Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Aug, 2020

By S&P Global

The joie de vivre ended for British travelers in France on Friday after the U.K. government imposed a new quarantine restriction requiring all returning vacationers to self-isolate for 14 days upon their return.

“We have got to be absolutely ruthless about this, even with our closest and dearest friends and partners. I think everybody understands that,” U.K. Prime Minister Boris Johnson said on Aug. 13 after England, Northern Ireland, Scotland, and Wales came to a consensus on the decision to add France to its so-called no-go list. “We can't be remotely complacent about our own situation. Everybody understands that in a pandemic you don't allow our population to be re-infected or the disease to come back in.”

“A British decision that we regret and which will lead to a measure of reciprocity, hoping that things will return to normal as soon as possible,” France’s European affairs minister Clément Beaune said on Twitter late Thursday night.

As of Aug. 15, France’s population had 36.2 cumulative coronavirus cases per 100,000 people within the past 14 days, while the U.K. had 19.8 cases per 100,000 people for the same period, according to European Centre for Disease Prevention and Control data. France reported more than 2,600 cases in 24 hours on Thursday—its greatest total since the country lifted its lockdown in May. While infection rates across the U.K. appear to have stabilized, parts of northern England are under partial lockdown measures – forbidding home visitors and keeping casinos, indoor gyms, bowling alleys, and other spaces closed.

Roughly 160,000 British tourists abroad in France acted quickly to find their way to the U.K. before the quarantine rule took effect at 4am Saturday morning. The U.K. government gave just 30 hours’ notice of the changing rules. Fares spiked as demand increased sharply. Plane tickets were purchased at a frenzied pace. Train tickets sold out. Even the boats were booked. Some people could not afford to make a hasty return home.

U.K. Transportation Secretary Grant Shapps told the BBC on Aug. 14 that Britons would be “breaking the law” if they did not comply with the 14-day isolation upon arrival in the U.K. and could risk fines of up to £1,000. The order also applies to the Netherlands, Monaco, Malta, Turks and Caicos, and Aruba, which have reported surges in coronavirus infections.

Approximately 300,000 French tourists were believed to have returned to France from the U.K. this weekend.

The move brings a powerful blow to both economies, which are struggling to make a meaningful recovery from the coronavirus-caused economic downturn despite increased activity after ending lockdowns in the spring.

The U.K.’s service sector-dependent economy shrunk 20% quarter-over-quarter in the three-month period from April to June and plunged into its worst-ever recession, according to official government data. Current conditions in the U.K. mark the worst growth contraction of any other large European economy. The country’s GDP remains 17.2% below pre-pandemic levels from February despite growing 11.3% since April’s lows.

The “figures confirm that hard times are here,” U.K. Chancellor Rishi Sunak said after the results were released Aug. 12.

Eurozone economies shrunk 12.1% in the second quarter, according to Eurostat, which also reported Aug. 14 that the pandemic has destroyed 5.5 million jobs in the E.U. labor market—equating to a 2.8% employment slump. France’s GDP dropped 13.8% quarter-over-quarter in its fastest-ever decline.

France is the second-most popular tourist destination for British vacationers after Spain—which was also recently added to the U.K.’s quarantine list for travelers. Tourism accounts for approximately 9% of France’s economic output.

More than 6 in 10 British adults, or 62%, said in an early August survey conducted by the U.K.’s Office for National Statistics that they were very unlikely to travel abroad on vacation if they had to self-isolate at home for two weeks upon returning to the U.K.

The new restrictions will likely dampen air travel for the remainder of the summer season through August and early September. The International Air Transport Association lowered its European outlook for airlines on Aug. 12, a day prior to the announcement, now forecasting passenger numbers for the region to decline 60% by year-end.

“It’s another devastating blow to the travel industry already reeling from the worst crisis in its history,” Tim Alderslade, CEO of the industry association Airlines U.K. that represents all airline carriers registered in the country, said in an Aug. 14 statement of the quarantine order.

Airline equities sunk Friday following the news alongside European benchmark indexes. U.K.-listed EasyJet, one of the largest budget airlines in Europe, saw its stock sink 7%. TUI Group, the German-based travel company that is the U.K.’s largest tour operator, saw its stock tank 8%. The European Stoxx 600 closed 1.2% lower.

Today is Monday, August 17, 2020, and here is today’s essential intelligence.

