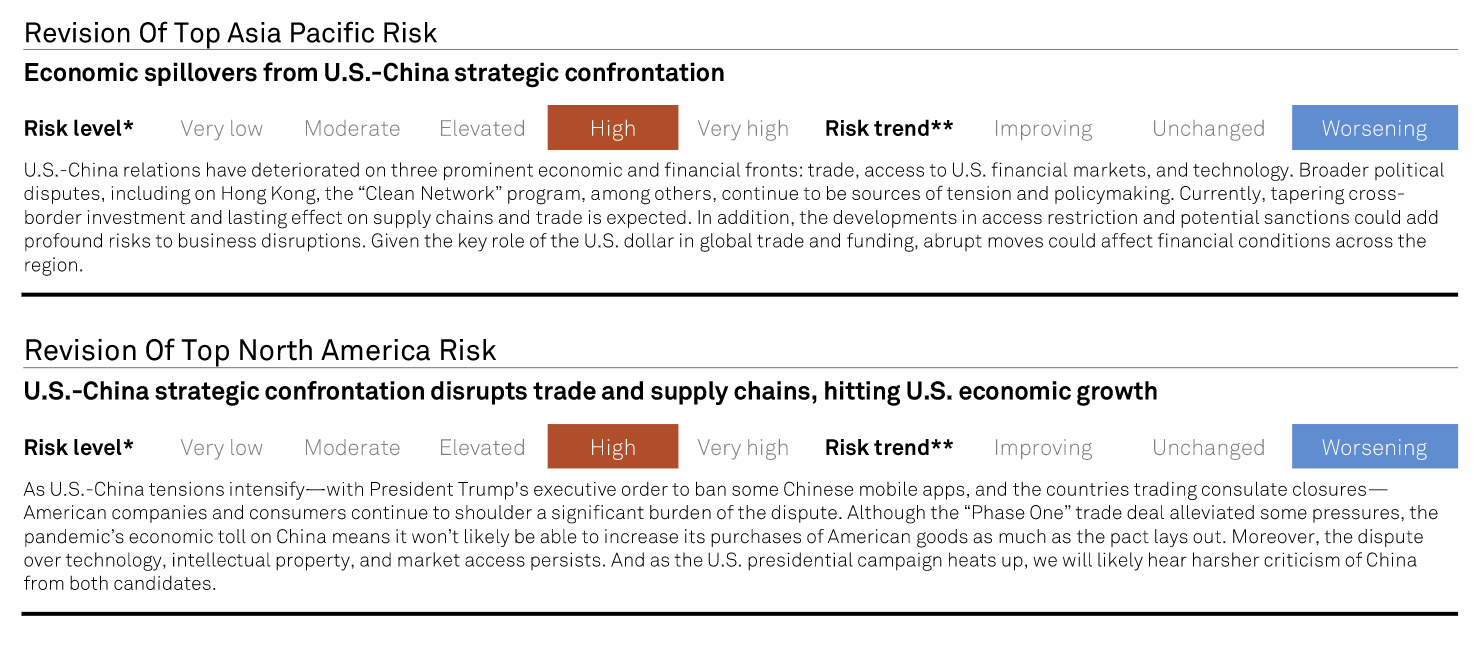

Economic Risks Rise As U.S.-China Disputes Heat Up

U.S.-China relations have deteriorated markedly in recent weeks across different fronts, causing the risks of an economic spillover on credit conditions in both countries to rise. With criticism of China increasingly evolving into policy in the U.S., particularly in the areas of China's access to U.S. technology and financial markets, S&P Global Ratings views the risk trend of an economic spillover as worsening. This change indicates that we believe the strained relationship between the economic giants could place additional pressure on economic and credit conditions in these two regions, and beyond.

—Read the full report from S&P Global Ratings

Changing Times Have Led To New Trends In Amendments To U.S. Middle-Market Credit Agreements

The COVID-19 pandemic—coupled with volatility in the energy markets--brought to an abrupt end the longest expansion of the U.S. corporate credit cycle. In the second quarter, the U.S. gross domestic product (GDP) declined at an annualized rate of 32.9%, the largest such drop for the nation. Many middle-market companies, especially the ones that are consumer-facing, have experienced intensified liquidity pressures and have capital structures that might not be sustainable over the long run because of their lack of scale. However, the dynamics of lending in the middle-market segment generally allow for more efficient monitoring and intervention outside of formal processes (such as bankruptcy).

