Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 25 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Private Equity Investors Looking for an Exit

The strength of private equity markets is determined by the frequency and quality of exits for investors. Investments can pay out through sales to another investor or company or through an IPO. After all, the value of any investment is whatever someone else is willing to pay for it. If you own an amazing private company, but no one will pay you for your stake, its valuation looks much less exciting. This dynamic means that strong M&A and IPO markets are a must for any private equity investor. And those markets have been notably weak.

In the first quarter of 2024, the value of global private equity-backedexits sank to its lowest level in three years. Exits were down 22% compared to the first quarter of 2023, which was already the lowest total since at least 2019, according to Prequin data. Continued high interest rates are weighing down hopes for an exit revival. M&A activity is highly correlated with the cost of debt since it becomes easier to buy things when it’s cheaper to borrow the money to do so.

IPO activity has also slowed. The first quarter of 2024 saw the lowest number of IPOs since the COVID-19-restricted market of 2020, and IPOs are down almost 70% since 2021. Some private companies could delay their IPOs by stretching the funding they received while interest rates were lower and capital was cheaper.

“When you take it in the context of the liquidity-driven period of ‘20 and ’21, there was a lot of capital around,” Dave Stadinski, Piper Sandler's global co-head of equity capital markets, said on "The Pipeline" podcast, hosted by S&P Global Market Intelligence. “A lot of companies raised money, maybe more than they expected to. And by some measures, there was a delay in returning to the capital markets.”

M&A is beginning to pick up despite higher interest rates. One reason for this increase is that venture capital-funded startups are finding it increasingly difficult to meet new funding rounds. With less money and lower valuations, the calculus of whether to sell to another company changes. Staying private for longer has become more difficult. Allocations to private equity have fallen for global pension funds since the year began. On Jan. 3, pension funds were slightly overallocated to private equity. That has now fallen to a slight under-allocation.

“It was only six or nine months ago where many companies and clients we were talking to were making plans for being private for longer,” Stadinski said. “There just wasn’t good line of sight for activity and receptivity in the public markets, but I think some of that is starting to change.”

Today is Thursday, April 25, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

