Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Apr, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Interest Rates Get a Little Too Interesting

Much of the news coming out of financial markets in the last year could be reduced to a simple formula: Interest rates are rising, and here is the effect of rising rates on this industry, sector or company. Interest rates have become unusually interesting after spending a tedious decade at or near zero. During a recent interview on S&P Global’s "The Essential Podcast," financial author Edward Chancellor delved into this topic, which is the focus of his latest book, The Price of Time: The Real Story of Interest.

The main cause of rising interest rates has been persistent inflation, which has been well above monetary targets. Higher interest rates have tightened financing conditions and increased broader credit risks, according to S&P Global Ratings. While inflation has retreated from its recent peaks, it remains, which may force central banks to raise rates further. Analysts at S&P Global Market Intelligence suggested that policy rates may reach 5.25% in the US, 4.50% in the UK and 4.25% in the eurozone and could stay at these levels through the end of 2023. These higher interest rates may lead to economic stagnation.

Edward Chancellor questioned if interest rates are the best way to control inflation. “There was this narrow tunnel vision that still prevails today in monetary policy circles, which is that interest is just a policy lever to control inflation,” Chancellor said. “But interest, as a control of inflation, is one of perhaps seven functions of interest [and] possibly the least important and definitely the least interesting. Possibly even one that isn’t as efficacious as people believe.”

Rising interest rates have been hard on companies and the financial sector. Companies struggle to repay their debts as interest rates go up. According to S&P Global Market Intelligence, the cost of debt has been increasing, and companies have been looking to reduce leverage. Banks respond to these pressures by building cash reserves in anticipation of loan losses. Lately, confidence in banks in the US and Europe has taken a hit due to margin compression and increased credit costs. For consumers, rising interest rates increase mortgage rates and worsen housing affordability. Mortgage costs have nearly doubled, forcing more consumers to rent or to continue renting for longer, according to S&P Global Ratings. The reason central banks force companies, banks and consumers to tighten their belts is to cool off the economy, which should reduce inflation.

Once again, Chancellor isn’t convinced this is the best course of action. “The relationship between inflation and interest rates is actually quite confusing,” Chancellor said. “The era of zero interest rates and quantitative easing didn’t actually produce the inflation that people expected. Higher interest rates can be inflationary since interest is part of the cost of doing business for producers.”

Markets appear to be adjusting to higher interest rates as expectations of a pivot in monetary policy have been pushed back to 2024 or beyond. Paul Gruenwald, S&P Global Ratings’ global chief economist, suggested that higher interest rates are driving a relatively orderly and necessary deceleration in transatlantic growth. Gruenwald’s latest global economic outlook suggests the macro impact of tight monetary policy appears limited for now.

Today is Friday, April 28, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

The next edition of the Daily Update will be published Tuesday, May 2.

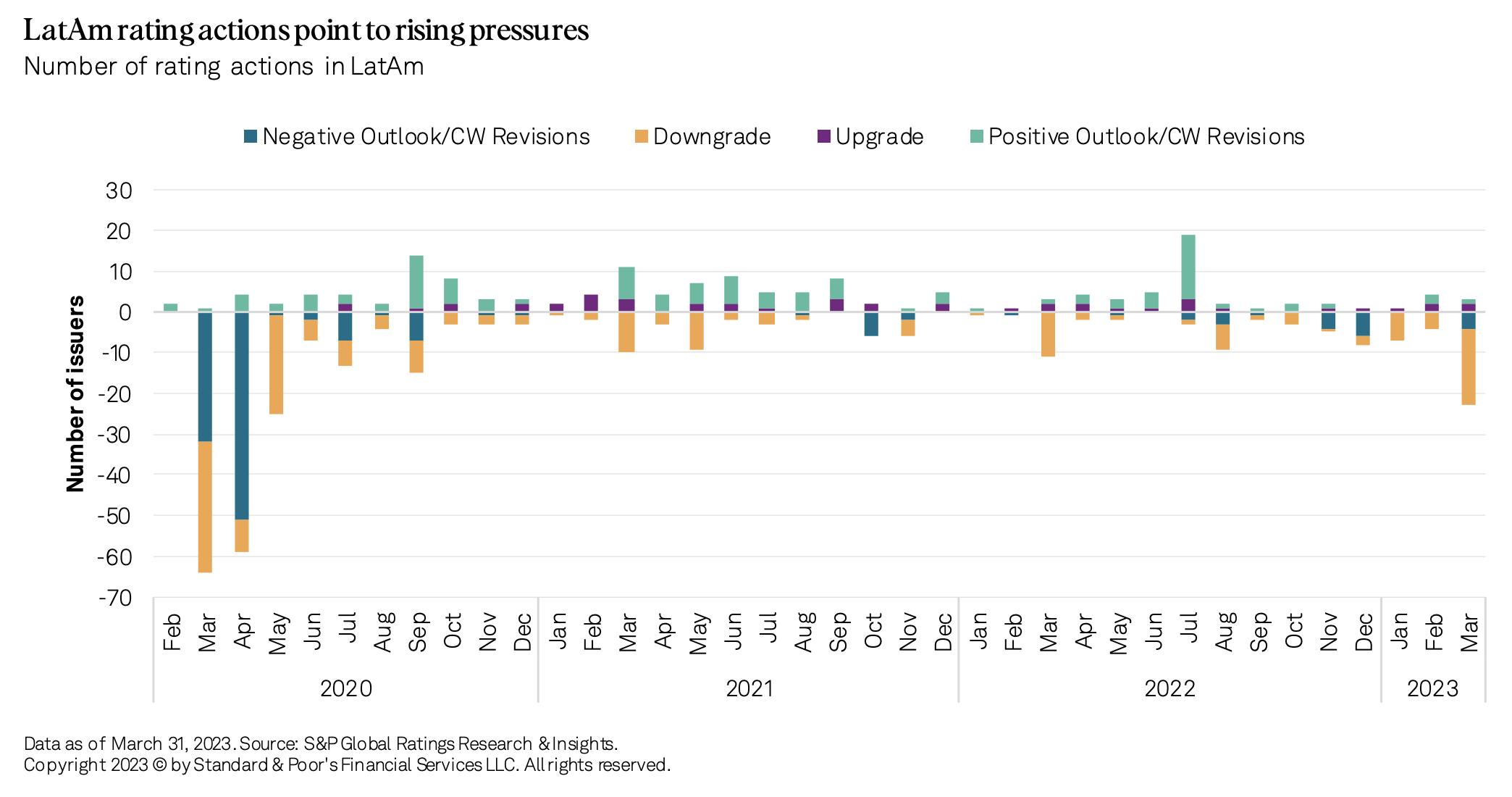

Latin America Sector Roundup 2Q 2023: Slower Growth, Tighter Financing Compound Pain

S&P Global Ratings projects GDP growth in the region to slow to 0.9% in 2023 and to gradually recover in 2024, although below its historical trend. LatAm's growth will remain constrained by elevated interest rates, high uncertainty over global economic growth and a challenging political landscape across most of the region. These factors will keep investment subdued.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Potential Applications Of U.S. Equities For Asia-Based Investors

Many investors have a so-called “home bias,” allocating to their domestic market in greater proportion than would be expected based on its representation in global equity markets. Asia-based investors are no exception. In this article, S&P Dow Jones Indices presents its US equity icons as one potential way to provide diversification for Asian investors. The breadth and depth of the US equity market means that investors risk overlooking a significant chunk of the global equity opportunity set by under-allocating to US equities, which may result in a large active share compared to a global benchmark.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

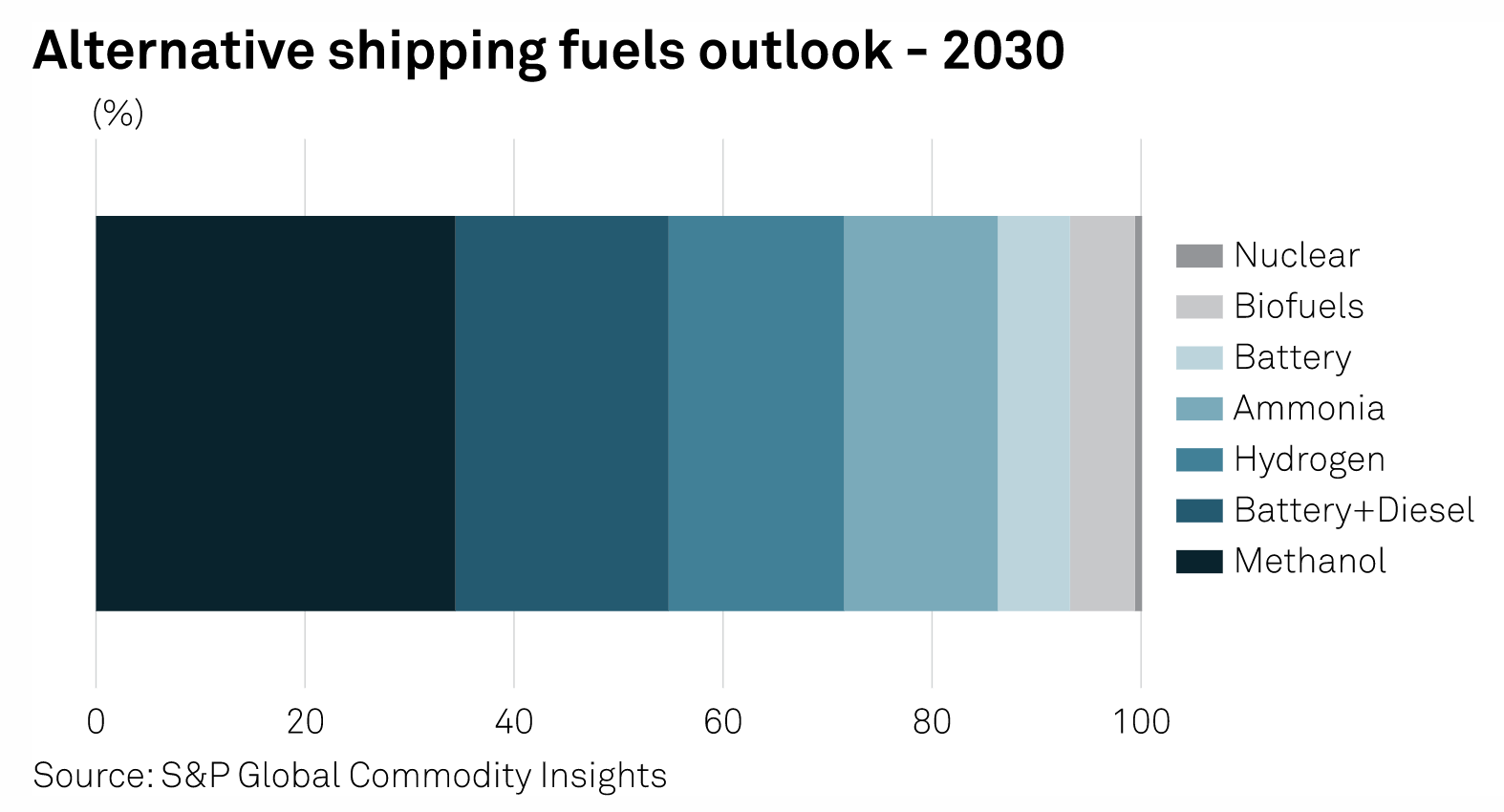

Proman To Go All-In On Methanol For Future Shipping Fleet

Proman's shipping division plans to make an eventual full switch to methanol from conventional oil-based fuels, betting on methanol's potential decarbonization effects and proven propulsion technology, a senior executive told S&P Global Commodity Insights. The Switzerland-headquartered methanol producer has established a 50-50 joint venture with Swedish tanker firm Stena Bulk, Proman Stena Bulk, to operate six MR dual-fuel tankers capable of running on methanol, of which four already in operation and two scheduled for delivery by early 2024.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

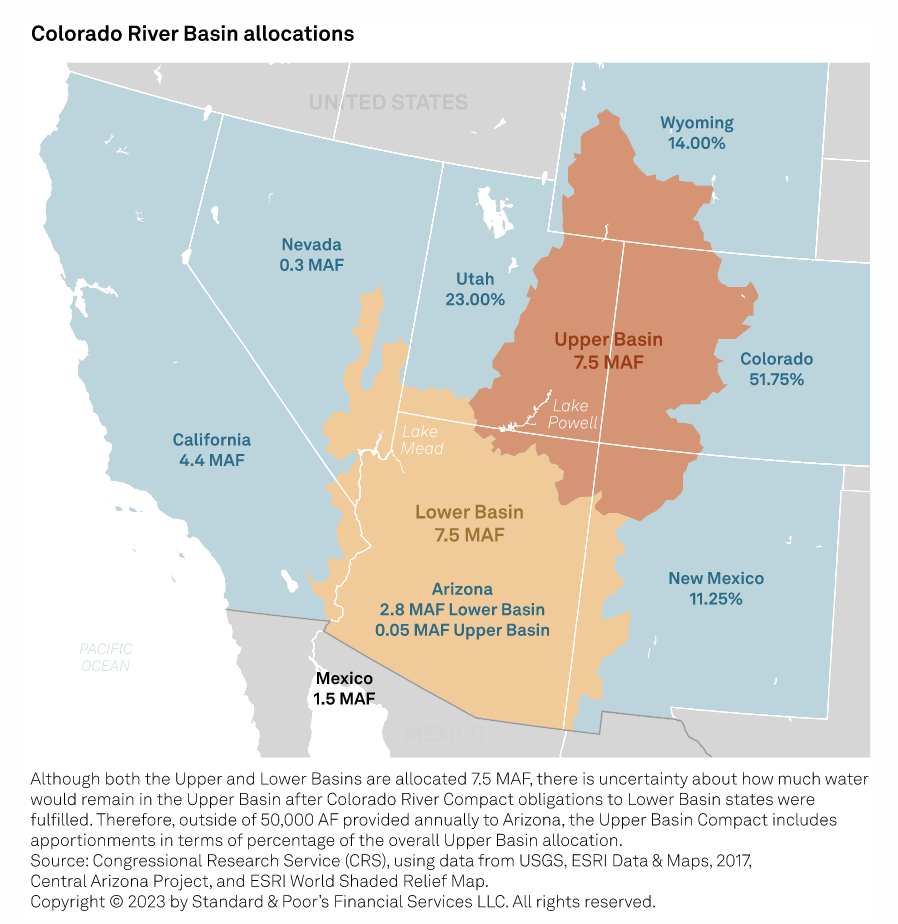

USBR Proposal Raises Water Supply Uncertainty For Lower Basin States; Impact May Trickle Down To Future Negotiations

Despite better than anticipated snowpack throughout the western U.S. and ongoing efforts to mitigate the effects of drought and aridification, longer term prospects for the Colorado River remain dire. Actions taken to date have been insufficient to turn the tide, prompting the United States Bureau of Reclamation (USBR) to release the draft SEIS, which affects water systems and hydroelectric power production in the Lower Basin states (Arizona, California and Nevada) that rely on the Colorado River system.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

