Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Aug, 2020

By S&P Global

As the U.S. pressures the Chinese technology companies ByteDance, WeChat, and Huawei, trade talks between Washington and Beijing are at a standstill—putting their phase-one trade agreement on ice.

“I don’t want to talk to China right now,” U.S. President Donald Trump said in Arizona on Tuesday after indefinitely postponing the negotiations over the weekend, according to Bloomberg. Continuing his attacks on the Asian country’s handling of the coronavirus pandemic as “unthinkable,” he warned that “we’ll see what happens” in regard to the U.S.’s commitment to the trade deal.

On Monday, President Trump vowed in a speech to supporters in Minnesota that he “will create tax credits for companies that bring jobs from China back to America,” promising that to “end our reliance on China, we will make our critical drugs and supplies right here in the United States.”

The U.S.-China phase-one agreement was agreed upon in January, when China committed to more than double its imports of nearly 550 U.S. products—totaling an extra $200 billion in purchases from 2017 levels through this year and next.

China may not view the delay of trade negotiations as a negative, instead taking the postponement as an opportunity to focus on rebalancing its import obligations. Although the country is publicly committed to purchasing $77 billion worth of U.S. goods this year in accordance with the terms of the phase-one agreement, China has fallen roughly $40 billion behind its commitments due to coronavirus-linked supply chain disruptions and demand shocks, according to Panjiva, part of S&P Global Market Intelligence. To achieve the cumulative $200 billion purchasing target, China would need to buy about $11.9 billion in goods monthly—and as of June, its total purchases amounted to just $6.3 billion.

"Taken together, the data shows that the purchasing commitments element of the trade deal is out of compliance, creating another potential source of friction between the two countries which would come on top of U.S. sanctions regarding Hong Kong's new security laws, U.S. engagement with Taiwan, sanctions targeted repression of the Uigher people in Xinjiang, apportionment of blame for the propagation of SARS-COV-2, and ownership and control of TikTok," Panjiva said in a recent analysis.

Tough market conditions may hinder China’s efforts to meet the deal’s purchase target for energy products despite China having increased its purchases of U.S. crude oil in recent trading cycles, according to S&P Global Platts. Trading sources told Platts that the volume of crude oil that state-owned Chinese companies will purchase in September is expected to exceed the amount bought during the last spree in May.

The S&P China 500 index has fully recovered from the pandemic-related sell-off, and at the end of last week was up 33% year-over-year, according to S&P Dow Jones Indices. Additionally, although China’s economic recovery from the coronavirus-caused downturn has been speedier than that of the U.S., it is not without risk.