—Read the full report from S&P Global Ratings

European banks' Q2 provisions a mixed bag as expected loss models vary

Second-quarter credit loss provisions at the largest 25 European banks offered a mixed picture, with levels dropping at 10 companies and increasing at 15, compared to the previous quarter, S&P Global Market Intelligence data shows. As they did in the first three months of the year, U.K.-based HSBC Holdings PLC and Spain's Banco Santander, SA made the largest absolute amount of provisions in the second quarter, although Santander, despite booking the largest second-quarter net loss among the banks in the sample, posted lower provisions versus the first three months.

—Read the full article from S&P Global Market Intelligence

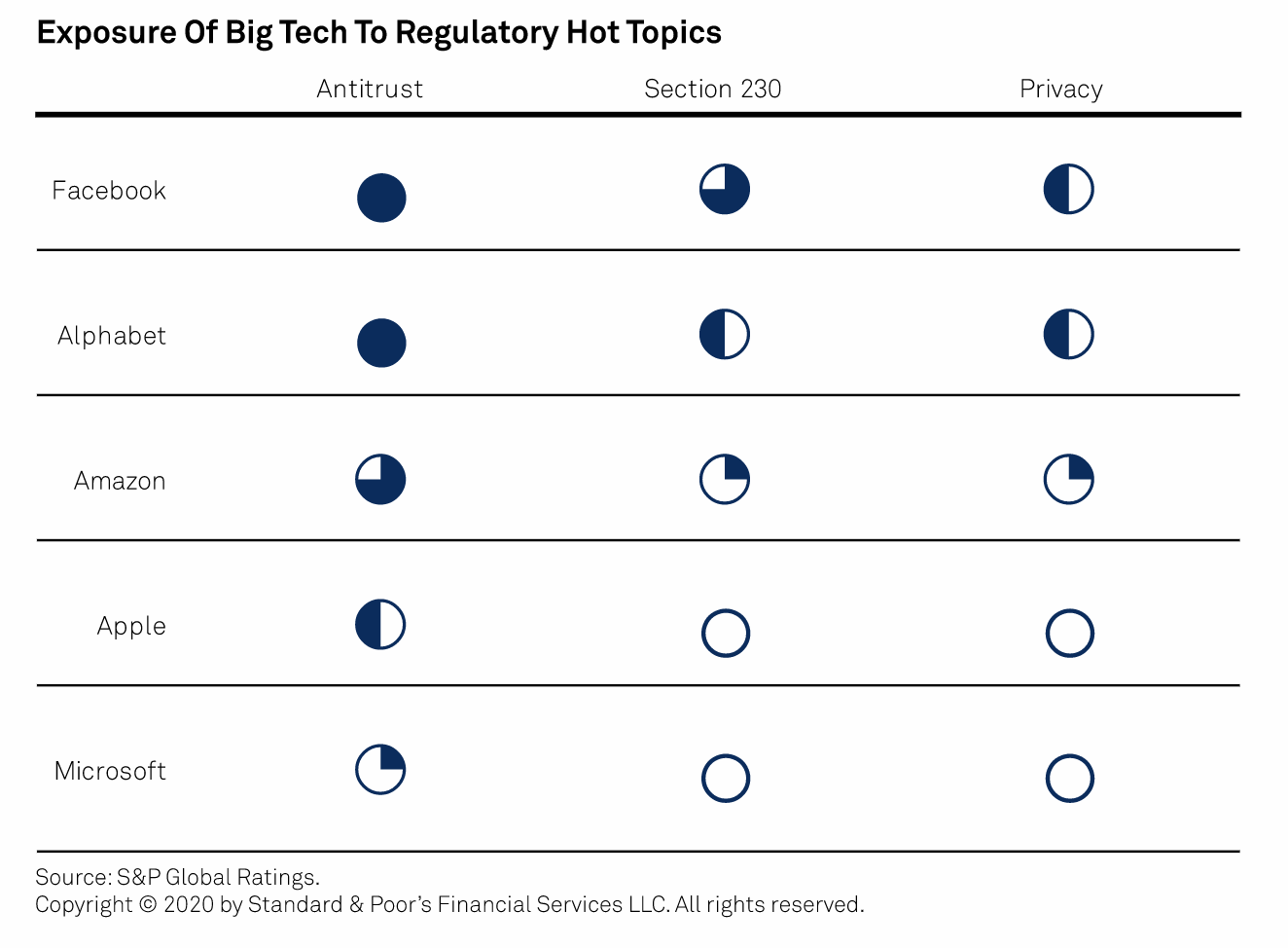

Regulators Lean In To U.S. Big Tech Firms

The seemingly unstoppable expansion of Apple Inc., Alphabet Inc., Amazon.com Inc., and Facebook Inc. in the smartphone ecosystem, digital advertising, e-commerce, and social media could decelerate as the tech giants face scrutiny from the U.S. Congress, Department of Justice (DoJ), and Federal Trade Commission (FTC)—and that's naming only the domestic regulators. The DoJ and FTC have favored self-regulation to avoid hindering innovation. And they haven't established a framework to regulate and provide ongoing monitoring of the rapidly changing technology industry. However, as the complaints from competitors and consumers have become more frequent, and as regulators themselves—as consumers--recognize the scale and power of these companies, they have mobilized. Regulators now have the difficult task of determining whether the rising concentration of market power in a handful of large tech participants acts in ways that are harmful to consumers and competitors, or, as large tech companies have asserted, promotes rapid innovation and job creation.

—Read the full report from S&P Global Ratings

Alphabet CEO posts pay ratio 1,085x median employee salary

Silicon Valley is known for paying its employees well — but it compensates its CEOs even better. For example, Alphabet Inc. CEO Sundar Pichai broke the bank when he took the helm of Google Inc.'s parent company, netting a total compensation package worth $280.6 million. The highest-paid CEO in the information technology sector for 2019, Pichai netted 1,085x the median pay range for the average Google employee. He collected over 4x the next-highest-paid CEO, Intel Corp.'s Robert Swan.

—Read the full article from S&P Global Market Intelligence

Verizon leads telco peers with highest median employee salary

Highly-paid CEOs get a lot of attention, but for the rest of us, it is the companies that are paying employees the most that we really want to know about. Among the top 20 U.S. publicly traded telecommunications firms by market capitalization, Verizon Communications Inc. took the No. 1 spot in terms of highest median employee pay, reporting a median employee salary of $172,971. With Verizon CEO Hans Vestberg earning a total compensation package worth $18.1 million, this gave the company a ratio of CEO to median employee compensation of 105x.

