Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Apr, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Crush is On for Chinese Soybean Market

China buys soybeans. Between Jan. 1 and Feb. 28, China imported 16.17 million metric tons of soybeans. Brazil is the world’s leading exporter of soybeans, followed by the US and Argentina. Once soybeans arrive in China, they are processed by a crush plant. At the crush plant, the soybeans’ hulls are removed and the soybeans are flattened into flakes and distilled to produce oil. Once the oil has been extracted, the flakes are processed into a protein-rich animal feed, which is popular with China’s massive pork industry. Because there can be a difference between the cost of raw soybeans and the cost of the crushed products, the profit margins of crushers are a good way to assess the state of the soybean market. Given the popularity of pork and soybean products in China, the price of soybeans can also be a useful way to measure the state of Chinese consumer demand.

As economic growth picked up in the first quarter, soybean crushers in China anticipated a big jump in demand for pork. Soybean imports were at record levels in the first two months of 2023, up 16% compared with last year. However, crushers in China found themselves squeezed between weaker-than-anticipated domestic demand for pork and a glut of soybeans from Brazil due to a bumper harvest.

Initially, weak demand caused crush margins to slide, which prompted crushers to reduce their purchase of soybeans by an estimated 20%. However, soybean prices have trended downward since the third quarter of 2022, due in large part to Brazilian oversupply. This caused crusher profit margins to swing abruptly upward mid-April. On April 20, the spot price on soybean meal was up 10% week over week. Crushers have responded to this turnaround by buying more soybeans. The downward price pressure on soybeans is expected to continue despite increased demand from crushers. Even with low prices, commercial crushers are hesitant to accept losses if consumer demand for pork products remains weaker than anticipated.

In Brazil, soybean cash premiums have dropped to historic lows due to the record harvest. In Argentina, soybean farmers are confronting compounding difficulties. Argentina is forced to sell at the same low prices due to Brazil’s record harvest. However, Argentina is dealing with one of the worst droughts in its history. This drought has depressed yields just as prices fell. Argentina’s soybean harvest is expected to come in at 55% of the previous year’s level. The Argentine government has taken measures to support small farmers in regional economies, but the low prices will create significant economic hardship.

China’s Ministry of Agriculture and Rural Affairs has been trying to reduce the domestic pork industry’s dependence on soybean meal animal feed to cut down imports of oilseeds such as soybeans. According to S&P Global Commodity Insights, the ministry proposed to reduce the soybean meal inclusion rate in feed from 15.3% in 2021 to 13.5% by 2025. China's pork industry has been struggling with oversupply and breeders have also tried to reduce feed costs by cutting soy inclusion rates.

If crusher margins continue to trend upward, it may signal that Chinese consumers are increasing their pork consumption. Ultimately, this might lead to a recovery in the open price of soybeans. However, any potential price turnaround may not come soon enough for Argentina’s struggling soybean farmers.