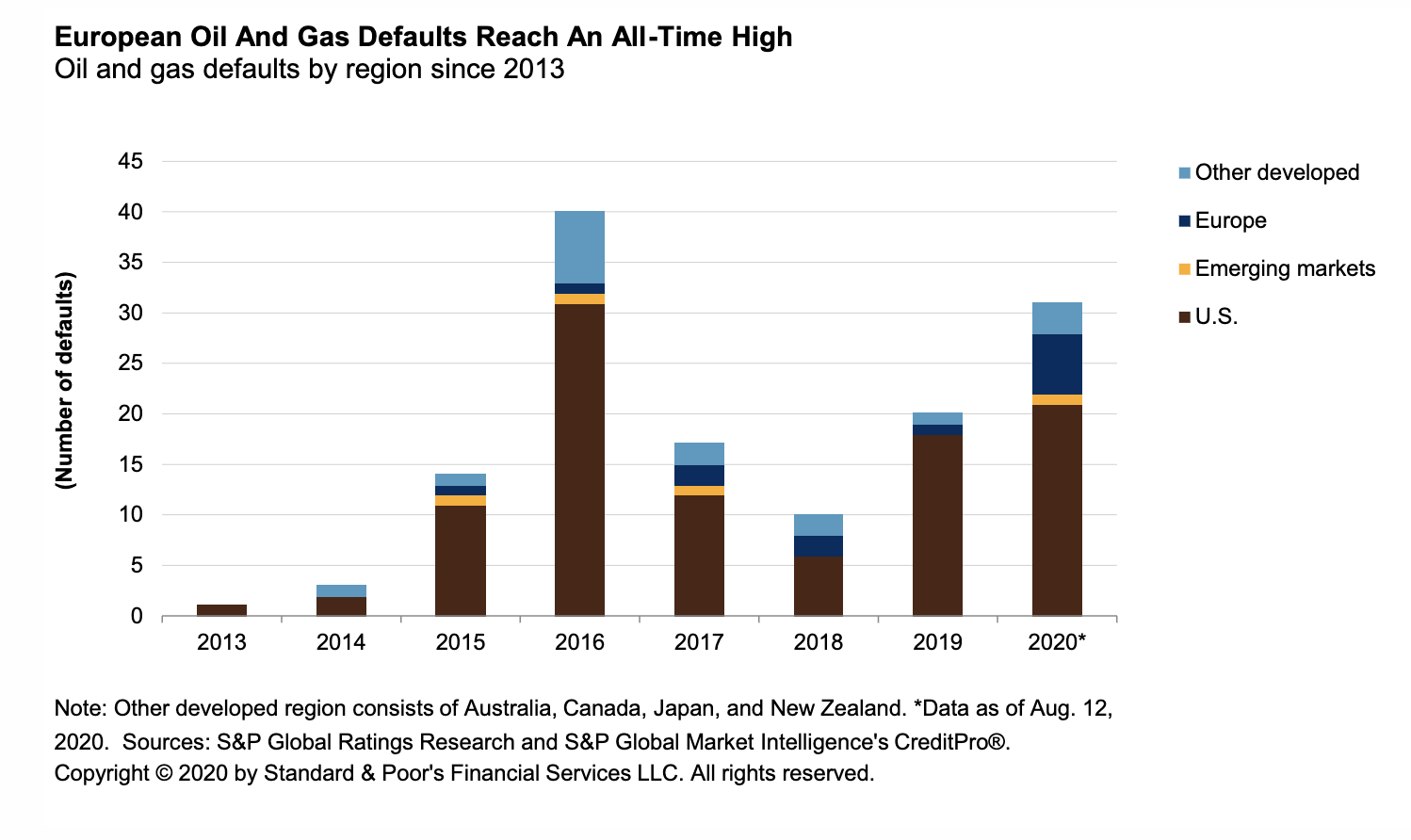

Default, Transition, and Recovery: The Lowest-Rated Entities Account for 92% of Corporate Defaults so Far This Year

The 2020 global corporate default tally reached 155 as of Aug. 12. The defaulters since S&P Global Ratings’ last report were U.K.-based casual dining restaurant chain Pizzaexpress Financing 1 PLC, Switzerland-based offshore driller Transocean Ltd., and New York-based engineered products designer and manufacturer UTEX Industries Inc. All three companies were rated 'CCC' or lower prior to default. Entities rated in the 'CCC' category or lower account for 92% of the defaults so far in 2020, illustrating the high default risk associated with this part of the ratings spectrum.

