Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Private Equity Stumbles into the Second Half

Beyond the neon glare of public market scrutiny, private equity’s decline during the first half of 2022 must be inferred from the pace of deals and the pace of fundraising. Private equity insiders suggest that greater caution, even in the face of good deals and a desire to preserve uncommitted funds, may account for the perceived slowdown.

By any measure, 2021 was a high-water mark for the private equity industry. Private equity and venture capital investment in the North American consumer sector exceeded $24 billion. Wealth management M&A activity hit record levels that year, with a total transaction value of $6.2 billion for private market mergers. Fundraising by venture capital and private equity firms in Association of Southeast Asian Nations countries hit an all-time high in 2021.

Thus far, 2022 has been a stark departure for the private equity industry. Macroeconomic conditions, including rising inflation and interest rates, are slowing private equity dealmaking. Private equity-backed M&A in the consumer sector fell in the first half of 2022 by more than 50%, according to S&P Global Market Intelligence. Special purpose acquisition companies with private equity backing have also been quieter this year. In the first quarter of 2021, 42 private equity-backed SPACs held initial public offerings. During the same period in 2022, that number dropped to three.

Fundraising has also turned sour for many private equity funds. A crowded private equity landscape has created conditions where more funds are pursuing investment from the same institutional investors. Some regions are seeing fundraising decline by as much as 78% for private equity and venture capital.

"No doubt the fundraising market is challenging right now, and this could persist for a bit as [limited partners] adjust to market dynamics. And it's most challenging in the corporate private equity segment of the market," said Carlyle CEO Kewsong Lee on the company’s second-quarter earnings call, according to S&P Global Market Intelligence.

It’s not all bad news for private equity. According to S&P Global Market Intelligence, lower valuations for companies have created a buyer’s market in the consumer discretionary and technology sectors. Private equity firms continue to sit on record amounts of dry powder, based on past fundraising. The wealth management industry has been reevaluating its traditional aversion to private equity. Even the decline in dealmaking can be interpreted as prudence, as general partners have learned to pick their timing with greater care.

Despite the gloom, the private equity sector continues to expand. But—after last year’s explosive growth—the modest growth of the first half of 2022 looks like a bit of a stumble.

Today is Tuesday, August 2, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

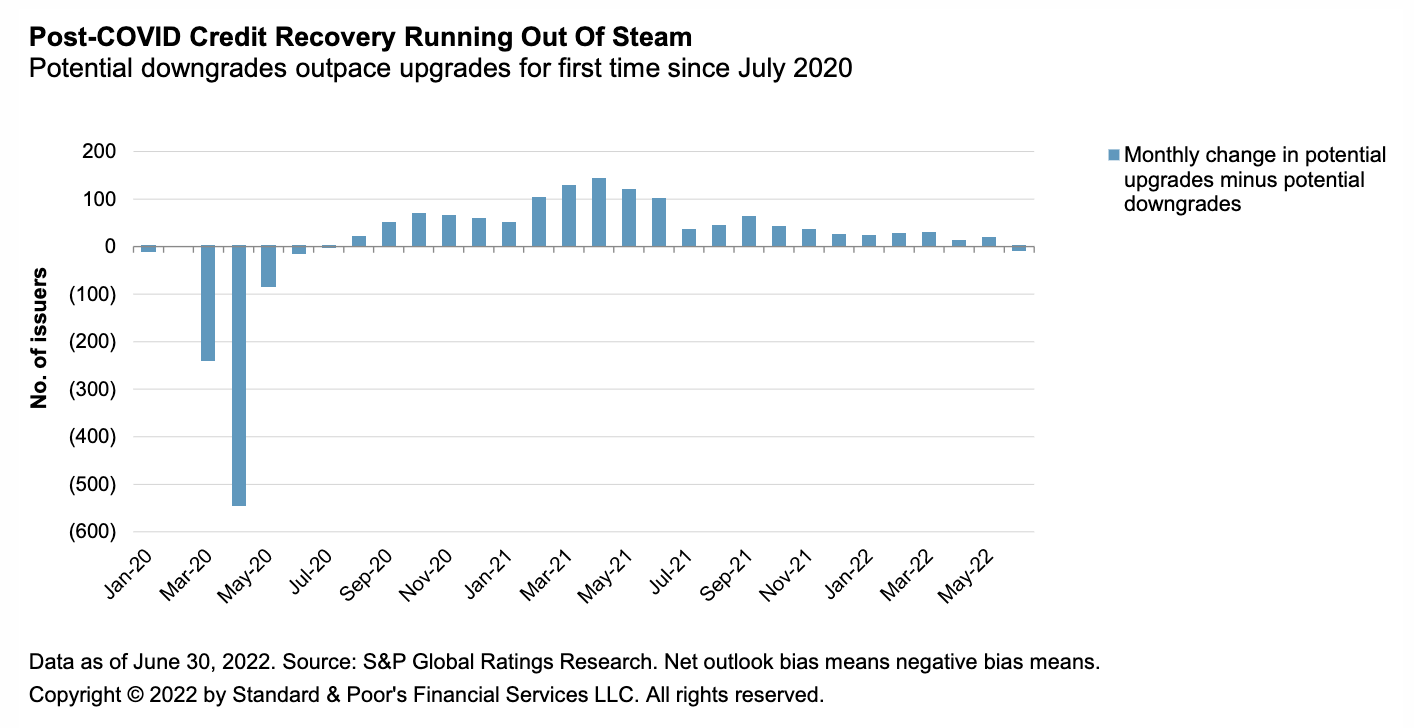

Credit Trends: Rating Indicators Signal A Turn In Rating Momentum

In June, the change in potential downgrades was greater than upgrades for the first time since July 2020, with five new potential fallen angels and 12 new weakest links included among 43 new potential downgrades—a stark contrast to no new potential fallen angels, seven new weakest links, and 34 new potential downgrades in May.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Seeking Refuge In High Forecasted Dividends