Today is Tuesday, April 25, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

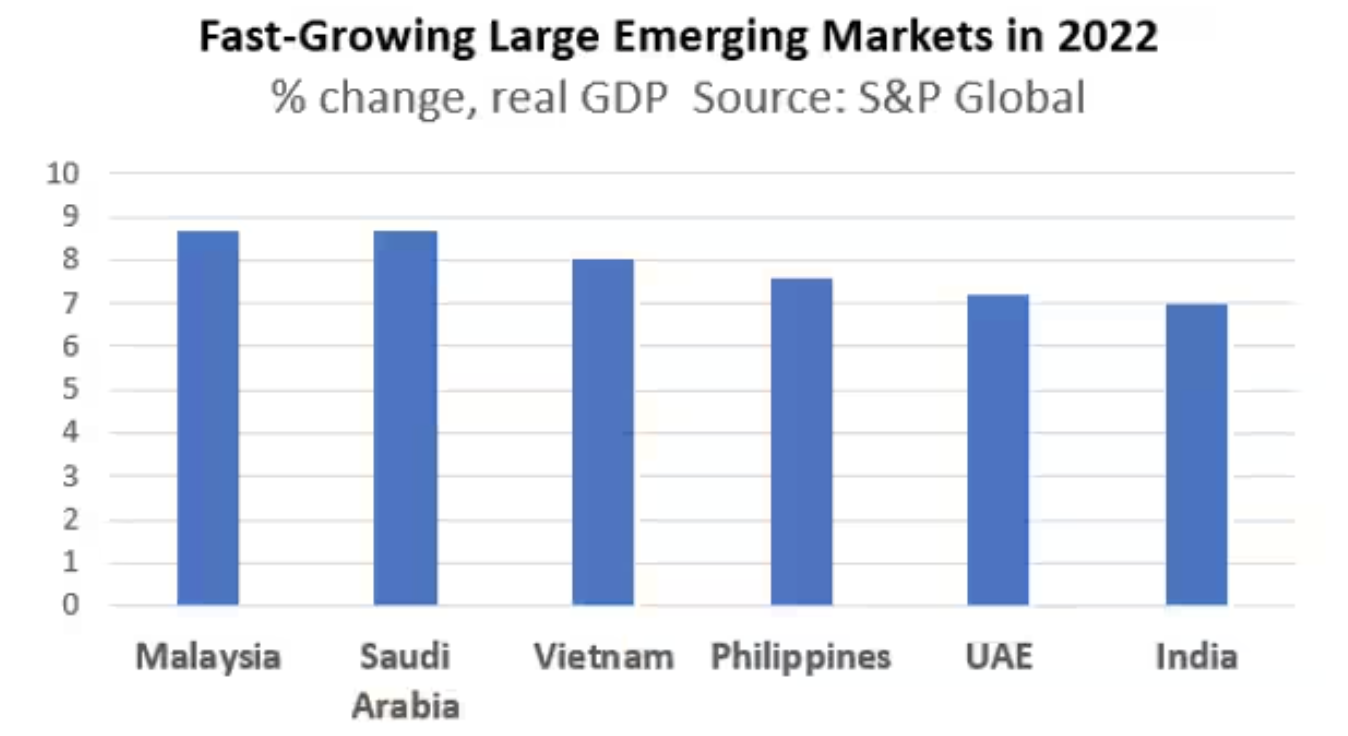

Philippines On Track To Become One Trillion Dollar Economy By 2033

The Philippines economy grew at a pace of 7.6% in 2022, the fastest rate of economic growth recorded by the Philippines since 1976. With strong growth forecast over the medium-term outlook, the size of Philippines GDP measured in US Dollar nominal terms is set to reach USD one trillion by 2033. This will make the Philippines one of the largest emerging markets in the Asia-Pacific as well as a leading emerging market globally. Average annual GDP per person has also risen dramatically over the past two decades, from below USD 1,000 per person in 2000 to USD 3,500 by 2022 and is projected to rise above USD 6,000 per person by 2030.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

