Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Aug, 2020

By S&P Global

By mid-April, when the majority of Americans were under lockdown orders one month into the outbreak, executives and board members from at least 90 U.S. companies forwent the remainder of their full-year salaries, gave up their bonuses, or reduced their overall short-term compensation in efforts of avoiding laying off or furloughing their employees, according to an S&P Global Market Intelligence analysis.

“Bonuses and variable pay were either cancelled or postponed, while the fixed pay of senior executives, and CEOs in particular, were significantly reduced. In many instances, such moves were prompted by financial necessity as a cost-cutting measure, while in other cases, it was implemented to show solidarity with the rest of the workforce, especially in companies in which job security is in jeopardy,” S&P Global Ratings said in an April report.

However, a study of Russell 3000 companies by the research analytics firm CGLytics found that during the pandemic thus far only 10% of 419 companies included in the benchmark index cut executives’ salaries by more than 25% of their 2019 total realized compensation. Two-thirds of the executives took pay cuts equal to or less than 10% of their total compensation from last year.

Executive compensation exists as a key factor within environmental, social, and governance (ESG) issues.

"CEO pay this season has significant implications for a company's reputation,” Corey Klemmer, director of engagement at investment adviser Domini Impact Investments LLC, told Market Intelligence in April during the worst of the pandemic, explaining that huge CEO bonuses paid out based on a company's 2019 performance as thousands of employees lost their income "could do significant reputational harm.”

“It risks making that company into a poster child for inequality and indifference in this moment when the world is searching for ethical and compassionate leaders.” Ms. Klemmer said. Rather, "corporate boards and management teams that show ethical, compassionate, and forward-thinking leadership in this moment are likely to have a dedicated and motivated workforce for years to come."

Prior to the pandemic, chief executive officers of S&P 500 companies took home an average $14.8 million in total compensation, 264 times more than the average employee’s salary, according to a recent American Federation of Labor and Congress of Industrial Organizations study.

Last year, the chief executive officer of the Illinois-based healthcare equipment firm Abbott Laboratories, Miles White, received a $22.1 million paycheck—making him the highest-paid executive in the U.S. industry, according to rankings of the 15 top-earning CEOs compiled by S&P Global Market Intelligence.

Vincent Forlenza, the CEO of New Jersey-headquartered healthcare equipment company Becton Dickinson and Co., was paid $15.3 million total last year. Of all the industry conglomerates analyzed by Market Intelligence, Mr. Forlenza had the highest CEO-to-median employee salary ratio, of 379-to-1, which is calculated by dividing the executive’s compensation by the median employee compensation to reflect the amount the executive is paid compared to general workers at the company.

The annualized total pay of Wells Fargo CEO Charles Scharf, $36.3 million last year, was 550 times greater than the salary of the bank’s median employee, which was $65,931, according to Wells Fargo disclosures analyzed by Market Intelligence. Mr. Scharf’s total compensation included a generous award from Wells Fargo intended to account for the pay the executive lost when leaving his position as CEO of the Bank of New York Mellon Corp. to join Wells Fargo last September.

After the New York City-founded asset management giant BlackRock raised its CEO Larry Fink’s salary by 5% last year, he earned $25.3 million in 2019. Mr. Fink is the highest-paid CEO in asset management.

Today is Tuesday, August 18, 2020, and here is today’s essential intelligence.

The Essential Podcast, Episode 19: Getting Local — Rethinking Food Supply Chains for Greater Resilience

Bowery Farming CEO Irving Fain, Five Acre Farms CEO Dan Horan, and S&P Global Market Intelligence reporter Alex Bitter join the Essential Podcast to talk about food supply chains and the challenges of getting food to market during a pandemic.

