Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Apr, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Global Macroeconomic & Credit Conditions Face Confluence of Risks

After starting the year strong, the global economy and credit markets are now confronting downside risks stemming from the Russia-Ukraine conflict, persistent inflationary pressures, forthcoming higher interest rates, and the lingering pandemic.

Global macroeconomic and credit conditions are set to experience notable upheaval from geopolitical, confidence, and market shocks, according to S&P Global Ratings’ latest economic and credit outlooks.

The Russia-Ukraine conflict’s direct disruptions to energy, agriculture, and other trade and capital flows have sent energy and food prices soaring—further complicating supply chains and increasing inflationary pressures, and creating new challenges for central banks as they approach aggressive monetary policy tightening. These factors are playing out as the pandemic plows on, with many economies managing to live with the virus while others continue to implement low-tolerance containment practices.

S&P Global Economics now expects global GDP growth of 3.6% this year after lowering its forecast due to these converging risks by 0.6 percentage point from its previous forecast..

“While the global economic impact of Russia's invasion of Ukraine has been modest so far, there is no cause for complacency. The longer the conflict drags on, the higher the risks. Buffers built up by households during the worst of the pandemic are sizable, but they will not last forever,” S&P Global Ratings Chief Global Economist Paul Gruenwald said in the second-quarter global economic outlook. “The fall in confidence could pick up speed if the conflict and associated economic pain on all sides drag on. The worst of the economic impact from the conflict is therefore likely still to come.”

As the beginning of 2022 has marked a turn in the positive credit momentum seen since last year, global credit conditions face prominent risks from the potential escalation of the Russia-Ukraine conflict or any expansion of sanctions onto gas and oil exports to Europe; central banks’ struggle to control inflation without choking economic growth, leading to higher borrowing costs especially for lower-rated credits; persistent supply disruptions and high commodities prices squeezing profit margins; and new COVID variants, according to S&P Global Ratings.

“While pale in comparison to the tragic human costs, the detrimental effects of the Russia-Ukraine conflict on global economic and credit conditions are becoming more pronounced, with measurable implications for our macro forecasts and credit ratings,” S&P Global Ratings Global Head of Analytical Research and Development Alexandra Dimitrijevic said in the second-quarter global credit conditions outlook. “Widening credit spreads in major markets suggest investors are becoming somewhat more risk-averse. Moreover, the uncertainty around the crisis and its ramifications, as well as the acceleration of monetary-policy tightening, have led to a pause in debt issuance at the lower end of the credit spectrum. Mounting challenges will likely weigh on the credit outlook for the rest of the year, depending, in large part, on the evolution of the conflict.”

Today is Monday, April 4, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

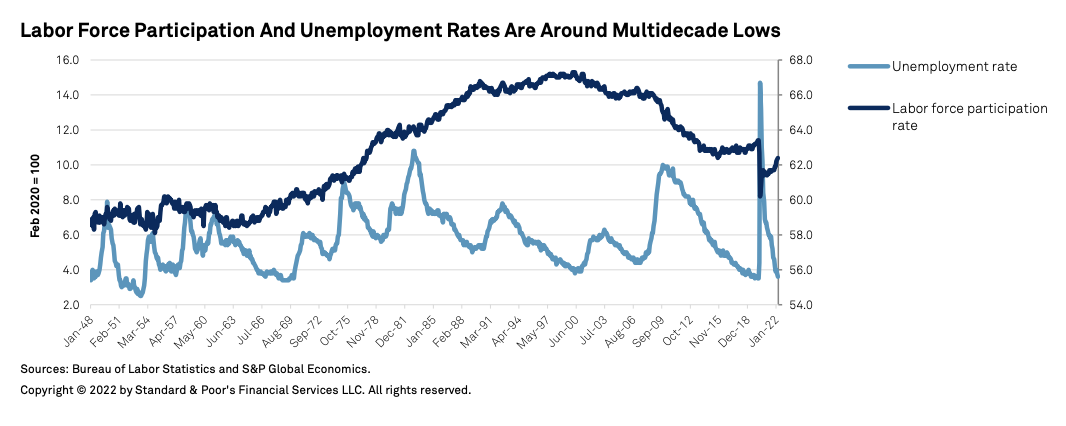

Economic Research: The March Jobs Report: The Wind At Its Back

U.S. nonfarm payrolls increased by 431,000, with a net 95,000 job gains the prior two months, according to the Bureau of Labor Statistics' (BLS) March jobs report. This underscores a strong economy. The report also puts the Fed on solid ground to act, confident that the U.S. economy can absorb tighter Fed policy and still grow.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Commodities Continued To March Higher Last Month