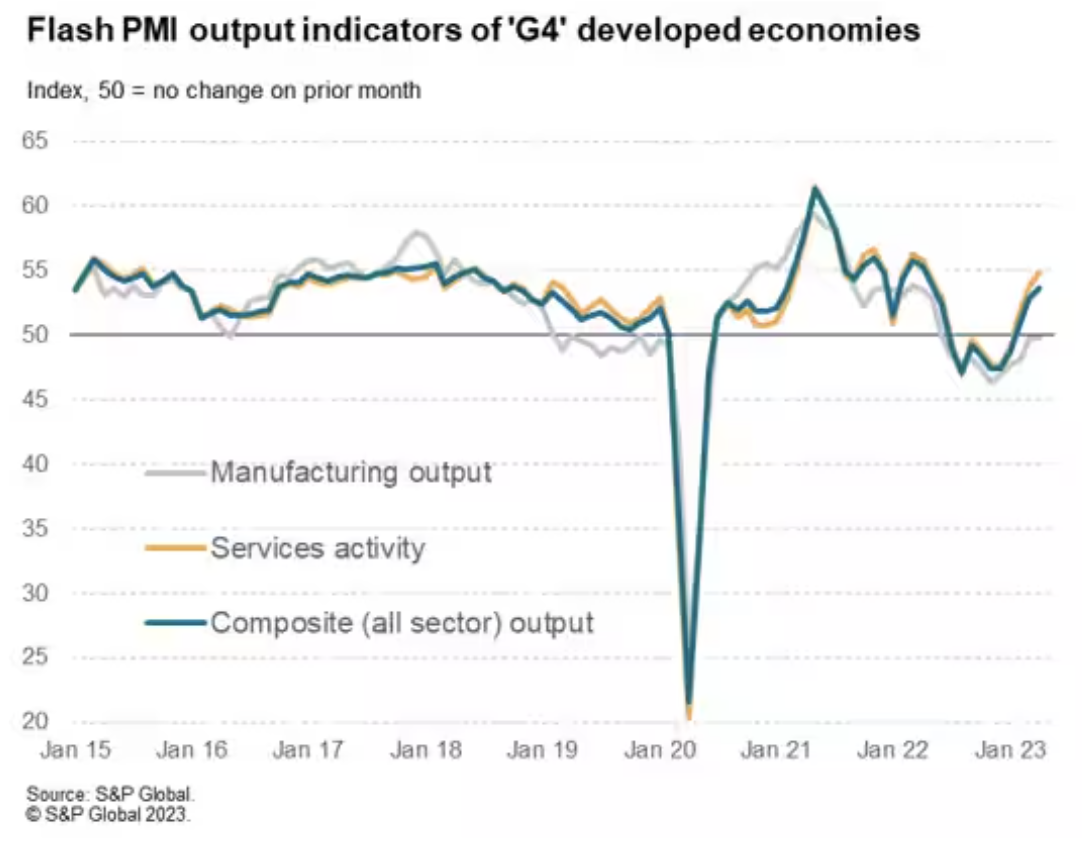

Flash PMI Data Signal Fastest Developed World Growth For 11 Months, Price Pressures Rise Further

Economic growth across the four largest developed economies has accelerated to the fastest for 11 months in April, according to early “flash” PMI data compiled by S&P Global. Growth is unbalanced, however, being driven entirely by services, as manufacturers continue to struggle amid falling demand. The skewed nature of growth, and likely delayed impact of higher borrowing costs, lends caution to the interpretation of the stronger data and suggests that growth could falter as the year proceeds, especially if interest rates continue to rise.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