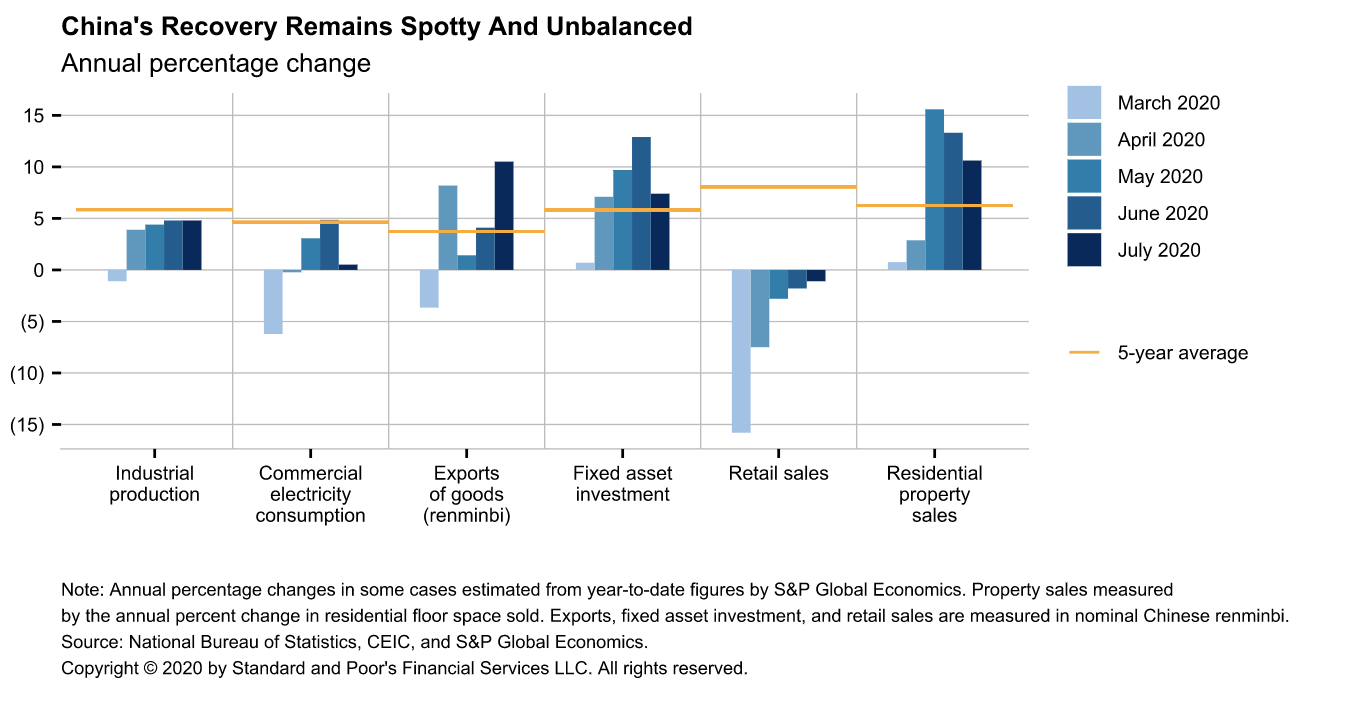

“China's economic data for July provide more indication the recovery remains unbalanced and reliant on extraordinary policy support,” S&P Global Ratings Chief APAC Economist Shaun Roache said in an Aug. 18 report. “Interest rates have risen as China's better-than-expected second quarter GDP lifted markets. At the same time, underlying inflation keeps falling, causing an even larger rise in real rates. S&P Global Ratings believes a climb in real interest rates may throw China's recovery off course just as it should be gathering steam.”

In the U.S., “as more states reverse plans for reopening and the U.S. government negotiates the next round of emergency stimulus to keep the economic recovery on track, recent real-time economic data continues to be mixed,” according to S&P Global Ratings Chief U.S. Economist Beth Ann Bovino. “S&P Global Economics still sees the probability of a worse economic outcome—than its base-case projection—at 30%-35%” with a challenging near-term outlook.