—Read the full report from S&P Global Ratings

U.S. Not-For-Profit Acute Health Care Mid-Year Sector View: Recovery Continues, Likely Uneven for the Rest of the Year

While the deep wounds from the loss of revenues related to the government shutdown of non-essential and non-emergent care may be in the rearview mirror, S&P Global Ratings believes acute-care hospitals and systems will continue to experience an uneven financial recovery into 2021. S&P Global Ratings’ sector as hospitals try to climb back to pre-COVID-19 volumes and margins. Hospitals in most regions are ramping up non-emergent and elective procedures and services, and S&P Global Ratings’ doesn't believe it will see a repeat of the widespread and extreme revenue and margin declines experienced in March and April.

—Read the full report from S&P Global Ratings

Credit Trends: U.S. Corporate Bond Yields As Of Aug. 12, 2020

This article contains data compiled by S&P Global Ratings Research, provider of analytical and timely information on S&P Global Ratings' secondary market yields for investment-grade and high-yield corporate bonds.

—Read the full report from S&P Global Ratings

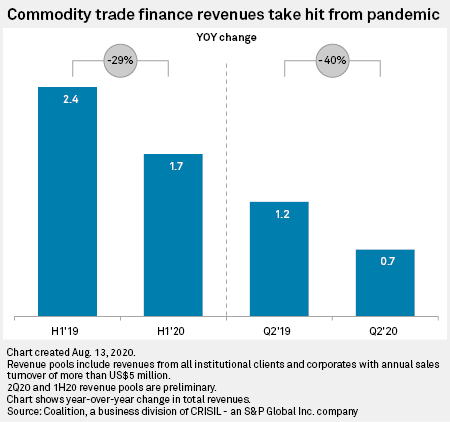

Hit by 40% Revenue Slump, Commodity Trade Finance Faces Bank Retreat, Reshaping

With commodity trade finance suffering from low volumes and high loan losses during the coronavirus pandemic, banks are retreating from the market. That leaves a funding vacuum that will be painful for midsize companies in particular, but which may attract alternative lenders, according to industry observers. Total commodity trade finance revenues for banks globally dropped 40% year over year in the second quarter of 2020, according to figures from Coalition, an S&P Global-owned research company. For the first six months of the year, they dropped 29%.

—Read the full article from S&P Global Market Intelligence

Nonprofit Borrowers Struggle With Paycheck Protection Program Uncertainty

For one nonprofit, getting a relief loan through the Paycheck Protection Program was a boon — but it came with risks. Nonprofit Finance Fund, a 501(c)3 nonprofit and community development financial institution, or CDFI, received a PPP loan of about $2.1 million, CEO Antony Bugg-Levine said in an interview. CDFIs are government-designated lenders that provide financial assistance to distressed or underserved communities and borrowers and can receive direct funding through a fund set up by the U.S. Treasury. NFF used its PPP loan for payroll, which allowed it to remain focused on its mission of funding other nonprofits.