The S&P GSCI posted its best quarterly return in decades, as inflation continued to post the highest readings in decades. Commodities rose another 9.63% in March after an 8.8% rise in February. Geopolitical conflict and inflation were the two main reasons for the broad-based uptick in commodities prices. The S&P GSCI Energy continued to lead the way last month, up 12.47% in March. The uncertain supply situation from Russia, the world’s largest natural gas exporter and third largest oil exporter, led the U.S. to release a record amount of emergency oil from the Strategic Petroleum Reserve. Germany, highly dependent on Russian energy, initiated an emergency plan that could lead to energy rationing.

—Read the full article from S&P Dow Jones Indices

Access more insights on capital markets >

Listen: Resurgence Of COVID-19 Threatens Oil Demand Revival In Asia

Asia's sustained oil demand revival over the last few months may face a fresh setback following COVID-19 outbreaks in China and other countries in the region. While sharp pull back in consumption appears remote at this stage, markets are keenly watching if Asia's top oil consuming nations resort to more lockdowns to stem the spread of the pandemic. In the latest episode of Oil Markets, Sambit Mohanty, Asia Energy Editor at S&P Global Commodity Insights; Jonathan Nonis, Associate Editorial Director for Asian oil products; and J.Y. Lim, Advisor for Asia-Pacific oil markets, discuss the possibility of another round of oil products demand destruction, Asia's crude buying strategy amid fears of a demand slowdown, and the impact on trade flows.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Unpacking Implications Of The SEC's Proposed Climate Disclosure Rule

In the latest episode of ESG Insider, hosts Lindsey Hall and Esther Whieldon explore the potentially wide-reaching implications for investors, companies, and climate disclosure globally. To help understand the SEC's proposal as it relates to audit and attestation requirements, they talk with Maura Hodge, IMPACT and ESG Audit Leader at professional services firm KPMG. They also discuss the challenges of measuring Scope 3 indirect emissions with their colleague Dr. James Salo, who heads environmental research & ESG modeling at S&P Global Sustainable1. And to explore legal implications surrounding the proposal, they talk with Mellissa Duru, special counsel at law firm Covington & Burling and co-vice chair of the firm's ESG practice. Mellissa previously worked at the SEC in its Corporate Finance Division and as a lead adviser to former Commissioner Kara Stein on the SEC's ESG-related regulatory policy.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

