Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Middle East's Refinery Expansion

The Middle East is flush with new refining capacity, just as global oil flows are being reshaped by Russia’s war in Ukraine.

Four new refineries — in Saudi Arabia, Kuwait, Iraq and Oman — have recently launched or are aiming to do so by the end of 2023. Abu Dhabi’s giant Ruwais complex is upgrading its facilities, Iraq’s Baiji refinery has been rehabilitated and Kuwait’s six-year-long Clean Fuels Project combined and upgraded the Mina Abdullah and Mina al-Ahmadi refineries into a single 800,000 b/d capacity complex.

The timing is good as global consumption of major refined products, including gasoline, diesel, jet fuel and fuel oil, is expected to reach 69.3 million b/d by 2030, up from 67 million b/d in 2023, according to S&P Global Commodity Insights, while petrochemical demand is also on the rise.

S&P Global Commodity Insights expects the Middle East’s total production of major refined products to increase 5.5% year over year in 2023 to 8.17 million b/d and to reach 8.48 million b/d by 2024.

Traditionally, this output would be mostly intended for customers in Asia, but the region’s proximity to Europe is helping it to capitalize on a market void left by Russian refined products due to the EU’s embargo and the G7’s price cap.

Exports of major refined products from Saudi Arabia, the United Arab Emirates, Kuwait, Iraq, Qatar and Bahrain to Northwest Europe surged almost 240% in the first four months of 2023 compared with the same period in 2022, and shipments to the Far East also rose.

Russian crude export shipments have also changed because of the war and related embargoes. The UAE had been importing large volumes of Russian fuel oil, gasoil, gasoline, naphtha and vacuum gas oil. Russian fuel shipments to the UAE surged soon after Moscow's invasion of Ukraine, briefly making the Middle Eastern country the biggest buyer of Russian oil shunned by European refiners.

Russian crude exports, and related discounts, have dropped over recent months as the country has sourced more non-G7 shipping capacity to sidestep price caps. The slump is also related to Moscow’s pledge to cut exports by 500,000 b/d in August to help support global oil prices.

Subsequently, Russian fuel exports to the Middle East fell sharply last month. Exports to Saudi Arabia collapsed by 190,000 b/d to just 28,000 b/d, S&P Global Commodity Insights data showed, while flows to the UAE fell to 236,000 b/d from 263,000 b/d in June.

Another seasonal wrinkle is the Middle East’s increasing use of oil for power generation as air conditioning demand hits peak summer levels. This comes at a time when OPEC+ countries are aggressively slashing their crude production.

The seasonal consumption figures could significantly shrink the amount of oil the region will be able to export, but analysts say the seasonal burn is likely to be somewhat smaller, at 868,000 b/d versus 902,000 b/d of crude burned in the same period of 2022, due to an expansion in natural gas availability.

Today is Tuesday, August 15, 2023, and here is today’s essential intelligence.

Written by Ken Fredman.