—Listen and subscribe to The Essential Podcast from S&P Global

Economic Research: U.S. Real-Time Economic Data Continues To Paint A Mixed Picture

As more states reverse plans for reopening and the U.S. government negotiates the next round of emergency stimulus to keep the economic recovery on track, recent real-time economic data continues to be mixed. While total COVID-19 cases in the U.S. have topped 5 million, the number of new cases has fortunately slowed recently, through Aug. 8. While S&P Global Ratings hope this signals that the U.S. is now able to contain the virus, with fewer states forced to reverse reopening their economies in the near future, the path of the virus is extremely uncertain. S&P Global Economics still sees the probability of a worse economic outcome—than its base-case projection—at 30%-35%. Although S&P Global Ratings’ base case is for a gradual recovery through next year, still-high levels of COVID-19 infections, together with no agreement in extending emergency COVID-19 relief, suggests that the near-term outlook remains challenging.

—Read the full report from S&P Global Ratings

Dining Out: July Marks 3rd Month of Recovery for US Restaurants

Sales and employment at U.S. restaurants posted another month of improvement in July but at rates below previous months as the industry remains challenged by the pandemic and economic crisis. July sales fell about 19% from the year-ago period, or $13 billion lower than pre-coronavirus levels in January and February, the National Restaurant Association said in an Aug. 14 report. The July sales decline was another monthly improvement after the sector's sales declined a revised 22.4% year over year in June and fell 38.1% year over year in May. Shares of most of the biggest publicly traded restaurant companies rose in the month ended Aug. 13 as the S&P 500 approached its record closing high.

—Read the full article from S&P Global Market Intelligence

Listen: Predicting The Next Global Oil Shock When The World Is Awash In Supply

Global oil supply far exceeds demand right now as the coronavirus pandemic keeps travel restrictions in place and commuters working from home. Commodities analysts Leigh Goehring and Adam Rozencwajg, managing partners of Goehring and Rozencwajg, argue that the pandemic and current oil market conditions will be a catalyst for a coming global energy crisis. They think we're not far from a global oil shortage because of the lack of investment happening today and the rapid depletion of the best US shale resources.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

U.S. Not-For-Profit Acute Health Care Mid-Year Sector View: Recovery Continues, Likely Uneven For The Rest Of The Year

