Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Apr, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Sourcing Battery Metals Amid the Energy Transition

The global minerals and metals trade is a complex and interconnected network, the fruits of which we enjoy in a wide range of consumer goods. What’s often lost on us when we scroll through our favorite apps is the first node in that network: Workers at mines in remote regions, often endeavoring through brutal conditions to source the commodities that power our bright and colorful phone screens and drive the technologies behind emissions reductions.

Under consumer pressure and the growing tide of investors considering environmental, social and governance factors, electric-vehicle makers and battery producers face a key challenge. Will consumers pay for more expensive EVs if it means responsibly sourced materials? Will they pay thousands of dollars less for EVs with materials from ethically questionable sources? Hanging in the balance is the future landscape of the EV market.

Ethical supply constraints could stem the flow of EVs reaching the market. Companies are between a rock (or a lump of cobalt) and a hard place: Sourcing battery metals from countries with more stringent environmental regulations and where workers are better protected means facing the labyrinth that is mining and exploration permitting in those countries, which could constrain the metals-to-market pipeline. Certain programs exist that enable transparent mineral and metal supply tracing. For example, the Copper Mark program can trace copper shipments from mine to end user. Similar frameworks could emerge for the materials that go into EV batteries.

It's clear that widespread EV adoption will require a lot more battery materials. What’s less clear is the battery chemistries that will fuel such growth. Several companies and research institutes are working on next-generation battery technologies that could be game changers for the industry. The anode material for technologies in the lithium-ion space is typically graphite, but groups are looking at using silicon and lithium metal on the anode side to improve performance, costs and safety. Li-Metal, for example, identified an opportunity to develop thinner anodes that improve battery economics and performance.

Battery chemistry aside, meeting EV demand growth will require more minerals and metals, though some chemistries may be more sustainable than others. Nevertheless, consumer and investor demand for ethically sourced materials places the impetus on EV makers and battery producers.

While consumers wield some power over companies with regard to ethical sourcing, most of the pressure comes from the high-value investors that fund mine exploration and development. Investing in or trading futures for the core metals needed to expand renewables and EVs is too expensive for most retail investors. EMG Advisors hopes to change this reality through a new exchange-traded fund for trading copper, lithium, nickel and cobalt futures contracts.

The energy transition is, itself, in a bit of a transition, one toward ethically sourced materials for more sustainable products, brought on by rising consumer power and the push by financiers to include ESG-related risks in company ratings.