Looming Rise In Prices Risks More Rate Hikes As US Inflation Broadly Cools

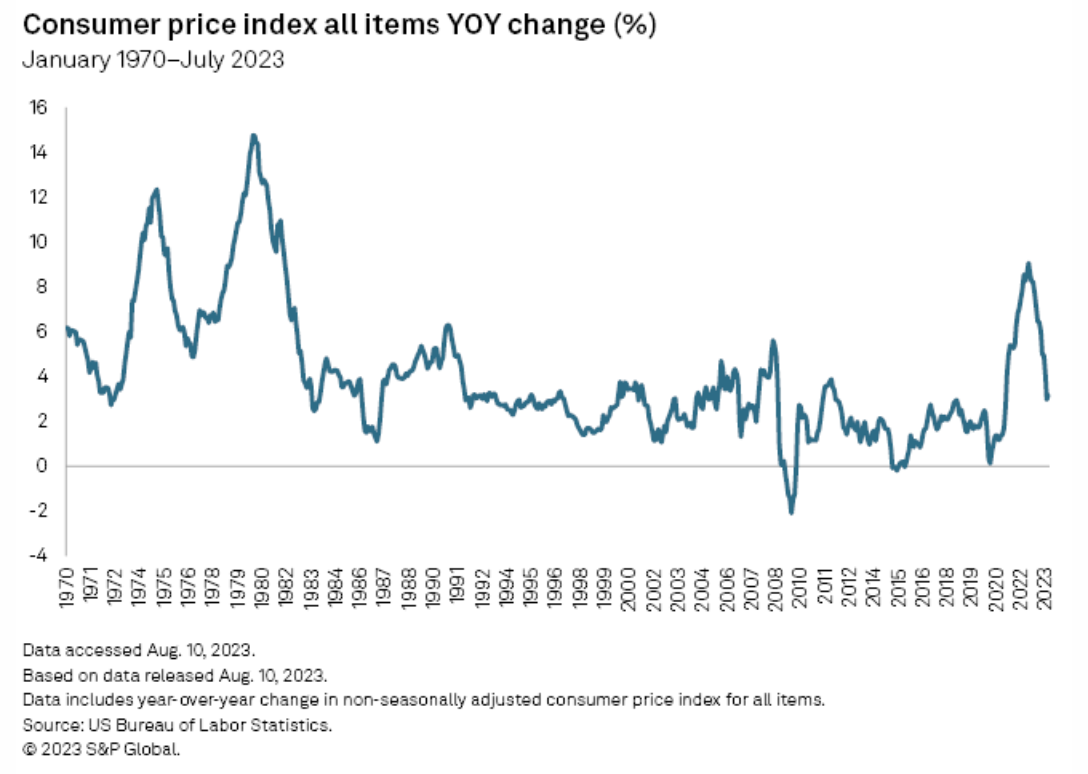

A slowdown in US inflation may be short-lived as the risk of unexpected price spikes is rising, throwing doubt on whether the Federal Reserve's rate hikes are truly over. The overall consumer price index increased 3.2% from July 2022 to July 2023 before a seasonal adjustment, the US Bureau of Labor Statistics reported Aug. 10. The index increased less than 0.2% from June to July, roughly the same increase from May to June and the smallest back-to-back increase since February 2021.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

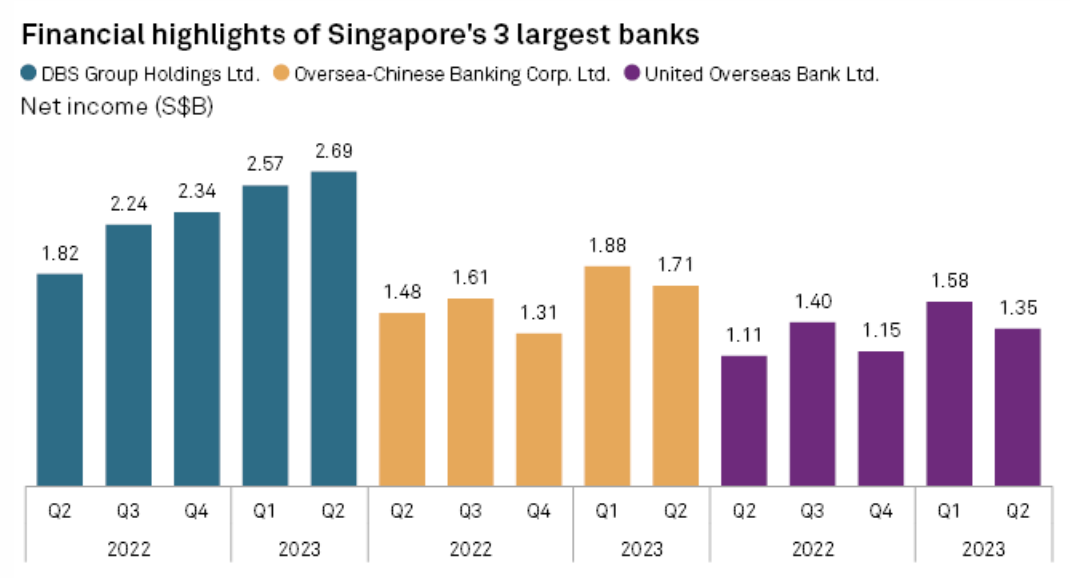

Singapore Banks Face Challenging Outlook As Loan Demand Slows

Singapore banks are likely to face muted results in the second half of 2023 after higher interest rates boosted profits in the first six months of the year. DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. and United Overseas Bank Ltd. recently reported double-digit year-over-year increases in net profit for the second quarter, driven by strong net interest income growth. However, loan growth has slowed. The Monetary Authority of Singapore reported a decrease in bank loans to S$799.292 trillion in June from S$841.525 trillion a year earlier.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