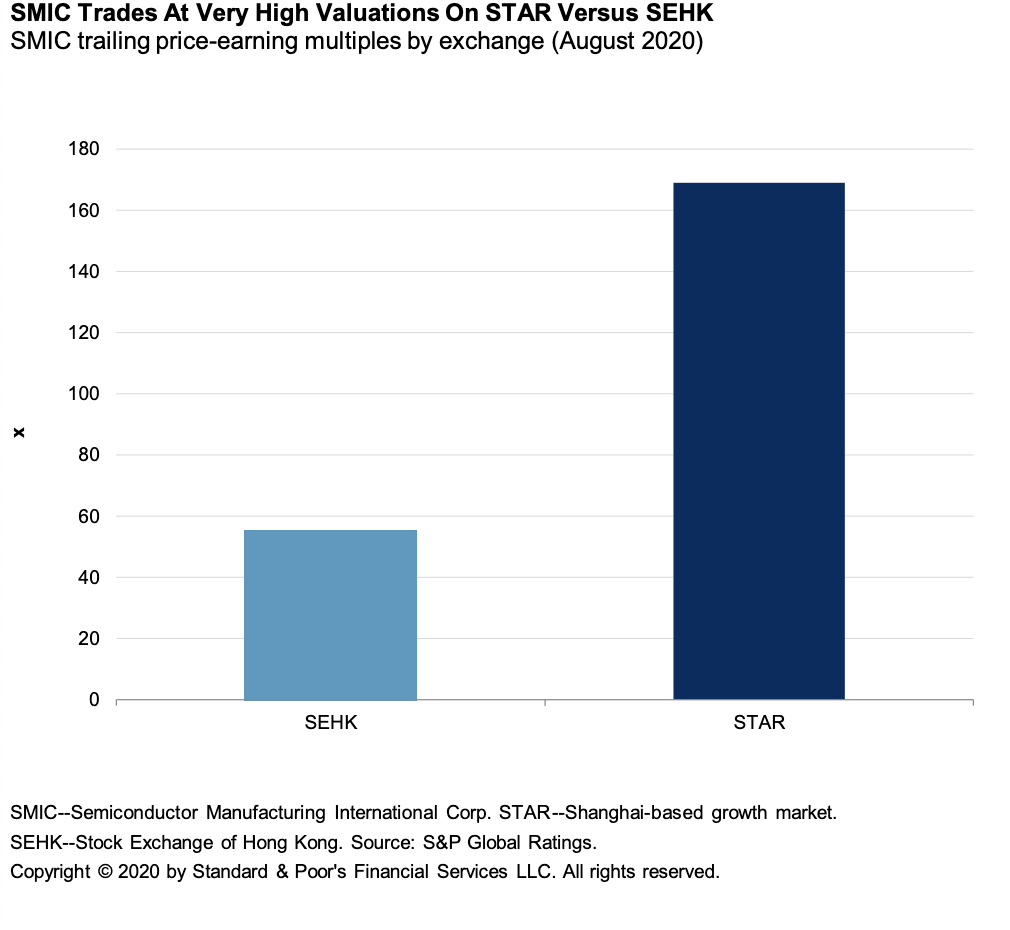

Earlier in August, the Trump Administration proposed new auditing requirements that could result in Chinese companies delisting from U.S. exchanges if they do not meet the regulations by 2022. If actualized, the forced delistings could create increased credit risks for Chinese companies unable to access financing, according to S&P Global Ratings. If Chinese companies are delisted, alternatives to the U.S. market include other global bourses, China's domestic markets, and the potential for dual-listed firms to convert their U.S. script into shares in Hong Kong.

“Our base-case view is that companies should have sufficient time to arrange alternative listings ahead of any forced exits from U.S. markets. However, if for any reason they went private without making other arrangements, a materially negative impact could ensue,” Ratings said in an Aug. 18 report. “This is particularly true for companies with lower credit standing and weaker liquidity, as they would be losing an important funding channel at a time when such companies already face challenges accessing the capital markets in uncertain times.”

In recent weeks, the Trump Administration has intensified its focus on Chinese technology companies—primarily the social media app TikTok and its parent company ByteDance, the social messaging app WeChat, and the telecommunications equipment company Huawei—seeking to ban the companies it considers “untrusted” from operating in U.S. markets due to perceived national security risks.

Today is Wednesday, August 19, 2020, and here is today’s essential intelligence.

Economic Research: China's Rate Rise Puts Recovery At Risk

China's July data show private demand remains soft, the recovery is still unbalanced, and core inflation is falling. Optimism about the recovery and a change in tone from policymakers had ushered in expectations of tighter monetary policies, and real interest rates have risen. Tighter financial conditions would hold back the recovery and prevent the needed handoff from stimulus to private demand. Interest rates have risen as China's better-than-expected second quarter GDP lifted markets. At the same time, underlying inflation keeps falling, causing an even larger rise in real rates. S&P Global Ratings believes a climb in real interest rates may throw China's recovery off course just as it should be gathering steam. China's economic data for July provide more indication the recovery remains unbalanced and reliant on extraordinary policy support. China's industrial sector has been remarkably resilient, largely aided by rising global demand for technology and medical equipment arising from the global pandemic.

—Read the full report from S&P Global Ratings

Major Cities To Be Hit Worse By Homeworking Trend, Says Office Landlord CEO

Large cities with longer average commute times are more likely to experience a severe and lasting impact from the surge in homeworking prompted by the COVID-19 pandemic, according to the CEO of a major European office landlord. Giacomo Balzarini, the CEO of PSP Swiss Property AG, said during a first-half earnings call that his company is more insulated from the trend due to the relatively smaller size of the Swiss cities in which its portfolio is based.

—Read the full article from S&P Global Market Intelligence

Landlords Bracing For 'No-Show' Students As Pandemic Upends College Reopenings

With most U.S. universities planning a mix of in-person and online teaching in the coming school year, owners of student housing properties would love it if everyone thought that way. The sector boomed in the years following the last financial crisis based on the proposition that some college students will pay more to live in more modern and luxurious settings than the traditional dormitories. Amid the pandemic, landlords hope they can still attract residents regardless of what happens on campus.

