Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

One Year Into the Inflation Reduction Act

On Aug. 16, 2022, when the Inflation Reduction Act was signed into law by President Joe Biden, there was no shortage of critics. Some derided the political gimmickry of suggesting that a spending bill dedicated to funneling billions of dollars into green technology was going to reduce inflation. Others insisted the money would be misspent on unproven renewable energy technologies, drawing private funds away from necessary upstream financing for oil and gas exploration. Still others claimed it would take years for projects funded by the Inflation Reduction Act to come online, given the extensive permitting process and environmental reviews that these types of projects typically undergo. One year later, the critics remain; but as a series of articles from S&P Global Market Intelligence makes clear, the impact of the Inflation Reduction Act has been seismic. A clean energy renaissance is taking place in the US, and the impact will accelerate as more projects begin operations.

The Inflation Reduction Act offers tax credits for a range of clean energy resources and extended incentives to build solar panels and wind turbines in the US. Companies have announced plans to build or expand 83 clean energy manufacturing facilities. While questions still exist about whether new technologies such as hydrogen fuel cells will be covered under the new tax credits, the inducement to build technologies in the US has created a boom in new manufacturing facilities for cleantech. The attempt to jump-start a homegrown solar panel and wind turbine industry in the US creates the possibility of global competition with China, which has traditionally dominated these industries.

Many critics of the Inflation Reduction Act focused on the incentives designed to spur domestic production of critical minerals for electric vehicle batteries. They pointed out that it takes years to develop the mining and processing facilities for these minerals. However, automakers and miners have responded enthusiastically to the incentives. Albemarle, Lithium Americas and General Motors have announced hundreds of millions of dollars in domestic mining and battery manufacturing site investments. Ford has announced a $3.5 billion investment in a Michigan battery plant, and Piedmont Lithium is building a lithium hydroxide processing plant in Tennessee. All of these projects have been announced or accelerated since the Inflation Reduction Act was signed.

However, the Inflation Reduction Act’s critics can still point to the slow pace of clean hydrogen development. While the act authorized a tax credit for hydrogen producers worth up to $3 per kilogram for clean hydrogen, rules that preclude existing hydrogen producers from buying renewable energy certificates to claim the credit have met with criticism. Only 11 of 115 announced hydrogen projects have drawn funding, according to S&P Global Commodity Insights. While the US Treasury Department promised simplified guidance on which projects would qualify for the $3-per-kilogram tax credit, it has missed several deadlines. Meanwhile, hydrogen producers have been active in lobbying Congress to amend the rules to apply to a wider range of projects.

Offshore wind is also lagging expectations. While the Inflation Reduction Act established significant incentives for offshore wind — a 10% domestic content bonus tacked onto a 30% investment tax credit — the limits placed on those incentives have proved challenging. Qualifying offshore wind projects are required to use 100% domestically made iron and steel in nonmanufactured components, and 20% of the total costs of manufactured components and subcomponents must be mined, produced or manufactured in the US. Despite the slow progress in offshore wind, 18 offshore wind shipbuilding projects and investments are under development in 12 manufacturing facilities and 13 ports. These projects create the capacity to develop more wind projects in the future.

Today is Thursday, August 17, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

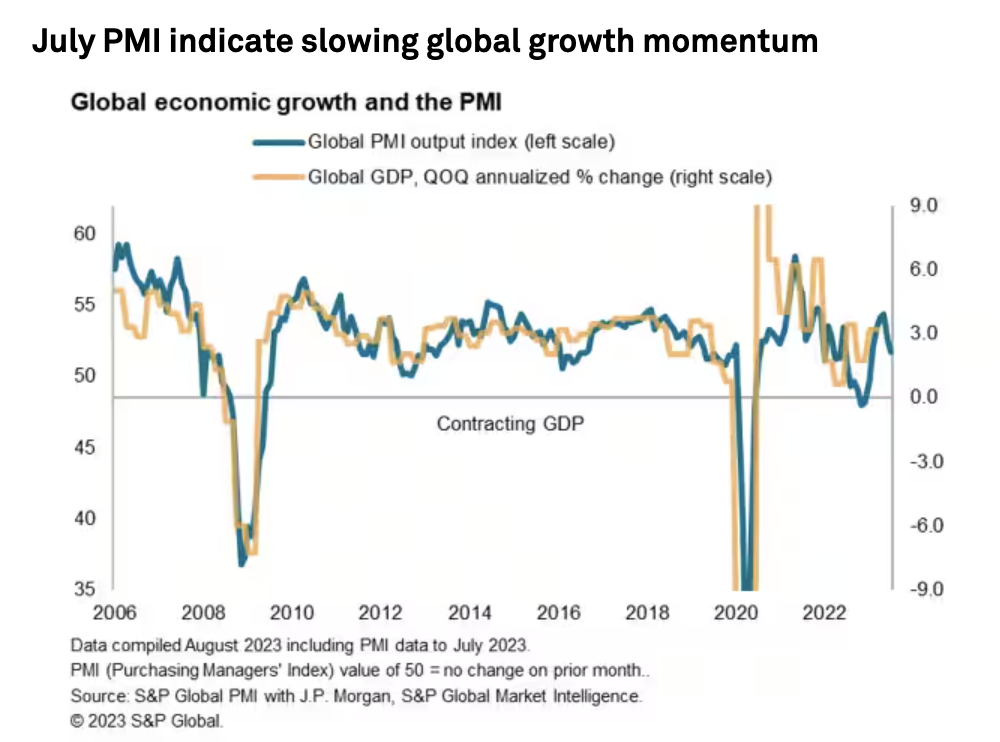

Global Inflation And Growth: What To Watch For In The Upcoming August PMI Surveys

The global economy continued to lose growth momentum at the start of the second half of 2023, underpinned by waning of service sector growth momentum and a deepening manufacturing downturn. Whether this continues in August and to what extent if so, will be eagerly watched with the upcoming flash PMI releases for major developed economies on August 23rd, followed by worldwide PMI figures at the start of September.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Default, Transition And Recovery: Defaults Slow In July

Monthly defaults fell to their lowest levels so far in 2023, with only seven defaults in July. Compared with previous years, the July monthly default tally is in line with 2021, which also had seven defaults, and is above the six in 2022. Despite this, the global corporate default tally has reached 91, more than double this point in 2022, and more than 24% above its 10-year average. Meanwhile, Europe is the only region with increased defaults from the previous month (one), bringing the 2023 regional tally to 14. The regional tally is nearly 2.3x its previous year tally and has reached its second highest year-to-date level since 2008. By sector, health care and consumer products have led defaults in Europe.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

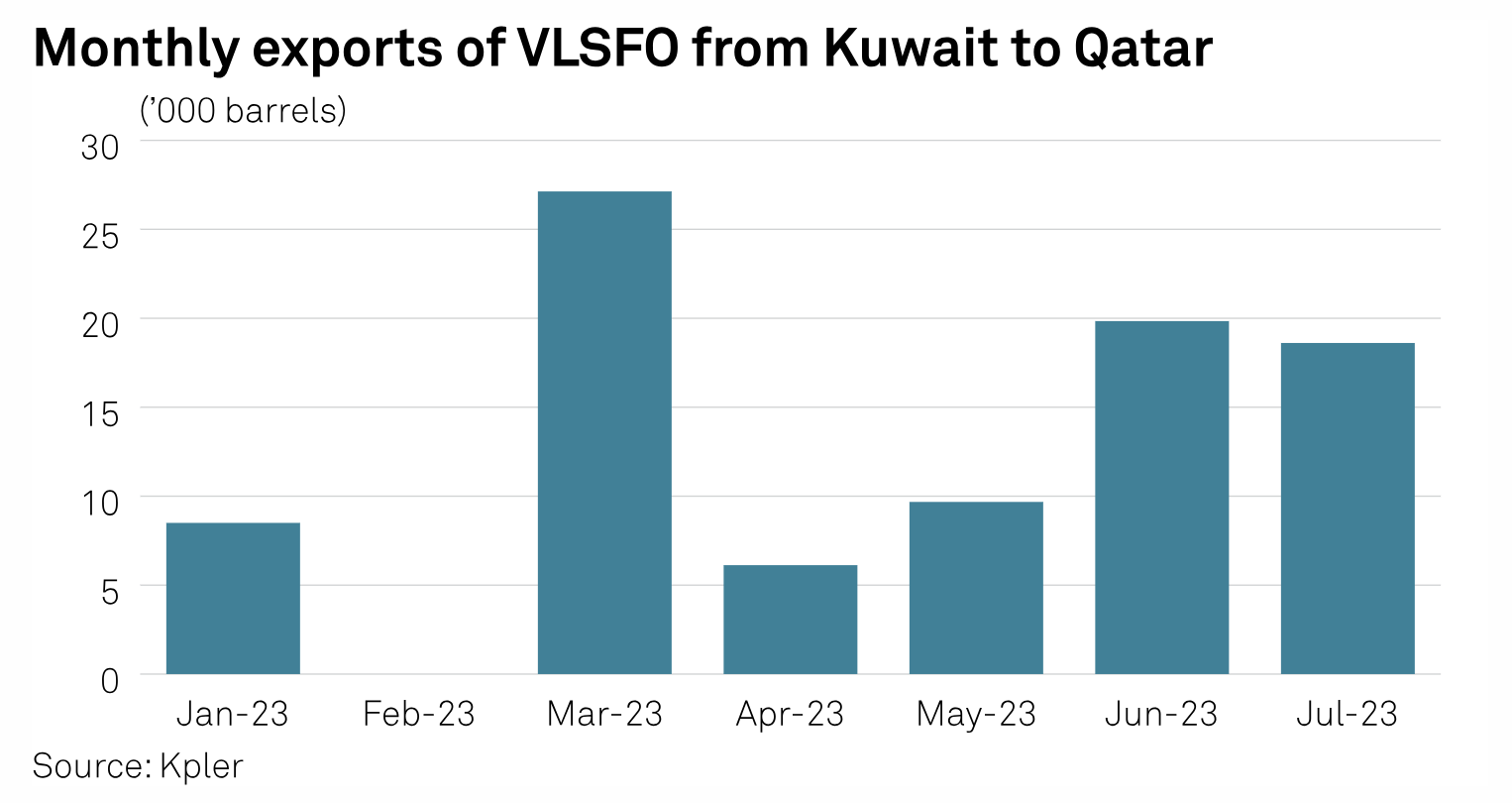

Kuwait Dominates Ship Fuel Sales To Qatar As Al Zour Refinery Finds New Markets

Kuwait has become the leading supplier of ship fuel to Qatar, one of the world's largest LNG producers and exporters, with its recently opened Al Zour refinery taking market share with products including fuel oils, jet fuel, diesel, naphtha and gasoline. Al Zour has shipped about 3 million barrels of fuel oil to Qatar in 2023, taking over from last year's suppliers including Bahrain, Malaysia and Singapore, according to Kpler shipping data. The refinery began exporting jet fuel, naphtha and low-sulfur fuel oil in November after commissioning the first of its three crude distillation units with plans to have production capacity of 615,000 b/d by the end of this year.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Decarbonization Efforts In India: How Ready Is The Steel Industry?

India has an ambitious target to double the steel production capacity by 2030 from current levels. While the steel industry gears up for this expansion, concerns of higher carbon emissions loom large amid India lacking a distinct roadmap for decarbonization and its carbon neutrality target set as far ahead as 2070. At the same time, Europe is gearing up to implement the Carbon Border Adjustment Mechanism (CBAM), which is expected to affect the sources and prices of steel imports. How is India going to be impacted by CBAM and how is India faring in its decarbonization journey? S&P Global Commodity Insights Senior Editor covering the Asia ferrous metals market Rituparna Nath spoke with the Managing Editor for Asia Metals News Rohan Somwanshi, Managing Editor of the Global Compliance Carbon markets Agamoni Ghosh and Senior Metals Analyst Paul Bartholomew to discuss these questions.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

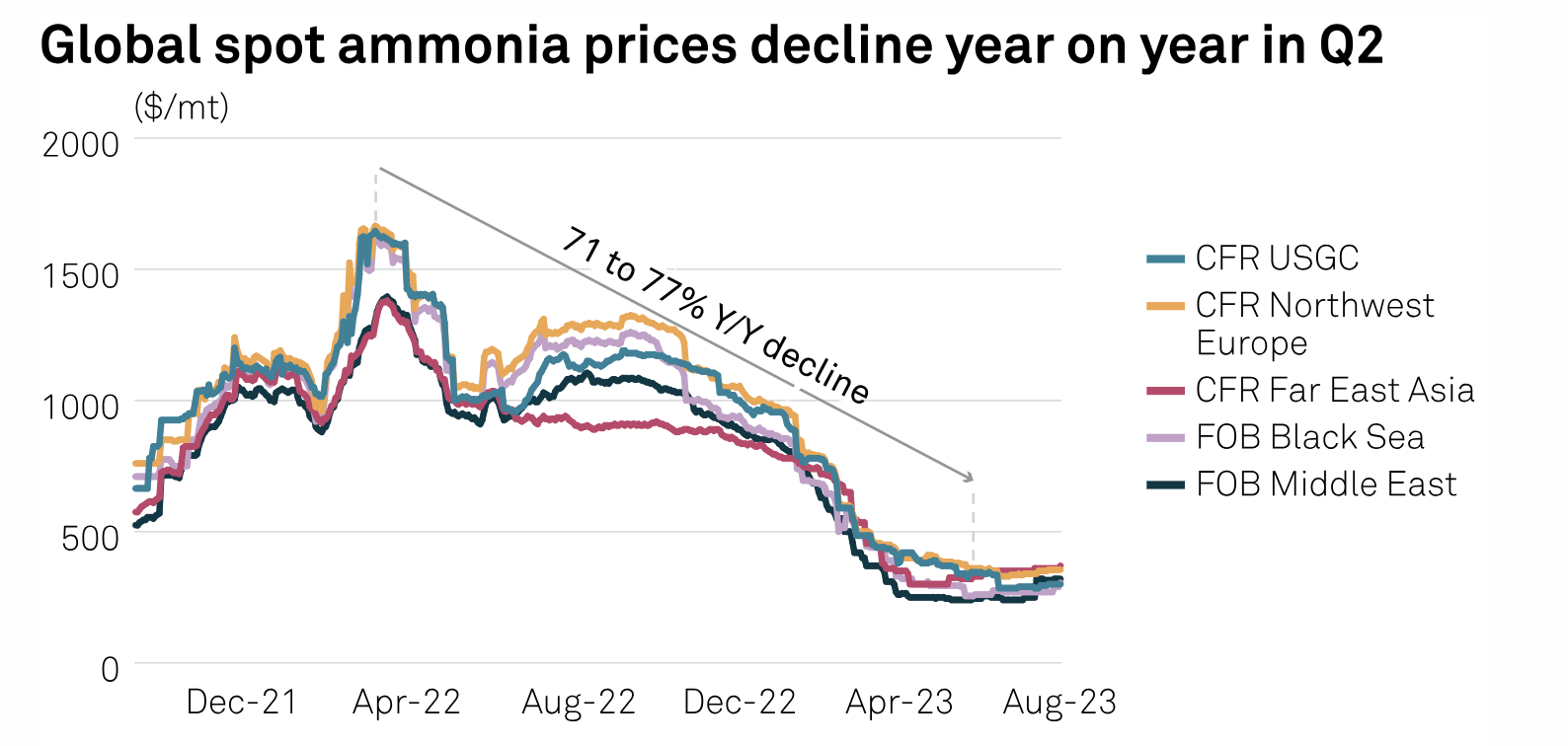

Analysis: Global Ammonia Prices Fall 50% On Year, Sparking Concerns Over Future Low-Carbon Market