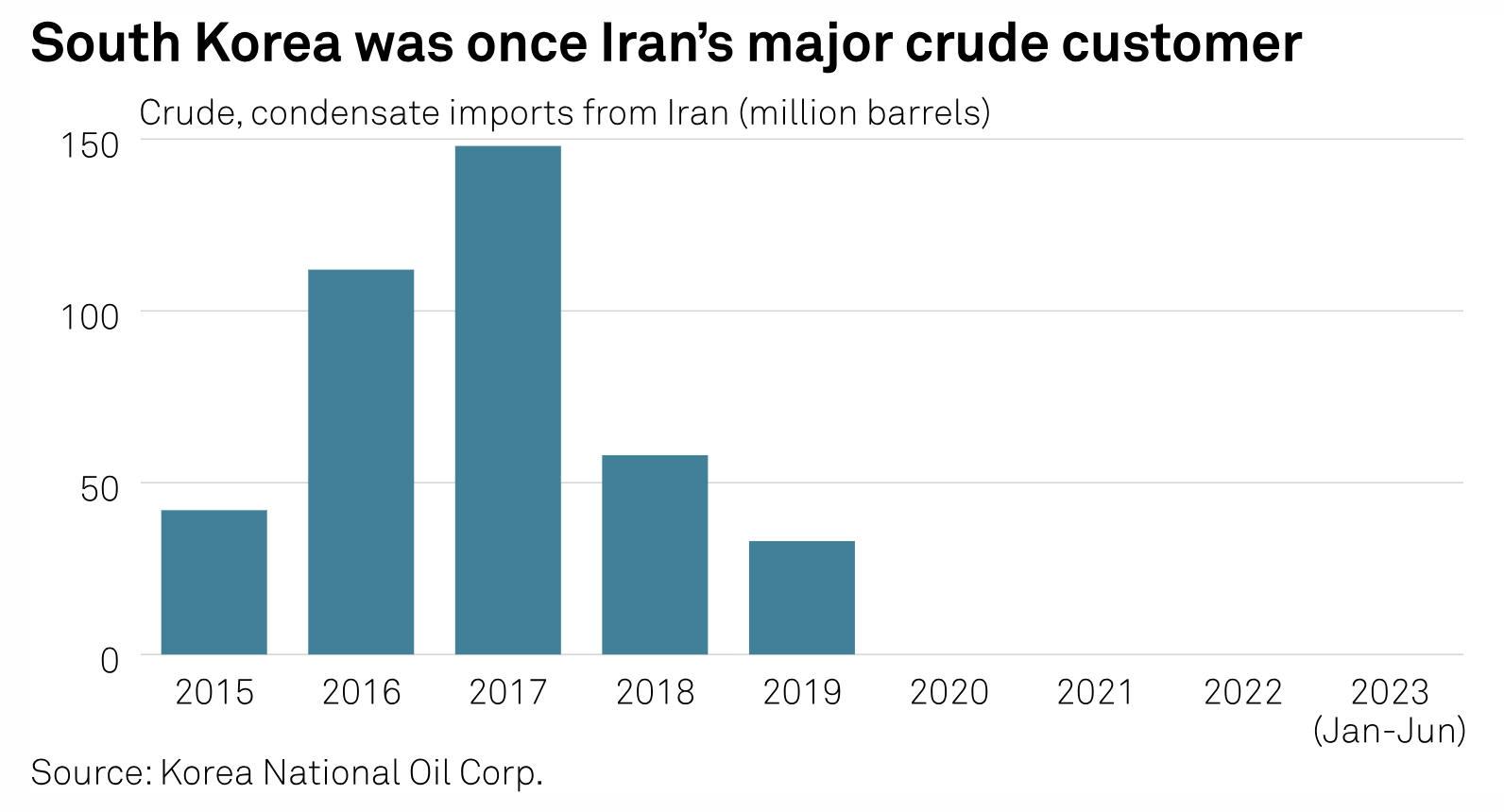

South Korea's Release Of Iran's Frozen Funds Unlikely To Lead To Oil Trade Resumption