—Read the full article from S&P Global Market Intelligence

Diversity and Inclusion in IT – Plenty of Positive Intent, but a Long Way to Go...

The prominence of the Black Lives Matter movement in the aftermath of the global outrage over the killing of George Floyd has again raised questions over the role organizations must play to increase diversity and inclusion in the workforce. The information technology industry is no exception – indeed, it is generally recognized that much more needs to be done to have the IT workforce better represent society overall.

—Read the full article from S&P Global Market Intelligence

Asia-Pacific green bond issuance falls to over 3-year low as social debt surges

The issuance of green bonds in Asia-Pacific in the second quarter fell to the lowest level in more than three years, as new debt has been diverted to social bonds aimed at addressing public health and economic inequalities due to the coronavirus pandemic. In the three months ended June 30, nine most active green-bond issuing markets in Asia-Pacific raised a total of US$5.22 billion, or 10% of the global issuance, according to Climate Bonds Initiative, a U.K. nonprofit organization that created the green bond standards. It was down from US$5.52 billion in the first quarter and US$16.53 billion a year earlier. It was also the lowest level since US$4.13 billion in the first quarter of 2017.

—Read the full article from S&P Global Market Intelligence

COVID-19 highlights need to dramatically ramp up financing for UN water goal

COVID-19 has created a worldwide need for constant hand-washing, and that has cast a spotlight on the importance of access to clean water. The pandemic has also underscored the lack of investor interest and bankable projects for achieving a key United Nations goal on water sanitation. The U.N. launched its 17 Sustainable Development Goals, known as the SDGs, in 2015 with an aim to create a safer, more prosperous planet by eradicating poverty, eliminating hunger and providing clean water and sanitation worldwide by 2030. Experts say the water goal is the most important as it has an impact all the other SDGs — especially climate — but lack of financing and awareness are hindering progress.

—Read the full article from S&P Global Market Intelligence

ENEOS, JERA launch Japan's 'largest-scale' hydrogen station in Tokyo

Japan's ENEOS and JERA jointly launched Aug. 25 one of the country's largest hydrogen stations on the site of the latter's operated Oi thermal power plant in central Tokyo, with the utility supplying feedstock city gas for the production of hydrogen. "The Oi station is the largest-scale hydrogen station in Japan, with double [the capacity] that of a normal station," ENEOS' executive officer Tomoo Shiota told an online press conference Aug. 25. With its hydrogen production capacity of 600 Nm3/h, the Tokyo Oi Hydrogen Station can fill about 10 fuel cell vehicles or six fuel cell buses in an hour, Shiota said.