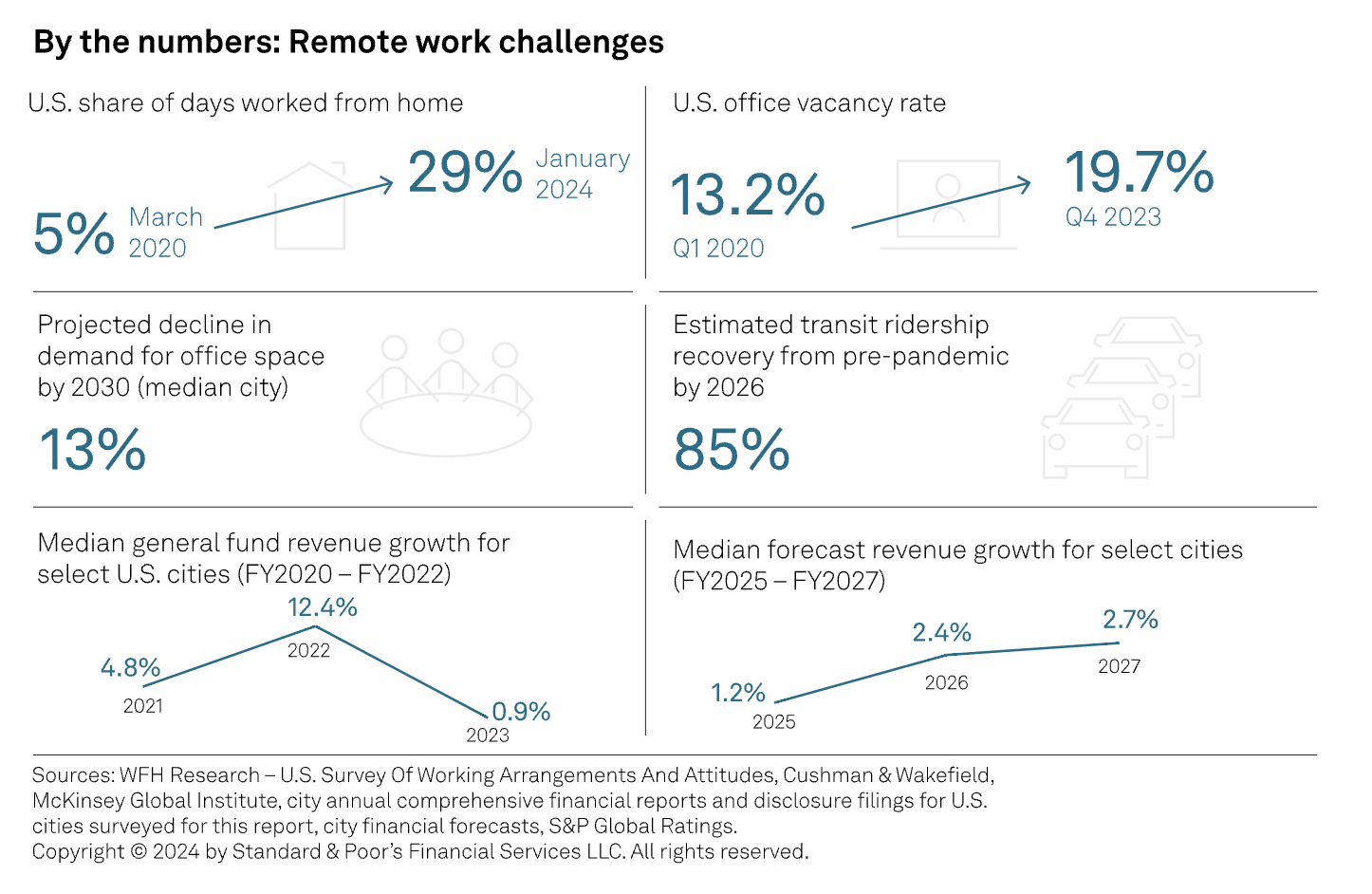

Credit Quality For US Cities Holds Up Despite Challenging Commercial Real Estate Market

As US cities continue to grapple with the transitional effects of remote work, S&P Global Ratings believes the medium-term credit outlook is marked by elevated economic and budgetary uncertainty. However, these challenges are not likely to be overwhelming or lead to significantly elevated negative rating bias. S&P Global Ratings expects cities to see sluggish revenue growth in the coming few years rather than precipitous cliffs from falling tax collections tied to commercial real estate (CRE), and it has widely observed residential valuations supporting tax base stability even in cities seeing CRE values decline.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Three-Quarter Decline In Terminated PE Deals Raises Hopes Of M&A Revival

The number of terminated private equity-backed deals in the first quarter fell for a third straight quarter to two, compared with 11 transactions in the same period in 2023, according to S&P Global Market Intelligence data. The data suggests more private equity deals are getting done as buyers and sellers work through valuation gaps. Alternative asset managers are following the decreasing trend of overall terminated M&A. Terminated M&A deals in the first quarter plunged 89.3% year over year to 17, the lowest quarterly count since at least 2020.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