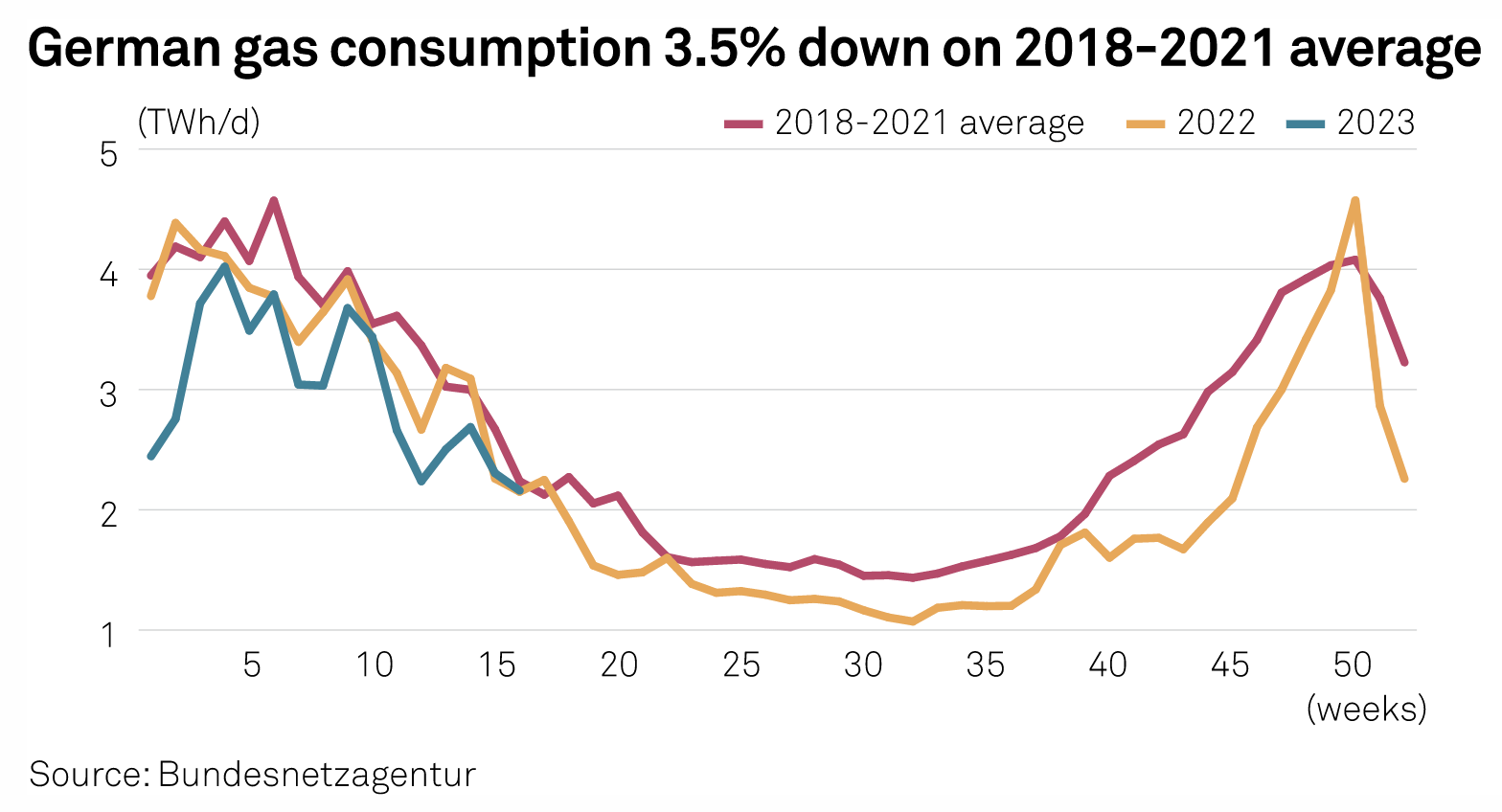

German Regulator Chief Laments Lack Of Gas Savings In Week 16

The head of the German energy regulator Klaus Muller said April 27 "hardly any" gas was saved in week 16 (to April 23) as he pushed again for consumers to continue to target 20% savings. Gas consumption averaged 2.16 TWh/d in week 16, down 3.5% on the average for the same week over 2018-2021. That meant Germany missed its gas savings target of at least 20% for the fourth consecutive week following reductions of only 13.7% in week 15, 10.3% in week 14 and 17.2% in week 13.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Mixed Results For Netflix To Start 2023

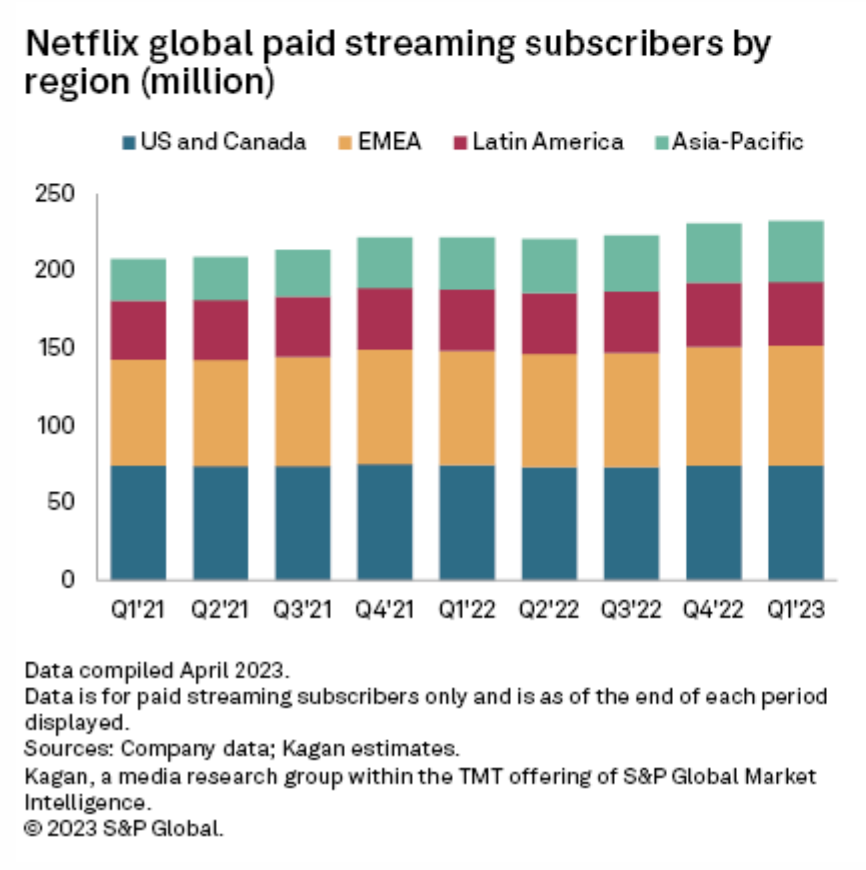

Netflix Inc.'s earnings results for the first quarter were a mixed bag, with strong free cash flow and solid operating income offset by sluggish subscriber gains. With subscriber growth slowing significantly in mature markets in North America and Europe, newer forays into advertising and improved monetization of password-sharing households could be key in keeping free cash flow and operating income solidly in the black.

—Read the article from S&P Global Market Intelligence