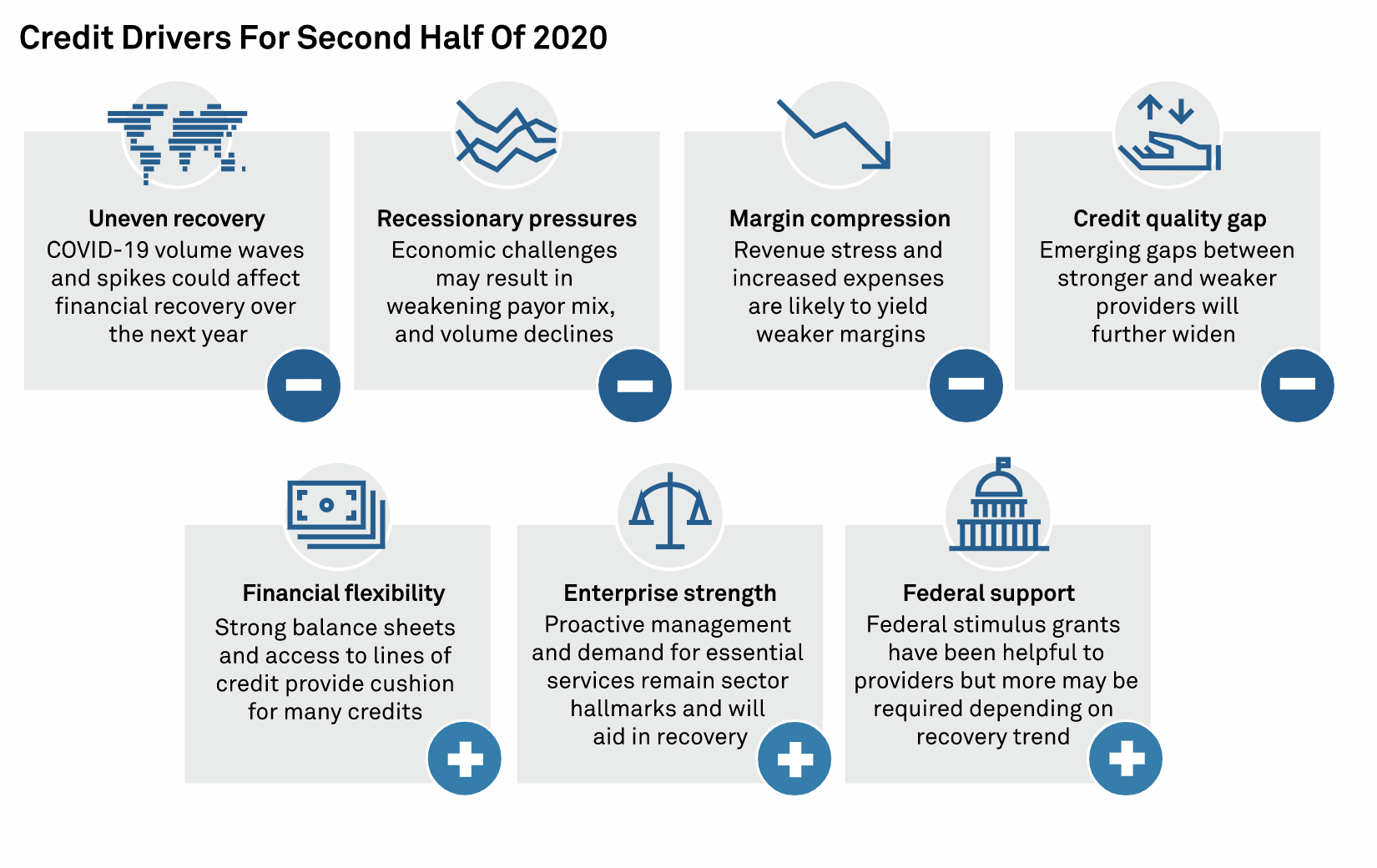

While the deep wounds from the loss of revenues related to the government shutdown of non-essential and non-emergent care may be in the rearview mirror, S&P Global Ratings believes acute-care hospitals and systems will continue to experience an uneven financial recovery into 2021. S&P Global Ratings’ sector view (previously called a sector outlook) continues to be negative as hospitals try to climb back to pre-COVID-19 volumes and margins. Hospitals in most regions are ramping up non-emergent and elective procedures and services, and S&P Global Ratings doesn’t believe a repeat of the widespread and extreme revenue and margin declines experienced in March and April will be seen.

—Read the full report from S&P Global Ratings

August Retail Market: US Sales Rise 1.2%; Bankruptcies Rival Decade-Ago Levels

U.S. retail sales grew more slowly than expected in July and retailer bankruptcies are reaching record levels, but restaurants and products like electronics outperformed forecasts for the month. Overall, retail sales in July rose 1.2% as the coronavirus surged in certain parts of the country. That is slower than the consensus estimate of 2% growth, according to Econoday. Weak car sales dogged growth. Excluding sales of cars and gasoline, sales were 1.5%, above the estimate of 0.9%.

—Read the full article from S&P Global Market Intelligence

Chilean Banks' Asset Quality Hasn't Slumped Yet Due To COVID-19--Helped By Government Measures