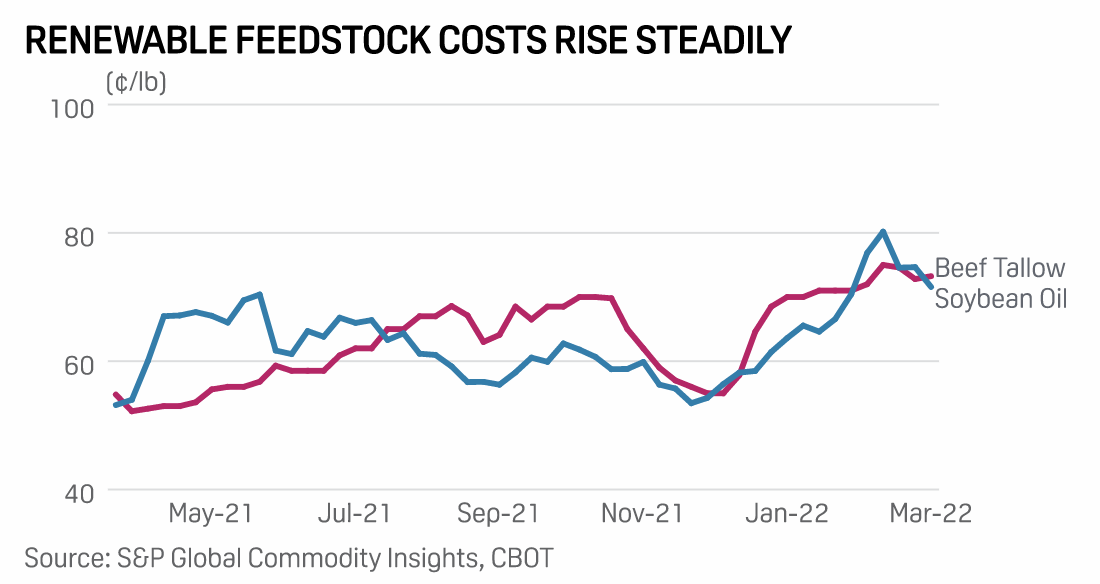

Feature: U.S. Airlines Cast A Wider Net In Search For Sustainable Aviation Fuel Supply

As U.S. airlines seek to lock in sustainable aviation fuel supply to reach their 2030 greenhouse gas emissions reduction goals, many are looking beyond suppliers who produce SAF using traditional feedstocks like hydrogenated vegetable oils and tallow. With more renewable diesel and SAF projects starting up, renewable feedstock supplies are tightening, increasing costs. The price of key soybean oil feedstock averaged 75.86 cents/lb in March, compared with the year-to-date average of 68.22 cents/lb, according to Platts assessments from S&P Global Commodity Insights.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

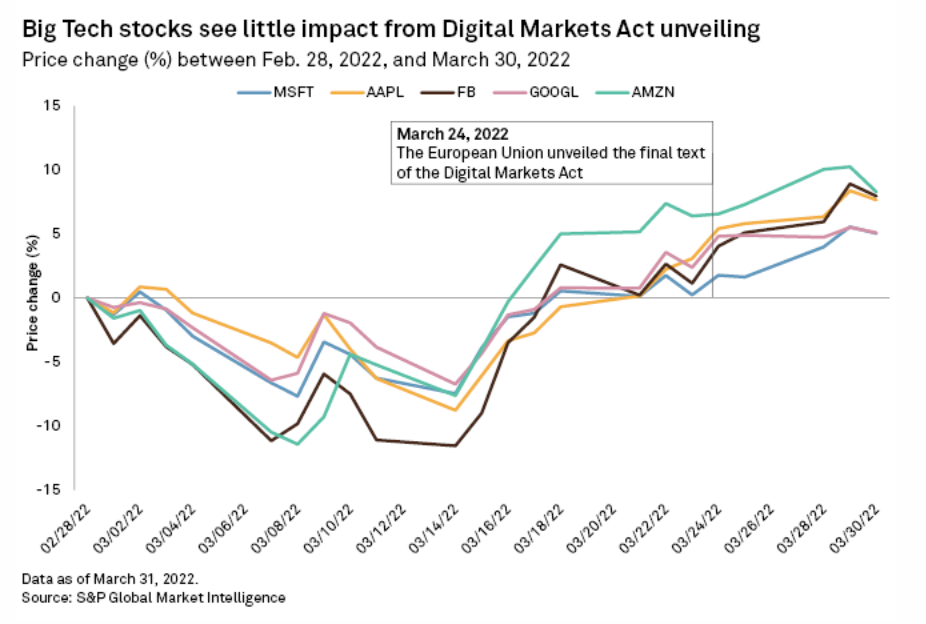

Big Fines Can Scare Big Tech, But Enforcing Digital Markets Act Is Key – Experts

Experts believe that while new EU regulations associated with the Digital Markets Act could have a significant impact on affected companies, enforcement will be the main determinant in ensuring the laws are effective. The European Council and European Parliament on March 24 approved the Digital Markets Act, or DMA, a framework of new initiatives intended to curb the dominance of Big Tech companies and related entities in Europe's digital landscape. The DMA's measures are designed to reduce the power of digital "gatekeepers," which are companies considered to hold too much market concentration, thereby preventing competitors from entering a market. The DMA does so by determining which businesses can interact on or alongside their platforms and the way they can operate.

—Read the full article from S&P Global Market Intelligence