Today is Monday, April 3, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

Week Ahead Economic Preview: Week Of April 3, 2023

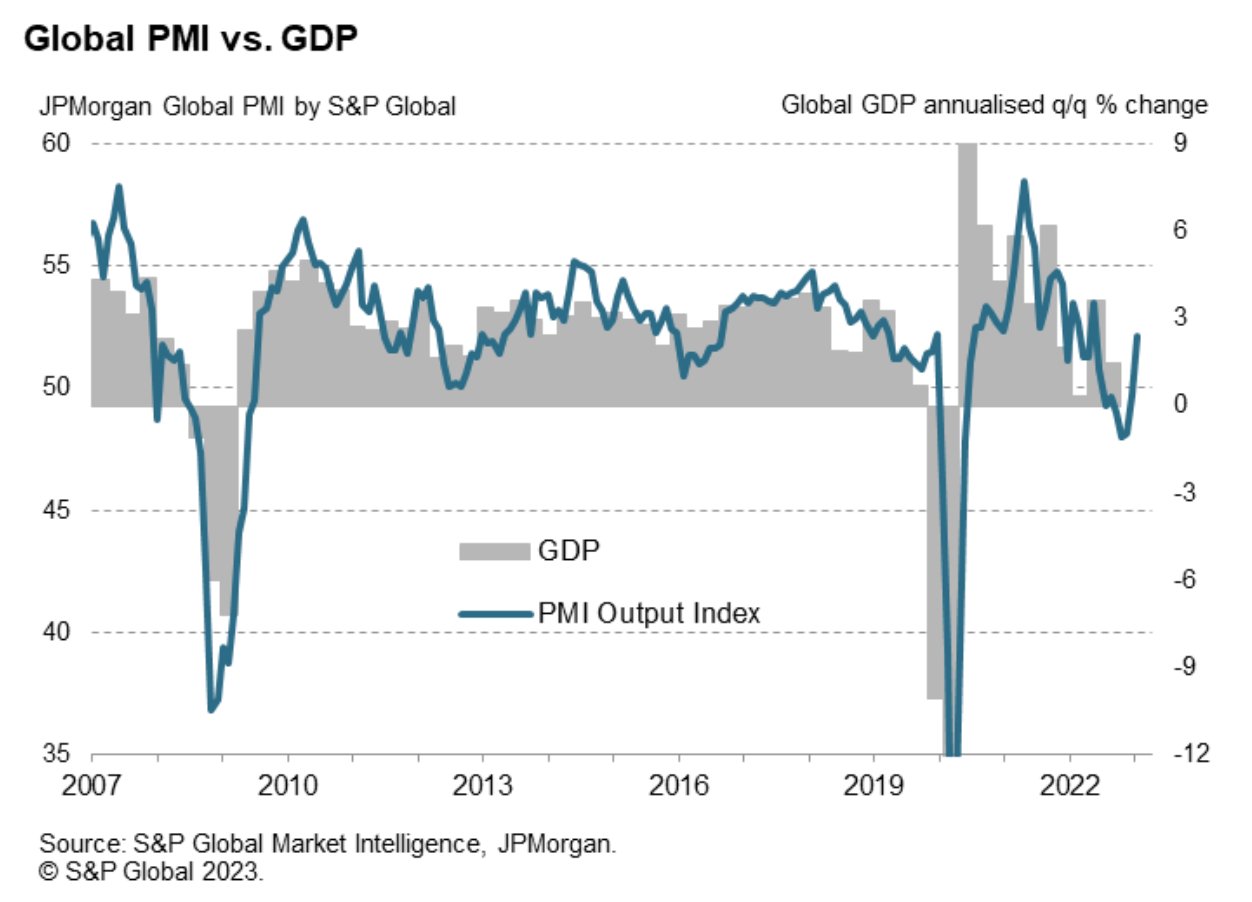

The turn of the month brings about a new set of worldwide PMI data ahead of the U.S. labor market report on Friday. Meanwhile central bank meetings will be held in various APAC economies including Australia, New Zealand and India, although the focus will be on comments from Fed speakers in the week for further insights after the March FOMC meeting. German output data and Japan's Tankan survey figures will also be due in a busy week of economic releases, in addition to several CPI figures.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

