Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Aug, 2023

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Asia’s Insurance Sector Primed for Growth

The insurance industry in most of the Asia-Pacific region seems set to grow, though not without some growing pains.

Mainland China already has the world’s second-largest insurance market after the US, but it still has plenty of room to expand, according to S&P Global Ratings. The outlook for life insurers is particularly optimistic. After a few rough years in which the COVID-19 pandemic hurt demand, the life insurance market is starting to recover.

“[Mainland] China's low penetration rates suggest there is much growth ahead in the market. Rising insurance awareness and demand for protection in the country will likely facilitate secular growth in the sector,” said WenWen Chen, an analyst at S&P Global Ratings.

Chinese property and casualty (P&C) insurers, on the other hand, will face more difficulty. Underwriting profits rose in 2022 because COVID-19 measures kept vehicle traffic, and therefore auto insurance claims, low. However, S&P Global Ratings expects underwriting pressure to come back in 2023–24. “P&C insurers will need to address the more challenging circumstances by honing their pricing models and otherwise strengthening their underwriting,” Chen said.

The P&C market is still expected to expand overall. According to Chen, “[as] economic activities normalize, both the life and P&C insurance sectors' premium growth will likely return to high single-digit growth in 2023 and 2024.”

The insurance industry in Hong Kong is also expected to see strong improvement. S&P Global Ratings expects new-business growth for the life insurance segment to hit 20%-25% in 2023 before dipping to 10%-15% in 2024. Meanwhile, growth in the P&C segment should be stable at about 5% for the next two years.

Hong Kong’s quickly aging population and demand from mainland China are the main drivers of this increase. “Mainland China customers are drawn to Hong Kong because of its widening interest rate differential, opportunities for asset diversification and the availability of comprehensive healthcare. Hong Kong insurers provide foreign currency-denominated savings and investment policies and more well-rounded critical illness and medical insurance offerings than their mainland counterparts,” said S&P Global Ratings analysts.

Increasing business with mainland China will further expose Hong Kong’s insurance sector to any volatility there, so the shift doesn’t come without risk.

Meanwhile, Japan and South Korea saw significant rate increases during the reinsurance renewal season in early April. In Japan, most contracts were renewed with rate increases of more than 20% because of inflationary pressure and increasing natural disasters, a source told S&P Global Market Intelligence. Renewal negotiations in Japan remained orderly despite the rate spikes. The same can’t be said for South Korea, where some negotiations were dragged into mid-March, putting “tremendous pressure” on cedents to reach terms by the April deadline.

As the insurance markets in the two countries harden, Japanese insurers are becoming more interested in other reinsurance forms such as insurance-linked securities, which let carriers transfer risk to capital markets. South Korean insurers tend to be more conservative, but some may start to consider alternative forms.

Though Asia’s insurance industry faces some challenges and not all segments will increase equally, it has opportunities for strong growth over the next few years.

Today is Wednesday, August 16, 2023, and here is today’s essential intelligence.

Written by Claire Delano.

Watch: Market Movers Americas, Aug. 14-18: US Macroeconomics Under Scrutiny, Ecuador Faces Historic Vote

This week, oil markets will be keeping an eye on the initial jobless claims report set to come out Thursday for guidance on how the labor market is faring. The data could provide key insights on what to expect from the September US Federal Reserve meeting, where market participants anticipate the Fed may pause its cycle of tightening interest rates on indications that inflation is easing.