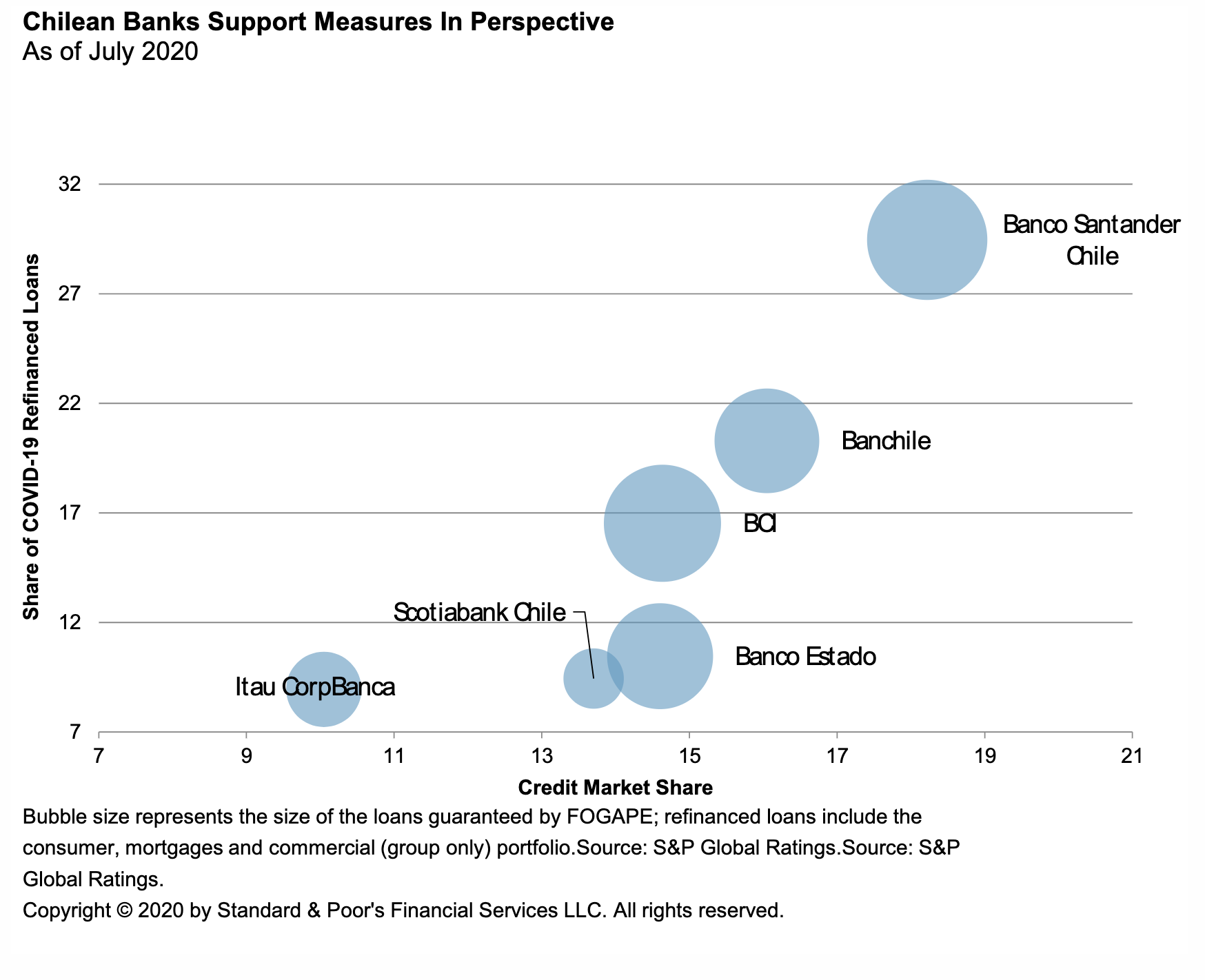

Chilean banks recently reported second quarter financial figures that were influenced by several actions taken by the Chilean government in coordination with the central bank and regulators to buffer the impact of the pandemic. In the first half of the year, credit grew fairly quickly, with a large portion of lines guaranteed by the government (known as the FOGAPE program) as part of authorities' measures to ensure credit availability. The growth in these lines more than offset a contraction of the consumer loan portfolio, given payments from customers to the financial entities during the lockdown. S&P Global Ratings believes that part of the contraction in consumer lending could be reverted in the last quarter of the year, depending on economic developments.

—Read the full report from S&P Global Ratings

Canadian Banks Mid-Year Outlook 2020: Navigating Through The Pandemic Cautiously

S&P Global Economics forecasts real GDP will contract 5.9% in 2020 before rising 5.4% in 2021, resulting in a peak-to-trough contraction of more than 13%. S&P Global Ratings expects an economic recovery in two stages: a near term bounce in aggregate demand and employment activity, followed by a more gradual protracted, and uneven improvement in the economy. S&P Global Ratings forecasts a near-term correction in house prices down 8.7% year over year, in first-quarter 2021, before starting to recover by the end of 2021 as the labor market finds its footing and the pandemic uncertainty fades. S&P Global Ratings expects the economy to still be 2.5% smaller in 2023 compared with the pre-pandemic anticipated size.