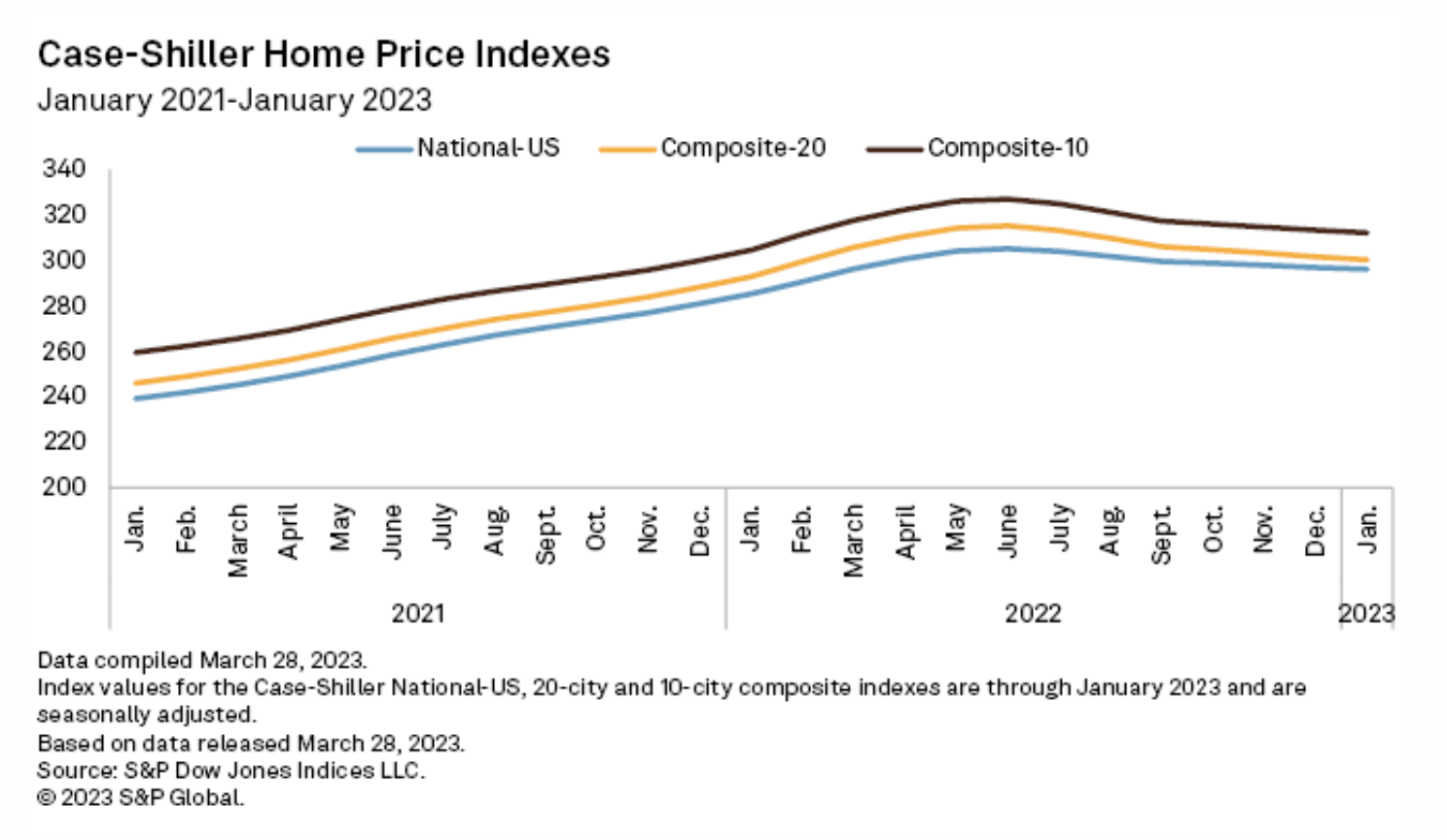

January U.S. Home Prices Show Slowest Growth Pace Since December 2019

U.S. home prices in January increased at the slowest pace since December 2019, as the Federal Reserve's monetary policy tightening continued to push interest rates higher. The S&P CoreLogic Case-Shiller US National Home Price NSA Index rose 3.8% on an annual basis in January. The index's previous slowest year-over-year uptick was a 3.7% increase in December 2019. While home prices logged an annual gain, the U.S. National Home Price Index declined 0.2% month over month after seasonal adjustment, marking the seventh consecutive month of decline.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Kazakhstan To Step Up Crude Shipments To Germany In April: Pipeline Operator

Kazakhstan is to increase crude deliveries to Germany to 100,000 mt in April, state pipeline operator KazTransOil said March 31, as the nascent trade via Russia's pipeline system gains pace. In a statement, KazTransOil said the Kazakh energy ministry had given its approval for the delivery, equivalent to around 24,000 b/d, and the crude would be transported via Russia's Transneft pipeline system to the Adamova Zastava delivery point on the Belarus-Poland border for onward transport to Germany.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