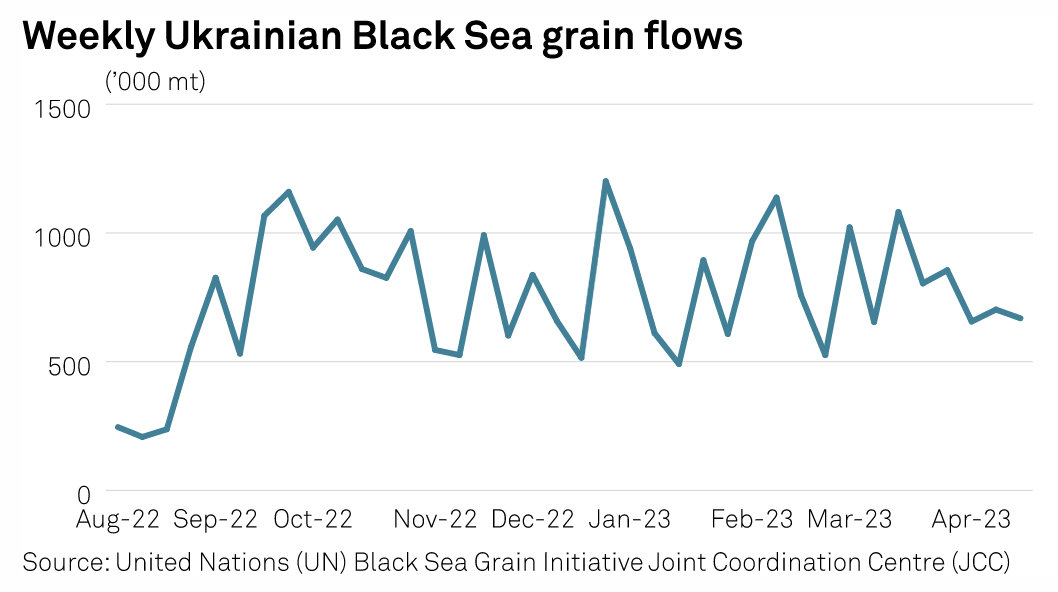

Black Sea Watch: Ukrainian Grain Flows Ease Amid Safe Passage Uncertainty

With the contested extension deadline for the Black Sea Grains Initiative approaching fast, and with little guidance as to what might follow after May 18, Ukraine grain export volumes are exhibiting a steady decline while an increasingly dysfunctional Russian wheat market is seen adding to participants' concerns.

"Large trading houses are being driven away from Russia, which doesn't bode well for the Black Sea trade," said a Geneva-based trader. "Russia appears determined to control all regional agricultural trade in the region and integrate vertically."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

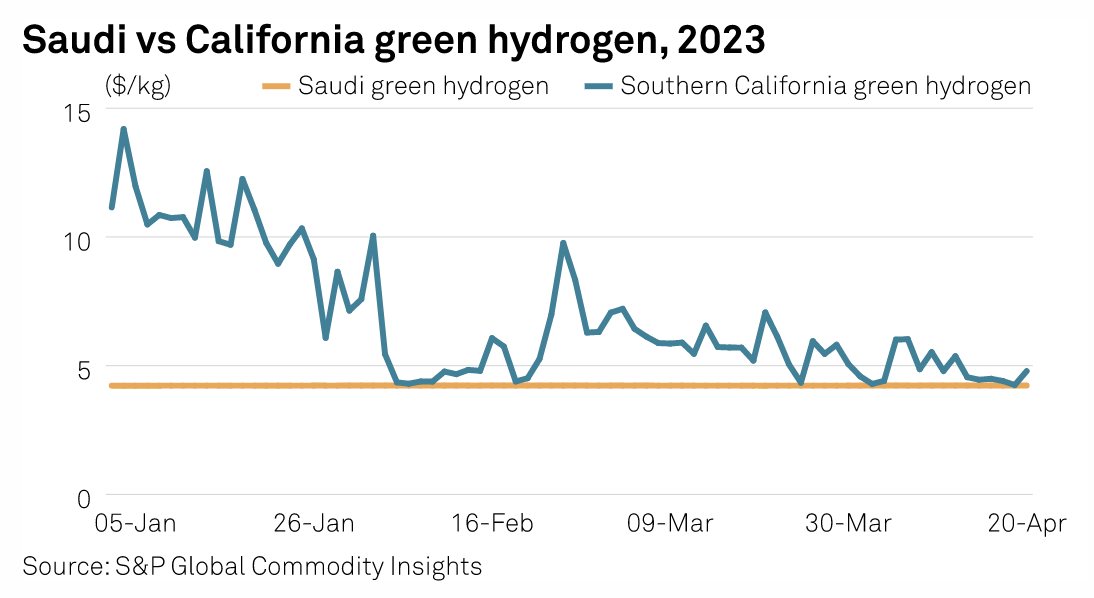

Air Products' Green Hydrogen Import Plans For California In Flux As Market Evolves: VP

Air Products CEO Seifi Ghasemi raised eyebrows earlier this year when he floated the idea of shipping green hydrogen from Saudi Arabia to California, but the company's hydrogen chief Eric Guter clarified in an interview that those plans are far from certain.