—Read the full report from S&P Global Ratings

Japan Megabanks Have Slowed Sale Of Stock In Corporate Borrowers Amid Pandemic

The pandemic has significantly slowed the Japanese megabanks' years-long effort to reduce their equity holdings in listed companies to which they lend. In the fiscal first quarter ended June 30, Sumitomo Mitsui Financial Group, Inc., Mitsubishi UFJ Financial Group Inc. and Mizuho Financial Group Inc. sold a combined ¥25.2 billion worth of their corporate customers' stock, according to company statements. It was about 5% of what they unloaded in the previous fiscal full-year ended March 31.

—Read the full article from S&P Global Market Intelligence

Goldman Sachs, Morgan Stanley, JPMorgan Top Gainers In Strong Q2 i-bank Trading

Trading revenues at the world's leading investment banks continued to grow in the second quarter, extending their gains from the previous three months, when the coronavirus pandemic triggered extreme volatility spikes in the capital markets. Most major U.S. and European institutions recorded growth in second-quarter revenues on both a quarter-over-quarter and an annual basis, S&P Global Market Intelligence data shows. Eleven out of the 13 tracked banks booked a year-over-year increase in total trading revenues and eight out of the 13 recorded higher revenues than in the first quarter.

—Read the full article from S&P Global Market Intelligence

PE Compliance Functions In Focus As SEC Uncovers Conflicts Of Interest

Some private fund managers still do not meet their compliance obligations or fulfill their fiduciary duties despite being subject to the rules since the Dodd-Frank Act required them to register with the Securities and Exchange Commission in 2012. Compliance procedures have fallen short in a number of areas, including conflict of interest management, according to a risk alert published by the SEC's Office of Compliance Inspections and Examinations, or OCIE. The alert reflects the results of its examinations of registered investment advisers managing private equity and hedge funds.

—Read the full article from S&P Global Market Intelligence

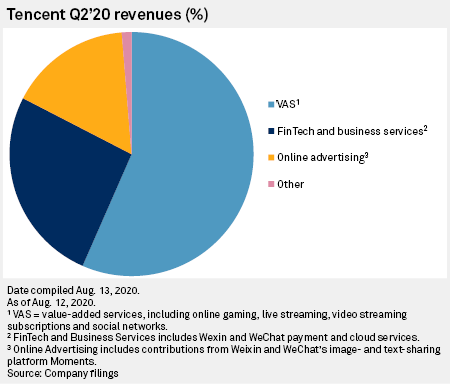

Tencent Can Hope For Limited Impact From Trump's Ill-Defined Ban, Analysts Say

Chinese internet company Tencent Holdings Ltd. is likely to see a minimal impact on its revenues from President Donald Trump's ban on its messaging service WeChat, analysts said. The scope of Trump's Aug. 6 order prohibiting "any transaction" with WeChat is unclear, the analysts said. The restrictions appear to apply to the international version of the app and not its domestic equivalent Weixin. In terms of customer numbers, the U.S. accounts for less than 3% of WeChat and Weixin's combined 1.21 billion users, analysts said. If the app alone is banned in the U.S., the impact on Tencent could therefore be limited, they added.

—Read the full article from S&P Global Market Intelligence

US Lawmakers Could Introduce Legislation Restraining Amazon, Big Tech

U.S. lawmakers are likely to introduce legislation to restrain the market power of Amazon.com Inc., Facebook Inc., Apple Inc. and Alphabet Inc.'s Google LLC unit as early as September but whether a bill would pass by the end of 2020 is unclear, experts say. Any legislative response would take into account testimony from Amazon CEO Jeff Bezos and the chief executives of Facebook, Apple and Alphabet. They testified virtually before the U.S. House Judiciary Committee's antitrust subcommittee July 29 as part of a more than yearlong investigation into the digital platforms and whether the firms have grown through anti-competitive practices.