—Read the full article from S&P Global Market Intelligence

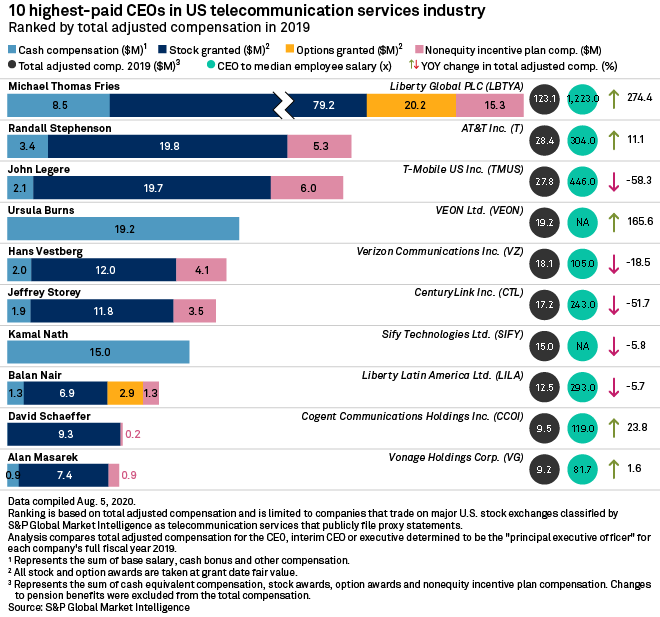

Amid Telecom CEO Exits, Liberty Global's Mike Fries Tops Highest Paid List

Mike Fries, CEO of London-based broadband and communications giant Liberty Global PLC, was the highest-paid telecommunications executive in 2019, according to compensation data compiled by S&P Global Market Intelligence. Fries, who was appointed president and CEO in June 2005, earned a total adjusted compensation of $123.1 million in 2019, up 274% year over year. The other three CEOs in the top four for 2019 — AT&T Inc.'s Randall Stephenson, T-Mobile US Inc.'s John Legere and VEON's Ursula Burns — left their executive positions in 2020. While Fries' cash compensation of $8.5 million was not the highest on the list, Fries' stocks and options awards — valued at $79.2 million in stock and $20.2 million in options — helped lift Fries to the top. Fries also received a $5 million sign-on bonus connected to his renewed employment agreement with Liberty Global, signed in April 2019.

—Read the full article from S&P Global Market Intelligence

Withdrawal of Michael O'Rielly's Nomination Creates Uncertain Future at FCC

President Donald Trump's decision to withdraw his nomination of Michael O'Rielly, a Republican member of the U.S. Federal Communications Commission, for a new term has thrown into question the coming political balance-of-power and policy agenda at the agency. Republicans on the commission currently hold a 3-2 majority, but that could change depending on the outcome of the November presidential election and whether someone is appointed to O'Rielly's seat by the end of the year. Without a 2020 appointment, which policy experts think is unlikely unless Trump reverses course on O'Rielly, the FCC would potentially be left with a 2-2 political split that would only be broken by whichever party wins the White House after the election.

—Read the full article from S&P Global Market Intelligence

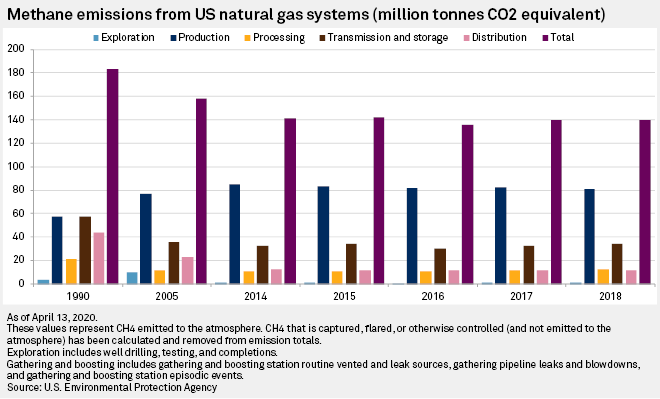

EPA Overrides Obama-Era Methane Regulation on Oil, Gas Industry in Final Rules

The U.S. Environmental Protection Agency eased methane emission oversight on new and modified oil and natural gas sources in final rules released Aug. 13. The rules no longer require oil and gas companies to monitor facilities for methane leaks, though the EPA would still require production and processing companies to monitor for volatile organic compounds, senior EPA officials told reporters Aug. 13. That requirement impacts methane emissions, too, since methane and volatile organic compounds are often co-emitted, according to the industry and agency.

—Read the full article from S&P Global Market Intelligence

Wind Turbine Makers Wobble Under COVID-19 Impacts

The coronavirus crisis has shaken the foundations of wind turbine manufacturing, driving two of the largest producers outside of China to net losses in the first half of the year and continuing to disrupt supply chains in key markets for both blade production and wind installations. Germany's Nordex SE reported negative EBITDA of €70.8 million in the first six months of 2020, down from positive €17.1 million in the previous year, with CEO José Luis Blanco citing "a massive shock" from the pandemic that meant the company and its suppliers had to shut factories and could not ship their products to construction sites.

—Read the full article from S&P Global Market Intelligence

Fridson on Finance: ESG Outperformed as COVID Hit, But Does Not Guarantee Alpha

The dispute over ESG-based investing, discussed in our previous article, has heated up in recent days. Leading asset managers, including Franklin Resources, State Street Corp. and Vanguard Group, sent letters asking the U.S. Department of Labor to reconsider investment rules floated by the department in June. The proposed regulations would require administrators of retirement plans to base their selection of investments solely on financial considerations. Administrators would be prohibited from subordinating return or increasing risk in pursuit of non-financial objectives.