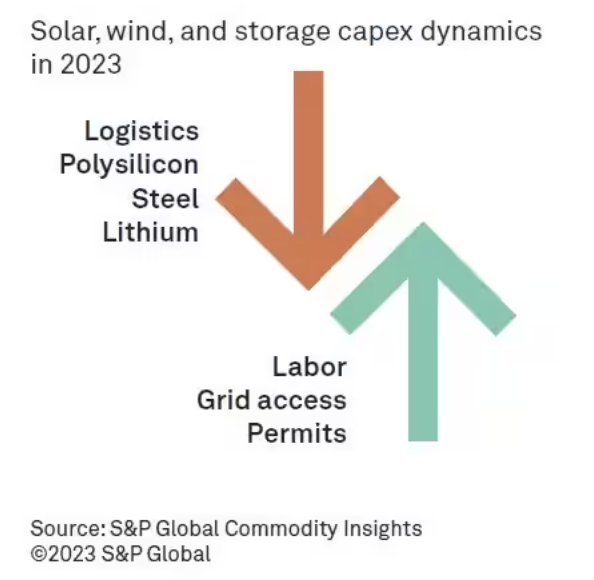

Cleantech Component Prices Decline But Do Not Immediately Translate Into Lower Renewable System CAPEX

After two years of tight supply chain dynamics, raw material and shipping costs decline in 2023, which has a direct impact on solar, wind and energy storage component prices. Global shipping costs are even back at pre-pandemic levels. These lower prices will, however, not translate immediately into overall lower capex for renewable power systems.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

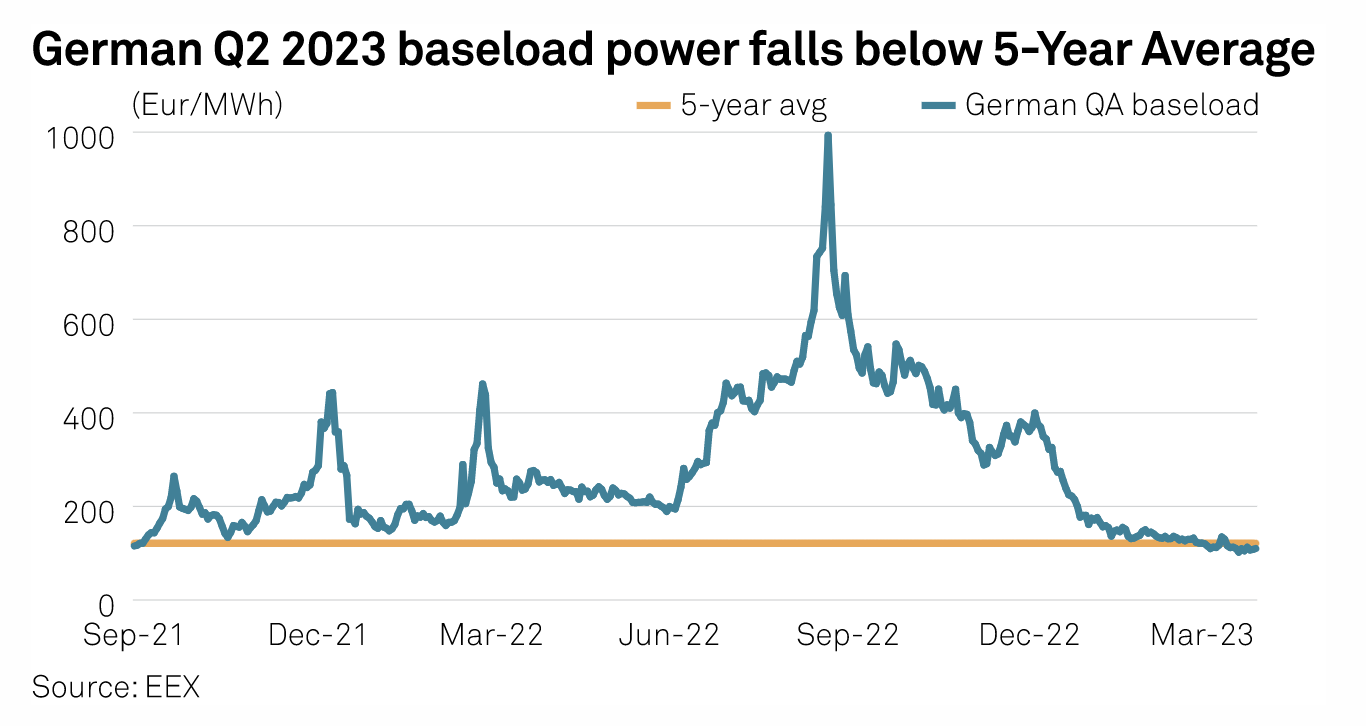

European Power Prices Edge Up On Cold Start To April, French Strike Extension

European power prices edged up in late March as colder, calmer weather forecasts combined with renewed French nuclear availability issues, but prior to this, prices had fallen to 18-month lows. German April power traded March 31 around Eur110/MWh after settling March 20 at Eur95.38/MWh, a level not seen since Aug. 2021, EEX data showed. In France, nuclear risk premiums reemerged for next winter as strikes by EDF workers delayed reactor maintenance with year-ahead power rising above Eur200/MWh and Q1 2024 above Eur400/MWh.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

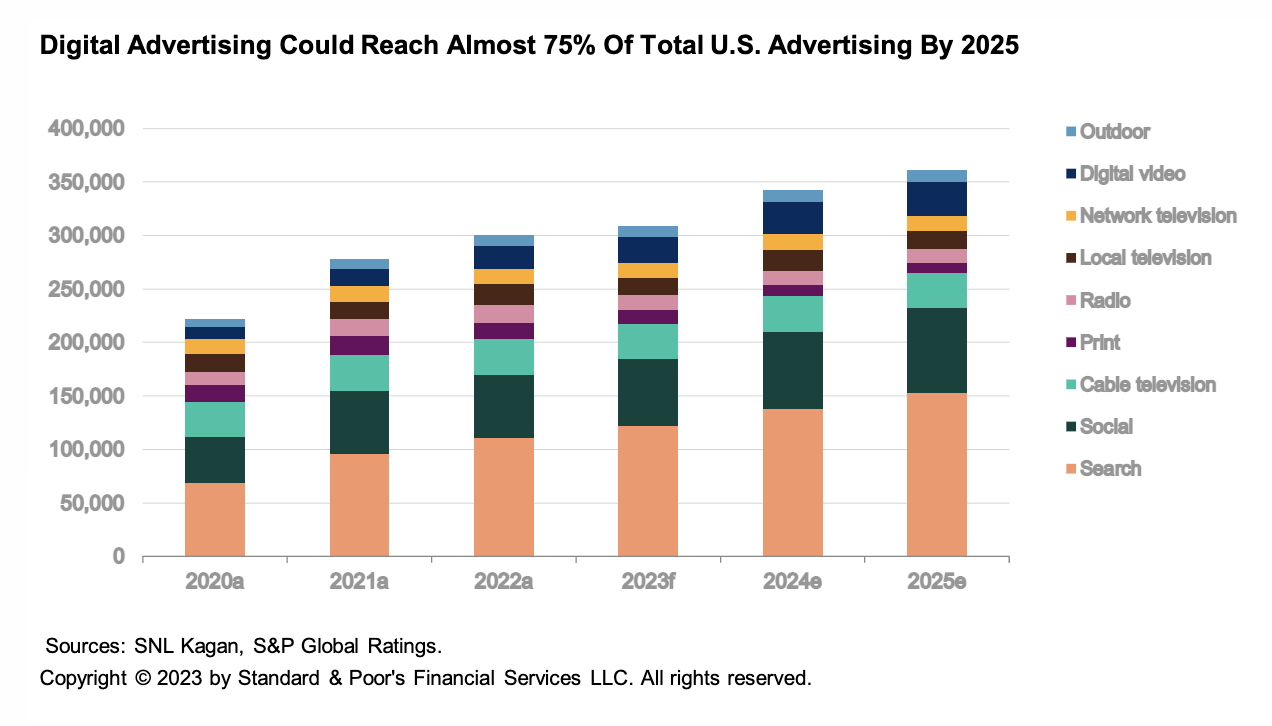

U.S. Advertising Forecast Revised In Light Of A Potential Shallower Recession

To understand 2023 advertising trends, one needs to first look at what happened to ad spending in 2022. Early in the year, advertisers reacted to fears of persistently high inflation, weakening macroeconomic metrics and troubling geopolitical events by pulling back advertising spending. In particular, digital and radio advertising, which are both bought close to airtime, weakened rapidly toward the end of the first quarter.

—Read the report from S&P Global Ratings