South Korea's release of Iran's frozen assets held in local banks is unlikely to lead to Iranian oil trade resumption for now, government officials as well as banking and refining industry sources in Seoul and Tehran said Aug. 11-14. The Korea Economic Daily reported last week that Seoul and Washington were discussing ways to release $7 billion worth of Iranian funds held in Woori Bank and the Industrial Bank of Korea with the condition that Tehran release US hostages held in Iran and limit its nuclear development process.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

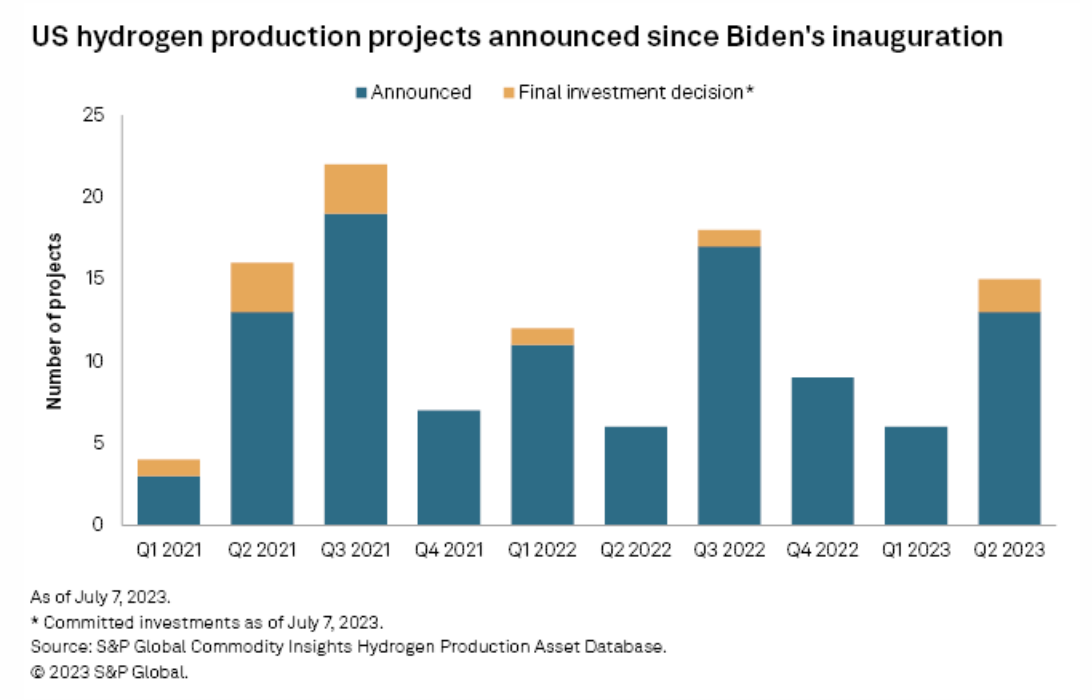

IRA At 1: Hydrogen Developers Hold Off Construction, Ramp Up Lobbying

Twelve months ago, clean hydrogen developers were celebrating historic federal investments in the nascent industry, expected to give the zero-emission gas the ability to compete with fossil fuels in the US. But on July 11, a lobbying group for the sector ran a full-page advertisement in The New York Times depicting a production plant posted with the sign "FACTORY CLOSURE."

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: SPR Refill: You Can Dust It Off And Try Again

The US' emergency crude stockpile — called the Strategic Petroleum Reserve, or SPR — played heavily in President Joe Biden’s strategy last year for curtailing global oil supply shortages and bringing down domestic fuel prices. The Biden administration has now turned its attention to refilling the SPR, which has seen some progress as well as some hiccups. Skanda Amarnath, executive director of the macroeconomic policy think tank Employ America, joined the podcast to discuss the crude buyback effort and actions the Department of Energy might pursue in the coming months. He also gave his take on how the SPR could best be put to use, legislation backed by Republicans to put some checks on the DOE’s authority over the SPR and how last year’s unprecedented drawdown impacted US ties with major oil producing countries on the world stage.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Electrifying The Future: Sales & Production Overview With A Focus On Electrification And Battery Trends

In an upcoming webinar, S&P Global Mobility will be diving into the electrification trends sweeping the automotive industry as well as the advancements in battery technology and the pivotal role it plays in the rapid adoption of electric vehicles. As the world embraces sustainable transportation solutions, understanding the evolving sales and production landscape with a keen eye on electrification trends and battery developments is critical.

—Register for the webinar from S&P Global Mobility

Content Type

Location

Language