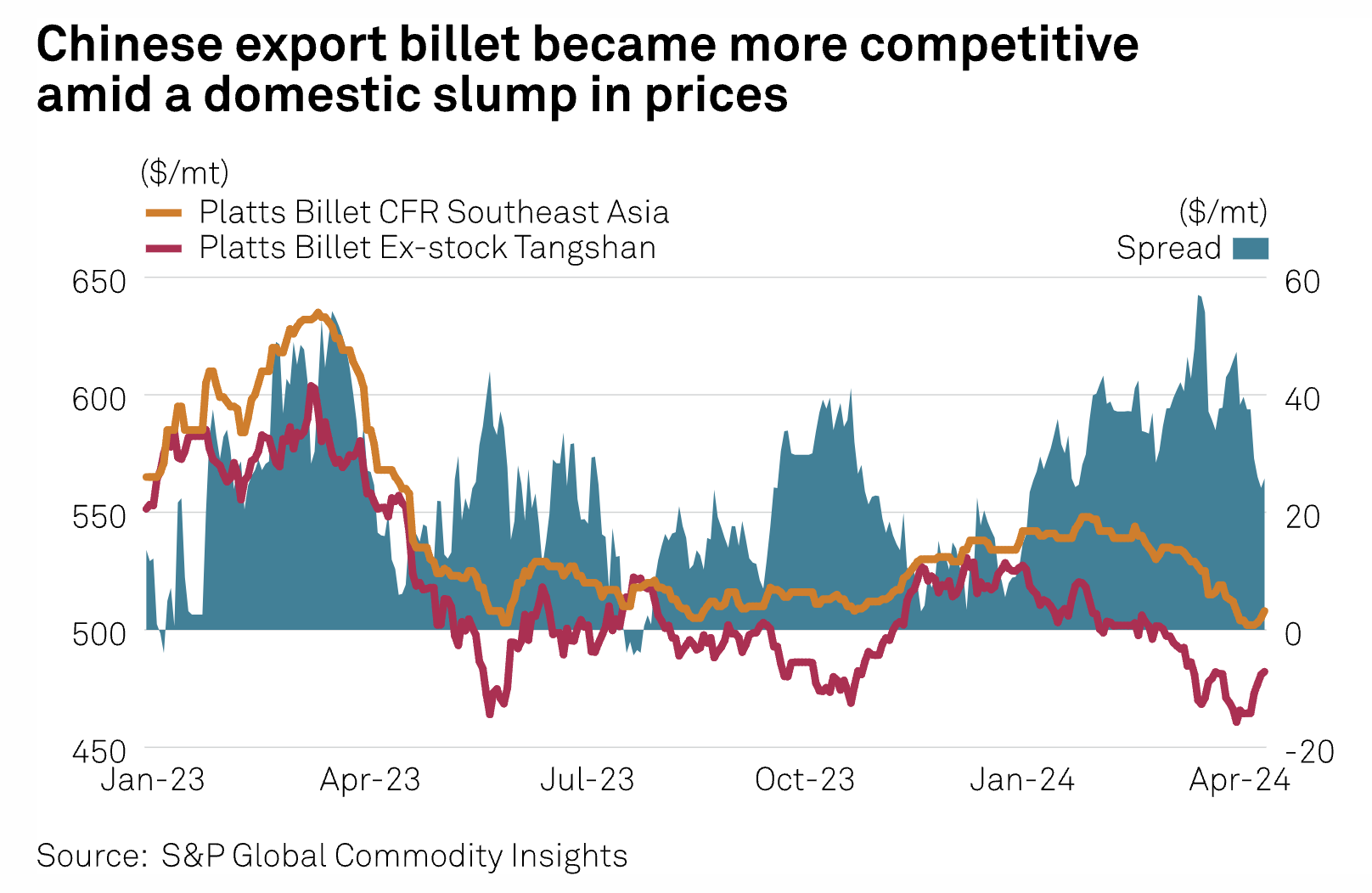

Asian Steel, Scrap To Face Headwinds In Q2 On Lackluster Demand, Export Challenges

The Asian steel market is set to face challenges moving into Q2 amid a sustained bearish Chinese property and construction sector outlook, and weakening support from raw material costs. Ferrous scrap sees muted demand across regional markets, with some Asian mills looking toward domestic scrap to potentially offset a weaker downstream steel market.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