—Read the full article from S&P Global Market Intelligence

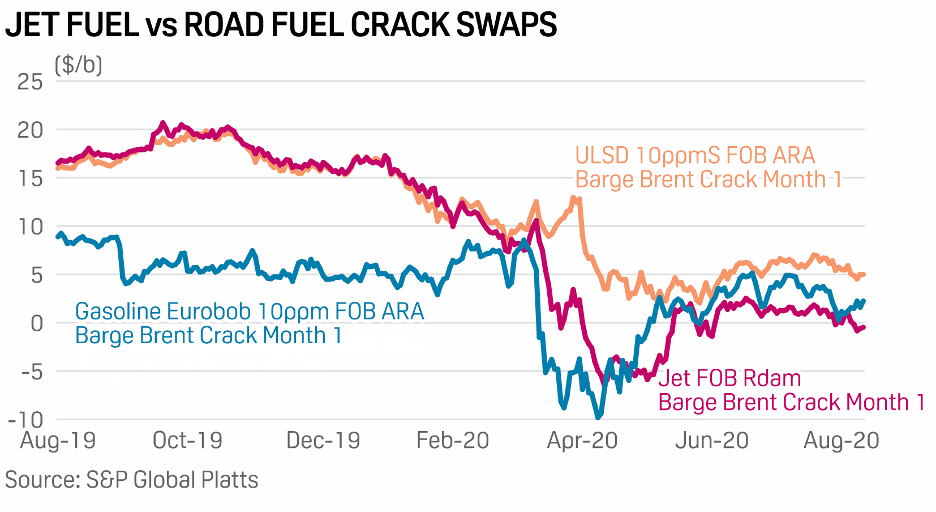

Analysis: Road Fuels Outpacing Jet as The Nature of Travel Changes

Across Europe consumers are opting for domestic holidays and destinations reachable by car this summer, widening the chasm between recovery in jet and road fuel demand. According to traders, some consumers are afraid to fly in light of the coronavirus pandemic, and others fear a quarantine may be imposed on their return. Further, other travelers want to avoid the risk of cancellations. All of this means that many travelers would prefer to stay closer to home. And this preference for domestic tourism has provided support to diesel markets.

—Read the full article from S&P Global Platts

South Korea's Longest Monsoon On Record To Push Q3 Gasoline Demand 12% Lower

Heavy rains and flash floods across various regions in South Korea could put the brakes on the country's auto fuel demand recovery since the peak of the COVID-19 cases in March-April, with refinery and industry officials expecting domestic gasoline consumption in the third-quarter to fall at least 12% from the second-quarter and year on year. South Korea has suffered from heavy downpours that continued for more than 50 days since late-June, marking the country's longest ever monsoon season. The heavy rains triggered numerous cases of river overflows, small to medium-scale flash floods, as well as landslides across the nation, leaving 33 dead and 9 missing and some 7,800 residents displaced from their homes, according to the Korea Meteorological Administration.

—Read the full article from S&P Global Platts

Rise In China's US LNG Imports Falls Short of Targets as Trade Pact Falters

An increase in Chinese purchases of U.S. LNG offered a welcome development for U.S. exporters hit by a wave of cargo cancellations during the coronavirus pandemic this summer, but it might not be enough as top Chinese and U.S. trade officials review their "phase one" trade deal Aug. 15. China's imports of the American fuel totaled about $300 million during the first half of the year, according to recent data from Panjiva, a business line of S&P Global Market Intelligence that provides news and analysis about global supply chains.

—Read the full article from S&P Global Market Intelligence

FEATURE: Seafarers Stranded at Sea as Pandemic Upends Global Shipping Markets

Global shipping markets are struggling to resume normal trade operations as the coronavirus-induced restrictions on seafarers takes toll on logistics chains, threatening earnings prospects and ramping up freight as well as demurrage costs, industry sources told S&P Global Platts. The recent government restrictions imposed by countries such as the Philippines and Hong Kong is adding to the woes and expenses of shipowners and operators alike, the sources said in the week ending Aug. 15.

—Read the full article from S&P Global Platts

Top Northern Appalachia Coal Mines Substantially Cut Back Output in Q2'20

As the coronavirus pandemic crushed demand for coal throughout the U.S. and around the world, output from some of the top coal mines in the Northern Appalachian region in the eastern U.S. saw precipitous declines. The top 25 coal mines in the region by production volume produced 14.0 million tons in the second quarter of 2020, according to an S&P Global Market Intelligence analysis of industry-reported data collected by the U.S. government. Output from these mines during the quarter fell 27.0% from 19.1 million tons produced in the previous quarter, when reports of novel coronavirus infections were beginning to trickle into the public domain, and dropped 45.8% from 25.7 million tons produced during the same period in 2019.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Language