—Read the full article from S&P Global Platts

Utility executives plot renewable hydrogen's future in US decarbonization

An unusual amount of commentary on renewable hydrogen during second-quarter earnings calls offered a view into the nascent U.S. power-to-gas ecosystem, with at least two U.S. utilities staking out leadership positions in the emerging decarbonization strategy. Executives at large North American utilities and power generators outlined plans to ramp up renewable hydrogen production in the coming years. While they generally agree it will take roughly a decade to scale up the technology, production marks the first step towards ultimately displacing downstream natural gas use, including at local distribution companies, or LDCs.

—Read the full article from S&P Global Market Intelligence

Cal-ISO reinstates restricted maintenance operations due to wildfire threats

The California Independent System Operator has reinstated restricted maintenance operations for Aug. 24 and 25 due to weather uncertainty and fire threats to the grid as firefighters battle thousands of acres of wildfires across the state. The restricted maintenance operations notice is in effect from 6 am PT Aug. 24 through 10 pm Aug. 25 and requires generators and transmission operators to postpone any planned outages for routine equipment maintenance, ensuring all grid assets are available for use. The ISO was previously on restricted maintenance operations from Aug. 14-21 due to a heatwave that caused rotating power outages Aug. 14 and 15 in order to maintain grid stability.

—Read the full article from S&P Global Platts

Factbox: US Gulf energy industry braces for impact from two storms

The US Gulf Coast energy industry was preparing for the arrival of two storms Aug. 24, as Tropical Storm Marco was due to make landfall on the eastern Louisiana coast, while Tropical Storm Laura was expected to strengthen into a hurricane before hitting the Texas/Louisiana border early Aug. 27. Oil and gas offshore producers have been shutting in output ahead of the storms. By Aug. 24, upstream operators had shut about 1.523 million b/d of oil, or 82.4% of offshore production, and 1.542 Bcf/d of natural gas, 56.9% of offshore production, according to the US Bureau of Safety and Environmental Enforcement.

—Read the full article from S&P Global Platts

Market Movers Americas, Aug 24-28: US crude, tanker markets keeping a close eye on approaching storms

In this week's Market Movers Americas, presented by Astrid Torres: crude tankers watch USGC storms, oil markets await double-punch from storms, China ups US crude purchases before trade talks, record California heat boosting power prices

—Watch and share this Market Movers video from S&P Global Platts

Limited buying appetite from China has resulted in a consistent downtrend in ESPO crude differentials

Surgut sold 6 October loading cargoes FOB Kozmino via tenders at premiums of 30 cents/b to 50 cents/b versus Dubai. This compares with last month, for September, done at premiums between $1.30-$1.70/b and $3.50/b for August loaders. Buyers of October cargoes were western trading houses and not the usual Chinese independent refiners, as limited margin recovery, approaching quota limits, and mostly port congestion in China have reduced ESPO buying appetite from baseload buyers in recent months.

—Read the full article from S&P Global Platts

S Korea shuns US crude amid tepid fuel demand; WTI still expensive

South Korea is rapidly losing its appetite for US crude oil with Asia's top North American oil customer expected to cut WTI and Eagle Ford imports by at least 50% in the third-quarter amid faltering domestic gasoline and jet fuel consumption, while WTI remains relatively expensive. South Korea's crude oil imports from the US in July dropped 66.7% from a year earlier to 4.92 million barrels, marking the biggest decline since the country began North American crude purchases in 2015, according to latest customs data.

—Read the full article from S&P Global Platts

Heightened volatility to roil crude, gas markets through 2021, analysts say

Crude oil and natural gas prices will remain volatile through the end of 2021, as supply and demand face an ongoing rebalancing act following the economic and market fallout caused by the COVID-19 pandemic, according to analysts. "The global oil and gas industry's recovery from coronavirus-related market disruptions will depend on gradually increasing demand as economic activity picks up, particularly in China, Southeast Asia, and the U.S.," Moody's wrote in an Aug. 23 report. "The recovery will likely be uneven, with the pandemic unsettling long-term energy consumption patterns and heightening volatility in oil and gas prices."

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language