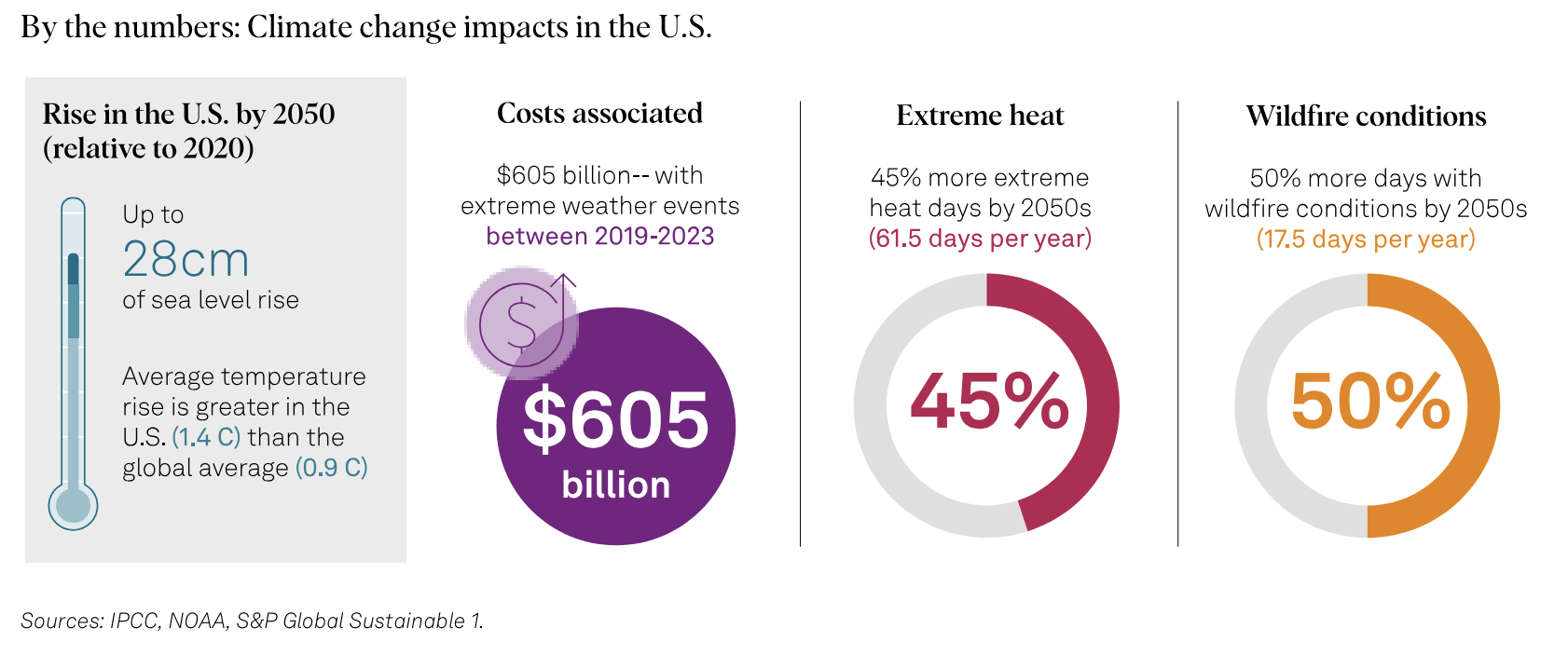

Sustainability Insights Research: Navigating Uncertainty: US Governments And Physical Climate Risks

In the US, warming is accelerating faster than the global average, according to the US Fifth National Climate Assessment. This is a potential credit risk to US governments, absent adaptation measures. Data from S&P Global Sustainable1 projects more frequent extreme heat events and coastal flooding from rising sea levels will underpin exposures for US local governments to 2050 — that is, if global warming does not remain well below the 2 degrees Celsius ambition of the Paris Agreement. Climate data can help inform our analysis .

—Read the article from S&P Global Ratings

Access more insights on sustainability >

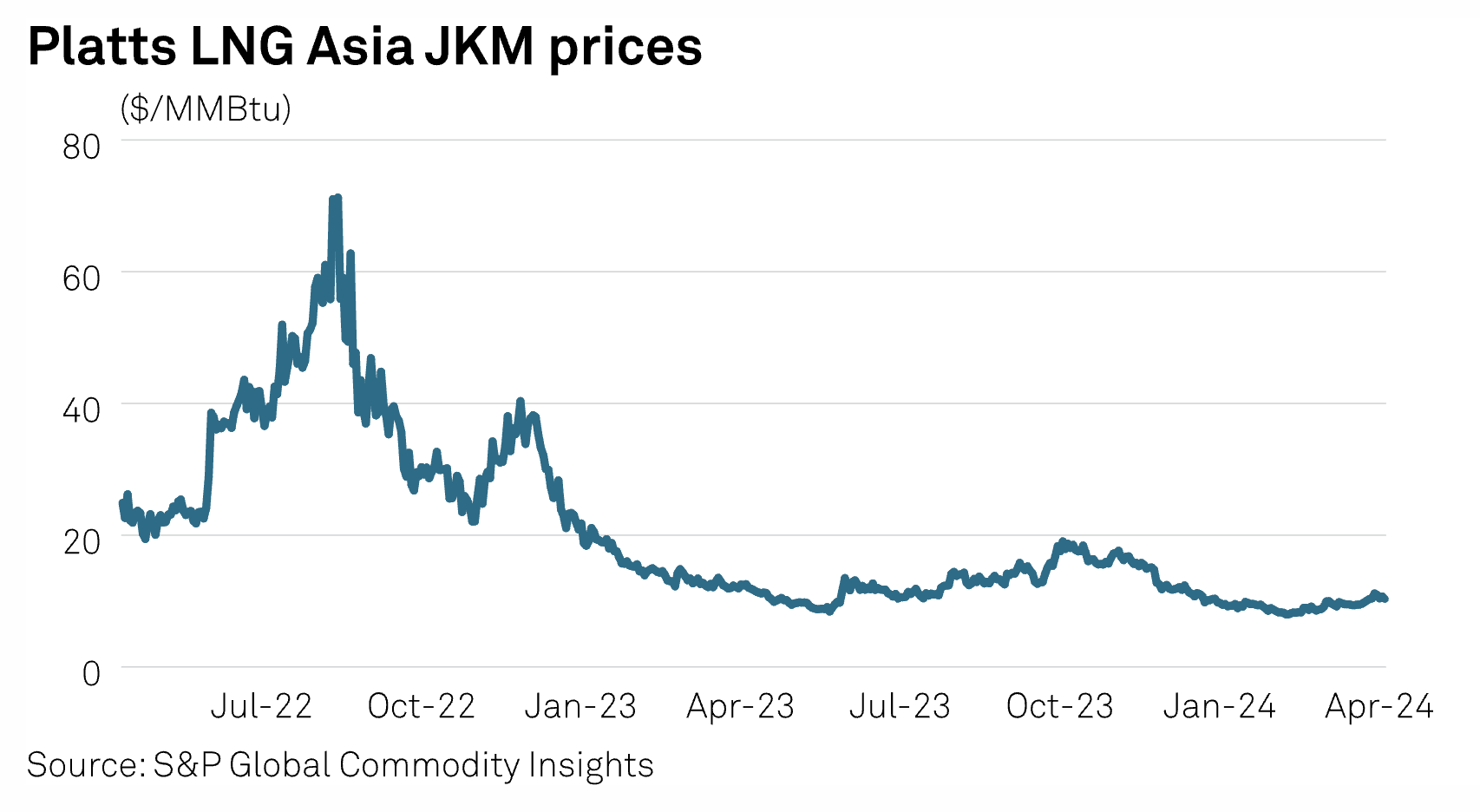

Oman LNG Looks To Fill Supply Gap Starting In 2029 With Possible New Train

Oman LNG is in early discussions with the government to expand production with its fourth train, possibly adding more than 30% to existing capacity with an eye toward filling a potential shortage seen in 2029 and onward, the company's Chief Marketing Officer Mahmoud al-Baloushi told S&P Global Commodity Insights on April 23. "The next six months will be important for us. Things will be more clear by the end of the year," Baloushi said at his office in Muscat. "By then, we will have a clear idea whether we're going for expansion or we say no we don't need it."

