Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

During this period of prolonged economic uncertainty, the U.S., its allies, and its adversaries are taking different measures to solidify their respective energy security.

The importance of energy security—defined by the International Energy Agency as “the uninterrupted availability of energy sources at an affordable price”—has intensified during the compounding global health, economic, and climate crises. In the short-term, energy security pertains to energy systems’ ability to respond to sudden changes in the supply-demand balance. Over the long-term, energy security includes appropriate investments that provide energy in accordance with economic developments and environmental needs.

The coronavirus crisis has sent the oil market reeling with oversupply and depleted demand during lockdowns, and additionally has altered the trajectory of the energy transition.

Globally, energy security concerns have spread throughout the oil market as it embarks on its recovery from the pandemic. The shift away from fossil fuels, low oil prices, a slowdown of new oil project investments, and recent attacks on refineries in Saudi Arabia have accelerated market participants’ anxieties over the stability of the world’s oil supply.

“Energy security comes at a price for both the consumer and the producer, as the former looks to diversify crude streams and the latter tries to ensure better returns,” Paul Hickin, associate editorial director of European and African oil news and analysis at S&P Global Platts, said in a recent commentary. “Guaranteed stable supply matched with regular demand is in the interest of all parties. Getting it wrong could prove costly.”

The U.S.’s sanctions against Russia, announced on April 15—which will prevent American institutions from purchasing primary, ruble-denominated sovereign debt after June 14—could be the first of more restrictive economic or energy sector sanctions to come, according to S&P Global Platts Analytics. Sanctions or weaker oil prices could prevent Russia’s oil output from recovering to pre-pandemic levels.

Russian President Vladimir Putin announced yesterday at the U.S. Leaders Climate Summit that the country has a "genuine interest in galvanizing international cooperation" in fighting climate change and is "willing to present a range of joint projects and consider potential benefits even for foreign companies that would like to invest in clean technologies, including in our country." The commitment comes as Russia is diversifying its reliance on oil revenues.

China has made efforts to maintain its energy security by increasing its crude inventories. The country has 933.8 million barrels of crude in stock this month, according to the data intelligence company Kpler. This accounts for 67% of China’s storage capacity, marks a 9.2% year-over-year increase in crude stocks, and is just 2.5% less than the country’s record high of 958.2 million barrels seen in September of last year.

Building and holding relatively larger crude stocks is part of China’s push to bolster its energy security during the country’s Five Year Plan, according to S&P Global Platts. However, cutting China’s carbon intensity by 18% in 2025 toward achieving net-zero emissions by 2060 is also a priority of the Five Year Plan—an effort that could be constrained by supply security.

“National security, in all its forms, appears to be having an outsized effect on economic and energy policies. In particular, the push for greater self-reliance in strategic industries and mitigation of supply-chain risks may have slowed the pace of economic rebalancing and the transition away from hitherto reliable domestic energy sources,” S&P Global Ratings Chief APAC Economist Shaun Roache and S&P Global Platts Analytics Head of Energy Scenarios and Policy and Technology Analytics Roman Kramarchuk said in a recent report. “The government may under-promise and over-deliver but, for now, the focus on supply-chain security is holding back the country's climate ambition … Overall, though, S&P Global believes that China has missed an opportunity to accelerate progress towards its commitment of net zero carbon by 2060.”

In the U.S., increased use of renewable energy will be crucial to reducing the country’s greenhouse gas emissions by half by 2030, as part of its renewed membership in the Paris Agreement. But climate goals and overall energy security may not be mutually exclusive.

"We're not in a zero-sum game here … [if] it's at a detriment in terms of our ability to invest and get excited about a full range of opportunities,” White House National Climate Adviser Gina McCarthy said March 4 during the HIS Markit CERA Week Conference. While the Biden Administration is "not going to go down the road of getting to zero [emissions] if that means we're impacting our safety, our health, [the] viability of our essential services,” she added that “we do have to think about all of these things and mix and match them, while at the same time reducing the emissions on the whole as quickly as we can."

Reducing energy market volatility is a key component of maintaining energy security in the years to come, as extreme weather events grow more frequent and countries launch their post-crisis plans. After recent events—from raging wildfires in Australia and the Western U.S., to a polar vortex in Texas, and a severe drought in Taiwan—governments like Japan are redirecting their investments to support the energy transition while their nations maintain stable energy supplies.

Argentina's Mortgage Market May Be Doomed To Repeat History

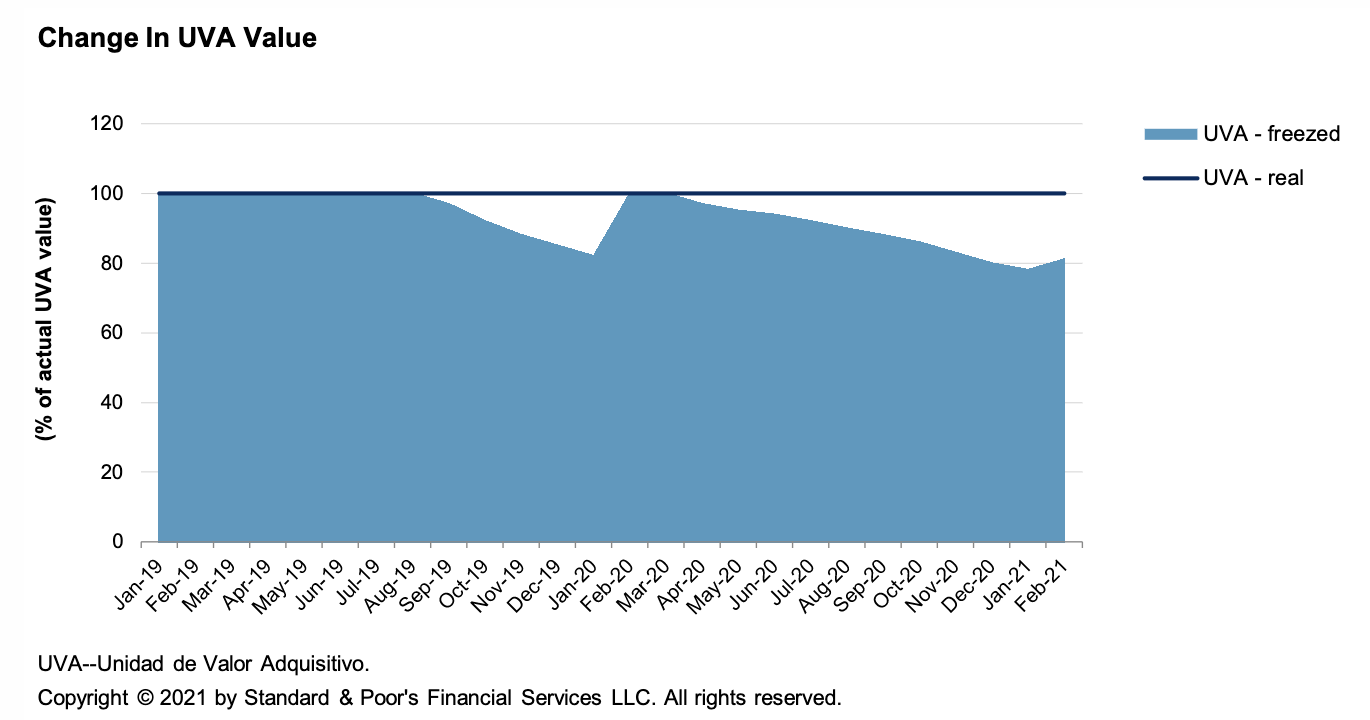

In Argentina, the fallout from severe economic constraints, including rising inflation and the government-backed freeze of the UVA value for UVA-denominated mortgage loans, is creating a trend of asset-liability mismatches that could reverse years of progress.

—Read the full report from S&P Global Ratings

Pension Spotlight: Risk Sharing Dilutes Pension Burden For Five States

U.S. state governments reduce pension stress when they share contribution volatility risk because the budgetary impact of poor returns doesn't fall solely on the sponsor. Sharing risk can offset some negative credit views of high return assumptions because it limits associated market volatility. Affordability through risk sharing features often leads to improved funded ratios.

—Read the full report from S&P Global Ratings

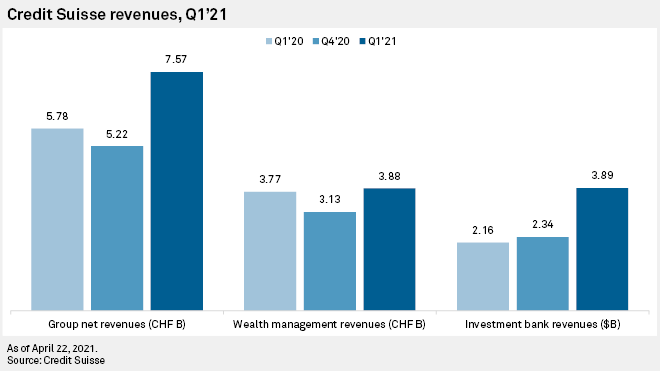

Credit Suisse CEO Defends Investment Bank Unit In Wake Of Archegos Sell-Off

Credit Suisse Group AG will conduct a review of its investment bank after the Archegos Capital sell-off but it is "a bit unfair" to say that everything is broken in that unit, CEO Thomas Gottstein said April 22. The Swiss group plans to downsize its prime financing and prime brokerage businesses, and will review the "overall size and look" of the investment bank as a result of the losses linked to the U.S. hedge fund.

—Read the full article from S&P Global Market Intelligence

UK Banks Speed Up Plans To Ax Branches And Switch Focus To Digital

British high street banks' planned branch closures for 2021 already outstrip total closures for 2020, as lenders focus on boosting their provision of digital services to customers. More than 4,000 bank and building society branches have closed in the U.K. over the past six years, according to a report from consumer group Which, at a rate of about 50 a month.

—Read the full article from S&P Global Market Intelligence

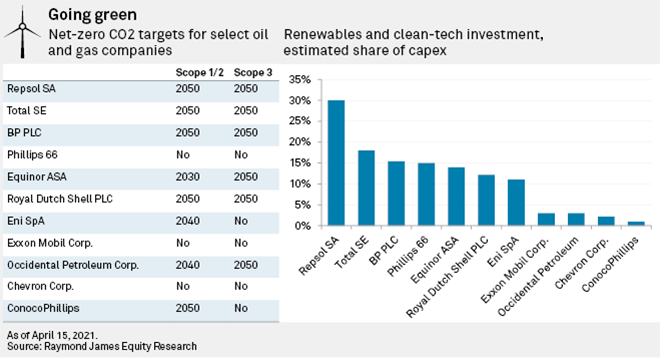

Shell Treads 'Narrow Path' As Scrutiny Of Big Oil's Climate Targets Intensifies

Oil and gas majors are under growing scrutiny to deliver on their climate pledges, with some investors and industry analysts still unconvinced that their transition can both deliver shareholder value and make a meaningful dent in reducing the pollution caused by their products.

—Read the full article from S&P Global Market Intelligence

Valero Moves Further Into Low-Carbon Fuels Space To Match Growing Demand

Valero sees growing demand for low-carbon fuels and will continue to seek out projects which reduce carbon intensity while delivering financial returns to their shareholders, CEO Joe Gorder said on the company's April 22 first quarter results call.

—Read the full article from S&P Global Platts

U.S. Senate Republicans Propose Infrastructure Plan Without Clean Energy Section

U.S. Senate Republicans on April 22 proposed a competing infrastructure plan to spend $568 billion over five years on traditional projects like roads, bridges and ports, skipping the clean energy focus of Democrats' plan. The Republican plan includes $299 billion for roads and bridges, $65 billion for broadband, $61 billion for public transit, $44 billion for airports, $35 billion for drinking water and wastewater, $20 billion for rail, and $17 billion for ports and inland waterways.

