Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Consumers, economists, and policymakers all agree that lights are flashing green on the U.S. economy’s road to recovery.

With 2 million vaccinations deployed across the country, consumers are spending their stimulus money, returning to work, and feeling optimistic about the economy. Consumer confidence has soared to a 14-month high, according to the Conference Board’s index, which roared to 121.7 this month from March’s revised 109 and is nearing the pre-pandemic February 2020 level of 132.6. Consumers’ feelings of security in engaging in activities put on hold during the pandemic are also rising. Reporting the highest levels since March and April of last year, Morning Consult found that 60% of the population now feels comfortable dining out, and 53% are comfortable going on vacation.

“U.S. households have good reason to be optimistic. With 916,000 job gains this March and a drop in initial jobless claims to a post-virus low, the jobs market is improving,” S&P Global Ratings Chief U.S. Economist Beth Ann Bovino said in a recent report. “We expect U.S. economic growth to surge to 11.3% (annualized), its highest rate in 37 years, with solid gains in the second quarter, following solid 6.4% growth in the first quarter. In tandem, we expect a shift to more balanced growth, supported by an increasing share of expenditure on services as summer brings even higher vaccination rates, wider reopening, and households ready to spend.”

Expanding the vaccination effort to those who are hesitant can further lift the U.S. economic rebound.

“Even prior to being vaccinated, adults who plan on being vaccinated are more confident in the economy than those who do not plan on getting vaccinated or who remain undecided,” Morning Consult economist John Leer said in an April 28 report. “The future path of consumer confidence in the United States not only depends on the speed with which the country vaccinates the population, but also the rate at which those who are undecided are convinced to get vaccinated.”

Credit conditions have also improved. The U.S. distress ratio, which indicates the proportion of speculative-grade issues with option-adjusted composite spreads of more than 1,000 basis points relative to U.S. Treasuries, dropped to 3.4%—the lowest level in almost 14 years and 10 times lower than the pandemic peak in March 2020, as of March 31 of this year, according to S&P Global Ratings. And most U.S. corporate sectors face rising input costs amid supply chain disruptions and rising commodity and labor costs. However, S&P Global Ratings expects just a relatively small percentage of companies to suffer profit-margin erosion, and any pressures are unlikely to weigh heavily on credit quality.

The Federal Reserve maintained its benchmark interest rate at nearly zero on April 28 and indicated that it will continue its buying of $120 billion in bonds each month as the recovery grows stronger. Fed Chairman Jerome Powell said the central bank would continue its accommodative monetary policy until the pandemic was "decisively behind us."

"Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened," the Fed said in its most recent quarterly forecast. "The sectors most adversely affected by the pandemic remain weak but have shown improvement."

Market participants have expressed concerns about the Fed’s policy and its support of transitory inflation above 2%, evidenced by investors’ pumping record amounts of money into inflation-protected government bonds. But such concerns may be misplaced.

“We think inflation fears are overblown and that orderly reflation, around a return to sustainable growth, is a healthy development for both macro and credit outcomes. The recent rise in U.S. Treasury yields, and its spillover into corporate bond yields, indicates greater confidence in a sustained economic recovery, including a normalization of both market functioning and risk pricing,” S&P Global Ratings Chief Economist Paul Gruenwald and Head of Global Research Alexandra Dimitrijevic said in a report last month. “As we emerge from the first pandemic-driven economic and financial shock in over a century, it is important to distinguish desired outcomes from legitimate risks … It’s important to make clear that volatility and disorder around a reflation path is the risk, not reflation itself.”

Today is Thursday, April 29, 2021, and here is today’s essential intelligence.

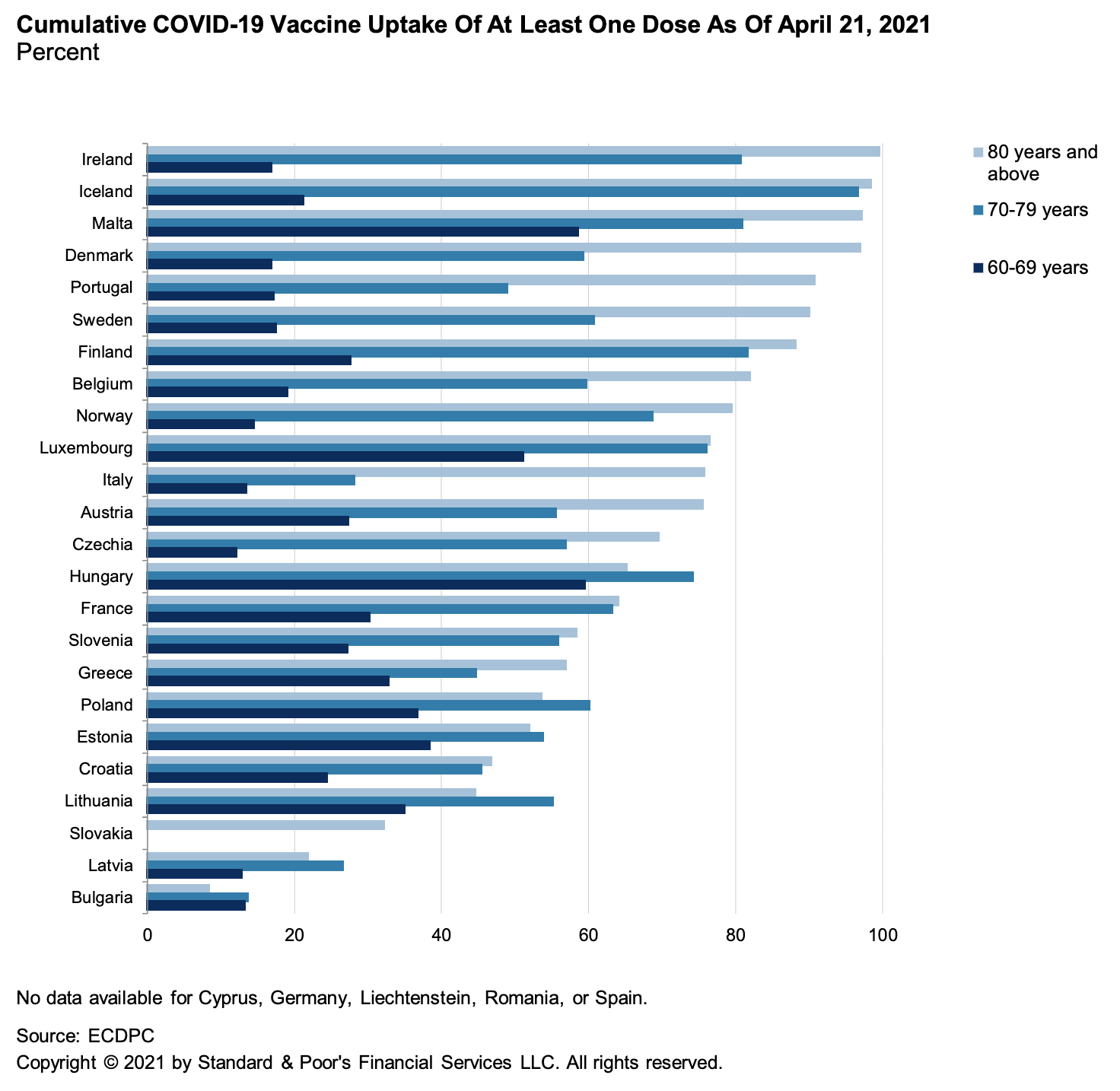

EU's Vaccine Supply Boost Will Aid The Race Against COVID Mutations

The April 19 announcement by Pfizer and BioNTech that they will substantially increase delivery of their COVID-19 prevention vaccine to the EU in the second quarter of 2021 should help bridge the gap left by lower-than-expected deliveries by AstraZeneca and Johnson & Johnson.

—Read the full report from S&P Global Ratings

Seeking Sustainable Dividends in Global Markets – Introducing the Dow Jones International Dividend 100 Index (Part 1)

Dividend strategies appeal to investors for various reasons. High-dividend-yield strategies can offer generous income, while dividend growth strategies tend to emphasize the quality of dividends. The Dow Jones International Dividend 100 Index, launched in March 2021, seeks to provide global exposure to both high dividend yield and dividend growth.

—Read the full report from S&P Dow Jones Indices

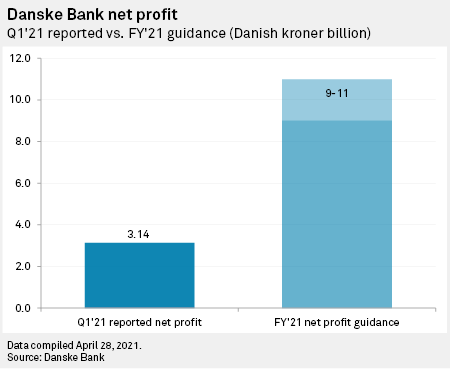

'New Captain, Same Strategy,' Confirms Danske's New CEO Amid Mixed Q1 Results

"The captain is new, but the course is clear," said Danske Bank A/S's new CEO Carsten Egeriis, as he presented the bank's first-quarter results just nine days into the job. Egeriis replaced Chris Vogelzang, who resigned after being named a suspect in connection with a money-laundering investigation in the Netherlands.

—Read the full article from S&P Global Market Intelligence

China Banks May Still Have RMB3 Trillion In Shadow Assets by Year-End Deadline

Last year, as the pandemic gripped China's financial system, banks were granted an extension on the deadline to remove or recognize exposure to certain legacy wealth management products (WMPs). The banks now have until the end of this year to perform this formidable task—but will likely need more time. S&P Global Ratings believes a faster dash to the deadline would prove too disruptive, given the knock-on effects to regulatory capital and sector-lending caps.

—Read the full report from S&P Global Ratings

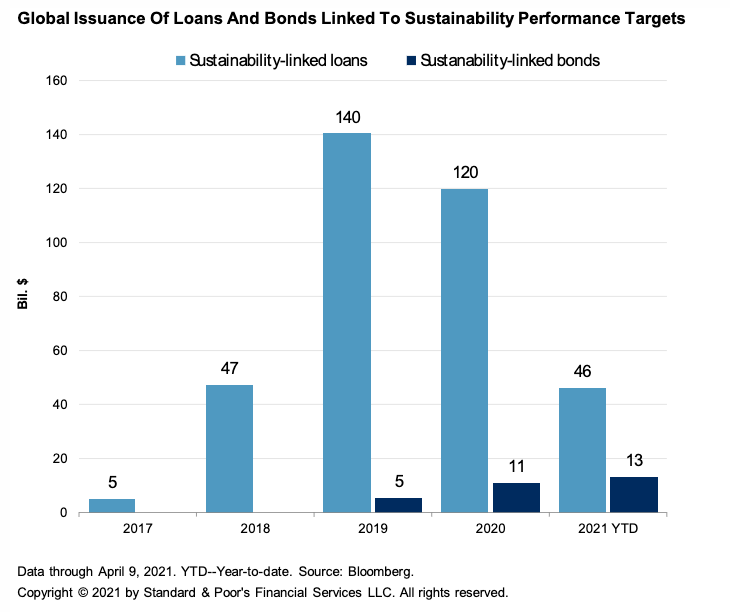

Environmental, Social, and Governance: How Sustainability-Linked Debt Has Become A New Asset Class

Global issuance of sustainability-linked debt instruments will likely surpass $200 billion this year, driven by ongoing sustainability-linked loan market growth and an acceleration in sustainability-linked bond issuance. Sustainability-linked instruments will broaden the universe of issuers who can obtain sustainable financing to those who may not have sufficient capital expenditures connected to sustainability projects, are at the beginning of their sustainability journeys, or are in transition and hard-to-abate sectors. The need for transparency and effective sustainability-related disclosure practices to avoid "ESG-washing" is crucial to expanding the practice of linking loan and bond pricing to environmental, social, and governance (ESG) performance.

—Read the full report from S&P Global Ratings

The ESG Pulse: A Spotlight on Structured Finance

S&P Global Ratings plans to introduce alpha-numerical ESG Credit Indicators starting from September 2021. S&P Global Ratings aim is to add transparency and help explain the influence of ESG factors on the credit rating analysis.

—Read the full report from S&P Global Ratings

Utility Sector Progressing on Gender Diversity, but Experts Say More Work Needed

Maintaining gender diversity should be an essential goal for all organizations, including state utility commissions and the utilities they regulate, although it is an endeavor that constitutes only one part of environmental, social and governance commitments that are dramatically altering the global workplace.

—Read the full article from S&P Global Market Intelligence

Overcast Conditions Put UK Solar Peak Predictions In the Shade

UK solar peak generation dropped off significantly April 27 as cloudy conditions replaced the clear skies of last week, but a new solar peak this spring remains a possibility, Sheffield Solar's Jamie Taylor told S&P Global Platts April 28.

—Read the full article from S&P Global Platts

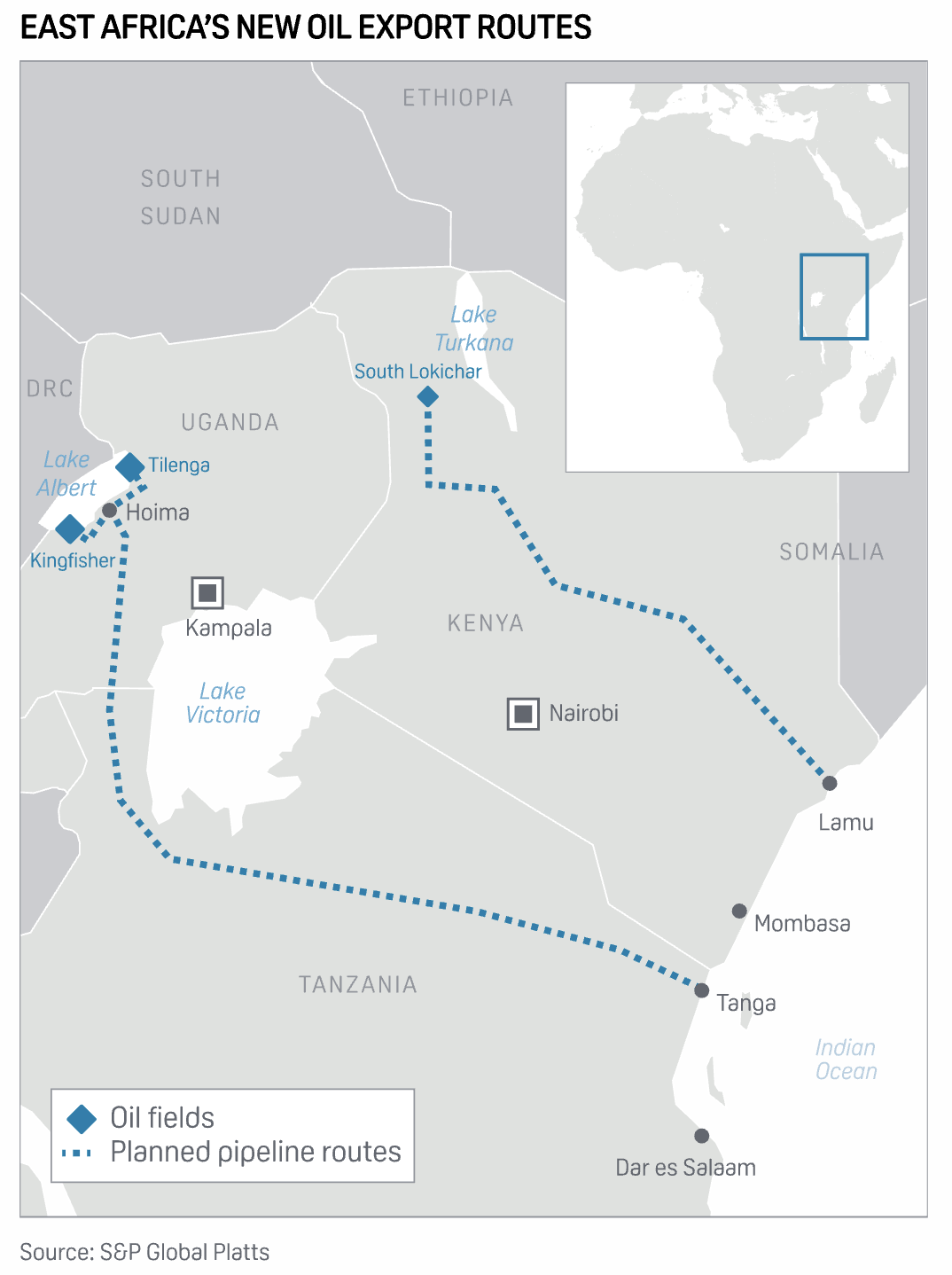

Fuel for Thought: Uganda's Struggle to Pump Its First Oil May be Still Far From Over

Uganda's long-delayed maiden oil project took a vital step to becoming more than a pipe dream this month but risks still hang over hopes of new export flows from East Africa.

—Read the full article from S&P Global Platts

OPEC's Output Pledge Music to Ears of Pandemic-Hit Asian Oil Buyers

The affirmation from OPEC and its allies that recovering demand had created conditions to boost output will offer relief to Asian oil buyers in the hope the move would ensure adequate supply and potentially prevent a sharp rise in prices at a time some economies are witnessing a resurgence of the COVID-19 virus.

—Read the full article from S&P Global Platts

Diesel Weakness Is A Headwind for Higher Runs In the Atlantic Basin

Diesel/jet will remain under pressure longer than gasoline due to relatively low jet demand, ample stocks and abundant potential arbitrage volumes from East of Suez. China is exporting around 700,000 b/d of diesel and India crude runs remain resilient despite the alarming increase in infection rates and risk of lockdowns.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language