Low-carbon ammonia project developers across the world are facing challenges securing final investment decisions, amid a downtrend in global spot ammonia prices and demand uncertainties, according to industry experts and an analysis of market data by S&P Global Commodity Insights. New project advancements have slowed in the low-carbon ammonia market, as in the hydrogen market, amid government policy delays to deal with worsening production economics, slow demand and supply chain issues.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

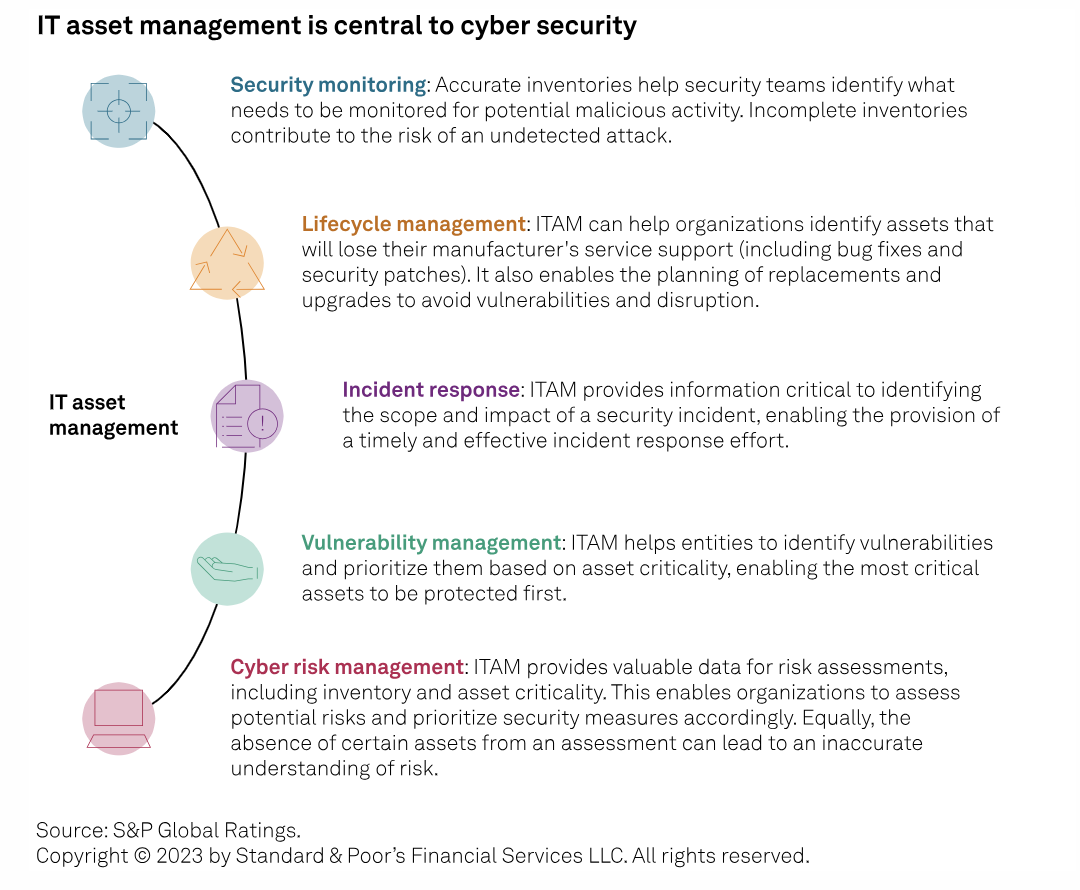

Cyber Risk Insights: IT Asset Management Is Central To Cyber Security

For a cyber security system to be effective it must know what it is meant to protect. At large organizations that can include thousands of connected devices, such as laptops and mobile phones, as well as multiple operating systems, software systems and networks. The process of logging, tracking and managing those resources is typically called IT Asset Management (ITAM) and its effective practice is foundational to good cyber defense.

—Read the report from S&P Global Ratings

Content Type

Language