—Read the full article from S&P Global Market Intelligence

Rated Chinese Issuers Have Other Options If Forced To Delist From U.S.

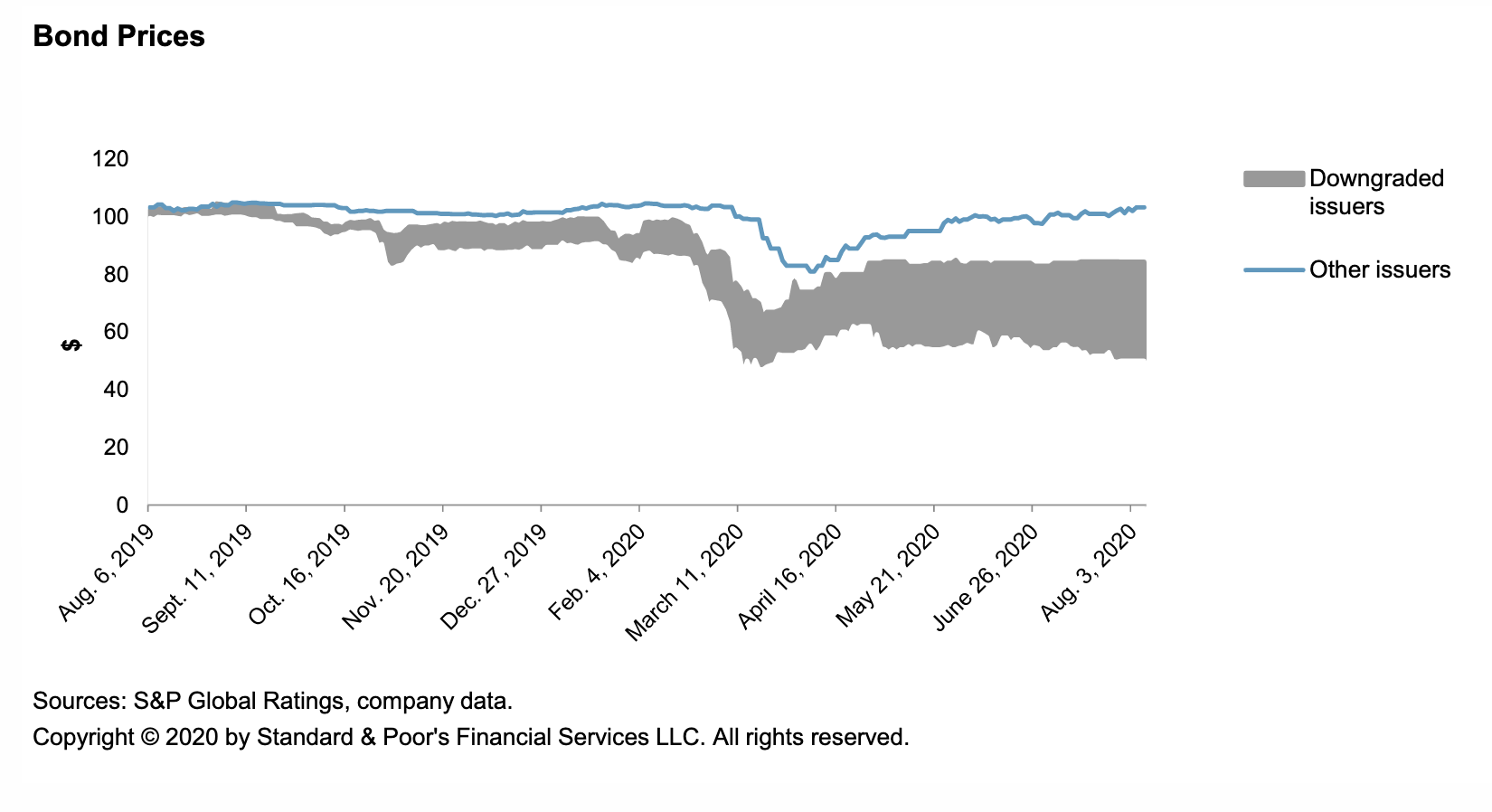

New requirements proposed by the U.S. Congress and the Trump administration could lead to delistings by Chinese companies that trade on U.S. exchanges. S&P Global Ratings sees this as a potential credit issue. Loss of equity-funding channels can limit financing options, and in some cases cause a dramatic increase in leverage or even trigger a default event and accelerate payment on debt.