Since the start of the year, stocks have been challenged from several fronts including high inflation and central bank rate increases, alongside supply chain disruptions exacerbated by the war in Ukraine and renewed COVID restrictions in China. Almost every sector has sold off and, what is more, investors have not been able to turn to other asset classes such as bonds or cryptocurrencies to hedge their losses.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

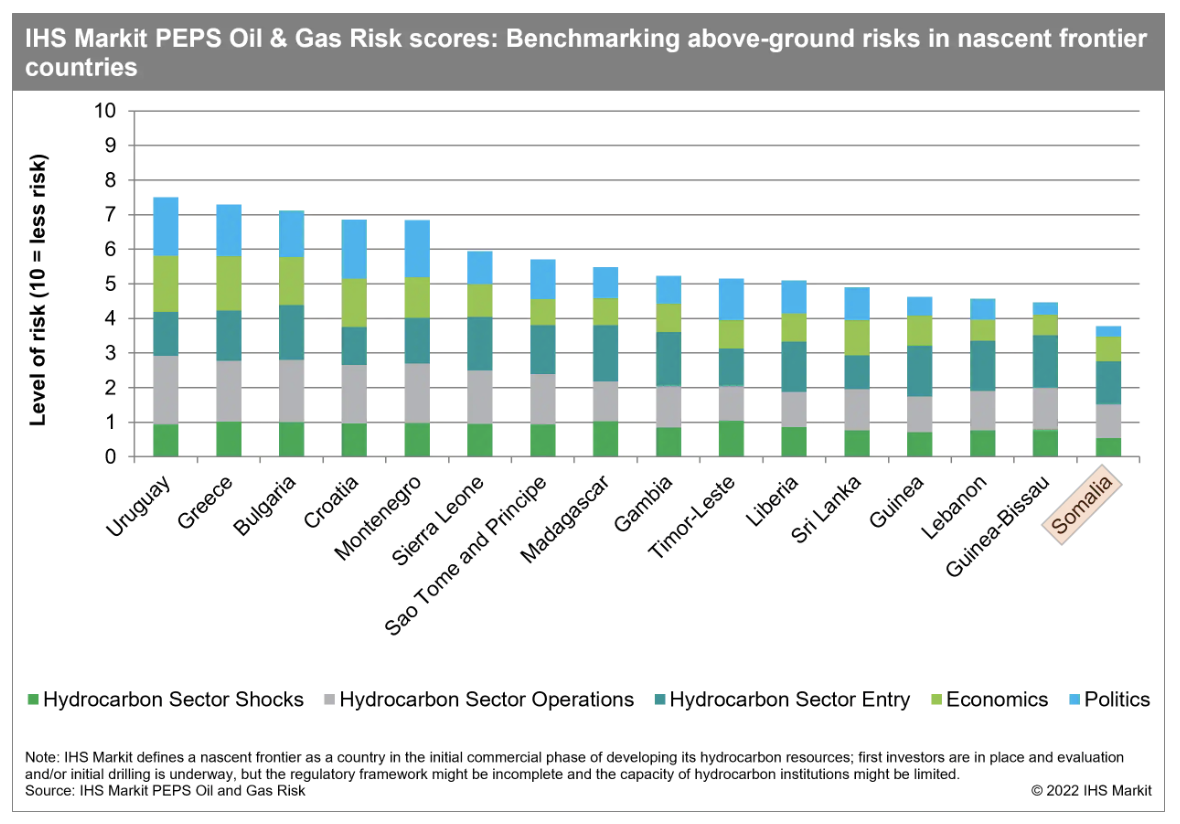

Will Somalia's Above-Ground Risks Blunt Its E&P Licensing Prospects?

Amid higher global oil prices and a sharpening focus on new oil and gas supply sources to offset dependence on Russia, East African frontier Somalia has a renewed opportunity to attract foreign investors to its upstream hydrocarbon sector. However, in light of limited exploration success to date, the acute governance, security, and infrastructure risks evident in the country may prove to be challenging hurdles for exploration and production development.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Nature Disclosure Is Evolving Through Challenges

The rapid decline of the world's biodiversity poses big financial risks to businesses and the global economy. One of the organizations working to help companies assess, report, and act on these risks is the Taskforce on Nature-related Financial Disclosures. The TNFD has been busy since forming in 2021—releasing beta disclosure frameworks and launching pilot projects to test out these frameworks. In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon speak with one of the experts deeply involved in crafting the frameworks, Emily McKenzie, technical director of the TNFD Secretariat.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Listen: To Declare, Or Not To Declare, A Climate Emergency, That Is The Question

So, what exactly would a climate emergency declaration free the Biden administration to do? Senior editor Jasmin Melvin posed that question to Liz Craddock, a partner at the Holland & Knight law firm. She joined the podcast to explain what authorities President Joe Biden would newly have at his disposal, the key energy statutes that could possibly come into play, and the potential political pitfalls, as well as legal risks and challenges, the administration would face from taking such action.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Upstart LIV Golf Continues To Expand But Finds Itself In The TV Rough

While LIV Golf continues to make headlines, its U.S. TV coverage remains off course. Backed by Saudi Arabia's sovereign-wealth fund, LIV Golf has gained attention for offering high-profile players like Dustin Johnson, Bryson DeChambeau, Brooks Koepka, and Phil Mickelson huge up-front sums to join the upstart circuit. It is also delivering record purses to those participating in its 54-hole, team-format tournaments, and it plans to significantly expand its event slate and prize money in 2023.

—Read the article from S&P Global Market Intelligence