—Watch the video from S&P Global Commodity Insights

Access more insights on the global economy >

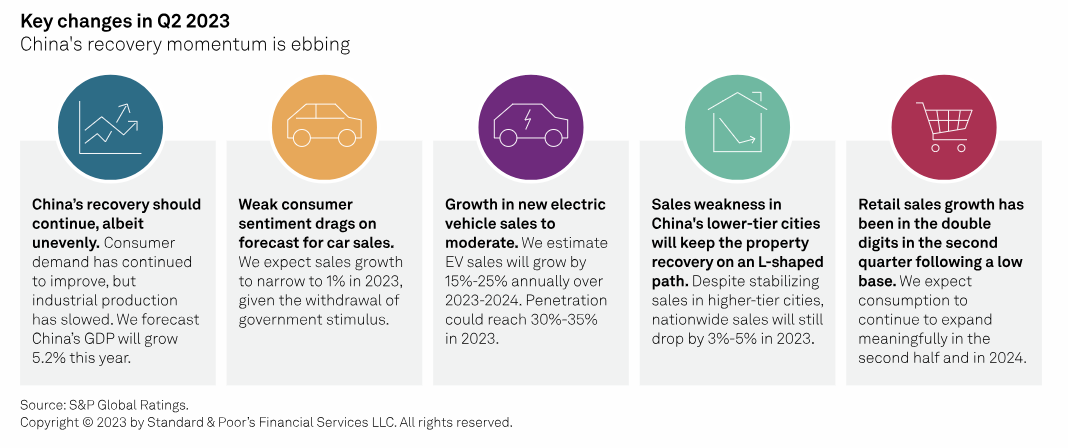

China Securitization Performance Watch 2Q 2023: Issuance Continues At A Slow Pace

China's securitization market remained lackluster in the first six months of 2023. Amid shaky consumer confidence and continued weakness in the property sector, RMBS issuance stayed stalled, and issuance slowed for auto loan ABS and corporate risk-related asset classes. Despite persisting growth momentum in some sectors such as leasing receivable ABS, uncertainties around sector fundamentals are likely to hinder a rapid issuance recovery. S&P Global Ratings expects annual issuance volume to decline by 8% during 2023.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

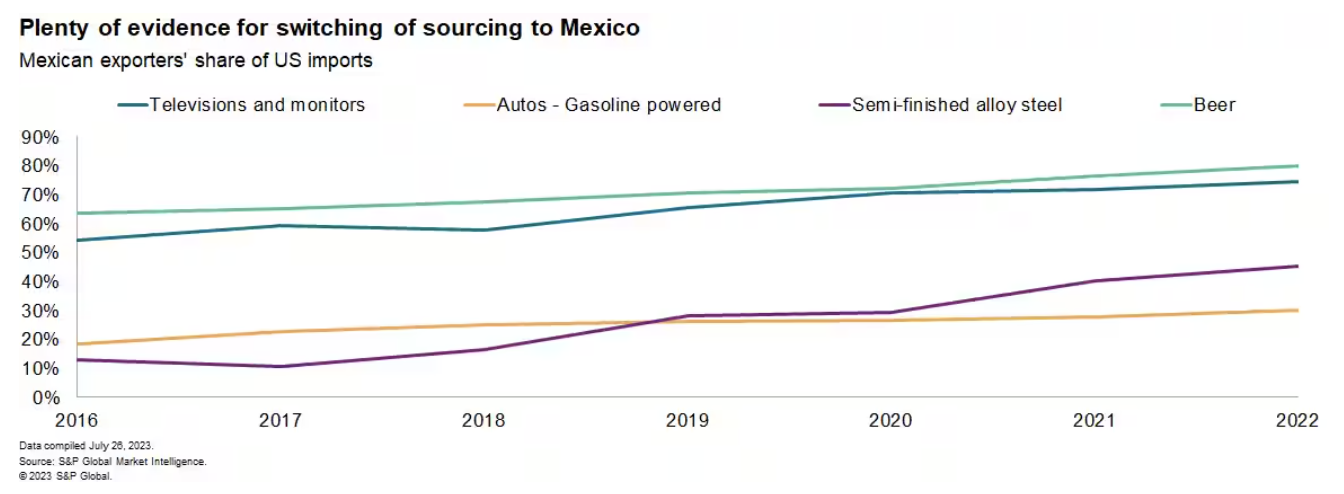

Mexico As A Supply Chain Reshoring Leader

Mexico has been a leader in reshoring of manufacturing both out of the US and away from mainland China. There's plenty of evidence of reshoring over the past five years, but success in the future is by no means guaranteed given stiff competition from other countries including Vietnam. Mexico has been well established as a center of integrated manufacturing supply chains, particularly around assembly, for the North American market. A process that started with the creation of NAFTA in 1994 was renewed with the reformation of NAFTA as USMCA in 2020.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

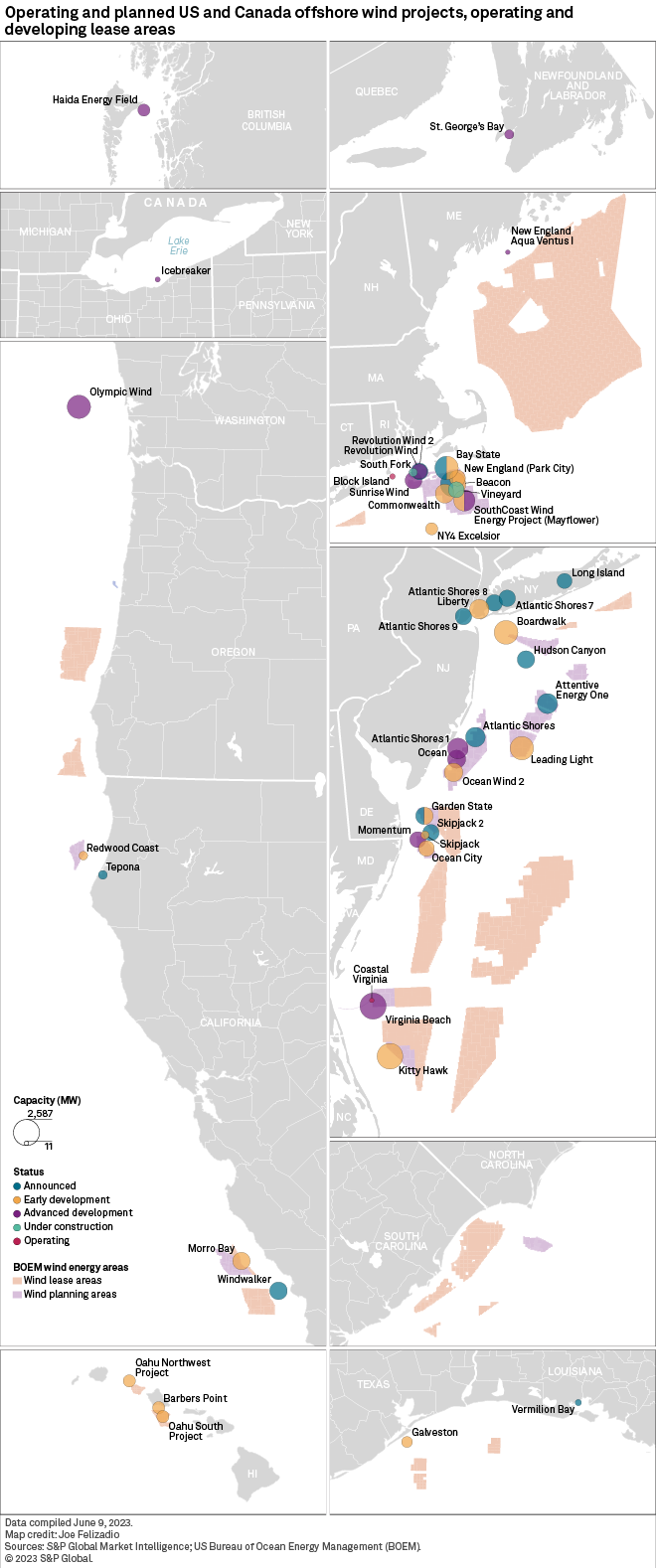

IRA At 1: US Boost To Offshore Wind Imperiled By Struggling Projects

Even as US offshore wind projects are afforded tax credits so generous that the European Union has claimed they violate trade treaties, developers of the nascent industry are questioning whether they can turn a profit. Inflation has stung offshore wind projects across the world. But the pain is acute for the backers of US projects that are trying to navigate a supply chain that has yet to develop.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

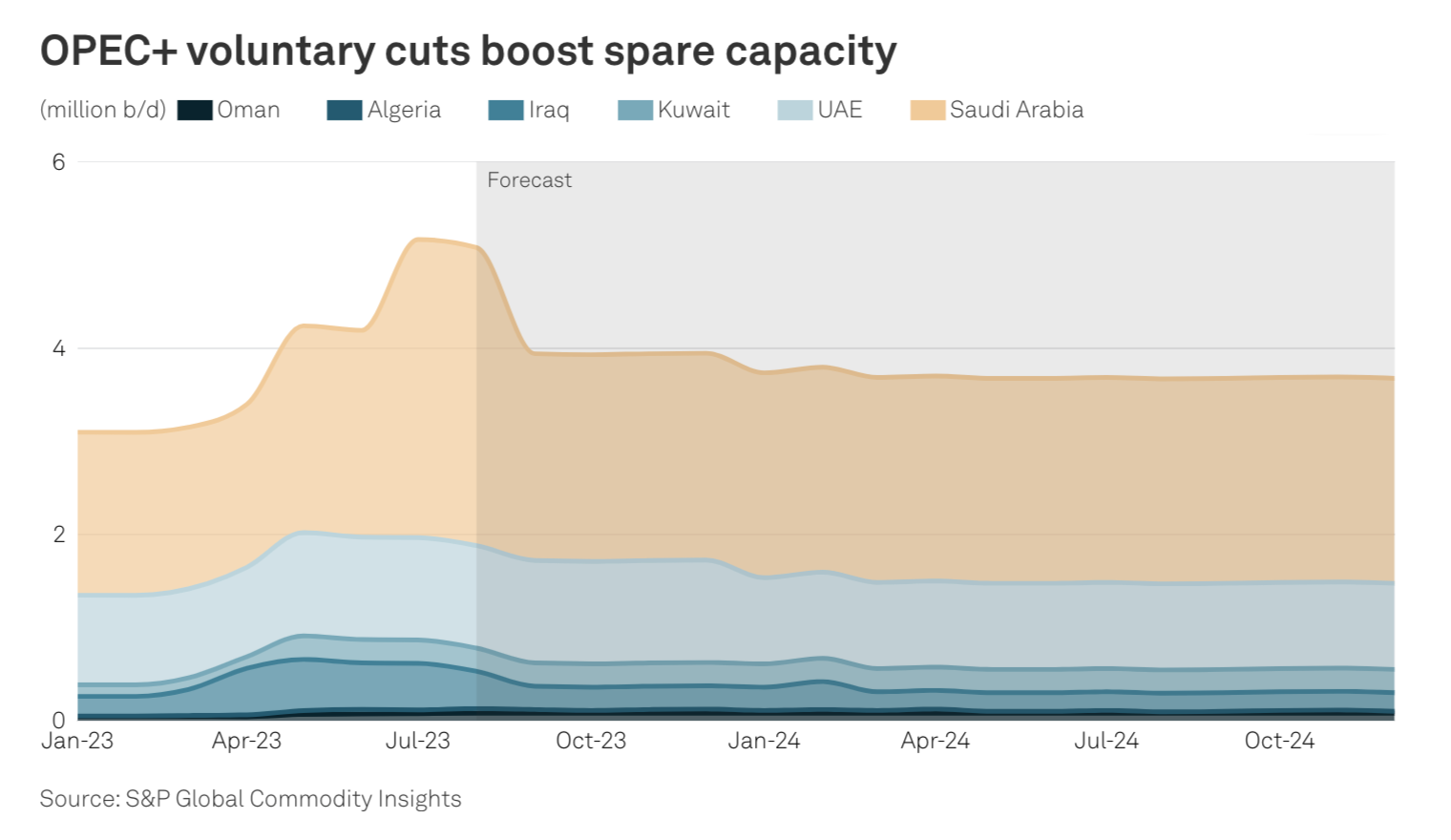

Energy Security Sentinel

How do geopolitical risks affect energy prices, and what security flashpoints have emerged across the world recently? This analysis shows how diversity of supply, higher levels of global spare capacity and the expansion of strategic fuel reserves have helped insulate markets from the risk of supply disruptions due to war, sanctions, climate change and unrest.

—Read the report from S&P Global Commodity Insights

Access more insights on energy and commodities >

Hosting And Cloud Transformation Summit 2023

At the Hosting and Cloud Transformation Summit (HCTS) 2023 in New York City, S&P Global Market Intelligence brings together experts across cloud, datacenters, AI, M&A and infrastructure to showcase 451 Research and S&P Global data and insights that help decision-makers invest in building the digital infrastructure of tomorrow. Join the S&P Global analyst team as they share the latest research across emerging areas such as generative AI and sustainable datacenters and meet with the analysts one-on-one to deepen your understanding.

—Register for the event from S&P Global Market Intelligence