"It's not something that we're discussing publicly," Guter, Air Products' vice president of global hydrogen for mobility, said. "We make announcements when we have made definitive decisions. That's why all the projects that [the company has announced] we're comfortable talking about, because those are projects that our board has sanctioned."

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

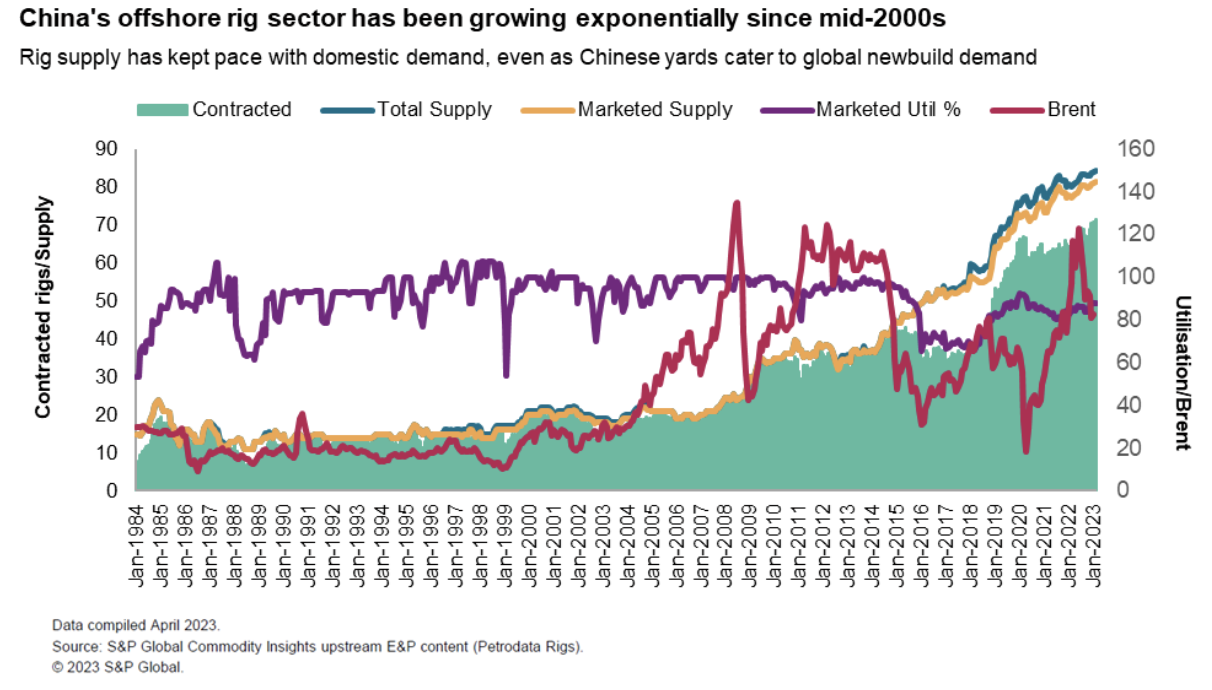

China: A Closed Rig Market With Global Reach

Just as how Google and Facebook are banned in China, even as Chinese-owned Tik Tok is the world's most downloaded mobile app, so it is with the Chinese rig market. Like the popular video service, Chinese rig contractors and China-made rigs have met with some success venturing beyond the country for work. However, its own offshore rig market is mostly a closed and domestic one that is hard for foreign firms to pierce.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Ep 111: Venture Capital In Complicated Markets

The buffeting the technology sector has received has forced a serious reevaluation of venture capital community positions. M&A analyst Melissa Incera digs into the current situation with host Eric Hanselman and points at that there are some bright spots in all of the gloom. While portfolio valuations are down, expectations for valuations are also lower. That presents possibilities for both VC’s and corporate acquirers, but cash flowing into funds is more selective. The green shoots of spring?

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence