Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Apr, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Chinese Financial Reforms May Be Consequential and Far-Reaching

Lost amid a packed news cycle during March, the announcement of financial reforms in China during the annual “Two Sessions” meetings will have important consequences for global finance and global economic stability. After a challenging 2022, in which the residual impact of the global pandemic muted Chinese growth, meetings of the National People's Congress and the Chinese People's Political Consultative Conference that began March 5 focused on stability and a return to modest growth in 2023. The formation of a new financial regulatory agency, the National Financial Regulatory Administration (NFRA), which was announced during the meetings, is intended to provide more centralized control, regulatory stringency and stronger policy coordination. This will likely have implications for China’s place in the global financial system as the world’s second-largest economy looks to reduce the inconsistencies that result from having different regional authorities.

News reports emanating from the Two Sessions meetings focused on the relatively modest growth target of 5% established by Chinese government authorities. However, according to S&P Global Ratings, the theme of these sessions was a desire for stability. Alongside a restive property sector, one of the challenges facing the Chinese economy is local government deficits and the debt burden these deficits create. Some local governments in China have attempted to cover for deficits using off-balance-sheet debts. However, increased central government oversight of borrowing by local governments and state-owned enterprises makes it unlikely local governments will try to drive growth primarily through further debt and investment.

According to S&P Global Ratings, “the long-term trend is clear: Beijing wants to ease the country off a reliance on investment-driven growth.”

An analysis of China’s financial reforms produced by S&P Global Ratings focuses on the challenges of executing the new regulations. The centralization of regulatory authority over financial markets in China is an important development, particularly the establishment of a "super regulator" in the NFRA. The creation of this entity will allow the People's Bank of China to shed its regulatory responsibilities and focus on monetary policy, as the Federal Reserve does in the US. However, there remain challenges to executing these reforms. Local governments have exercised regulatory authority for a long time and will need time to adjust. The regulatory reforms announced thus far are more a set of principles than an operating structure. Policies will need to be clarified.

According to a recent “Credit Conditions” report from S&P Global Ratings, Chinese government policies aimed at reining in leverage may challenge some highly indebted borrowers. Large Chinese banks have grown increasingly focused on asset quality, according to S&P Global Market Intelligence. Nonperforming loan ratios have been trending in a positive direction year over year, but bank margins remain under pressure.

The new centralized regulatory authority announced at the Two Sessions meetings should provide additional stability for Chinese financial markets and banks as the country pivots away from investment-led growth. As always, execution is the tricky part.

Today is Thursday, April 6, 2023, and here is today’s essential intelligence. The next edition of the Daily Update will be published Tuesday, April 11.

Written by Nathan Hunt.

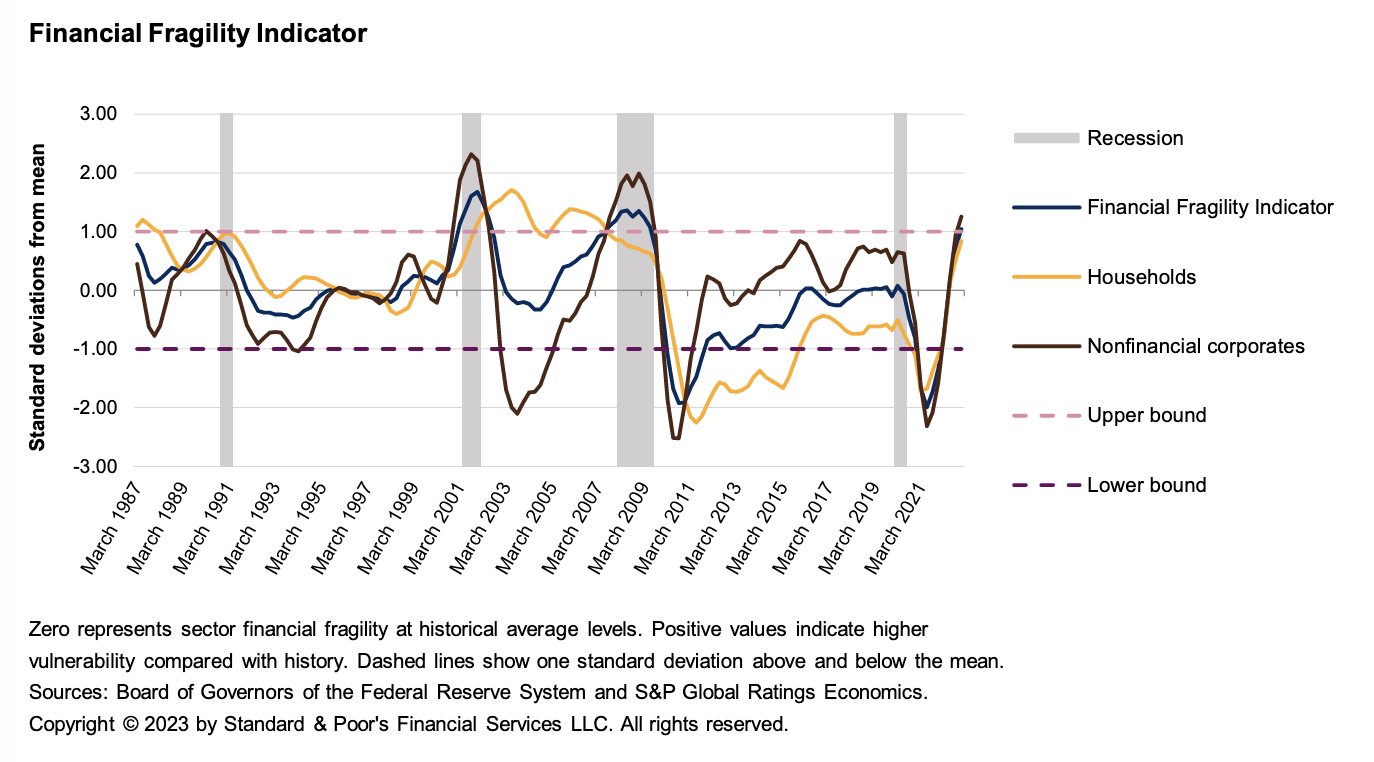

Economic Research: Financial Fragility For U.S. Households And Businesses Hits Its Highest Level Since The Global Financial Crisis

The Financial Fragility Indicator (FFI) deteriorated in fourth-quarter 2022 to its highest level since the global financial crisis as higher prices and interest rates damaged private-sector balance sheets. After crossing the zero line — its historical average — in third-quarter 2022, the FFI reached 1.10 in the fourth quarter (that is, 1.10 standard deviations above its mean), indicating the vulnerability of the U.S. private sector.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

2023 Private Equity Outlook

The S&P Global Market Intelligence Private Equity Outlook is an annual report that summarizes and analyzes the results of a survey delivered to private equity and venture capital professionals worldwide. Each year, it asks questions covering deal activity expectations, changes in strategy, challenges, preferences in Environmental, Social, Governance (ESG) and technology adoption. This year’s survey saw record responses from 246 PE firms, 129 VC firms, and for the first time, 131 limited partners, giving the most well-rounded view of private market sentiment since launching the survey in 2017.

—Read the report from S&P Global Market Intelligence

Access more insights on capital markets >

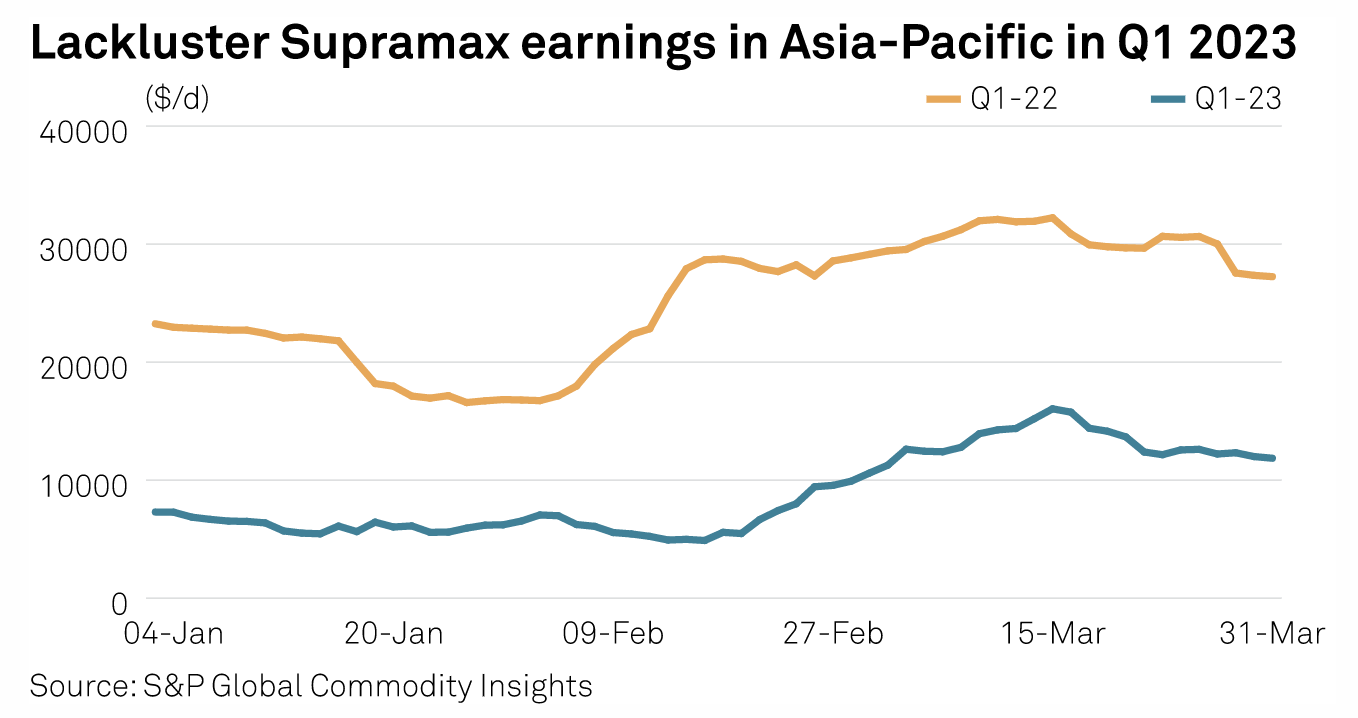

China Growth Recovery To Dictate Asian Freight Market In Q2

After a lackluster first quarter, dry bulk market participants are pinning hopes on revival in freight rates, with China's gradual economic recovery and signs of rebounding embattled property sector likely supporting bulk demand in Q2. Contrary to market expectations, the reopening of the Chinese economy after the pandemic failed to lift the freight market, while demand for iron ore — a major dry bulk commodity — perked up in Q1. Beijing has set a GDP growth target of around 5% for 2023, according to a government report released March 4.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

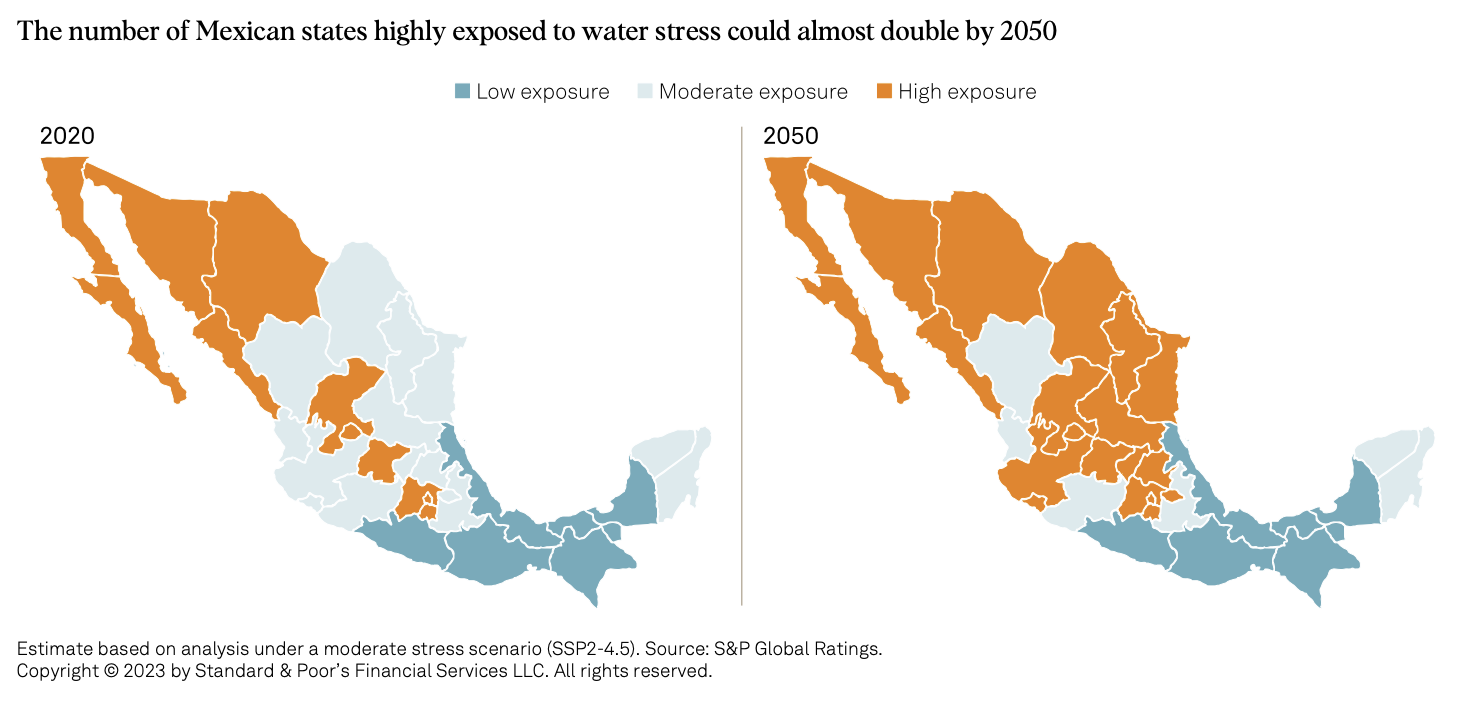

Sustainability Insights: Research: More Mexican States Could Face Water Stress By 2050

The number of Mexican states exposed to high water stress will almost double to 20 by 2050, from 11 in 2020, under all scenarios covered in our analysis, without adaptation measures. States facing the greatest risk are already short of water and may experience decreased economic growth as the frequency and intensity of droughts increase. An increase in investments in water infrastructure over the long term could weaken some states' and municipalities' budgetary performance and result in higher debt but go some way to building resilience to water scarcity.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Listen: OPEC+ Oil Production Cuts Shake Oil Markets

Increased volatility, rising prices and strained geopolitical relations. These are some of the side-effects of the latest OPEC+ production cut. Meanwhile, Platts Market on Close crude assessments fully reflect traders' sharp reaction to the surprise move amid uncertainty in various oil grades. In this episode of the Platts Oil Markets podcast, S&P Global Commodity Insights editors Rosemary Griffin, Sam Angell and Luke Stuart join Joel Hanley to discuss the immediate impact of the OPEC+ announcement, the decision by Russian sellers to change the way they price barrels and potential threats to an already fragile global oil supply.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 110: Fintech In The APAC Region

The world of Financial Technologies is evolving rapidly and the APAC region is one of the most diverse, with some countries having some of the deepest levels of FinTech adoption to others, that are bypassing traditional financial frameworks as so much of their populations are unbanked. Analyst Sampath Sharma joins host Eric Hanselman to explore the wide range of FinTech approaches that are in play and how they fit into the global perspective. The future is bright but in some very different ways.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence