Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Many countries have been advertising their ambitious decarbonization plans but have yet to take the aggressive action needed to put their plans in motion. However, change may be on the horizon.

A group of global leaders reaffirmed or even advanced their net zero commitments and detailed the steps they will take to achieve their long-term goals at last week’s Leaders Climate Summit.

"This was a framing around 'here is a crisis' but 'here is a pathway to success as we deal with it,'" Jonathan Pershing, senior advisor to the special presidential envoy for climate at the US Department of State, said about the summit during an April 26 webinar hosted by the Society of Environmental Journalists, according to S&P Global Platts.

Chinese President Xi Jinping restated his pledge to reverse China’s carbon emissions before 2030 and achieve carbon neutrality by 2060. The Chinese government has promised to "strictly control coal-fired power generation projects" and "strictly limit the increase in coal consumption" as part of its Five Year Plan through 2025, after which China said it will phase coal out of its energy mix to make way for renewables. This year, China said it will strive to curb coal’s share of energy consumption to 56%.

"China has committed to move from carbon peak to carbon neutrality in a much shorter time span than what might take many developed countries, and that requires extraordinarily hard efforts from China," a transcript of President Xi's speech at the summit said, according to S&P Global Platts.

Roadblocks remain. S&P Global Platts Analytics projects that Chinese coal-fired power generation will peak by 2027, two years after President Xi’s target.

“S&P Global believes that China has missed an opportunity to accelerate progress towards its commitment of net zero carbon by 2060” in its Five Year Plan, S&P Global Ratings Chief APAC Economist Shaun Roache and S&P Global Platts Analytics Head of Energy Scenarios and Policy and Technology Analytics Roman Kramarchuk said in a recent report. “China's climate ambitions are being held back by its efforts to achieve supply-chain security in strategic sectors, including energy but also technology. These efforts could encourage more investment and manufacturing, at the expense of consumption and services. They could also delay the transition away from coal, a hitherto reliable energy source, which accounts for 80% of China's emissions.”

Other Asian economies affirmed ambitious targets. Japan pledged that renewables and nuclear power will account for at least 50% of the country’s energy generation mix by 2030.

Host U.S. President Joe Biden committed to reducing the country’s greenhouse gas emissions by 50%-52% from 2005 levels by 2030.This move advances the U.S.’s determined contribution to the Paris Agreement’s goal from the 26%-28% target set by former President Barack Obama.

Introducing an international climate finance plan at the summit, the U.S. said its International Development Finance Corp. will expand its climate-related investments to at least one-third of its new investments. All agencies, according to the plan, will "seek to end international investments in and support for carbon-intensive fossil fuel-based energy projects.”

The clean energy-oriented provisions within the Biden Administration’s proposed $2 trillion infrastructure package are the most sweeping and determined legislative plans introduced in an effort to transition the U.S. economy. The provision focuses on widespread manufacturing of electric vehicles, setting a clean electricity standard to achieve 100% clean power by 2035 and net-zero emissions economy-wide by 2050, and creating hydrogen and carbon capture projects. U.S. Republican lawmakers have proposed an alternative $568 billion plan focusing on traditional energy generation and infrastructure and lacking a clean energy agenda.

Achieving net zero status in the U.S. may prove slow and difficult without Congressional support. An increase in corporate engagement can accelerate the pace of change. A multitude of companies around the world have already made commitments to lower their carbon emissions. Others in the U.S. have supported the Biden Administration and its nationally determined contribution and infrastructure package.

Although “climate has not climbed up the issue portfolio" for corporations over the last decades, resulting in a lack of federal climate policy, corporate interests can "forcibly come in and push for climate action" as strongly as they do for other actions to change current conditions quickly, Rhode Island Democratic Sen. Sheldon Whitehouse said April 27 at the Foreign Policy Magazine Climate Summit, according to S&P Global Platts.

"To me it was striking this number of companies and these particular companies like Walmart, Target, GM, and Ford put themselves out there to support the Biden Admin … [It’s] a big deal to expose yourself as a company supporting the NDC,” Anne Kelly, vice president of government relations at the non-profit sustainability organization Ceres, said during the April 26 Society of Environmental Journalists webinar, according to S&P Global Platts. "I'm really seeing companies saying if we don't get the rules right," these climate goals will not be met, she added.

New climate targets will bolster demand for carbon offset credits. The International Emissions Trading Association anticipates that the 2021 United Nations Climate Change Conference, known as COP26, will generate public and private investment in emissions reduction efforts that will increase engagement with greenhouse gas emissions removals and offsets.

A failure to address climate risks, including those associated with carbon prices, could prove costly. S&P Global Trucost data shows that major global companies face up to $283 billion in carbon pricing costs and 13% of their earnings at risk by 2025, under a high-carbon-price scenario.

"No nation can solve this crisis on our own," President Biden said at the Leaders Climate Summit. "All of us, particularly those of us who represent the world's largest economies, we have to step up."

Today is Wednesday, April 28, 2021, and here is today’s essential intelligence.

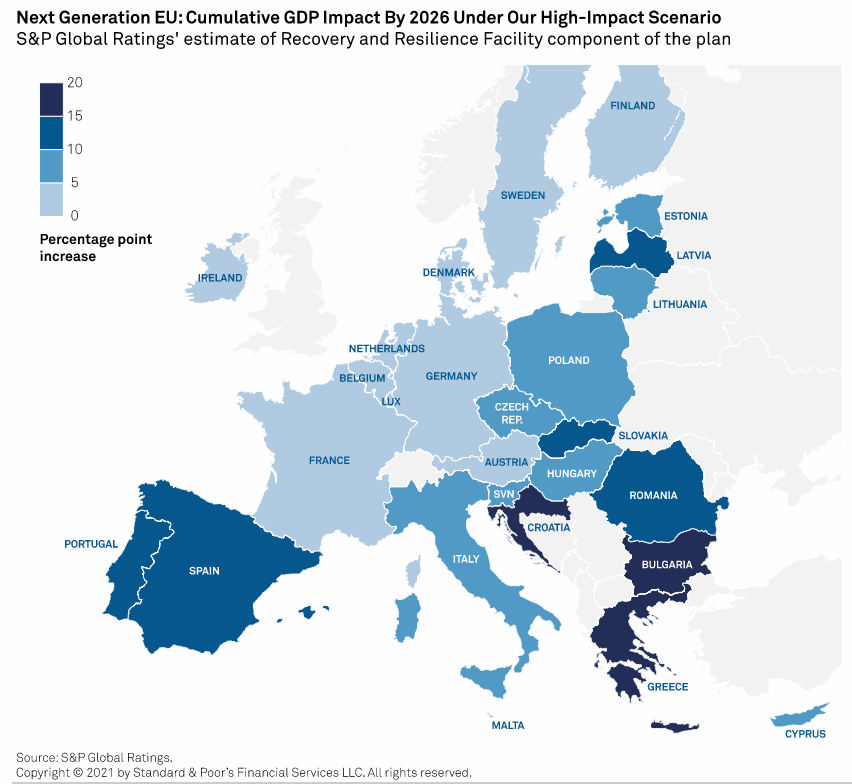

Next Generation EU Will Shift European Growth Into A Higher Gear

The Next Generation EU plan could add 1.5% to GDP under S&P Global Ratings low-impact scenario over the next five years and 4.1% under a high-impact scenario, where S&P Global Ratings made different assumptions about the timing of disbursements, the absorption of funds, and the size of growth multipliers from public spending.

—Read the full report from S&P Global Ratings

Russian Miners May Face U.S. Sanctions If Tensions Rise, Former Officials Say

The Russian metals sector may be a target for future U.S. sanctions if President Vladimir Putin escalates a growing battle with the West through military action, former U.S. government officials told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Historic Global Steel Price Rally Sweeps Iron Ore to All-Time High

The staggering recovery of global steel demand last year has driven the market for its main ingredient, iron ore, soaring in recent months, and helped S&P Global Platts 62%-Fe IODEX CFR China reach an all-time high of $193.85/dmt on April 27.

—Read the full article from S&P Global Platts

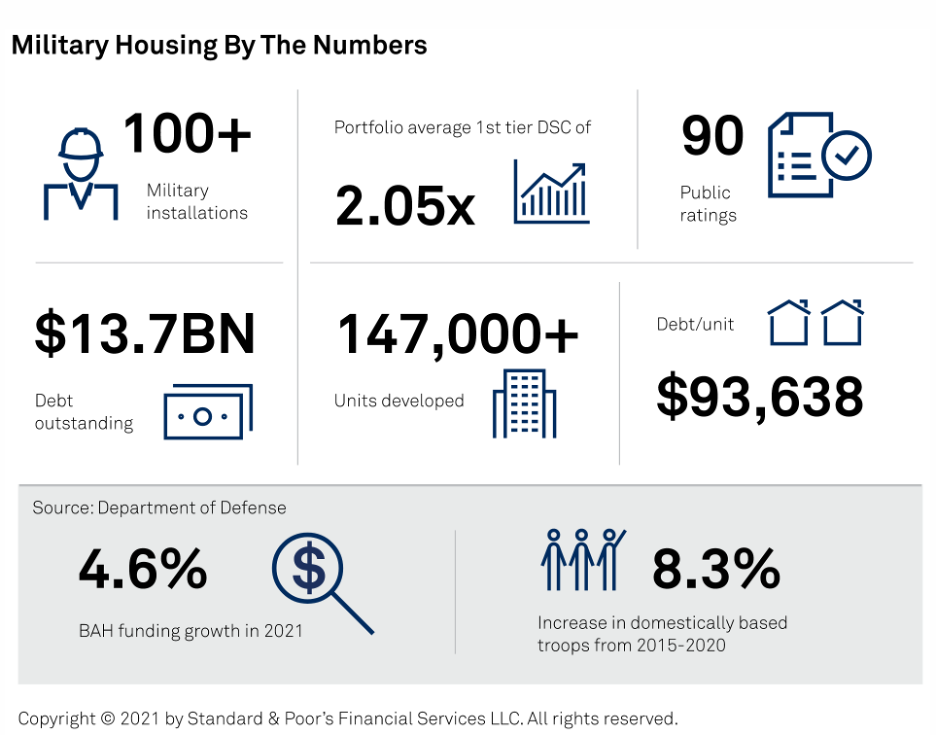

Military Housing: Performance Is Stable As Investment Needs Build

S&P Global Ratings expects continued stability in military housing ratings based on several credit factors: the strong demand for on-base housing, as demonstrated by a steady increase in personnel throughout the U.S. armed forces; the continued bipartisan support for the Department of Defense (DoD), with a long history of appropriations by Congress; and strong debt service coverage ratios throughout most of S&P Global Ratings rated projects.

—Read the full report from S&P Global Ratings

How The Decline In The U.S. Television Ecosystem Could Squeeze Credit Ratings

More and more U.S. consumers are choosing direct-to-consumer (DTC) streaming video services and opting out of pay-TV video bundles--also known as cord-cutting. S&P Global Ratings views more cord-cutting and fewer pay-TV bundles as negative for the U.S. television sector's credit quality.

—Read the full report from S&P Global Ratings

Market Eyes Fed Bond Taper Signal as Data Jumps, but Meeting Likely Uneventful

Since the Federal Reserve last met, the U.S. job market has boomed, once concerning COVID-19 vaccination rates have rapidly accelerated, and home prices, auto sales and manufacturing have all picked up. Similar indications of a faster-than-anticipated post-pandemic economic rebound compelled the Bank of Canada last week to cut its weekly bond purchases from $4 billion Canadian to $3 billion Canadian and move up its expected inflation target from sometime in 2023 to some time in the second half of 2022. But a similar, hawkish move to match its northern central bank counterpart would be a shocking surprise out of the Fed's two-day Federal Open Market Committee meeting, which began April 27. Committee members are unlikely to even discuss tapering the Fed's monthly purchases of $80 billion worth of Treasury securities and $40 billion worth of mortgage-backed securities.

—Read the full article from S&P Global Market Intelligence

U.S. Leveraged Loan Fund Assets Surge Anew as Investors Eye Floating-Rate Debt

U.S. leveraged loan fund coffers grew by another $4 billion in March as retail and institutional investors continued to focus attention toward floating-rate debt.

—Read the full article from S&P Global Market Intelligence

U.S. Corporate Cost Pressures May Hit Profit Margins In the Near Term

Most U.S. corporate sectors expect the pandemic, supply chain disruptions, and rising commodity and labor costs to drive up input prices this year. Such pressures are largely manageable through cost-saving strategies, productivity gains, or pass-through to customers.

—Read the full report from S&P Global Ratings

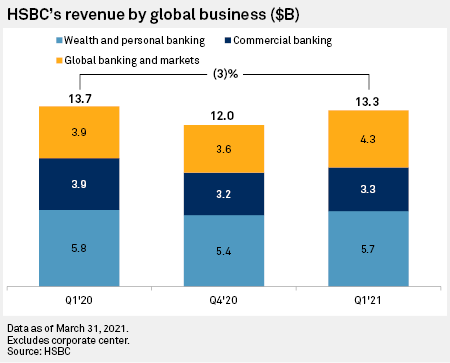

HSBC Eyes Acquisitions to Boost Wealth Management Business

HSBC Holdings PLC is looking to use extra capital for acquisitions to boost its wealth management capabilities, according to CEO Noel Quinn. The U.K.-based bank's primary focus within its wealth and personal banking business is to grow the wealth part of the division, Quinn said on an April 27 earnings call, noting that the group is on the lookout for both organic and bolt-on inorganic opportunities to drive that growth. "We will look at opportunities as they emerge," said Quinn.

—Read the full article from S&P Global Market Intelligence

Nomura Aims to Rebuild U.S. Wholesale Business After Archegos Loss

Nomura Holdings Inc. said it is committed to rebuilding its U.S. wholesale business, once its fastest-growing segment, after a loss tied to the collapse of Archegos Capital led the largest Japanese brokerage to post its steepest quarterly loss in 12 years.

—Read the full article from S&P Global Market Intelligence

Amundi Set to Become 'European Leader' In ETF Market With Potential Lyxor Deal

French asset manager Amundi SA is set to become the second-largest player in the exchange-traded fund market in Europe and the "European leader in ETFs," if its proposed acquisition of Lyxor's core activities goes ahead as planned.

—Read the full article from S&P Global Market Intelligence

Seeking Net Zero? Just Follow The Money.

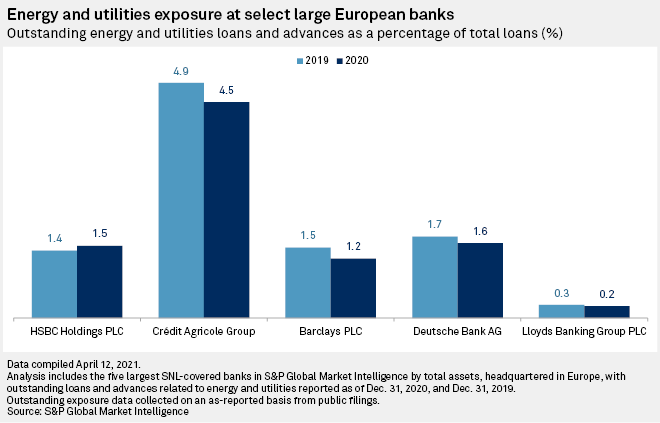

If the world is going to achieve the lofty target of reaching net-zero emissions by 2050, one thing is clear: Banks need to take a leading role in financing the transition.

—Read the full article from S&P Global Sustainable1

Italy Proposes Eur23.8 Billion In EU Funds for Energy Transition Projects

Italy's parliament voted April 27 in favor of using Eur23.80 billion ($28.74 billion) of European recovery funds for energy projects as part of its National Resilience and Recovery Plan.

—Read the full article from S&P Global Platts

U.S. EPA Gives Green Light to California, Other States to Set Tougher Car Standards

The US Environmental Protection Agency on April 26 took the first steps in dismantling the Trump administration's rollback of fuel economy standards for cars and light trucks, including announcing it will uphold states' rights to set tougher-than-federal rules.