—Read the full article from S&P Global Market Intelligence

S&P Podcast: Energy Sector Grapples With Growing Environmental Justice Movement

As calls for racial justice grow across the U.S., the impacts of energy infrastructure projects on communities of color are also getting more attention. A 2019 report by the Union of Concerned Scientists, for example, found that on average, communities of color in the Northeast and Mid-Atlantic breathe 66% more air pollution from vehicles than white residents, while a 2016 report from the NAACP noted that coal plants are disproportionately located in low-income communities and communities of color. S&P Global Market Intelligence's Energy Evolution podcast recently spoke with academic experts, environmental groups and local activists who shed some light on what those statistics look like on the ground.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

Analysis: States' Renewable Mandates Continue To Grow; Nine Set 100% Clean Energy Goals

US states continue to boost renewable energy goals, with Virginia and Colorado recently joining the growing number with 100% clean energy targets and multiple others, including Ohio and New Hampshire, in heated political battles over state energy needs. Across the US 38 states have some form of clean energy goal in place is states across the US, with nine states aiming for 100% by 2050. In regions where there is no state action utilities are stepping up net-zero emissions targets, such as major plays in the US Southeastern states.

—Read the full article from S&P Global Platts

EPA Methane Rule Could Hamper Efforts To Regulate Existing Oil, Gas Sources

The Trump administration's rollback of Obama-era methane regulations is technically aimed at new and modified oil and gas facilities, but it could also limit federal oversight of the industry's largest source of methane emissions: existing operations. On Aug. 13, the U.S. Environmental Protection Agency released two final rules that eased methane regulations for the oil and gas sector. The rules rescinded methane regulations for new and modified oil and gas facilities established under the Obama administration.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Asia, Aug 17-21: Oil Demand Recovery Remains Fragile; Key OPEC+ Meet In Focus

The highlights on S&P Global Platts Market Movers - Asia this week with Petrochemicals Editor Sophia Yao: OPEC lowers oil demand projection for 2020, 2021. Heavy rains expected to hit South Korea's Q3 gasoline demand. Clean freight market expects further upside. LNG prices hit 7-month high on supply outages.

—Watch and share this Market Movers video from S&P Global Platts

US Seizes 1.1 Million Barrels Of Iranian Gasoline Bound For Venezuela: DOJ

The US government has seized four Iranian gasoline cargoes totaling 1.12 million barrels bound for Venezuela, the latest move in the Trump administration's increased sanctions pressure on both oil-producing countries. The US Department of Justice announced Aug. 14 it had executed a US district judge's seizure order and confiscated the cargoes from four tankers: the Bella, the Bering, the Pandi and the Luna. DOJ filed a complaint in July in the US District Court for the District of Columbia seeking to forfeit all petroleum product cargo aboard the four vessels.

—Read the full article from S&P Global Platts

Naphtha Bucks Downtrend In India As Medical Hardware Fly Off The Shelves

The rush to produce medical-related plastics and hardware in the battle against COVID-19 has not only helped India's naphtha demand to buck the negative growth trend seen for the bulk of the oil barrel, it has led to the oil product posting a near double-digit growth so far this year. With rising demand for medical plastics and other equipment, analysts said it has created a dramatic surge in demand for naphtha from petrochemical makers, helping to more than offset the fall in industrial petrochemicals demand.

—Read the full article from S&P Global Platts

Rise In China's US LNG Imports Falls Short Of Targets As Trade Pact Falters

An increase in Chinese purchases of U.S. LNG offered a welcome development for U.S. exporters hit by a wave of cargo cancellations during the coronavirus pandemic this summer, but it might not be enough as top Chinese and U.S. trade officials review their "phase one" trade deal Aug. 15. China's imports of the American fuel totaled about $300 million during the first half of the year, according to recent data from Panjiva, a business line of S&P Global Market Intelligence that provides news and analysis about global supply chains.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language