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

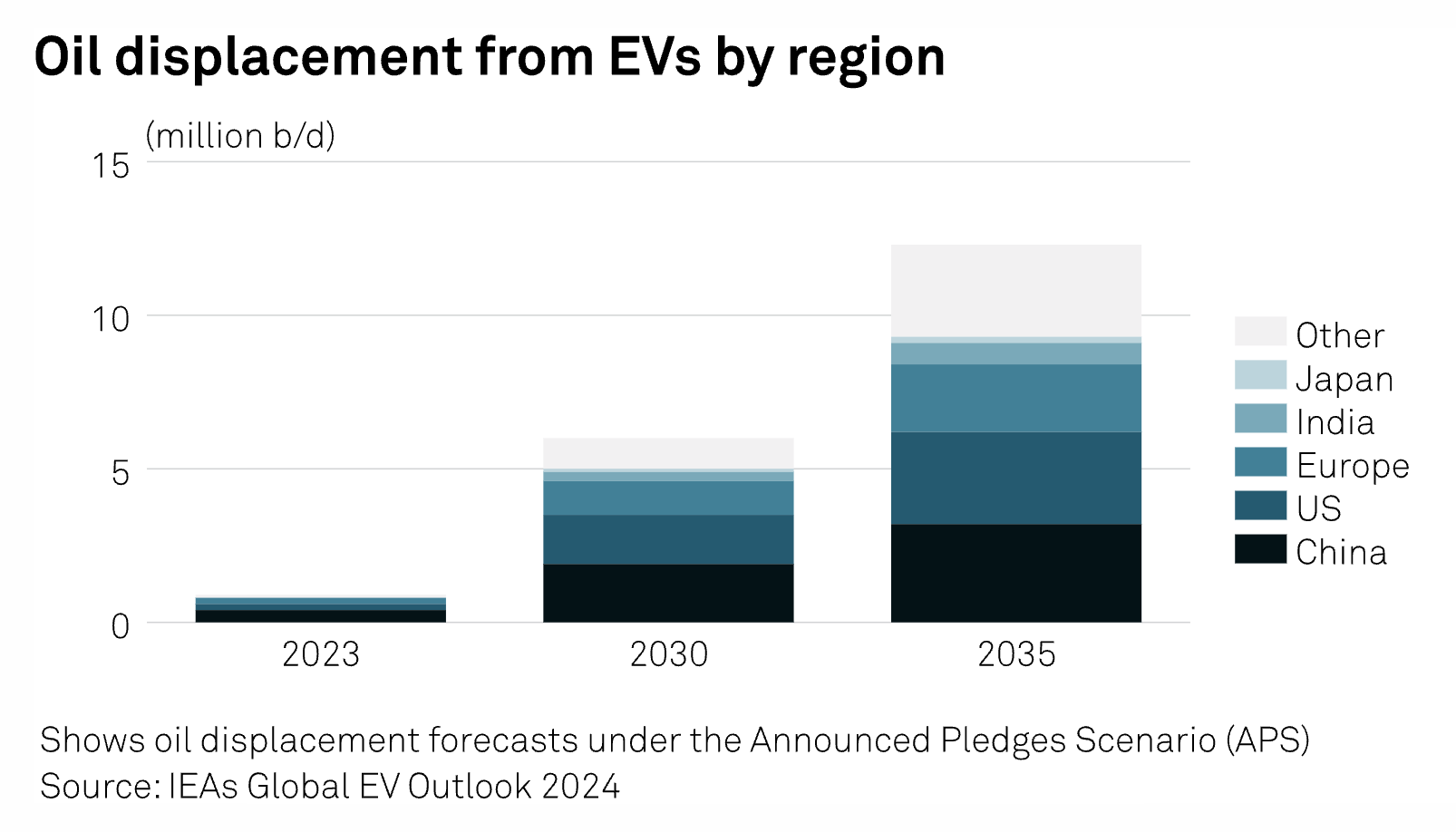

IEA Sees Electric Car Boom Displacing Up To 12 Million B/D Of Oil By 2035

The International Energy Agency raised April 23 its estimates for global oil demand displacement from booming sales of electric vehicles citing growing policy impetus in key markets. New emissions standards adopted in the US, EU, and Canada over the past year mean oil demand displacement from electric vehicles (EVs) will amount to 6 million b/d by 2030 and 11 million b/d by 2035 based on current policies, the IEA said in its latest annual Global Electric Vehicle Outlook.

—Read the article from S&P Global Commodity Insights