—Read the full article from S&P Global Platts

Net Zero by 2050 Needs Six-Fold Increase In Clean H2 Consumption: Report

A net-zero greenhouse gas emissions global economy will need 500 million to 800 million mt of clean hydrogen consumption a year by 2050, five to seven times greater than today's market, the Energy Transitions Commission said in a report published April 27.

—Read the full article from S&P Global Platts

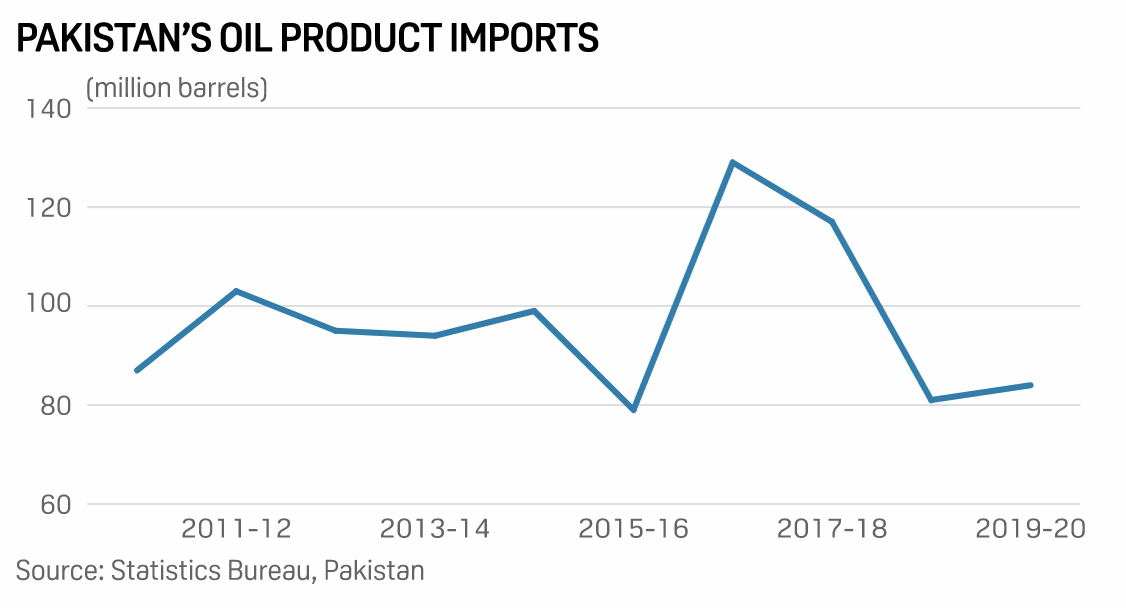

Pakistan's New Refinery Expansion Policy to Pave Way for Sharp Reduction In Fuel Imports

Pakistan's refining capacity is expected to rise sharply in coming years as the pace of current upgrades and construction picks up ahead of the approval of the country's new refinery policy, paving the way for the South Asian consumer to sharply reduce its dependence on imports for gasoline and other oil products.

—Read the full article from S&P Global Platts

Texas Gulf Coast Price Premiums to Endure as Gas Exports Tighten Regional Market Balance

Surging natural gas export demand from Mexico and from the Gulf Coast LNG terminals is tightening the supply balance in East and South Texas recently as it promises to convert the region into a premium basis market.

—Read the full article from S&P Global Platts

Commodity Price Recovery Spurs Confidence Among Oil and Gas CEOs

A year after the global outbreak of the coronavirus and the oil and gas demand destruction that the pandemic caused, the building recovery in commodity prices and how markets are reacting have renewed optimism among energy company chief executives, consulting firm KPMG found in a new survey.

—Read the full article from S&P Global Platts

OPEC+ Alliance Affirms Crude Oil Output Hike From May, Banking on Improved Demand

OPEC and its allies have the green light to ease back on their production cuts, after ministers April 27 endorsed previously agreed plans to boost crude oil output from May.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language