—Read the full article from S&P Global Platts

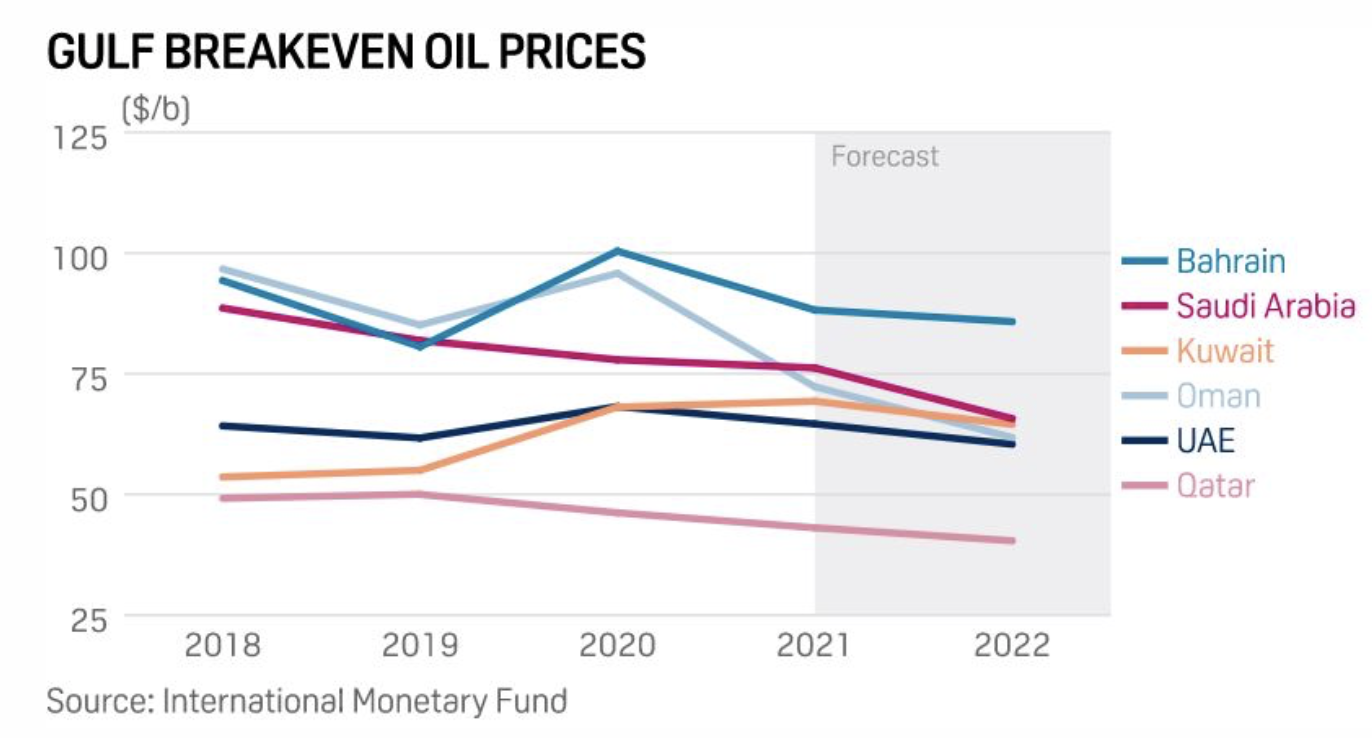

Lower Gulf Fiscal Oil Breakeven Prices Seen Supporting Easing Of OPEC+ Cuts

Lower fiscal oil breakeven prices needed to balance Gulf budgets are expected to help support the easing of OPEC+ cuts as regional members of the alliance reap the benefits of higher crude prices, greater non-hydrocarbon revenue and restrained public spending.

—Read the full article from S&P Global Platts

OPEC+ Brushes Off Latest US Antitrust Bill As It Prepares To Relax Oil Production Quotas

U.S. lawmakers' efforts to revive antitrust legislation targeting OPEC will add a wrinkle to the April 28 meeting between the oil bloc, Russia and other allies, but officials within the group say they are not worried about the prospects of American interference.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language