—Read the full report from S&P Global Ratings

The Flood of U.S. Treasury Issuance and Duration Supply Continues

In its Q3 2020 refunding statement released on Aug. 5, 2020, the U.S. Treasury announced its plan to increase auction sizes across all nominal coupon tenors over the August-October quarter, with larger increases in longer tenors (7-year, 10-year, 20-year and 30-year). To gauge the demand appetite for U.S. Treasuries, let’s review the size and composition of U.S. Treasury holdings by one of the larger buyers these days, the Federal Reserve. Since March 2020, the Federal Reserve has stepped in with a broad array of actions to limit the economic damage from the COVID-19 pandemic, including the resumption of security purchases. On March 23, 2020, the Fed made the purchases opened, saying it would buy securities “in the amounts need to support smooth marketing function and effective transmission of monetary policy to broader financial conditions.”

—Read the full article from S&P Dow Jones Indices

Coal Sector Faces Tightening Access To Capital As Demand Dynamics Weaken

Thermal coal producers in North America are subject to several intractable pressures; the COVID-19 pandemic is only the most recent. With more investors citing ESG factors in restricting capital to the industry, many of the world's largest banks and asset managers are no longer financing new thermal coal projects. Some are even liquidating their holdings, which has contributed to declining share prices in the past year and widening yields on debt securities. As such, S&P Global Ratings’ view capital structures as increasingly unsustainable without some indication that new capital will emerge for refinancing in the next few years.

—Read the full report from S&P Global Ratings

U.S. Utilities, Power Providers Continue Plans To Accelerate Coal Retirements

U.S. coal producers are already in a tough spot, but the hints power generators dropped on second-quarter earnings calls suggest they may soon be announcing plans to retire even more of the nation's aging coal fleet. Demand for coal has been decimated by the COVID-19 pandemic, with production and employment in the sector falling to new lows as the lower demand weighs further on a sector already in secular decline. In recent weeks, multiple power generators made comments about the future of their generation fleets suggesting more coal plant retirements loom on the horizon.

—Read the full article from S&P Global Market Intelligence

Spotlight: Ethanol Plants Part Of The Solution For Forthcoming Renewable Diesel Feedstock Problem

With US ethanol production only around 85% of capacity on weak margins, recent news about new renewable diesel (RD) capacity provides a genuine reason for optimism in the industry. Distillers corn oil (DCO) is a co-product of corn ethanol production and is one of several vegetable oils used as RD feedstock. According to the US Department of Agriculture, 1.85 million short tons of DCO were extracted from ethanol plants in 2019, most of which was used for ester-based biodiesel production and animal feed.

—Read the full article from S&P Global Platts

U.S. Interior Approves Auctioning Oil Leases In Alaska's Arctic National Wildlife Refuge

The US Interior Department approved a long-delayed Record of Decision Aug. 17 to allow oil and natural gas leasing in the Arctic National Wildlife Refuge, setting the stage for a possible lease sale by December. US environmental groups are expected to file lawsuits to block the sale, and it's uncertain what appetite the oil and industry will have to bid for acreage with any drilling certain to be drawn-out litigation delays, particularly at a time of depressed oil prices.

—Read the full article from S&P Global Platts

Scorching Temperatures, Power Outages Push California Gas Prices To Summer Highs

A record-breaking heatwave and surge in cooling demand led to a spike in natural gas prices in California Aug. 17, with the highest levels seen so far this summer posted. Temperatures across the state have averaged more than 82 degrees Fahrenheit since Aug. 14, roughly 8 F above normal, and are expected to remain above 80 F through the end of the week. Excessive heat warnings are in effect through Aug. 20 across much of the state and neighboring regions from the US National Weather Service, with dangerously hot conditions and temperatures between 96 and 108 F expected, the highest of which will be away from the coast.

—Read the full article from S&P Global Platts

S Korea Takes Another Step Toward Hydrogen Economy With Hanwha's Byproduct Plant

From setting up the biggest liquid hydrogen plant in the world to producing the carbon-free fuel as a byproduct, South Korea is fast implementing new technologies to expand the scope of hydrogen production as it bets on robust growth prospects -- moves that might encourage other Asian countries to follow suit. After recently unveiling plans to set up the world's largest liquid hydrogen plant, South Korea now has another first -- starting commercial production at the world's first byproduct hydrogen-based fuel cell power plant.

—Read the full article from S&P Global Platts

NAIC Re-Examining Issues Of Race In Insurance After Decades Of Inaction

After leaving the topic alone for nearly two decades, the National Association of Insurance Commissioners is restarting its work to examine the role that race plays in insurance affordability and availability. During a special session held as part of the NAIC's virtual summer national meeting, consumer advocates and regulators called for recognition of systemic racism and inherent bias in the insurance industry and offered thoughts on how to tackle the issue.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Americas, Aug 17-21: Markets Await News Of US LNG Cargo Cancellations

In this week's Market Movers Americas, presented by Sarah Hernandez: Market awaits October cargo cancellations from US LNG facilities as recovery eyed, Coronavirus effects extend to seasonal gasoline trends, Clean tanker freight strong on back of high ULSD stocks, Aluminum tariffs take effect for Canada.

—Watch and share this Market Movers video from S&P Global Platts

Analysis: Permian Supply Concerns Push Socal Winter Gas Prices Toward Record Highs

SoCal Gas city-gate winter 2020-21 forwards prices are now at their highest since early May as stalling West Texas gas production and shifting regional fundamentals boost competition for Permian supply. On Aug. 14, calendar-month prices for December, January and February settled at $4.83, $4.62 and $4.30/MMBtu, respectively – nearly at par with record highs recorded in May. At an average $4.58/MMBtu, peak winter-season prices at SoCal Gas are also trading nearly 50 cents above last winter's historical average, S&P Global Platts' most recently published pricing data shows.

—Read the full article from S&P Global Platts

FEATURE: US Refiners Accelerate Plans To Reconfigure Plants

Facing demands for cleaner energy, some US refiners have accelerated plans to reconfigure plants even as questions remain about demand recovery from the coronavirus pandemic. Phillips 66 on Aug. 12 announced plans to turn its 120,200 b/d Rodeo refinery in California into the world's largest renewables fuel project, replacing crude with organic feedstock like cooking oil, fats, greases and soybean oils to make renewable diesel, renewable gasoline and jet fuel.

—Read the full article from S&P Global Platts

Low Oil Prices Hamper China's Efforts To Meet US Trade Deal Target

China has stepped up its purchases of US crude oil in recent trading cycles in an effort to comply with the Phase 1 trade deal with Washington struck in January, but low oil prices may severely impede Beijing's efforts to meet the purchase target for energy products in terms of dollar value. The acceleration of purchases comes at a time when a review of the trade deal due over the weekend was postponed indefinitely, but tough market conditions this year mean that any targets dependent on a revival of the economy or energy demand will be out of reach.

—Read the full article from S&P Global Platts

China's US LNG Imports Fall Short Of Phase 1 Trade Targets: Panjiva

China's imports of US LNG totaled about $300 million during the first half of the year, and together with purchases of the remainder of US energy products, fell short of Phase 1 trade targets, according to recent data from Panjiva, a business line of S&P Global Market Intelligence that provides news and analysis about global supply chains. China has fallen almost $40 billion behind its commitments to buy US goods under the agreement amid coronavirus-linked supply chain disruptions and demand shocks. Meanwhile, a review of Phase 1 targets that was due on Aug. 15 was postponed amid reports of Chinese efforts to boost purchases.

—Read the full article from S&P Global Platts

Analysis: USGC 0.5%S Bunkers Remain Pressured Amid Vague Exports Outlook

A retreating petroleum complex in March signaled swift price declines for 0.5%S marine fuel in US Gulf Coast wholesale and retail markets, but Houston 0.5%S bunkers remain depressed as exports activity remains blunted. Prices for Brent and physical barges and bunkers in the Gulf Coast set fresh lows in April, but as the futures markets have rebounded over the last few months, Houston 0.5%S bunkers is still lagging, hampered by limited demand, a consistent theme highlighted by sources in recent months.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language